EmployEE Handbook - Marymount University

EmployEE Handbook - Marymount University

EmployEE Handbook - Marymount University

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

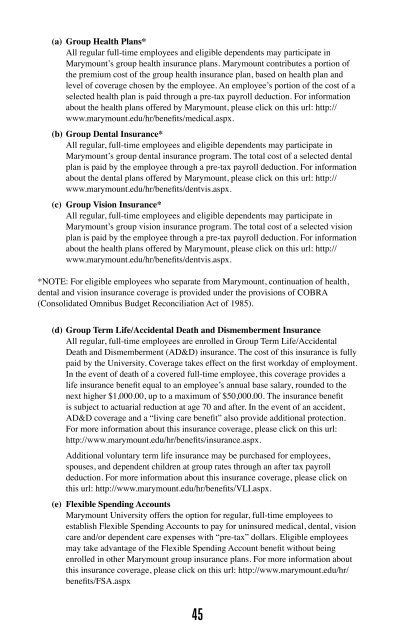

(a) Group Health Plans*<br />

All regular full-time employees and eligible dependents may participate in<br />

<strong>Marymount</strong>’s group health insurance plans. <strong>Marymount</strong> contributes a portion of<br />

the premium cost of the group health insurance plan, based on health plan and<br />

level of coverage chosen by the employee. An employee’s portion of the cost of a<br />

selected health plan is paid through a pre-tax payroll deduction. For information<br />

about the health plans offered by <strong>Marymount</strong>, please click on this url: http://<br />

www.marymount.edu/hr/benefits/medical.aspx.<br />

(b) Group Dental Insurance*<br />

All regular, full-time employees and eligible dependents may participate in<br />

<strong>Marymount</strong>’s group dental insurance program. The total cost of a selected dental<br />

plan is paid by the employee through a pre-tax payroll deduction. For information<br />

about the dental plans offered by <strong>Marymount</strong>, please click on this url: http://<br />

www.marymount.edu/hr/benefits/dentvis.aspx.<br />

(c) Group Vision Insurance*<br />

All regular, full-time employees and eligible dependents may participate in<br />

<strong>Marymount</strong>’s group vision insurance program. The total cost of a selected vision<br />

plan is paid by the employee through a pre-tax payroll deduction. For information<br />

about the health plans offered by <strong>Marymount</strong>, please click on this url: http://<br />

www.marymount.edu/hr/benefits/dentvis.aspx.<br />

*NOTE: For eligible employees who separate from <strong>Marymount</strong>, continuation of health,<br />

dental and vision insurance coverage is provided under the provisions of COBRA<br />

(Consolidated Omnibus Budget Reconciliation Act of 1985).<br />

(d) Group Term Life/Accidental Death and Dismemberment Insurance<br />

All regular, full-time employees are enrolled in Group Term Life/Accidental<br />

Death and Dismemberment (AD&D) insurance. The cost of this insurance is fully<br />

paid by the <strong>University</strong>. Coverage takes effect on the first workday of employment.<br />

In the event of death of a covered full-time employee, this coverage provides a<br />

life insurance benefit equal to an employee’s annual base salary, rounded to the<br />

next higher $1,000.00, up to a maximum of $50,000.00. The insurance benefit<br />

is subject to actuarial reduction at age 70 and after. In the event of an accident,<br />

AD&D coverage and a “living care benefit” also provide additional protection.<br />

For more information about this insurance coverage, please click on this url:<br />

http://www.marymount.edu/hr/benefits/insurance.aspx.<br />

Additional voluntary term life insurance may be purchased for employees,<br />

spouses, and dependent children at group rates through an after tax payroll<br />

deduction. For more information about this insurance coverage, please click on<br />

this url: http://www.marymount.edu/hr/benefits/VLI.aspx.<br />

(e) Flexible Spending Accounts<br />

<strong>Marymount</strong> <strong>University</strong> offers the option for regular, full-time employees to<br />

establish Flexible Spending Accounts to pay for uninsured medical, dental, vision<br />

care and/or dependent care expenses with “pre-tax” dollars. Eligible employees<br />

may take advantage of the Flexible Spending Account benefit without being<br />

enrolled in other <strong>Marymount</strong> group insurance plans. For more information about<br />

this insurance coverage, please click on this url: http://www.marymount.edu/hr/<br />

benefits/FSA.aspx<br />

45