Annual Review 2012 - Luxottica

Annual Review 2012 - Luxottica Annual Review 2012 - Luxottica

170 | ANNUAL REPORT 2012 as such, the holders of these options became entitled to exercise such options beginning on that date until their termination in 2014. During 2012, 3.9 million options (0.7 million in 2011) from this grant were exercised. As of December 31, 2012, 3.4 million options were outstanding. A summary of related party transactions as of December 31, 2012 and 2011, is provided below. In 2011, the Group completed the acquisition of Multiopticas, which is no longer considered a related party as of December 31, 2011. Please refer to note 4 “Business Combinations” for further details. The table below reports the revenues and costs related to the transactions with Multiopticas that occurred until the completion of the acquisition. As of December 31, 2012 Related parties (thousands of Euro) Consolidated Statement of Income Consolidated Statement of Financial Position Revenues Costs Assets Liabilities Brooks Brothers Group, Inc. - 802 13 40 Eyebiz Laboratories Pty Limited 1,194 44,862 7,898 9,086 Others 650 764 447 72 Total 1,844 46,428 8,358 9,198 As of December 31, 2011 Related parties (thousands of Euro) Consolidated Statement of Income Consolidated Statement of Financial Position Revenues Costs Assets Liabilities Brooks Brothers Group, Inc. - 984 - 155 Multiopticas Group 4,743 25 1,600 2,465 Eyebiz Laboratories Pty Limited 970 44,584 8,553 17,793 Others 581 871 727 159 Total 6,294 46,464 10,880 20,572 Total remuneration due to key managers amounted to approximately Euro 43.2 million and Euro 48.9 million in 2012 and 2011, respectively. 30. EARNINGS PER SHARE Basic and diluted earnings per share were calculated as the ratio of net income attributable to the stockholders of the Company for 2012 and 2011 amounting to Euro 541,700 thousands and Euro 452,343 thousand, respectively, to the number of outstanding shares - basic and dilutive of the Company. Basic earnings per share in 2012 were equal to Euro 1.17, compared to Euro 0.98 in 2011, respectively. Diluted earnings per share in 2012 were equal to Euro 1.15 compared to Euro 0.98 in 2011, respectively.

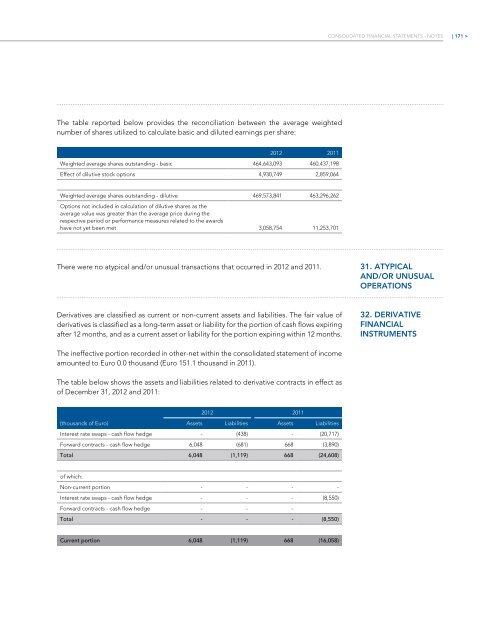

Consolidated financial statements - NOTES | 171 > The table reported below provides the reconciliation between the average weighted number of shares utilized to calculate basic and diluted earnings per share: 2012 2011 Weighted average shares outstanding - basic 464,643,093 460,437,198 Effect of dilutive stock options 4,930,749 2,859,064 Weighted average shares outstanding - dilutive 469,573,841 463,296,262 Options not included in calculation of dilutive shares as the average value was greater than the average price during the respective period or performance measures related to the awards have not yet been met 3,058,754 11,253,701 There were no atypical and/or unusual transactions that occurred in 2012 and 2011. 31. ATYPICAL AND/OR UNUSUAL OPERATIONS Derivatives are classified as current or non-current assets and liabilities. The fair value of derivatives is classified as a long-term asset or liability for the portion of cash flows expiring after 12 months, and as a current asset or liability for the portion expiring within 12 months. 32. DERIVATIVE FINANCIAL INSTRUMENTS The ineffective portion recorded in other-net within the consolidated statement of income amounted to Euro 0.0 thousand (Euro 151.1 thousand in 2011). The table below shows the assets and liabilities related to derivative contracts in effect as of December 31, 2012 and 2011: 2012 2011 (thousands of Euro) Assets Liabilities Assets Liabilities Interest rate swaps - cash flow hedge - (438) - (20,717) Forward contracts - cash flow hedge 6,048 (681) 668 (3,890) Total 6,048 (1,119) 668 (24,608) of which: Non-current portion - - - - Interest rate swaps - cash flow hedge - - - (8,550) Forward contracts - cash flow hedge - - - Total - - - (8,550) Current portion 6,048 (1,119) 668 (16,058)

