CEB Investors' and Analysts' Briefing 4Q10 - Cebu Pacific Air

CEB Investors' and Analysts' Briefing 4Q10 - Cebu Pacific Air

CEB Investors' and Analysts' Briefing 4Q10 - Cebu Pacific Air

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

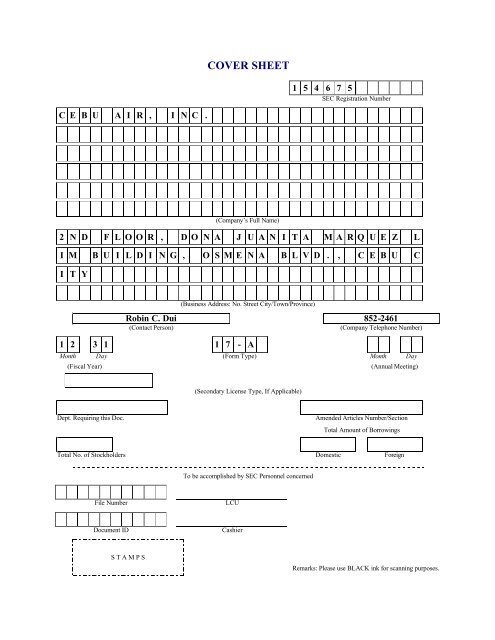

COVER SHEET<br />

1 5 4 6 7 5<br />

SEC Registration Number<br />

C E B U A I R , I N C .<br />

(Company’s Full Name)<br />

2 N D F L O O R , D O N A J U A N I T A M A R Q U E Z L<br />

I M B U I L D I N G , O S M E N A B L V D . , C E B U C<br />

I T Y<br />

(Business Address: No. Street City/Town/Province)<br />

Robin C. Dui 852-2461<br />

(Contact Person)<br />

(Company Telephone Number)<br />

1 2 3 1 1 7 - A<br />

Month Day (Form Type) Month Day<br />

(Fiscal Year)<br />

(Annual Meeting)<br />

(Secondary License Type, If Applicable)<br />

Dept. Requiring this Doc.<br />

Amended Articles Number/Section<br />

Total Amount of Borrowings<br />

Total No. of Stockholders Domestic Foreign<br />

To be accomplished by SEC Personnel concerned<br />

File Number<br />

LCU<br />

Document ID<br />

Cashier<br />

S T A M P S<br />

Remarks: Please use BLACK ink for scanning purposes.

SECURITIES AND EXCHANGE COMMISSION<br />

SEC FORM 17-A<br />

ANNUAL REPORT PURSUANT TO SECTION 17<br />

OF THE SECURITIES REGULATION CODE AND SECTION 141<br />

OF THE CORPORATION CODE OF THE PHILIPPINES<br />

1. For the fiscal year ended December 31, 2010<br />

2. SEC Identification No. 154675<br />

3. BIR Tax Identification No. 000-948-229-000<br />

<strong>Cebu</strong> <strong>Air</strong>, Inc.<br />

4. Exact name of issuer as specified in its charter<br />

<strong>Cebu</strong> City, Philippines<br />

5. Province, country or other jurisdiction of incorporation or organization<br />

6. Industry Classification Code: (SEC Use Only)<br />

2 nd Floor, Dona Juanita Marquez Lim Building, Osmena Blvd., <strong>Cebu</strong> City 6000<br />

7. Address of issuer's principal office Postal Code<br />

(032) 255-4552<br />

8. Issuer's telephone number, including area code<br />

Not Applicable<br />

9. Former name, former address <strong>and</strong> former fiscal year, if changed since last report<br />

10. Securities registered pursuant to Sections 8 <strong>and</strong> 12 of the Code, or Sections 4 <strong>and</strong> 8 of the<br />

RSA<br />

Title of Each Class<br />

Common Stock, P1.00 Par Value<br />

Number of Shares of Common<br />

Stock Outst<strong>and</strong>ing <strong>and</strong> Amount<br />

of Debt Outst<strong>and</strong>ing<br />

613,236,550 shares<br />

11. Are any or all of the securities listed on the Philippine Stock Exchange?<br />

Yes [x] No [ ]

12. Indicate by check mark whether the registrant:<br />

(a) has filed all reports required to be filed by Section 17 of the Code <strong>and</strong> SRC Rule 17<br />

thereunder or Sections 11 of the RSA <strong>and</strong> RSA Rule 11(a)-1 thereunder, <strong>and</strong> Sections 26 <strong>and</strong><br />

141 of the Corporation Code of the Philippines, during the preceding twelve (12) months (or<br />

for such shorter period the registrant was required to file such reports)<br />

Yes [x] No [ ]<br />

(b) has been subject to such filing requirements for the past 90 days.<br />

Yes [x] No [ ]<br />

13. State the aggregate market value of the voting stock held by non-affiliates of the registrant.<br />

The aggregate market value shall be computed by reference to the price at which the stock<br />

was sold, or the average bid <strong>and</strong> asked prices of such stock, as of a specified date within 60<br />

days prior to the date of filing. If a determination as to whether a particular person or entity is<br />

an affiliate cannot be made without involving unreasonable effort <strong>and</strong> expense, the aggregate<br />

market value of the common stock held by non-affiliates may be calculated on the basis of<br />

assumptions reasonable under the circumstances, provided the assumptions are set forth in<br />

this Form.<br />

The aggregate market value of stocks held by non-affiliates is P23,897,216,250.

TABLE OF CONTENTS<br />

Page No.<br />

PART I – BUSINESS AND GENERAL INFORMATION<br />

Item 1 Business.........................................................................................................1<br />

Item 2 Properties…………………………………………………………………. 14<br />

Item 3 Legal Proceedings…………………………………………………………14<br />

Item 4 Submission of Matters to a Vote of Security Holders……………………. 14<br />

PART II – OPERATIONAL AND FINANCIAL INFORMATION<br />

Item 5<br />

Item 6<br />

Market for Registrant’s Common Equity <strong>and</strong><br />

Related Stockholder Matter………………………………………………. 15<br />

Management’s Discussion <strong>and</strong> Analysis or<br />

Plan of Operation…………………………………………………………. 17<br />

Item 7 Financial Statements……………………………………………………… 30<br />

Item 8<br />

Changes in <strong>and</strong> Disagreements with Accountants on<br />

Accounting <strong>and</strong> Financial Disclosure…………………………………….. 30<br />

Item 9 Independent Public Accountants <strong>and</strong> Audit Related Fee………………… 30<br />

PART III – CONTROL AND COMPENSATION INFORMATION<br />

Item 10 Board of Directors <strong>and</strong> Executive Officers of the Registrant…………….. 32<br />

Item 11 Executive Compensation…………………………………………………. 39<br />

Item 12<br />

Security Ownership of Certain Beneficial Owners <strong>and</strong><br />

Management……………………………………………………………… 40<br />

Item 13 Certain Relationships <strong>and</strong> Related Transactions…………………………. 42<br />

PART IV – CORPORATE GOVERNANCE<br />

Item 14 Corporate Governance……………………………………………………. 42<br />

PART V – EXHIBITS AND SCHEDULES<br />

Item 15 Exhibits <strong>and</strong> Reports on SEC Form 17-C………………………………… 43<br />

SIGNATURES ..................................................................................................................... 44<br />

INDEX TO FINANCIAL STATEMENTS AND<br />

SUPPLEMENTARY SCHEDULES…………………………………………………….. 46

PART 1 – BUSINESS AND GENERAL INFORMATION<br />

Item 1.<br />

Business<br />

<strong>Cebu</strong> <strong>Air</strong>, Inc. (the Company) is an airline that operates under the trade name “<strong>Cebu</strong> <strong>Pacific</strong> <strong>Air</strong>”<br />

<strong>and</strong> is the leading low-cost carrier in the Philippines. It pioneered the “low fare, great value”<br />

strategy in the local aviation industry by providing scheduled air travel services targeted to<br />

passengers who are willing to forego extras for fares that are typically lower than those offered by<br />

traditional full-service airlines while offering reliable services <strong>and</strong> providing passengers with a<br />

fun travel experience.<br />

The Company was incorporated in August 26, 1988 <strong>and</strong> was granted a 40-year legislative<br />

franchise to operate international <strong>and</strong> domestic air transport services in 1991. It commenced its<br />

scheduled passenger operations in 1996 with its first domestic flight from Manila to <strong>Cebu</strong>. In<br />

1997, it was granted the status as an official Philippine carrier to operate international services by<br />

the Office of the President of the Philippines, pursuant to Executive Order (EO) No. 219.<br />

