Annual Review 2012 - Luxottica

Annual Review 2012 - Luxottica

Annual Review 2012 - Luxottica

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

158 |<br />

ANNUAL REPORT <strong>2012</strong><br />

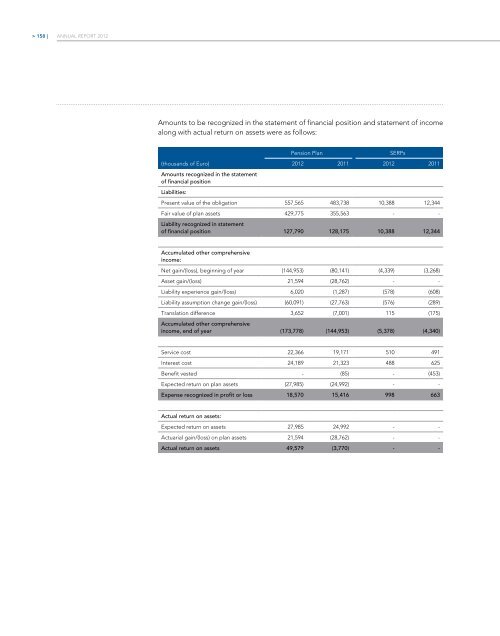

Amounts to be recognized in the statement of financial position and statement of income<br />

along with actual return on assets were as follows:<br />

Pension Plan<br />

SERPs<br />

(thousands of Euro) <strong>2012</strong> 2011 <strong>2012</strong> 2011<br />

Amounts recognized in the statement<br />

of financial position<br />

Liabilities:<br />

Present value of the obligation 557,565 483,738 10,388 12,344<br />

Fair value of plan assets 429,775 355,563 - -<br />

Liability recognized in statement<br />

of financial position 127,790 128,175 10,388 12,344<br />

Accumulated other comprehensive<br />

income:<br />

Net gain/(loss), beginning of year (144,953) (80,141) (4,339) (3,268)<br />

Asset gain/(loss) 21,594 (28,762) - -<br />

Liability experience gain/(loss) 6,020 (1,287) (578) (608)<br />

Liability assumption change gain/(loss) (60,091) (27,763) (576) (289)<br />

Translation difference 3,652 (7,001) 115 (175)<br />

Accumulated other comprehensive<br />

income, end of year (173,778) (144,953) (5,378) (4,340)<br />

Service cost 22,366 19,171 510 491<br />

Interest cost 24,189 21,323 488 625<br />

Benefit vested - (85) - (453)<br />

Expected return on plan assets (27,985) (24,992) - -<br />

Expense recognized in profit or loss 18,570 15,416 998 663<br />

Actual return on assets:<br />

Expected return on assets 27,985 24,992 - -<br />

Actuarial gain/(loss) on plan assets 21,594 (28,762) - -<br />

Actual return on assets 49,579 (3,770) - -