TUITION REMISSION AUTHORIZATION FORM

TUITION REMISSION AUTHORIZATION FORM

TUITION REMISSION AUTHORIZATION FORM

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

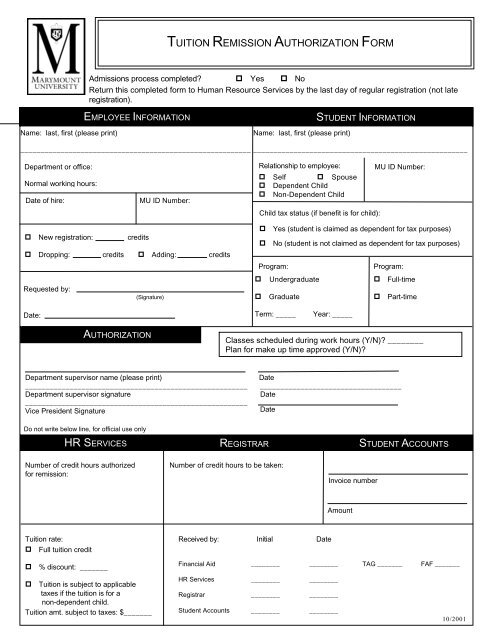

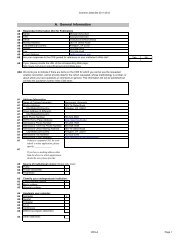

<strong>TUITION</strong> <strong>REMISSION</strong> <strong>AUTHORIZATION</strong> <strong>FORM</strong><br />

Admissions process completed? Yes No<br />

Return this completed form to Human Resource Services by the last day of regular registration (not late<br />

registration).<br />

Name: last, first (please print)<br />

EMPLOYEE IN<strong>FORM</strong>ATION<br />

Name: last, first (please print)<br />

STUDENT IN<strong>FORM</strong>ATION<br />

_________________________________________________________ _____________________________________________________<br />

Department or office:<br />

Normal working hours:<br />

Date of hire:<br />

MU ID Number:<br />

Relationship to employee: MU ID Number:<br />

Self Spouse<br />

Dependent Child<br />

Non-Dependent Child<br />

Child tax status (if benefit is for child):<br />

New registration: credits<br />

Dropping: credits Adding: credits<br />

Requested by:<br />

(Signature)<br />

Yes (student is claimed as dependent for tax purposes)<br />

No (student is not claimed as dependent for tax purposes)<br />

Program:<br />

Program:<br />

Undergraduate<br />

Full-time<br />

Graduate<br />

Part-time<br />

Date:<br />

Term: _____<br />

Year: _____<br />

<strong>AUTHORIZATION</strong><br />

Classes scheduled during work hours (Y/N)? ________<br />

Plan for make up time approved (Y/N)?<br />

Department supervisor name (please print)<br />

_______________________________________________________<br />

Department supervisor signature<br />

_______________________________________________________<br />

Vice President Signature<br />

Date<br />

___________________________________<br />

Date<br />

Date<br />

Do not write below line, for official use only<br />

y:<br />

HR SERVICES<br />

REGISTRAR<br />

STUDENT ACCOUNTS<br />

Number of credit hours authorized<br />

for remission:<br />

Number of credit hours to be taken:<br />

Invoice number<br />

Amount<br />

Tuition rate:<br />

Full tuition credit<br />

<br />

% discount: _______<br />

Tuition is subject to applicable<br />

taxes if the tuition is for a<br />

non-dependent child.<br />

Tuition amt. subject to taxes: $_______<br />

Received by: Initial Date<br />

Financial Aid ________ ________ TAG _______ FAF _______<br />

HR Services ________ ________<br />

Registrar ________ ________<br />

Student Accounts ________ ________<br />

10/2001

INSTRUCTIONS FOR COMPLETING AND PROCESSING<br />

THE <strong>TUITION</strong> <strong>REMISSION</strong> <strong>AUTHORIZATION</strong> <strong>FORM</strong><br />

STEP 1 Employee:<br />

1 . You must complete the Admissions process before applying for this benefit.<br />

2 . Obtain a Tuition Remission Authorization Form from the Human Resource Services Office.<br />

3 . Complete all the information on the reverse side of this form.<br />

4 . Employees’ spouses and dependent children who intend to study full-time must apply for<br />

federal and state financial aid through the usual Financial Aid process. Visit the Financial<br />

Aid Office for additional information.<br />

STEP 2 Supervisor:<br />

1 . Verify that the employee has been employed for the required amount of time and meets all<br />

the requirements in the appropriate Employment Manual.<br />

2 . Authorize the form and make a copy for your records.<br />

STEP 3 Employee:<br />

Return this completed form to the Human Resource Services Office by the last day of<br />

regular registration (not late registration).<br />

STEP 4 Human Resource Services Office:<br />

1 . Verify that the required waiting period has been met and record the number of credits authorized<br />

for tuition remission.<br />

2 . Determine if the tuition remission is subject to applicable taxes. Employees’ whose children<br />

are not dependents for tax purposes are subject to taxes. Make an additional copy of the<br />

Tuition remission forms that need to be taxed and submit the copies to the Benefits Manager<br />

for processing in the computer. Request from Student Accounts the amounts subject<br />

to taxes.<br />

3 . On the last day of regular registration (not late registration), take a copy of all tuition remission<br />

forms to the Student Accounts Office.<br />

4 . File original tuition remission forms in the Human Resource Services Office.<br />

STEP 6<br />

Read your employment manual for additional information about this employment benefit.<br />

10/2001