International operations began in 2001 with flights from Manila to Hong Kong.<br />

In 2005, the Company adopted the low cost carrier (LCC) business model. The core element of<br />

the LCC strategy is to offer affordable air servic es to passengers. This is achieved by having:<br />

high-load, high-frequency flights; high aircraft utilization; a young <strong>and</strong> simple fleet composition;<br />

<strong>and</strong> having low distribution costs.<br />

The Company operates an extensive route network serving 50 domestic routes <strong>and</strong> 23<br />

international routes with a total of 1,832 scheduled weekly flights. It operates from four hubs,<br />

including the Ninoy Aquino International <strong>Air</strong>port (NAIA) Terminal 3 located in Pasay City,<br />

Metro Manila; Mactan-<strong>Cebu</strong> International <strong>Air</strong>port located in Lapu-Lapu City, part of<br />

Metropolitan <strong>Cebu</strong>; Diosdado Macapagal International <strong>Air</strong>port located in Clark, Pampanga; <strong>and</strong><br />

Davao International <strong>Air</strong>port located in Davao City, Davao del Sur.<br />

As of December 31, 2010, the Company operated a fleet of 31 aircraft which comprises of ten<br />

<strong>Air</strong>bus A319, 14 <strong>Air</strong>bus A320, <strong>and</strong> seven ATR 72-500 aircraft. It operates its <strong>Air</strong>bus aircraft on<br />

both domestic <strong>and</strong> international routes <strong>and</strong> operates the ATR 72-500 aircraft on domestic routes,<br />

including destinations with runway limitations. The average aircraft age of the Company’s fleet<br />

is approximately 3.1 years as of December 31, 2010.<br />

The Company has three principal distribution channels: the internet; direct sales through booking<br />

sales offices, call centers <strong>and</strong> government/corporate client accounts; <strong>and</strong> third-party sales outlets.<br />

Aside from passenger service, it also provides airport-to-airport cargo services on its domestic<br />

<strong>and</strong> international routes. In addition, the Company offers ancillary services such as cancellation<br />

<strong>and</strong> rebooking options, in-flight merch<strong>and</strong>ising such as sale of duty-free products on international<br />

flights, excess baggage <strong>and</strong> travel-related products <strong>and</strong> services.<br />

1

Third Party Sales Outlets<br />

As of December 31, 2010, the Company had a network of distributors in the Philippines selling<br />

its domestic <strong>and</strong> international air services within an agreed territory or geographical coverage.<br />

Each distributor maintains <strong>and</strong> grows its own client base <strong>and</strong> can impose on their clients a service<br />

or transaction fee. Typically, a distributor’s client base would include agents, travel agents or end<br />

customers. The Company also had a network of foreign general sales agents, wholesalers, <strong>and</strong><br />

preferred sales agents who market, sell <strong>and</strong> distribute its air services in other countries.<br />

Publicly-Announced New Product or Service<br />

The Company continues to analyze its route network. The Company can opt to increase<br />

frequencies on existing routes or add new routes/destinations. The Company can also opt to<br />

eliminate unprofitable routes <strong>and</strong> redeploy capacity.<br />

The Company plans to exp<strong>and</strong> its fleet over the course of the next four years to 47 aircraft by the<br />

end of 2014 (net of redelivery of six leased aircraft). It has already signed a purchase agreement<br />

in February 2007 (as amended) on the basis of which it has firm orders for 22 <strong>Air</strong>bus A320<br />

aircraft, which are scheduled to be delivered starting October 2010, three of which have already<br />

arrived as of December 31, 2010. It has also entered into operating lease agreements for two<br />

<strong>Air</strong>bus A320 aircraft.<br />

The additional aircraft will support the Company’s plans to increase frequency on current routes<br />

<strong>and</strong> to add new city pairs <strong>and</strong> destinations. The Company has increased frequencies on domestic<br />

routes such as Manila to Cagayan de Oro, <strong>Cebu</strong>, Davao, Gen. Santos, <strong>and</strong> Puerto Princesa <strong>and</strong><br />

international routes such as Manila to Hong Kong, Singapore, Kuala Lumpur, Bangkok, <strong>and</strong><br />

Incheon. The Company plans to launch services from Manila to Pusan which is expected to start<br />

in 2011.<br />

Competition<br />

The Philippine aviation authorities deregulated the airline industry in 1995 eliminating certain<br />

restrictions on domestic routes <strong>and</strong> frequencies which resulted in fewer regulatory barriers to<br />

entry into the Philippine domestic aviation market. On the international market, although the<br />

Philippines currently operates under a bilateral framework, whereby foreign carriers are granted<br />

l<strong>and</strong>ing rights in the Philippines on the basis of reciprocity as set forth in the relevant bilateral<br />

agreements between the Philippine government <strong>and</strong> foreign nations, the Philippine government<br />

may consider liberalizing the Philippine aviation industry by allowing foreign carriers to exercise<br />

“freedoms of the air” traffic rights beyond those that were established under the bilateral<br />

agreements. The Philippine government may pursue “Open Skies” arrangements or policies such<br />

as ASEAN Open Skies. It may also pursue arrangements or policies similar to EO 29 or EO 500-<br />

A. This will significantly increase competition in the airline business. This will also allow the<br />

Company to exp<strong>and</strong> its route network.<br />

The Company faces intense competition on both its domestic <strong>and</strong> international routes. The level<br />

<strong>and</strong> intensity of competition varies from route to route based on a number of factors. Principally,<br />

it competes with other airlines that service the routes it flies. However, on certain domestic<br />

3

outes, the Company also considers alternative modes of transportation, particularly sea <strong>and</strong> l<strong>and</strong><br />

transport, to be competitors for its services. Substitutes to its services also include video<br />

conferencing <strong>and</strong> other modes of communication.<br />

The Company’s main competitor in the Philippines is Philippine <strong>Air</strong>lines (“PAL”), a full-service<br />

Philippine flag carrier. Most of the Company’s domestic <strong>and</strong> international destinations are also<br />

serviced by PAL. The Company also competes in the Philippines with <strong>Air</strong> Philippines Express, a<br />

domestic operator with relations to PAL. Certain smaller airlines, including Zest <strong>Air</strong> <strong>and</strong> South<br />

East Asian <strong>Air</strong>lines also compete with the Company domestically. According to Civil<br />

Aeronautics Board (CAB) data, the Company is the leading domestic airline in the Philippines by<br />

passengers carried, with a market share of 48.2% for the year ended December 31, 2010.<br />

The Company intends to capture a portion of the growing tourist market <strong>and</strong> the large OFW<br />

population. The Company is a leading low-cost airline offering services to more destinations <strong>and</strong><br />

serving more routes with a higher frequency between the Philippines <strong>and</strong> other ASEAN countries<br />

than any other airline in the Philippines. The Company currently competes with the following<br />

LCC’s <strong>and</strong> full-service airlines in its international operations: <strong>Air</strong>Asia, Tiger <strong>Air</strong>ways, Jetstar<br />

<strong>Air</strong>ways, PAL, Cathay <strong>Pacific</strong>, Singapore <strong>Air</strong>lines, Thai <strong>Air</strong>ways, among others.<br />

Recently, <strong>Air</strong>Asia has confirmed the set up of a joint venture in the Philippines which is targeted<br />

to start operations in the third quarter of 2011. The Philippine joint venture will operatate out of<br />

Clark in Pampanga initially with two A320 aircraft. <strong>Air</strong>Asia has been operating in the<br />

Philippines since 2005, with one daily flight between Kuala Lumpur <strong>and</strong> Clark, <strong>and</strong> one daily<br />

flight between Kota Kinabalu <strong>and</strong> Clark.<br />

In addition, Tiger <strong>Air</strong>ways <strong>and</strong> Philippine carrier Seair initially set-up a “Partner <strong>Air</strong>line”<br />

program. Seair will operate Singapore flights to/from Clark flights using two 144-seater A319<br />

aircraft leased from Tiger. Seair’s seats <strong>and</strong> ancillary services for this route will be sold through<br />

Tiger’s website. Tiger recently took 32.5% stake in Seair.<br />

Jetstar <strong>Air</strong>ways also recently announced that it is in talks with various local companies, looking<br />

for a Filipino partner. Jetstar <strong>Air</strong>ways wants to tap markets outside Manila such as <strong>Cebu</strong> <strong>and</strong><br />

Aklan.<br />

Raw Materials<br />

Fuel is a major cost component for airlines. The Company’s fuel requirements are classified by<br />

location <strong>and</strong> sourced from various suppliers.<br />

The Company’s fuel suppliers at its international stations include PTT, Petronas, Shell-<br />