- Page 205 and 206: Consolidated financial statements -

- Page 207 and 208: Consolidated financial statements -

- Page 209 and 210: Consolidated financial statements -

- Page 211 and 212: Consolidated financial statements -

- Page 213 and 214: Consolidated financial statements -

- Page 215 and 216: Consolidated financial statements -

- Page 217 and 218: Consolidated financial statements -

- Page 219 and 220: Consolidated financial statements -

- Page 221 and 222: Consolidated financial statements -

- Page 223 and 224: Consolidated financial statements -

- Page 225 and 226: Consolidated financial statements -

- Page 227 and 228: Consolidated financial statements -

- Page 229 and 230: Consolidated financial statements -

- Page 231 and 232: Consolidated financial statements -

- Page 233 and 234: Consolidated financial statements -

- Page 235 and 236: Consolidated financial statements -

- Page 237 and 238: Consolidated financial statements -

- Page 239 and 240: Consolidated financial statements -

- Page 241 and 242: Consolidated financial statements -

- Page 243 and 244: Consolidated financial statements -

- Page 245 and 246: Consolidated financial statements -

- Page 247 and 248: Consolidated financial statements -

- Page 249 and 250: Consolidated financial statements -

- Page 251 and 252: Consolidated financial statements -

- Page 253 and 254: Consolidated financial statements -

- Page 255: Consolidated financial statements -

- Page 259 and 260: Consolidated financial statements -

- Page 261 and 262: Consolidated financial statements -

- Page 263 and 264: Consolidated financial statements -

- Page 265 and 266: Consolidated financial statements -

- Page 267 and 268: Consolidated financial statements -

- Page 269 and 270: Consolidated financial statements -

- Page 271 and 272: Consolidated financial statements -

- Page 273 and 274: Consolidated financial statements -

- Page 275 and 276: Consolidated financial statements -

- Page 277 and 278: Consolidated financial statements -

- Page 279: www.luxottica.com

Consolidated financial statements - NOTES<br />

| 171 ><br />

The table reported below provides the reconciliation between the average weighted<br />

number of shares utilized to calculate basic and diluted earnings per share:<br />

<strong>2012</strong> 2011<br />

Weighted average shares outstanding - basic 464,643,093 460,437,198<br />

Effect of dilutive stock options 4,930,749 2,859,064<br />

Weighted average shares outstanding - dilutive 469,573,841 463,296,262<br />

Options not included in calculation of dilutive shares as the<br />

average value was greater than the average price during the<br />

respective period or performance measures related to the awards<br />

have not yet been met 3,058,754 11,253,701<br />

There were no atypical and/or unusual transactions that occurred in <strong>2012</strong> and 2011.<br />

31. ATYPICAL<br />

AND/OR UNUSUAL<br />

OPERATIONS<br />

Derivatives are classified as current or non-current assets and liabilities. The fair value of<br />

derivatives is classified as a long-term asset or liability for the portion of cash flows expiring<br />

after 12 months, and as a current asset or liability for the portion expiring within 12 months.<br />

32. DERIVATIVE<br />

FINANCIAL<br />

INSTRUMENTS<br />

The ineffective portion recorded in other-net within the consolidated statement of income<br />

amounted to Euro 0.0 thousand (Euro 151.1 thousand in 2011).<br />

The table below shows the assets and liabilities related to derivative contracts in effect as<br />

of December 31, <strong>2012</strong> and 2011:<br />

<strong>2012</strong> 2011<br />

(thousands of Euro) Assets Liabilities Assets Liabilities<br />

Interest rate swaps - cash flow hedge - (438) - (20,717)<br />

Forward contracts - cash flow hedge 6,048 (681) 668 (3,890)<br />

Total 6,048 (1,119) 668 (24,608)<br />

of which:<br />

Non-current portion - - - -<br />

Interest rate swaps - cash flow hedge - - - (8,550)<br />

Forward contracts - cash flow hedge - - -<br />

Total - - - (8,550)<br />

Current portion 6,048 (1,119) 668 (16,058)