Annual Review 2012 - Luxottica

Annual Review 2012 - Luxottica Annual Review 2012 - Luxottica

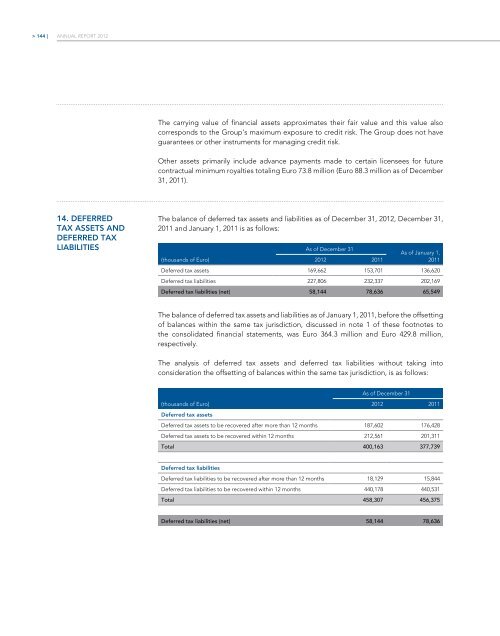

144 | ANNUAL REPORT 2012 The carrying value of financial assets approximates their fair value and this value also corresponds to the Group’s maximum exposure to credit risk. The Group does not have guarantees or other instruments for managing credit risk. Other assets primarily include advance payments made to certain licensees for future contractual minimum royalties totaling Euro 73.8 million (Euro 88.3 million as of December 31, 2011). 14. DEFERRED TAX ASSETS AND DEFERRED TAX LIABILITIES The balance of deferred tax assets and liabilities as of December 31, 2012, December 31, 2011 and January 1, 2011 is as follows: As of December 31 (thousands of Euro) 2012 2011 As of January 1, 2011 Deferred tax assets 169,662 153,701 136,620 Deferred tax liabilities 227,806 232,337 202,169 Deferred tax liabilities (net) 58,144 78,636 65,549 The balance of deferred tax assets and liabilities as of January 1, 2011, before the offsetting of balances within the same tax jurisdiction, discussed in note 1 of these footnotes to the consolidated financial statements, was Euro 364.3 million and Euro 429.8 million, respectively. The analysis of deferred tax assets and deferred tax liabilities without taking into consideration the offsetting of balances within the same tax jurisdiction, is as follows: As of December 31 (thousands of Euro) 2012 2011 Deferred tax assets Deferred tax assets to be recovered after more than 12 months 187,602 176,428 Deferred tax assets to be recovered within 12 months 212,561 201,311 Total 400,163 377,739 Deferred tax liabilities Deferred tax liabilities to be recovered after more than 12 months 18,129 15,844 Deferred tax liabilities to be recovered within 12 months 440,178 440,531 Total 458,307 456,375 Deferred tax liabilities (net) 58,144 78,636

Consolidated financial statements - NOTES | 145 > The gross movement in the deferred income tax accounts is as follows: As of January 1, 2012 78,636 Exchange rate difference and other movements 16,932 Business combinations 4,898 Income statements (28,910) Tax charge/(credit) directly to equity (13,412) At December 31, 2012 58,144 The movement of deferred income tax assets and liabilities during the year, without taking into consideration the offsetting of balances within the same tax jurisdiction, is as follows: Deferred tax assets (thousands of Euro) As of January 1, 2012 Exchange rate difference and other movements Business combinations Income statements Tax charged/ (credited) to equity As of December 31, 2012 Inventories 78,264 (2,013) 5,127 21,678 - 103,056 Insurance and other reserves 10,923 (137) - 557 - 11,343 Net operating loss carry forwards 16,191 3,657 (948) (12,441) - 6,459 Rights of return 11,194 3,234 1,103 551 - 16,082 Deferred tax on derivatives 7,484 55 - (1,017) (6,484) 38 Employee related reserves 90,473 (13,837) - 13,652 14,120 104,408 Occupancy reserves 18,275 (837) - 928 - 18,366 Trade names 84,278 (2,553) - 767 (67) 82,425 Fixed assets 10,369 3,658 - 202 - 14,229 Other 50,288 (18,286) 6,037 5,653 67 43,759 Total 377,739 (27,059) 11,319 30,530 7,636 400,163 Deferred tax liabilities (thousands of Euro) As of January 1, 2012 Exchange rate difference and other movements Business combinations Income statements Tax charged/ (credited) to equity As of December 31, 2012 Dividends 6,155 - - (592) - 5,563 Trade names 233,729 (5,585) 23,433 (17,620) - 233,957 Fixed assets 66,120 (24,358) - 13,729 - 55,491 Other intangibles 140,682 16,372 (7,305) 2,093 - 151,842 Other 9,688 3,444 80 4,009 (5,767) 11,454 Total 456,375 (10,127) 16,208 1,619 (5,767) 458,307