Singapore, SK-Korea <strong>and</strong> Chevron HK, among others. It also purchases fuel from PTT<br />

Philippines <strong>and</strong> Phoenix Petroleum. The Company purchases fuel stocks on a per parcel basis, in<br />

such quantities as are sufficient to meet its monthly operational requirements. Most of the<br />

Company’s contracts with fuel suppliers are on a yearly basis <strong>and</strong> may be renewed for subsequent<br />

one-year periods.<br />

4

Dependence on One or a Few Major Customers <strong>and</strong> Identify any such Major Customers<br />

The Company’s business is not dependent upon a single customer or a few customers that a loss<br />

of anyone of which would have a material adverse effect on the Company.<br />

Transactions with <strong>and</strong>/or Dependence on Related Parties<br />

The Company’s significant transactions with related parties are described in detail in Note 26 of<br />

the Notes to Consolidated Financial Statements.<br />

Patents, Trademarks, Licenses, Franchises, Concessions <strong>and</strong> Royalty Agreements<br />

Patents / Trademarks<br />

The Company has registered the “<strong>Cebu</strong> <strong>Pacific</strong>” <strong>and</strong> the <strong>Cebu</strong> <strong>Pacific</strong> feather-like device trade<br />

marks with the Philippine Intellectual Property Office (PIPO). In the Philippines, certificates of<br />

registration of a trade mark filed with the PIPO prior to the effective date of the Philippine<br />

Intellectual Property Code in 1998 are generally effective for a period of 20 years from the date<br />

of the certificate, while those filed after the Philippine Intellectual Property Code became<br />

effective are generally effective for a shorter period of ten years, unless terminated earlier. The<br />

Company currently has 16 trademark applications pending with the PIPO. It has also registered<br />

the business name “<strong>Cebu</strong> <strong>Pacific</strong> <strong>Air</strong>” with the Department of Trade <strong>and</strong> Industry. Registering a<br />

business name with the Department of Trade <strong>and</strong> Industry precludes another entity engaged in the<br />

same or similar business from using the same business name as one that has been registered. A<br />

registration of a business name shall be effective for five years from the initial date of registration<br />

<strong>and</strong> must be renewed within the first three months following the expiration of the five-year period<br />

from the date of original registration.<br />

Licenses / Permits<br />

The Company operates its business in highly regulated environment. The Company’s business<br />

depends upon the permits <strong>and</strong> licenses issued by the government authorities or agencies for its<br />

operations which include the following:<br />

• Legislative Franchise to Operate a Public Utility<br />

• Certificate of Public Convenience <strong>and</strong> Necessity<br />

• Letter of Authority<br />

• <strong>Air</strong> Operator Certificate<br />

• Certificate of Registration<br />

• Certificate of <strong>Air</strong>worthiness<br />

The Company also has to seek approval from the relevant airport authorities to secure airport<br />

slots for its operations.<br />

5

Franchise<br />

In 1991, pursuant to Republic Act (RA) No. 7151, the Company was granted a franchise to<br />

operate air transportation services, both domestic <strong>and</strong> international. In accordance with the<br />

Company’s franchise, which extends up to year 2031:<br />

a) The Company is subject to franchise tax of five (5) percent of the gross revenue derived<br />

from air transportation operations. For revenue earned from activities other than air<br />

transportation, the Company is subject to regular corporate income tax <strong>and</strong> to real<br />

property tax.<br />

b) In the event that any competing individual, partnership or corporation received <strong>and</strong><br />

enjoyed tax privileges <strong>and</strong> other favorable terms which tended to place the Company at<br />

any disadvantage, then such privileges shall have been deemed by the fact itself of the<br />

Company’s tax privileges <strong>and</strong> shall operate equally in favor of the Company.<br />

Kindly refer to Note 1 of the Notes to Consolidated Financial Statements.<br />

Government Approval of Principal Products or Services<br />

The Company operates its business in highly regulated environment. The Company’s business<br />

depends upon the permits <strong>and</strong> licenses issued by the government authorities or agencies for its<br />

operations which include the following:<br />

• Legislative Franchise to Operate a Public Utility<br />

• Certificate of Public Convenience <strong>and</strong> Necessity<br />

• Letter of Authority<br />

• <strong>Air</strong> Operator Certificate<br />

• Certificate of Registration<br />

• Certificate of <strong>Air</strong>worthiness<br />

The Company also has to seek approval from the relevant airport authorities to secure airport<br />

slots for its operations.<br />

Effects of Existing or Probable Government Regulations on the Business<br />

Civil Aeronautics Administration <strong>and</strong> Civil Aviation Authority of the Philippines (CAAP)<br />

Policy-making for the Philippine civil aviation industry started with RA 776, known as the Civil<br />

Aeronautics Act of the Philippines (the “Act”), passed in 1952. The Act established the policies<br />

<strong>and</strong> laws governing the economic <strong>and</strong> technical regulation of civil aeronautics in the country. It<br />

established the guidelines for the operation of two regulatory organizations, CAB for the<br />

regulation of the economic activities of airline industry participants <strong>and</strong> the <strong>Air</strong> Transportation<br />

Office, which was later transformed into the CAAP, created pursuant to RA 9497, otherwise<br />

known as the Civil Aviation Authority Act of 2008.<br />

6

The CAB is authorized to regulate the economic aspects of air transportation, to issue general<br />

rules <strong>and</strong> regulations to carry out the provisions of RA 776, <strong>and</strong> to approve or disapprove the<br />

conditions of carriage or tariff which an airline desires to adopt. It has general supervision <strong>and</strong><br />

regulation over air carriers, general sales agents, cargo sales agents, <strong>and</strong> airfreight forwarders, as<br />

well as their property, property rights, equipment, facilities <strong>and</strong> franchises.<br />

The CAAP, a government agency under the supervision of the Department of Transportation <strong>and</strong><br />

Communications for purposes of policy coordination, regulates the technical <strong>and</strong> operational<br />

aspects of air transportation in the Philippines, ensuring safe, economic <strong>and</strong> efficient air travel. In<br />

particular, it establishes the rules <strong>and</strong> regulations for the inspection <strong>and</strong> registration of all aircraft<br />

<strong>and</strong> facilities owned <strong>and</strong> operated in the Philippines, determines the charges <strong>and</strong>/or rates pertinent<br />

to the operation of public air utility facilities <strong>and</strong> services, <strong>and</strong> coordinates with the relevant<br />

government agencies in relation to airport security. Moreover, CAAP is likewise tasked to<br />

operate <strong>and</strong> maintain domestic airports, air navigation <strong>and</strong> other similar facilities in compliance<br />

with the International Civil Aviation Organization (ICAO), the specialized agency of the United<br />

Nations whose m<strong>and</strong>ate is to ensure the safe, efficient <strong>and</strong> orderly evolution of international civil<br />

aviation.<br />

The Company complies with <strong>and</strong> adheres to existing government regulations.<br />

Category 2 Rating<br />

In early January 2008, the Federal Aviation Administration (FAA) of the United States<br />

downgraded the aviation safety ranking of the Philippines to Category 2 from the previous<br />

Category 1 rating. The FAA assesses the civil aviation authorities of all countries with air carriers<br />

that operate to the U.S. to determine whether or not foreign civil aviation authorities are meeting<br />

the safety st<strong>and</strong>ards set by the ICAO. The lower Category 2 rating means a country either lacks<br />

laws or regulations necessary to oversee airlines in accordance with minimum international<br />

st<strong>and</strong>ards, or its civil aviation authority is deficient in one or more areas, such as technical<br />

expertise, trained personnel, recordkeeping or inspection procedures. Further, it means Philippine<br />

carriers can continue flyin g to the U.S. but only under heightened FAA surveillance or<br />

limitations. In addition, the Philippines has been included in the “Significant Safety Concerns”<br />

posting by the ICAO as a result of an unaddressed safety concern highlighted in the recent ICAO<br />

audit. As a result of this unaddressed safety concern, <strong>Air</strong> Safety Committee (ASC) of the<br />

European Union banned all Philippine commercial air carriers from operating flights to <strong>and</strong> from<br />

Europe. The ASC based its decision on the absence of sufficient oversight by the CAAP.<br />

Although the Company does not currently operate flights to the U.S. <strong>and</strong> Europe, the foregoing<br />

may adversely affect its ability to establish new routes to other countries that base their decision<br />

on flight access on the FAA <strong>and</strong> ASC’s evaluation.<br />

EO 28 <strong>and</strong> 29<br />

In March 2011, the Government issued EO 28 which provides for the reconstitution <strong>and</strong><br />

reorganization of the existing Single Negotiating Panel into the Philippine <strong>Air</strong> Negotiating Panel<br />

