Estimation, Evaluation, and Selection of Actuarial Models

Estimation, Evaluation, and Selection of Actuarial Models

Estimation, Evaluation, and Selection of Actuarial Models

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

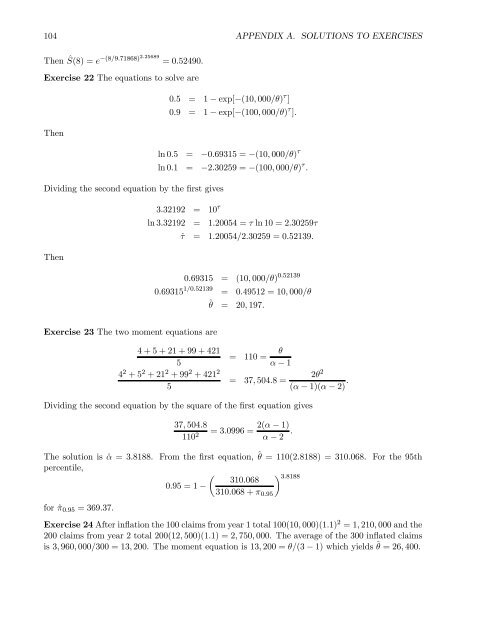

104 APPENDIX A. SOLUTIONS TO EXERCISES<br />

Then Ŝ(8) = e−(8/9.71868)2.25689 =0.52490.<br />

Exercise 22 The equations to solve are<br />

Then<br />

Dividing the second equation by the first gives<br />

Then<br />

0.5 = 1− exp[−(10, 000/θ) τ ]<br />

0.9 = 1− exp[−(100, 000/θ) τ ].<br />

ln 0.5 = −0.69315 = −(10, 000/θ) τ<br />

ln 0.1 = −2.30259 = −(100, 000/θ) τ .<br />

3.32192 = 10 τ<br />

ln 3.32192 = 1.20054 = τ ln 10 = 2.30259τ<br />

ˆτ = 1.20054/2.30259 = 0.52139.<br />

0.69315 = (10, 000/θ) 0.52139<br />

0.69315 1/0.52139 = 0.49512 = 10, 000/θ<br />

ˆθ = 20, 197.<br />

Exercise 23 The two moment equations are<br />

4+5+21+99+421<br />

5<br />

4 2 +5 2 +21 2 +99 2 + 421 2<br />

5<br />

= 110 = θ<br />

α − 1<br />

2θ 2<br />

= 37, 504.8 =<br />

(α − 1)(α − 2) .<br />

Dividing the second equation by the square <strong>of</strong> the first equation gives<br />

37, 504.8<br />

2(α − 1)<br />

110 2 =3.0996 =<br />

α − 2 .<br />

The solution is ˆα =3.8188. From the first equation, ˆθ = 110(2.8188) = 310.068. For the 95th<br />

percentile,<br />

µ<br />

<br />

310.068 3.8188<br />

0.95 = 1 −<br />

310.068 + π 0.95<br />

for ˆπ 0.95 = 369.37.<br />

Exercise 24 After inflation the 100 claims from year 1 total 100(10, 000)(1.1) 2 =1, 210, 000 <strong>and</strong> the<br />

200 claims from year 2 total 200(12, 500)(1.1) = 2, 750, 000. The average <strong>of</strong> the 300 inflated claims<br />

is 3, 960, 000/300 = 13, 200. The moment equation is 13, 200 = θ/(3 − 1) which yields ˆθ =26, 400.