- Page 179 and 180: CONSOLIDATED FINANCIAL STATEMENTS |

- Page 181 and 182: Consolidated financial statements -

- Page 183 and 184: Consolidated financial statements -

- Page 185 and 186: Consolidated financial statements -

- Page 187 and 188: Consolidated financial statements -

- Page 189 and 190: Consolidated financial statements -

- Page 191 and 192: Consolidated financial statements -

- Page 193 and 194: Consolidated financial statements -

- Page 195 and 196: Consolidated financial statements -

- Page 197 and 198: Consolidated financial statements -

- Page 199 and 200: Consolidated financial statements -

- Page 201 and 202: Consolidated financial statements -

- Page 203 and 204: Consolidated financial statements -

- Page 205 and 206: Consolidated financial statements -

- Page 207 and 208: Consolidated financial statements -

- Page 209 and 210: Consolidated financial statements -

- Page 211 and 212: Consolidated financial statements -

- Page 213 and 214: Consolidated financial statements -

- Page 215 and 216: Consolidated financial statements -

- Page 217 and 218: Consolidated financial statements -

- Page 219 and 220: Consolidated financial statements -

- Page 221 and 222: Consolidated financial statements -

- Page 223 and 224: Consolidated financial statements -

- Page 225 and 226: Consolidated financial statements -

- Page 227 and 228: Consolidated financial statements -

- Page 229: Consolidated financial statements -

- Page 233 and 234: Consolidated financial statements -

- Page 235 and 236: Consolidated financial statements -

- Page 237 and 238: Consolidated financial statements -

- Page 239 and 240: Consolidated financial statements -

- Page 241 and 242: Consolidated financial statements -

- Page 243 and 244: Consolidated financial statements -

- Page 245 and 246: Consolidated financial statements -

- Page 247 and 248: Consolidated financial statements -

- Page 249 and 250: Consolidated financial statements -

- Page 251 and 252: Consolidated financial statements -

- Page 253 and 254: Consolidated financial statements -

- Page 255 and 256: Consolidated financial statements -

- Page 257 and 258: Consolidated financial statements -

- Page 259 and 260: Consolidated financial statements -

- Page 261 and 262: Consolidated financial statements -

- Page 263 and 264: Consolidated financial statements -

- Page 265 and 266: Consolidated financial statements -

- Page 267 and 268: Consolidated financial statements -

- Page 269 and 270: Consolidated financial statements -

- Page 271 and 272: Consolidated financial statements -

- Page 273 and 274: Consolidated financial statements -

- Page 275 and 276: Consolidated financial statements -

- Page 277 and 278: Consolidated financial statements -

- Page 279: www.luxottica.com

144 |<br />

ANNUAL REPORT <strong>2012</strong><br />

The carrying value of financial assets approximates their fair value and this value also<br />

corresponds to the Group’s maximum exposure to credit risk. The Group does not have<br />

guarantees or other instruments for managing credit risk.<br />

Other assets primarily include advance payments made to certain licensees for future<br />

contractual minimum royalties totaling Euro 73.8 million (Euro 88.3 million as of December<br />

31, 2011).<br />

14. DEFERRED<br />

TAX ASSETS AND<br />

DEFERRED TAX<br />

LIABILITIES<br />

The balance of deferred tax assets and liabilities as of December 31, <strong>2012</strong>, December 31,<br />

2011 and January 1, 2011 is as follows:<br />

As of December 31<br />

(thousands of Euro) <strong>2012</strong> 2011<br />

As of January 1,<br />

2011<br />

Deferred tax assets 169,662 153,701 136,620<br />

Deferred tax liabilities 227,806 232,337 202,169<br />

Deferred tax liabilities (net) 58,144 78,636 65,549<br />

The balance of deferred tax assets and liabilities as of January 1, 2011, before the offsetting<br />

of balances within the same tax jurisdiction, discussed in note 1 of these footnotes to<br />

the consolidated financial statements, was Euro 364.3 million and Euro 429.8 million,<br />

respectively.<br />

The analysis of deferred tax assets and deferred tax liabilities without taking into<br />

consideration the offsetting of balances within the same tax jurisdiction, is as follows:<br />

As of December 31<br />

(thousands of Euro) <strong>2012</strong> 2011<br />

Deferred tax assets<br />

Deferred tax assets to be recovered after more than 12 months 187,602 176,428<br />

Deferred tax assets to be recovered within 12 months 212,561 201,311<br />

Total 400,163 377,739<br />

Deferred tax liabilities<br />

Deferred tax liabilities to be recovered after more than 12 months 18,129 15,844<br />

Deferred tax liabilities to be recovered within 12 months 440,178 440,531<br />

Total 458,307 456,375<br />

Deferred tax liabilities (net) 58,144 78,636