(PANP) <strong>and</strong> Philippine <strong>Air</strong> Consultation Panel (PACP) (collectively, the Philippine <strong>Air</strong> Panels).<br />

The PANP shall be responsible for the initial negotiations leading to the conclusion of the<br />

relevant <strong>Air</strong> Services Agreements (ASAs) while the PACP shall be responsible for the succeeding<br />

negotiations of such ASAs or similar arrangements.<br />

7

Also in March 2011, the government issued EO 29 which authorizes the CAB <strong>and</strong> the Philippine<br />

<strong>Air</strong> Panels to pursue more aggressively the international civil aviation liberalization policy to<br />

boost the country’s competitiveness as a tourism destination <strong>and</strong> investment location. Among<br />

others, EO 29 provides the following:<br />

• In the negotiation of the ASAs, the Philippine <strong>Air</strong> Panels may offer <strong>and</strong> promote third, fourth<br />

<strong>and</strong> fifth freedom rights to the country’s airports other than the NAIA without restriction as to<br />

frequency, capacity <strong>and</strong> type of aircraft, <strong>and</strong> other arrangements that will serve the national<br />

interest as may be determined by the CAB; <strong>and</strong><br />

• Notwithst<strong>and</strong>ing the provisions of the relevant ASAs, the CAB may grant any foreign air<br />

carriers increases in frequencies <strong>and</strong>/or capacities in the country’s airports other than the<br />

NAIA, subject to conditions required by existing laws, rules <strong>and</strong> regulations. All grants of<br />

frequencies <strong>and</strong>/or capacities which shall be subject to the approval of the President shall<br />

operate as a waiver by the Philippines of the restrictions on frequencies <strong>and</strong> capacities under<br />

the relevant ASAs.<br />

The issuance of the foregoing EOs may significantly increase competition.<br />

Research <strong>and</strong> Development<br />

The Company incurred minimal amounts for research <strong>and</strong> development activities, which do not<br />

amount to a significant percentage of revenues.<br />

Cost <strong>and</strong> Effects of Compliance with Environmental Laws<br />

The operations of the Company are subject to various laws enacted for the protection of the<br />

environment. The Company has complied with the following applicable environmental laws <strong>and</strong><br />

regulations:<br />

• Presidential Decree No. 1586 (Establishing an Environmental Impact Assessment System)<br />

which directs every person, partnership or corporation to obtain an Environmental<br />

Compliance Certificate (ECC) before undertaking or operating a project declared as<br />

environmentally critical by the President of the Philippines. Petro-chemical industries,<br />

including refineries <strong>and</strong> fuel depots, are considered environmentally critical projects for<br />

which an ECC is required. The Company has obtained ECCs for the fuel depots it operates<br />

<strong>and</strong> maintains in Domestic Road, Pasay City (“Manila Depot”), Lapu-Lapu City (“<strong>Cebu</strong><br />

Depot”) <strong>and</strong> Sasa, Davao City (“Davao Depot”) for the storage <strong>and</strong> distribution of aviation<br />

fuel for its aircraft.<br />

• RA 8749 (The Implementing Rules <strong>and</strong> Regulations of the Philippine Clean <strong>Air</strong> Act of 1999)<br />

requires operators of aviation fuel storage tanks, which are considered as a possible source of<br />

air pollution, to obtain a Permit to Operate from the applicable regional office of the EMB.<br />

The aviation fuel storage tanks in the Company’s Manila Depot, <strong>Cebu</strong> Depot <strong>and</strong> Davao<br />

Depot are subject to <strong>and</strong> are compliant with this requirement.<br />

8

• RA 9275 (Implementing Rules <strong>and</strong> Regulations of the Philippine Clean Water Act of 2004)<br />

requires owners or operators of facilities that discharge regulated effluents to secure from the<br />

Laguna Lake Development Authority (Luzon area) <strong>and</strong>/or the applicable regional office of<br />

the EMB (Visayas <strong>and</strong> Mindanao areas) a discharge permit, which is the legal authorization<br />

granted by the Department of Energy <strong>and</strong> Natural Resources for the discharge of waste water.<br />

The Company’s operations generate waste water <strong>and</strong> effluents for the disposal of which a<br />

Discharge Permit was obtained from the Laguna Lake Development Authority <strong>and</strong> the<br />

Environment Management Bureau of Region 7 which enables it to discharge <strong>and</strong> dispose of<br />

liquid waste or water effluent generated in the course of its operations at specifically<br />

designated areas. The Company also contracted the services of government-licensed <strong>and</strong><br />

accredited third parties to transport, h<strong>and</strong>le <strong>and</strong> dispose its waste materials.<br />

Compliance with the foregoing laws does not have a material effect to the Company’s capital<br />

expenditures, earnings <strong>and</strong> competitive position.<br />

On an annual basis, the Company spend approximately P300,000 in connection with its<br />

compliance with applicable environmental laws.<br />

Employees<br />

As of December 31 2010, the Company had 2,475 permanent full time employees, categorized as<br />

follows:<br />

Division:<br />

Employees<br />

Operations……...…………………………………… 1,699<br />

Commercial …………………………………… 485<br />

Support Departments (1) ……………………………… 291<br />

2,475<br />

Note:<br />

(1) Support Departments include the Office of the General Manager, the Corporate Finance, Planning <strong>and</strong><br />

Legal Affairs Department, People Department, Administrative Services Department, Procurement<br />

Department, Information Systems Department, Comp troller Department, Internal Audit Department <strong>and</strong><br />

Treasury Department.<br />

The Company’s employees are not unionized, <strong>and</strong> it has not experienced any labor strikes or<br />

work stoppages in past three years.<br />

Risk<br />

The major business risks facing the Company are as follows:<br />

(1) Cost <strong>and</strong> Availability of Fuel<br />

The cost <strong>and</strong> availability of fuel are subject to many economic <strong>and</strong> political factors <strong>and</strong> events<br />

occurring throughout the world, the most important of which are not within the Company’s<br />

control. Fuel prices have been subject to high volatility, fluctuating substantially over the past<br />

9

several years. Any increase in the cost of fuel or any decline in the availability of adequate<br />

supplies of fuel could have a material adverse effect on the Company’s operations <strong>and</strong><br />

profitability.<br />

The Company implements various fuel management strategies to manage the risk of rising fuel<br />

prices including hedging. The Company may also consider adding fuel surcharge in the event of<br />

significant increase in fuel prices.<br />

(2) Competition<br />

The Company faces intense competition on its domestic <strong>and</strong> international routes, both from other<br />

low-cost carriers <strong>and</strong> from full-service carriers. Its existing competitors or new entrants into the<br />

market may undercut its fares in the future, increase capacity on their routes or attempt to conduct<br />

low-fare or low-cost airline operations of their own in an effort to increase market share, any of<br />

which could negatively affect the Company’s business. The Company also faces competition<br />

from ground <strong>and</strong> sea transportation alternatives, including buses, trains, ferries, boats <strong>and</strong> cars,<br />

which are the principal means of transportation in the Philippines. Video teleconferencing <strong>and</strong><br />

other methods of electronic communication, <strong>and</strong> improvements therein, also add a new dimension<br />

of competition to the industry as they, to a certain extent, provide lower-cost substitutes for air<br />

travel.<br />

The Company focuses on areas of costs, on-time performance, service delivery <strong>and</strong> scheduling<br />

to remain competitive.<br />

(3) Lack of Marketing Alliance<br />

Many airlines have marketing alliances with other airlines under which they market <strong>and</strong> advertise<br />

their status as marketing alliance partners. The Company is not a member of any such marketing<br />

alliance with respect to its passenger services. Its lack of alliance could harm its business <strong>and</strong><br />

competitive ability.<br />

The Company may try to enter into code sharing agreements, interlining agreements or any other<br />

marketing alliances in the future.<br />

(4) Economic Downturn<br />

The deterioration in the financial markets has heralded a recession in many countries, which led<br />

to significant declines in employment, household wealth, consumer dem<strong>and</strong> <strong>and</strong> lending <strong>and</strong>, as a<br />

result, has adversely affected economic growth in the Philippines <strong>and</strong> elsewhere. Since a<br />

substantial portion of airline travel, for both business <strong>and</strong> leisure, is discretionary, the airline<br />

industry tends to experience adverse financial results during general economic downturns. Any<br />

deterioration in the economy could negatively affect consumer sentiment <strong>and</strong> lead to a reduction<br />

in dem<strong>and</strong> for flying which could adversely affect the Company’s business. The Company could<br />

also experience difficulty accessing the financial markets, which could make it more difficult or<br />

expensive to obtain funding in the future.<br />

10

(5) Availability of Debt Financing<br />

The Company’s business is highly capital intensive. It has historically required debt financing to<br />

acquire aircraft <strong>and</strong> expect to incur significant amounts of debt in the future to fund the<br />

acquisition of additional aircraft, its operations, other anticipated capital expenditures, working<br />

capital requirements <strong>and</strong> expansion overseas. Failure to obtain additional financing could<br />

adversely affect the Company’s ability to grow its business <strong>and</strong> its future profitability.<br />

