the world of private banking

the world of private banking

the world of private banking

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

THE RISE OF tHE ROtHScHILDS<br />

<br />

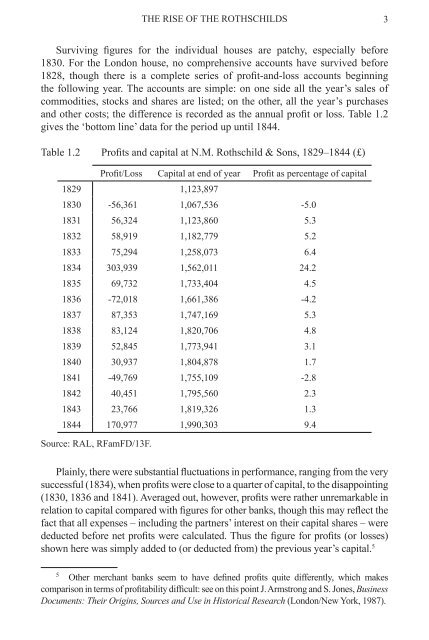

Surviving figures for <strong>the</strong> individual houses are patchy, especially before<br />

1830. For <strong>the</strong> London house, no comprehensive accounts have survived before<br />

1828, though <strong>the</strong>re is a complete series <strong>of</strong> pr<strong>of</strong>it-and-loss accounts beginning<br />

<strong>the</strong> following year. The accounts are simple: on one side all <strong>the</strong> year’s sales <strong>of</strong><br />

commodities, stocks and shares are listed; on <strong>the</strong> o<strong>the</strong>r, all <strong>the</strong> year’s purchases<br />

and o<strong>the</strong>r costs; <strong>the</strong> difference is recorded as <strong>the</strong> annual pr<strong>of</strong>it or loss. Table 1.2<br />

gives <strong>the</strong> ‘bottom line’ data for <strong>the</strong> period up until 1844.<br />

Table 1.2 Pr<strong>of</strong>its and capital at N.M. Rothschild & Sons, 1829–1844 (£)<br />

Pr<strong>of</strong>it/Loss Capital at end <strong>of</strong> year Pr<strong>of</strong>it as percentage <strong>of</strong> capital<br />

1829 1,123,897<br />

1830 -56,361 1,067,536 -5.0<br />

1831 56,324 1,123,860 5.3<br />

1832 58,919 1,182,779 5.2<br />

1833 75,294 1,258,073 6.4<br />

1834 303,939 1,562,011 24.2<br />

1835 69,732 1,733,404 4.5<br />

1836 -72,018 1,661,386 -4.2<br />

1837 87,353 1,747,169 5.3<br />

1838 83,124 1,820,706 4.8<br />

1839 52,845 1,773,941 3.1<br />

1840 30,937 1,804,878 1.7<br />

1841 -49,769 1,755,109 -2.8<br />

1842 40,451 1,795,560 2.3<br />

1843 23,766 1,819,326 1.3<br />

1844 170,977 1,990,303 9.4<br />

Source: RAL, RFamFD/13F.<br />

Plainly, <strong>the</strong>re were substantial fluctuations in performance, ranging from <strong>the</strong> very<br />

successful (1834), when pr<strong>of</strong>its were close to a quarter <strong>of</strong> capital, to <strong>the</strong> disappointing<br />

(1830, 1836 and 1841). Averaged out, however, pr<strong>of</strong>its were ra<strong>the</strong>r unremarkable in<br />

relation to capital compared with figures for o<strong>the</strong>r banks, though this may reflect <strong>the</strong><br />

fact that all expenses – including <strong>the</strong> partners’ interest on <strong>the</strong>ir capital shares – were<br />

deducted before net pr<strong>of</strong>its were calculated. Thus <strong>the</strong> figure for pr<strong>of</strong>its (or losses)<br />

shown here was simply added to (or deducted from) <strong>the</strong> previous year’s capital. <br />

<br />

O<strong>the</strong>r merchant banks seem to have defined pr<strong>of</strong>its quite differently, which makes<br />

comparison in terms <strong>of</strong> pr<strong>of</strong>itability difficult: see on this point J. Armstrong and S. Jones, Business<br />

Documents: Their Origins, Sources and Use in Historical Research (London/New York, 1987).

![[Pham_Sherisse]_Frommer's_Southeast_Asia(Book4You)](https://img.yumpu.com/38206466/1/166x260/pham-sherisse-frommers-southeast-asiabook4you.jpg?quality=85)