EmployEE Handbook - Marymount University

EmployEE Handbook - Marymount University

EmployEE Handbook - Marymount University

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

take a maximum of eighteen (18) credit hours in a 12-month academic year. Employees<br />

who are on an extended non-medical leave are not eligible for enrollment under Tuition<br />

Remission. In cases involving medical leave, a physician’s release is required prior to<br />

enrollment under tuition remission. If several employees in a work area wish to enroll<br />

but enrollments must be limited because of work demands, the following priority is to<br />

be followed by the authorizing supervisor: undergraduate degree, first master’s degree,<br />

additional master’s degree, non-degree course.<br />

Spouse and Dependent Children<br />

Spouses and dependent children of full-time employees are eligible for tax free<br />

undergraduate tuition remission(subject to current federal statutes) for not more than<br />

eighteen (18) credits in the fall semester and eighteen (18) credits in the spring semester<br />

and twelve (12) credits during all the summer terms. This assistance is available to spouses<br />

and dependent children after the employee has completed one year of continuous full-time<br />

employment at <strong>Marymount</strong>. Tuition benefits under this program will never be more than<br />

100%. If financial aid is available, tuition remission will be reduced by the amount of<br />

the aid provided. NOTE: It is the responsibility of the sponsoring employee to apply<br />

for all appropriate financial aid through the regular Financial Aid procedures and<br />

observe appropriate deadlines. Failure to apply for financial aid will result in the<br />

withholding of tuition remission assistance.<br />

Spouses and dependent children of full-time employees are eligible for taxable graduate<br />

tuition remission (subject to current federal statutes) of 25% after the sponsoring employee<br />

has completed one year of continuous full-time employment and 100% after five calendar<br />

years of full-time employment at <strong>Marymount</strong>, after crediting applicable financial aid.<br />

Tuition remission benefits will cover no more than twelve (12) credits in the fall and<br />

spring semesters and nine (9) credits during all the summer terms. If financial aid is<br />

available, tuition remission will be reduced by the amount of the aid provided. NOTE: It<br />

is the responsibility of the sponsoring employee to apply for all appropriate financial<br />

aid through the regular Financial Aid procedures and observe appropriate deadlines.<br />

Failure to apply for financial aid will result in the withholding of tuition assistance.<br />

Employees must apply for admission for themselves, their spouses and/or dependent<br />

children. The application fee is waived for employees. Only classes that are regularly<br />

scheduled on a <strong>Marymount</strong> campus in Virginia are eligible. Consortium classes are not<br />

covered by Tuition Remission.<br />

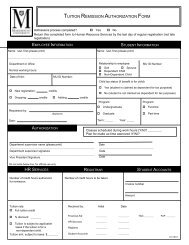

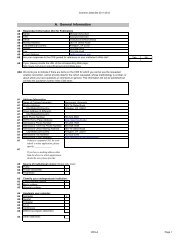

Employees must complete the appropriate Tuition Remission Authorization Form at the<br />

same time as enrollment in any class or program. Forms are available from the Office of<br />

Human Resource Services, or are downloadable from the MU Portal at http://archive.<br />

marymount.edu/hr/benefits/TuitionRemission_Form.pdf.<br />

Tuition Exchange<br />

Tuition Exchange enables the dependent children of full-time <strong>Marymount</strong> faculty, staff,<br />

and administrators to choose from those participating colleges and universities that agree<br />

to remit tuition for eligible and approved participants from other member institutions. The<br />

student must meet all eligible admissions requirements and be admitted to the participating<br />

member institution. The number of students “exported” each year by <strong>Marymount</strong> varies<br />

and the availability of “slots” in any particular year are not guaranteed. This program<br />

is defined as a scholarship and not a benefit. Employees may obtain Tuition Exchange<br />

48