(6) Foreign Exchange <strong>and</strong> Interest Rate Fluctuations<br />

The Company’s exposure to foreign exchange rate fluctuations is principally in respect of its U.S.<br />

dollar-denominated long-term debt as well as a majority of its operating costs, such as U.S.<br />

dollar-denominated purchases of aviation fuel. On the other h<strong>and</strong>, the Company’s exposure to<br />

interest rate fluctuations is relative to debts incurred which have floating interest rates. In such<br />

cases, any significant devaluation of the Philippine peso <strong>and</strong> any significant increases in interest<br />

rates will result to increased obligations that could adversely impact the Company’s result of<br />

operations.<br />

The Company may enter into derivative contracts in the future to hedge foreign exchange<br />

exposure. In addition, the Company may fix the interest rates for a portion of its loans.<br />

(7) <strong>Air</strong>port <strong>and</strong> <strong>Air</strong> Traffic Control Infrastructure Constraints<br />

The Company relies on operational efficiency to reduce unit costs <strong>and</strong> provide reliable service.<br />

Any delay to the addition of capacity at airports or upgrade of facilities in the Philippines could<br />

affect the Company’s operational efficiency.<br />

(8) Reliance on Third Party Facilities <strong>and</strong> Service Providers<br />

The Company’s inability to lease, acquire or access airport facilities <strong>and</strong> service providers on<br />

reasonable terms to support its growth or to maintain its current operations would have a material<br />

adverse effect on our business, prospects, financial condition <strong>and</strong> results of operations.<br />

Furthermore, the Company’s reliance on third parties to provide essential services on its behalf<br />

gives the Company less control over the efficiency, timeliness <strong>and</strong> quality of services.<br />

(9) Safety <strong>and</strong> Security<br />

The Company is exposed to potentially significant losses in the event that any of its aircraft is lost<br />

or subject to an accident, terrorist incident or other disaster. In addition, any such event would<br />

give rise to significant costs related to passenger claims, repairs or replacement of a damaged<br />

aircraft <strong>and</strong> its temporary or permanent loss from service. Moreover, aircraft accidents or<br />

incidents, even if fully insured, are likely to create a public perception that the airline is less safe<br />

than other airlines, which could significantly reduce its passenger volumes <strong>and</strong> have a material<br />

adverse effect on its business, prospects, financial condition <strong>and</strong> results of operations. Terrorist<br />

attacks could also result in decreased seat load factors <strong>and</strong> yields <strong>and</strong> could result in increased<br />

costs, such as increased fuel expenses or insurance costs.<br />

The Company is committed to operational safety <strong>and</strong> security. Its commitment to safety <strong>and</strong><br />

security is reflected in its rigorous aircraft maintenance program <strong>and</strong> flight operations manuals,<br />

intensive flight crew, cabin crew <strong>and</strong> employee training programs <strong>and</strong> strict compliance with<br />

applicable regulations regarding aircraft <strong>and</strong> operational safety <strong>and</strong> security.<br />

11

(10) Maintenance Cost <strong>and</strong> Performance of Maintenance Repair Organizations<br />

As the fleet ages, maintenance <strong>and</strong> overhaul expenses will increase. Any significant increase in<br />

maintenance <strong>and</strong> overhaul expenses <strong>and</strong> the inability of maintenance repair organizations to<br />

provide satisfactory service could adversely affect the business.<br />

The Company enters into long term contracts to manage maintenance <strong>and</strong> overhaul expenses.<br />

(11) Reliance on Automated Systems <strong>and</strong> the Internet<br />

The Company depends on automated systems to operate its business, including, among others, its<br />

website, its reservation <strong>and</strong> its departure control systems. Any disruption to its website or online<br />

reservation <strong>and</strong> telecommunication services could result in losses, increased expenses <strong>and</strong> could<br />

harm its reputation.<br />

(12) Dependence on the Efforts of Executive Officers <strong>and</strong> Other Key Management<br />

The Company’s success depends to a significant extent upon the continued services of its<br />

executive officers <strong>and</strong> other key management personnel. The unavailability of any of its<br />

executive officers <strong>and</strong> other key management or failure to recruit suitable or comparable<br />

replacements could have a material adverse effect on our business, prospects, financial condition<br />

<strong>and</strong> results of operations.<br />

(13) Retaining <strong>and</strong> Attracting Qualified Personnel<br />

The Company’s business model requires it to have highly skilled, dedicated <strong>and</strong> efficient pilots,<br />

engineers <strong>and</strong> other personnel. Its growth plans will require the Company to hire, train <strong>and</strong> retain<br />

a significant number of new employees in the future. However, from time to time, the airline<br />

industry has experie nced a shortage of skilled personnel, particularly pilots <strong>and</strong> engineers. The<br />

Company competes against full-service airlines which offer wage <strong>and</strong> benefit packages that<br />

exceed those offered by the Company. The inability of the Company to hire, train <strong>and</strong> retain<br />

qualified employees at a reasonable cost could result in inability to execute it growth strategy,<br />

which would have a material adverse effect on our business, prospects, financial condition <strong>and</strong><br />

results of operations. In addition, the Company may find it increasingly challenging to maintain<br />

its corporate culture as it replaces or hires additional personnel.<br />

The Company may have to increase wages <strong>and</strong> benefits to attract <strong>and</strong> retain qualified personnel.<br />

(14) Availability of Insurance<br />

Insurance is fundamental to airline operations. Because of terrorist attacks or other world events,<br />

certain aviation insurance could become unavailable or available only for reduced amounts of<br />

coverage that are insufficient to comply with the le vels of coverage required by the Company’s<br />

aircraft lenders <strong>and</strong> lessors or applicable government regulations. Any inability to obtain<br />

insurance, on commercially acceptable terms or at all, for the Company’s general operations or<br />

specific assets would have a material adverse effect on business, prospects, financial condition<br />

<strong>and</strong> results of operations.<br />

12

(15) Regulations<br />

The Company has no control over applicable regulations. Changes in the interpretation of current<br />

regulations or the introduction of new laws or regulations could have a material adverse effect on<br />

the Company’s business, prospects, financial condition <strong>and</strong> results of operations.<br />

(16) Catastrophes <strong>and</strong> Other Factors Beyond the Company’s Control<br />

Like other airlines, the Company is subject to delays caused by factors beyond its control,<br />

including weather conditions, traffic congestion at airports, air traffic control problems <strong>and</strong><br />

increased security measures. In the event that the Company delays or cancels flights for any of<br />

these reasons, revenues <strong>and</strong> profits would be reduced <strong>and</strong> the Company’s reputation would suffer<br />

which could result in a loss of customers.<br />

(17) Unionization, Work Stoppages, Slowdowns <strong>and</strong> Increased Labor Costs<br />

At present, the Company has a non-unionized workforce. However, in the event the employees<br />

unionize, it could result to dem<strong>and</strong>s that may increase operating expenses <strong>and</strong> adversely affect the<br />

Company’s profitability. Likewise, disagreements between the labor union <strong>and</strong> management<br />

could result to work slowdowns or stoppages or disruptions which could be harmful to the<br />

business.<br />

(18) Restrictions under the Philippine Constitution <strong>and</strong> other Laws<br />

The Company is subject to nationality restrictions under the Philippine Constitution <strong>and</strong> other<br />

laws, limiting ownership of public utility companies to citizens of the Philippines or corporations<br />

or associations organized under the laws of the Philippines of which at least 60% of the capital<br />

stock outst<strong>and</strong>ing is owned <strong>and</strong> held by citizens of the Philippines. There is a risk that these<br />

ownership restrictions may be breached which could result in the revocation of the Company’s<br />

franchise generally <strong>and</strong> its rights to fly on certain international routes.<br />

(19) Relationship with Third Party Sales Outlets<br />

While part of the Company’s strategy is to increase bookings through the internet, sales through<br />

third party sales outlets remain an important distribution channel. There is no assurance that the<br />

