EmployEE Handbook - Marymount University

EmployEE Handbook - Marymount University

EmployEE Handbook - Marymount University

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2. Supplemental Retirement Annuity (SRA)<br />

All eligible regular, full-time and part-time employees may contribute to a<br />

TIAA-CREF Supplemental Retirement Annuity (SRA). This optional program<br />

permits <strong>Marymount</strong> employees to enhance their retirement program by making<br />

contributions through a “pre-tax” payroll deduction. Employees may initiate<br />

contributions to an SRA at the beginning of their <strong>Marymount</strong> employment or<br />

anytime thereafter. For more information about this retirement plan, please click<br />

on this url: http://www.marymount.edu/hr/benefits/suppRetire.aspx.<br />

3. Supplemental Retirement Annunity (RA)<br />

This is a closed program that is only open to employees who are already<br />

contributing to this supplemental annuity. Like the SRA, it offers its participants<br />

the opportunity to make pre-tax contributions through payroll deductions. Unlike<br />

the SRA however, a participant can’t stop and restart their contributions. It only<br />

offers its participants the option to increase or decrease their contributions or<br />

change the type of payroll deduction from a fixed dollar amount to a percentage<br />

or vice versa. For more information about this retirement plan, contact the MU<br />

Benefits Manager.<br />

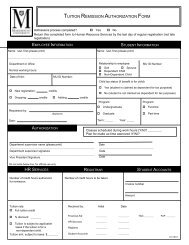

<strong>Marymount</strong> <strong>University</strong> Tuition Benefit<br />

The following schedule of tuition benefits applies to all full-time employees of<br />

<strong>Marymount</strong> <strong>University</strong>: staff, administrators and faculty: For more information about this<br />

benefit please click on this url: http://www.marymount.edu/hr/benefits/tuition.aspx.<br />

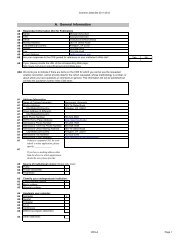

Employee Benefit<br />

All regular, full-time employees are eligible for full tuition remission at the undergraduate<br />

and graduate level after six months of continuous full-time <strong>Marymount</strong> employment.<br />

( NOTE: Subject to current Federal statutes, undergraduate courses are not subject to<br />

taxes; however, the cost of graduate courses above $5,250 in a calendar year are taxable.<br />

Contact the Payroll Department for more information). Employee’s service eligibility<br />

for tuition remission is calculated as of the first day of the semester or term. Prior to<br />

completion of six months of continuous employment, employees are eligible for tuition<br />

remission on a pro-rated basis.<br />

Employees who enroll under a pro-rated schedule are responsible to arrange with Student<br />

Accounts to make timely payment of the remaining balance. Questions about pro-rated<br />

Tuition Remission should be directed to Human Resource Services.<br />

Employees may receive tuition remission for not more than six (6) credits per semester<br />

unless job-related factors required taking fewer than six credit hours in the immediately<br />

preceding semester. Any exception to the six (6) credits per semester limit is at the<br />

discretion of the supervisor and must be approved by the appropriate vice president.<br />

Classes, unless otherwise approved, must be scheduled outside regular <strong>Marymount</strong> work<br />

hours of the employee involved (regular work hours for day-time employees are 9:00<br />

a.m. to 5:00 p.m. and for other employees vary with their shift assignment). Employees<br />

may be permitted to take one (1) class per semester during their regular work hours at<br />

the discretion of their supervisor and with the approval of their vice president. Approval<br />

of a request to take a class during regular work hours is subject to the needs of the<br />

department and division, but will not be unreasonably withheld. Any time taken during<br />

work hours must be made up in the same week in which it is taken. An employee may<br />

47