Company will be able to maintain favorable relationships with them nor be able to suitably<br />

replace them. The Company’s revenues could be adversely impacted if third parties who sell its<br />

air services elect to prioritize other airlines.<br />

(20) Outbreaks<br />

Any present or future outbreak of contagious diseases could have a material adverse effect on the<br />

Company’s business, prospects, financial condition <strong>and</strong> results of operations.<br />

(21) Domestic Concentration<br />

Since the Company’s operations has focused <strong>and</strong>, at least in the near term, will continue to focus<br />

on air travel in the Philippines, it would be materially <strong>and</strong> adversely affected by any<br />

circumstances causing a reduction in dem<strong>and</strong> for air transportation in the Philippines, including<br />

13

adverse changes in local economic <strong>and</strong> political conditions, negative travel advisories issued by<br />

foreign governments, declining interest in the Philippines as a tourist destination, or significant<br />

price increases linked to increases in airport access costs <strong>and</strong> fees imposed on passengers.<br />

(22) Investment Risk<br />

The Company has investment securities, the values of which are dependent on fluctuating market<br />

prices. Any negative movement in the market price of the Company’s investments could affect<br />

the Company’s results of operations.<br />

The foregoing risks are not all inclusive. Other risks that may affect the Company’s business <strong>and</strong><br />

operations may not be included in the above disclosure.<br />

Item 2.<br />

Properties<br />

As of the December 31, 2010, the Company does not own any l<strong>and</strong> or buildings. It leases the<br />

office space used for its corporate headquarters from the Philippine Aerospace Development<br />

Corp., while it leases its hangar, aircraft parking <strong>and</strong> other operational space from the Manila<br />

International <strong>Air</strong>port Authority. Kindly refer to Notes 12, 16 <strong>and</strong> 27 of the Notes to Consolidated<br />

Financial Statements for the detailed discussions on Properties, Leases, Purchases <strong>and</strong> Capital<br />

Expenditure Commitments.<br />

Item 3.<br />

Legal Proceedings<br />

The Company is subject to law suits <strong>and</strong> legal actions in the ordinary course of business. The<br />

Company is not a party to, <strong>and</strong> its properties are not subject of, any material pending legal<br />

proceedings that could be expected to have a material adverse effect on the Company’s financial<br />

position or result of operations.<br />

Item 4.<br />

Submission of Matters to a Vote of Security Holders<br />

There were no matters submitted to a vote of security holders during the fourth quarter of the year<br />

covered by this report.<br />

14

PART II - OPERATIONAL AND FINANCIAL INFORMATION<br />

Item 5.<br />

Market for Registrant’s Common Equity <strong>and</strong> Related Stockholder Matter<br />

Market Information<br />

The principal market for the Company’s common equity is the Philippine Stock Exchange. Sales<br />

prices of the common stock follow:<br />

High<br />

Low<br />

Year 2010<br />

October to December 2010 P133.50 P82.00<br />

As of March 23, 2011, the latest trading date prior to the completion of this annual report, sales<br />

prices of the common stock is at P86.30.<br />

Holders<br />

The number of shareholders of record as of December 31, 2010 was 20. Common shares<br />

outst<strong>and</strong>ing as of December 31, 2010 were 613,236,550.<br />

15

List of Stockholders of Record<br />

As of December 31, 2010<br />

Number of Percent to<br />

Name of Stockholders Shares Held Total Outst<strong>and</strong>ing<br />

1. CP<strong>Air</strong> Holdings, Inc. 400,816,841 65.36%<br />

2. PCD Nominee Corporation (Non-Filipino) 161,004,740 26.25%<br />

3. PCD Nominee Corporation (Filipino) 51,411,960 8.38%<br />

4. Lucille Chiongbian Solon 1,000 0.00%<br />

5. Gloria Jane L. Enrile 500 0.00%<br />

5. Priscilla C. Solon 500 0.00%<br />

6. Jan Carlo Domingo Bunda 200 0.00%<br />

6. Manuel Rio dela Rosa Bunda 200 0.00%<br />

6. Generosa Gonzales Doolani 200 0.00%<br />

6. Mohan Gonzales Doolani 200 0.00%<br />

6. Sunita Gonzales Doolani 200 0.00%<br />

7. Jose F. Buenaventura 1 0.00%<br />

7. Antonio L. Go 1 0.00%<br />

7. Frederick D. Go 1 0.00%<br />

7. James L. Go 1 0.00%<br />

7. John L. Gokongwei, Jr. 1 0.00%<br />

7. Lance Y. Gokongwei 1 0.00%<br />

7. Robina Y. Gokongwei-Pe 1 0.00%<br />

7. Oh Wee Khoon 1 0.00%<br />

7. Ricardo J. Romulo 1 0.00%<br />

Total 613,236,550 100.00%<br />

Dividends<br />

No dividend was declared in 2010.<br />

On March 17, 2011, the Board of Directors of the Company approved the declaration of a regular<br />

cash dividend in the amount of P2.00 per share <strong>and</strong> a special cash dividend in the amount of<br />

P1.00 per share from the unrestricted retained earnings of the Company to all stockholders of<br />

record as of April 14, 2011 <strong>and</strong> payable on May 12, 2011.<br />

Recent Sales of Unregistered Securities<br />

Not Applicable. All shares of the Company are listed in the Philippine Stock Exchange.<br />

16

Item 6.<br />

Management's Discussion <strong>and</strong> Analysis or Plan of Operation<br />

The following discussion should be read in conjunction with the accompanying consolidated<br />

financial statements <strong>and</strong> notes thereto, which form part of this Report. The consolidated financial<br />

statements <strong>and</strong> notes thereto have been prepared in accordance with the Philippine Financial<br />

Reporting St<strong>and</strong>ards (PFRS).<br />

Results of Operations<br />

Year Ended December 31, 2010 Compared with Year Ended December 31, 2009<br />

Revenues<br />

The Company posted revenues of P29.089 billion for the year ended December 31, 2010 which<br />

was 24.8% higher than the P23.311 billion revenues generated last year. Considerable<br />

improvement in revenues is accounted for as follows:<br />

Passenger Revenues<br />

Passenger revenues increased by P5.152 billion or 26.4% to P24.656 billion in the year ended<br />

December 31, 2010 from P19.504 billion revenues posted last year. This increase was primarily<br />

due to the 19.5% increase in passenger volume to 10.5 million in the twelve months ended<br />

December 31, 2010 from 8.8 million in the twelve months ended December 31, 2009. This was<br />

driven by the increase in number of flights year on year <strong>and</strong> higher seat load factor in 2010. The<br />

Company increased the size of its fleet by adding two <strong>Air</strong>bus A320 aircraft <strong>and</strong> two ATR 72-500<br />

aircraft during the twelve months ended December 31, 2009. These aircraft were in operation for<br />

the entire twelve months ended December 31, 2010 thereby resulting in more flights compared to<br />

2009. Moreover, three <strong>Air</strong>bus A320 aircraft arrived during the last quarter of 2010 which further<br />

contributed to the increased number of flights. Total number of flights in 2010 was up by 8.2%<br />

year on year. The increase in passenger revenues for the twelve months ended December 31,<br />

2010 compared with the twelve months ended December 31, 2009 was also attributable to the<br />

increase in the average fares which moved up by 5.8% to P2,357 in 2010 from P2,227 in prior<br />

year.<br />

Cargo Revenues<br />

Cargo revenues increased by P411.194 million or 24.4% to P2.096 billion in the year ended<br />

December 31, 2010 from P1.684 billion in the year ended December 31, 2009, mainly as a result<br />

of the increase in the volume of cargo transported during the period.<br />

Ancillary Revenues<br />

Ancillary revenues increased by P214.862 million or 10.1% to P2.337 billion in the year ended<br />

December 31, 2010 from P2.122 billion registered in 2009. Changes in the Company’s travel<br />

regulations led to the reduction in rebooking, refunds <strong>and</strong> cancellation fees as the Company no<br />

longer allows booking changes including cancellations within 24 hours from the estimated date of<br />

departure. This offset the increase in revenues generated from excess baggage <strong>and</strong> other ancillary<br />

services. Excluding rebooking, refunds <strong>and</strong> cancellation fees, ancillary revenues grew by 33.7%<br />

in the twelve months ended December 31, 2010 compared with the twelve months ended<br />

December 31, 2009. The introduction of additional ancillary revenue sources <strong>and</strong> increases in<br />

rates contributed to the improvement in other ancillary revenues in 2010.<br />

17

Expenses<br />

The Company incurred expenses of P22.639 billion for the year ended December 31, 2010,<br />

12.4% higher than the P20.147 billion expenses incurred last year. Increase in expenses due to<br />

seat growth was partially offset by the strengthening of the Philippine peso against the U.S. dollar<br />

to an average of P45.12 per U.S. dollar for the twelve months ended December 31, 2010 from an<br />

average of P47.64 per U.S. dollar in 2009 based on the Philippine Dealing System weighted<br />

average rates. Expenses increased as a result of the following:<br />

Flying Operations<br />

Flying operations expenses increased by P2.560 billion or 28.9% to P11.417 billion in the year<br />

ended December 31, 2010 from P8.857 billion in the year ended December 31, 2009. Increase in<br />

flying operations expenses was mainly attributable to the increase in aviation fuel expenses by<br />

33.3% to P9.808 billion in the twelve months ended December 31, 2010 from P7.360 billion<br />

incurred last year as a result of the overall increase in the number of flights as well as increase in<br />

aviation fuel prices. Aviation fuel prices rose as referenced by the increase in the average<br />

published MOPS price of U.S. $90.10 per barrel in the twelve months ended December 31, 2010<br />

compared to the U.S. $69.97 per barrel in 2009.<br />

<strong>Air</strong>craft <strong>and</strong> Traffic Servicing<br />

<strong>Air</strong>craft <strong>and</strong> traffic servicing expenses decreased by P170.026 million or 6.5% to P2.462 billion<br />

in the year ended December 31, 2010 from P2.632 billion posted in 2009. Decline was mainly<br />

due to lower airport charges further reduced by the strengthening of the Philippine peso against<br />

the U.S. dollar in 2010.<br />

Repairs <strong>and</strong> Maintenance<br />

Repairs <strong>and</strong> maintenance expenses decreased by P278.995 million or 10.9% to P2.290 billion in<br />

the year ended December 31, 2010 from P2.569 billion last year. Decline in repairs <strong>and</strong><br />

maintenance expenses resulted from the Company’s effective cost management. The appreciation<br />

of the Philippine peso against the U.S. dollar in 2010 also contributed to the decrease.<br />

Depreciation <strong>and</strong> Amortization<br />

Depreciation <strong>and</strong> amortization expenses increased by P183.246 million or 9.6% to P2.101 billion<br />

in the year ended December 31, 2010 from P1.918 billion in the year ended December 31, 2009<br />

mainly because of the addition of two ATR 72-500 aircraft during the course of the twelve<br />

months ended December 31, 2009 which were in operation for the entire twelve months ended<br />

December 31, 2010 <strong>and</strong> the acquisition of three <strong>Air</strong>bus A320 aircraft during the last quarter of<br />

2010. The acquisition of one spare engine in fourth quarter 2009 also contributed to the increase.<br />

<strong>Air</strong>craft <strong>and</strong> Engine Lease<br />

<strong>Air</strong>craft <strong>and</strong> engine lease expenses decreased by P119.031 million or 6.9% to P1.605 billion in<br />

the year ended December 31, 2010 from P1.724 billion in prior year consequent to the return of<br />

two leased Boeing 757 aircraft in June <strong>and</strong> October 2009. Decline in aircraft <strong>and</strong> engine lease<br />

expenses was also attributable to the strengthening of the Philippine peso to an average of P45.12<br />

per U.S. dollar for the twelve months ended December 31, 2010 compared to an average of<br />

P47.64 per U.S. dollar for the twelve months ended December 31, 2009.<br />

18

Reservation <strong>and</strong> Sales<br />

Reservation <strong>and</strong> sales expenses increased by P341.289 million or 34.3% to P1.336 billion in the<br />

year ended December 31, 2010 from P0.995 billion in 2009. This increase was primarily<br />

attributable to the increased advertising <strong>and</strong> promotions expenditures incurred to promote the<br />

Company’s services on the Company’s international routes during the twelve months ended<br />

December 31, 2010. Increase was also due to higher commission expenses as a result of the<br />

overall increase in passenger <strong>and</strong> cargo volumes, especially on the international operations.<br />

General <strong>and</strong> Administrative<br />

General <strong>and</strong> administrative expenses decreased by P127.622 million or 15.5% to P694.888<br />

million in year ended December 31, 2010 from P822.510 million last year. This was due to the<br />

impairment loss on other receivables recognized in 2009 which offset the increase in other<br />

general <strong>and</strong> administrative expenses due to the additional staff <strong>and</strong> service requirements<br />

associated with the increased flight <strong>and</strong> passenger activity in the twelve months ended December<br />

31, 2010.<br />

Passenger Service<br />

Passenger service expenses increased by P58.585 million or 10.1% to P639.481 million in the<br />

year ended December 31, 2010 from P580.896 million in the year ended December 31, 2009.<br />

This increase was mainly due to the additional cabin crew requirements for <strong>Air</strong>bus A319 fleet<br />

consequent to the reconfiguration of said aircraft which increased the seat capacity from 150<br />

passengers to 156 passengers thereby requiring more cabin crew to attend to passenger needs.<br />

The Company also hired additional cabin crew for the three <strong>Air</strong>bus A320 aircraft acquired in the<br />

last quarter of 2010.<br />

Operating Income<br />

As a result of the foregoing, the Company registered operating income of P6.450 billion for the<br />

year ended December 31, 2010, 103.9% higher than the P3.164 billion posted in 2009.<br />

Interest Expense<br />

Interest expense decreased by P81.345 million or 8.0% to P931.482 million in the year ended<br />

December 31, 2010 from P1012.827 million in the year ended December 31, 2009. Decline was<br />

due to the repayment of the Company’s outst<strong>and</strong>ing obligations in accordance with the loan<br />

repayment schedules partially offset by the interest incurred on additional loans availed during<br />

the last quarter of 2010. Likewise, the strengthening of the Philippine peso against the U.S. dollar<br />

in 2010 also contributed to the decline.<br />

Long-term debt as of December 31, 2010 amounted to P18.433 billion, 7.7% higher than the<br />

P17.110 balance as of December 31, 2009. Additional loans were obtained during the last quarter<br />

of 2010.<br />

Foreign Exchange Gains<br />

Foreign exchange gains increased by P158.797 million or 38.0% to P576.979 million in the year<br />

ended December 31, 2010 from P418.182 million in prior year. This was due to the<br />

strengthening of the Philippine peso against the U.S. dollar to an average of P45.12 per U.S.<br />

dollar for the twelve months ended December 31, 2010 from an average of P47.64 per U.S. dollar<br />

in 2009. The Company’s principal exposure to foreign exchange rate fluctuations is in respect of<br />

U.S. dollar denominated long-term debt incurred in connection with aircraft acquisitions.<br />

19

Fuel Hedging Gains<br />

Fuel hedging gains of P474.255 million in the year ended December 31, 2010 resulted from the<br />

higher mark-to-market valuation on fuel hedging positions.<br />

Interest Income<br />

Interest income increased by P228.647 million or 2584.0% to P237.496 million in the year ended<br />

December 31, 2010 from P8.849 million in 2009. Increased cash from operations were placed in<br />

short-term money markets <strong>and</strong> investment securities which earned interests thus resulting to a<br />

significant increase in interest income in the current year.<br />

Fair Value Gains of Financial Assets designated at FVPL<br />

Fair value gains amounted to P107.631 million for the year ended December 31, 2010. This<br />

resulted from the changes in the fair values of quoted debt <strong>and</strong> equity instruments designated at<br />

fair value through profit or loss (FVPL) acquired during the current year.<br />

Equity in Net Income (Loss) of Joint Venture<br />

The Company had equity in net income of joint venture of P25.249 million in the year ended<br />

December 31, 2010, an improvement from last year’s net loss of P25.474 million as the losses of<br />

SIAEP, a company which was established in July 2008 <strong>and</strong> began commercial operations in<br />

August 2009, narrowed. Higher income generated by the current operations of A+ also<br />

accounted for the improvement.<br />

Income before Income Tax<br />

As a result of the foregoing, the Company posted income before income tax of P6.940 billion for<br />

the year ended December 31, 2010, 114.3% higher than the P3.238 billion registered in 2009.<br />

Provision for (Benefit from) Income Tax<br />

Provision for income tax for the year ended December 31, 2010 was P17.760 million. Increase in<br />

provision for income tax was mainly due to the deferred tax liabilities recognized in connection<br />

with the net unrealized foreign exchange gains on foreign currency denominated obligations as a<br />

result of the strengthening of the Philippine peso during the year.<br />

Net Income<br />

Audited net income for the year ended December 31, 2010 surged to P6.922 billion, 112.5%<br />

higher than the P3.258 billion net income posted in 2009.<br />

Year Ended December 31, 2009 Compared with Year Ended December 31, 2008<br />

Revenues<br />

The Company posted revenues of P23.311 billion for the year ended December 31, 2009, 18.4%<br />

higher than the P19.682 billion revenues posted last year. Substantial growth in revenues is<br />

accounted for as follows:<br />

Passenger Revenues<br />

Passenger revenues increased by P2.400 billion or 14.0% to P19.504 billion in the year ended<br />

December 31, 2009 from P17.104 billion in the year ended December 31, 2008. Increase in<br />

passenger revenues was primarily due to the increase in passenger volume to 8.8 million in 2009<br />

from 6.7 million in 2008, resulting from the addition of two <strong>Air</strong>bus A320 aircraft <strong>and</strong> two ATR<br />

20

72-500 aircraft, increased frequency in existing routes <strong>and</strong> the introduction of new destinations in<br />

2009, including Ozamis, Surigao, Siargao, Cauayan, Catarman, Virac <strong>and</strong> Calbayog. In addition,<br />

the Company acquired four <strong>Air</strong>bus A320 aircraft <strong>and</strong> six ATR 72-500 aircraft during the course<br />

of 2008, which were in operation throughout 2009, their first full year of service. Total number of<br />

flights also increased by 41.9% to 80,725 in 2009 from 56,872 in 2008, with the number of<br />

international <strong>and</strong> domestic flights increasing by 24.9% <strong>and</strong> 46.3%, respectively. The effect of the<br />

increase in passenger volume was partially offset by the decrease in the average one-way fares by<br />

13.2% to P2,227 in 2009 from P2,567 in 2008.<br />

Cargo Revenues<br />

Cargo revenues increased by P345.888 million or 25.8% to P1.684 billion in the year ended<br />

December 31, 2009 from P1,339 billion in 2008, primarily as a result of the increase in the<br />

volume of cargo carried on existing routes which, in turn, was largely due to the increase in the<br />

number of flights flown in 2009 as compared with 2008.<br />

Ancillary Revenues<br />

Ancillary revenues increased by P883.028 million or 71.3% to P2.122 billion in the year ended<br />

December 31, 2009 from P1.239 billion in prior year. This increase was primarily due to the<br />

increase in rebooking, refunds <strong>and</strong> cancellation fees <strong>and</strong> increased excess baggage revenues<br />

consequent to the increase in the number of passengers carried. The Company also generated<br />

higher ancillary revenues on a unit basis on its international flights. In addition, 2009 was the first<br />

complete year in which the Company recognized ancillary revenues resulting from the new<br />

services the Company was able to provide with its Navitaire reservation systems, such as charges<br />

for prepaid baggage, advance seat selection <strong>and</strong> website administration as well as commissions<br />

earned in respect of sales of travel insurance <strong>and</strong> from hotel partners.<br />

Expenses<br />

The Company incurred expenses of P20.147 billion for the year ended December 31, 2009,<br />

12.2% higher than the P17.954 billion expenses incurred for the year ended December 31, 2008.<br />

Increase in expenses was partially influenced by the devaluation of the Philippine peso to an<br />

average of P47.637 per U.S. dollar for the twelve months ended December 31, 2009 from an<br />

average of P44.475 per U.S. dollar for the twelve months ended December 31, 2008. Expenses<br />

increased as a result of the following:<br />

Flying Operations<br />

Flying operations expenses decreased by P750.691 million or 7.8% to P8.857 billion in the year<br />

ended December 31, 2009 from P9.608 billion in 2008, primarily as a result of the decrease in<br />

aviation fuel expenses by 13.4% to P7.360 billion in 2009 from P8.502 billion in 2008. Aviation<br />

fuel prices decreased to an average published MOPS price of U.S.$69.97 per barrel in 2009 from<br />

U.S.$121.36 per barrel in 2008. The decrease in aviation fuel prices was partially offset by the<br />

increase in the volume of fuel consumed in 2009 compared with 2008 as a result of an overall<br />

increase in the number of flights. Decrease in flying operations expenses was partially reduced by<br />

the increases in flight deck <strong>and</strong> aviation insurance expenses due to the addition of two <strong>Air</strong>bus<br />

A320 aircraft <strong>and</strong> two ATR 72-500 aircraft in 2009.<br />

<strong>Air</strong>craft <strong>and</strong> Traffic Servicing<br />

<strong>Air</strong>craft <strong>and</strong> traffic servicing expenses increased by P684.923 million or 35.2% to P2.632 billion<br />

in the year ended December 31, 2009 from P1.947 billion in the previous year primarily as a<br />

result of the overall increase in the number of flights, including increased number of international<br />

flights for which l<strong>and</strong>ing <strong>and</strong> take-off fees <strong>and</strong> groundh<strong>and</strong>ling charges are generally higher than<br />

those of domestic flights.<br />

21

Repairs <strong>and</strong> Maintenance<br />

Repairs <strong>and</strong> maintenance expenses increased by P722.437 million or 39.1% to P2,569 billion in<br />

the year ended December 31, 2009 from P1.847 billion in the year ended December 31, 2008,<br />

mainly due to the overall increase in the number of flights <strong>and</strong> the weakening of the Philippine<br />

peso to an average of P47.637 per U.S. dollar for the twelve months ended December 31, 2009<br />

from an average of P44.475 per U.S. dollar for the twelve months ended December 31, 2008.<br />

Depreciation <strong>and</strong> Amortization<br />

Depreciation <strong>and</strong> amortization expenses increased by P370.930 million or 24.0% to P1.918<br />

billion in the year ended December 31, 2009 from P1.547 billion in 2008. Increase was due to<br />

the addition of two ATR 72-500 aircraft in 2009. Moreover, 2009 was the first full year in which<br />

depreciation was recorded on the four ATR 72-500 aircraft delivered in late 2008.<br />

<strong>Air</strong>craft <strong>and</strong> Engine Lease<br />

<strong>Air</strong>craft <strong>and</strong> engine lease expenses increased by P661.039 million or 62.2% to P1.724 billion in<br />

the year ended December 31, 2009 from P1.063 billion last year. This was mainly caused by the<br />

lease of two additional <strong>Air</strong>bus A320 aircraft in 2009 at generally higher lease rates compared<br />

with the other leased aircraft. Devaluation of the Philippine peso against the U.S. dollar during<br />

the year also contributed to the increase.<br />

Reservation <strong>and</strong> Sales<br />

Reservation <strong>and</strong> sales expenses increased by P142.682 million or 16.7% to P994.695 million in<br />

the year ended December 31, 2009 from P852.012 million in the year ended December 31, 2008.<br />

This increase was attributable to the increase in commission expenses due to the overall increase<br />

in the number of passengers, as well as in the increase in advertising <strong>and</strong> promotion costs.<br />

Advertising <strong>and</strong> promotions expenditures increased in line with the growth of the business.<br />

Conversely, increase in reservation <strong>and</strong> sales expenses was partially offset by the decrease in<br />

bookings <strong>and</strong> reservations costs in 2009 as a result of the introduction of the Navitaire reservation<br />

systems.<br />

General <strong>and</strong> Administrative<br />

General <strong>and</strong> administrative expenses increased by P259.677 million or 46.1% to P822.510<br />

million in the year ended December 31, 2009 from P562.834 million in 2008. This increase was<br />

primarily due to the non-recurring provision of P209.662 million relating to the receivable from<br />

<strong>Air</strong> Slovakia, to which the Company had sub-leased two aircraft. Likewise, increase was<br />

attributable to the increase in staff <strong>and</strong> related services expenses associated with the increased<br />

flight <strong>and</strong> passenger activity in 2009. Excluding this non-recurring provision, general <strong>and</strong><br />

administrative expenses would have increased by 8.9%, amounting to P612.848 million.<br />

Passenger Service<br />

Passenger service expenses increased by P70.171 million or 13.7% to P580.896 million in the<br />

year ended December 31, 2009 from P510.725 million in the previous year. This increase was<br />

primarily due to an increase in cabin crew costs, partially offset by a decrease in the cost of<br />

passenger food <strong>and</strong> supplies.<br />

Operating Income<br />

As a result of the foregoing, the Company registered operating income of P3.164 billion for the<br />

year ended December 31, 2009, 83.1% higher than the P1.728 billion posted in 2008.<br />

22

Interest Expense - net<br />

Net interest expense increased by P179.744 million or 21.8% to P1.004 billion in the year ended<br />