Annual Review 2012 - Luxottica

Annual Review 2012 - Luxottica Annual Review 2012 - Luxottica

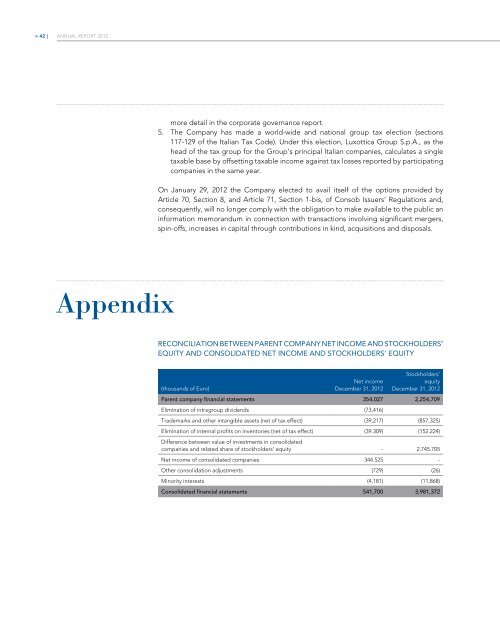

42 | ANNUAL REPORT 2012 more detail in the corporate governance report. 5. The Company has made a world-wide and national group tax election (sections 117-129 of the Italian Tax Code). Under this election, Luxottica Group S.p.A., as the head of the tax group for the Group’s principal Italian companies, calculates a single taxable base by offsetting taxable income against tax losses reported by participating companies in the same year. On January 29, 2012 the Company elected to avail itself of the options provided by Article 70, Section 8, and Article 71, Section 1-bis, of Consob Issuers’ Regulations and, consequently, will no longer comply with the obligation to make available to the public an information memorandum in connection with transactions involving significant mergers, spin-offs, increases in capital through contributions in kind, acquisitions and disposals. Appendix RECONCILIATION BETWEEN PARENT COMPANY NET INCOME AND STOCKHOLDERS’ EQUITY AND CONSOLIDATED NET INCOME AND STOCKHOLDERS’ EQUITY (thousands of Euro) Net income December 31, 2012 Stockholders’ equity December 31, 2012 Parent company financial statements 354,027 2,254,709 Elimination of intragroup dividends (73,416) Trademarks and other intangible assets (net of tax effect) (39,217) (857,325) Elimination of internal profits on inventories (net of tax effect) (39.309) (152.224) Difference between value of investments in consolidated companies and related share of stockholders' equity - 2.745.705 Net income of consolidated companies 344.525 - Other consolidation adjustments (729) (26) Minority interests (4,181) (11,868) Consolidated financial statements 541,700 3,981,372

MANAGEMENT REPORT - APPENDIX | 43 > NON-IFRS MEASURES Adjusted measures We use in this Management Report certain performance measures that are not in accordance with IFRS. Such non-IFRS measures are not meant to be considered in isolation or as a substitute for items appearing on our financial statements prepared in accordance with IFRS. Rather, these non-IFRS measures should be used as a supplement to IFRS results to assist the reader in better understanding our operational performance. Such measures are not defined terms under IFRS and their definitions should be carefully reviewed and understood by investors. Such non-IFRS measures are explained in detail and reconciled to their most comparable IFRS measures below. In order to provide a supplemental comparison of current period results of operations to prior periods, we have adjusted for certain non-recurring transactions or events. We have made such adjustments to the following measures: operating income and operating margin, EBITDA, EBITDA margin and net income by excluding non-recurring costs related to the reorganization of the retail business in Australia of Euro 21.7 million, Euro 15.2 million net of tax benefit , and a non-recurring accrual for the tax audit relating to Luxottica S.r.l. (Fiscal Year 2007) of approximately Euro 10.0 million. The Group believes that these adjusted measures are useful to both management and investors in evaluating the Group’s operating performance compared with that of other companies in its industry because they exclude the impact of non-recurring items that are not relevant to the Group’s operating performance. The adjusted measures referenced above are not measures of performance in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (IFRS). We include these adjusted comparisons in this presentation in order to provide a supplemental view of operations that excludes items that are unusual, infrequent or unrelated to our ongoing core operations. See the tables hereinafter for a reconciliation of the adjusted measures discussed above to their most directly comparable IFRS financial measure or, in the case of adjusted EBITDA, to EBITDA, which is also a non-IFRS measure. For reconciliation of EBITDA to its most directly comparable IFRS measure, see the pages following the tables that follows.

- Page 77 and 78: 75 Other information 2000-2012 EVOL

- Page 79 and 80: Other information 77 share Capital

- Page 81 and 82: Other information 79 1990 1991 1992

- Page 84 and 85: www.luxottica.com

- Page 87: ANNUAL REPORT 2012 Fiscal year ende

- Page 91 and 92: MANAGEMENT REPORT | 5 > Management

- Page 93 and 94: MANAGEMENT REPORT | 7 > 2011. In 20

- Page 95 and 96: MANAGEMENT REPORT | 9 > As a result

- Page 97 and 98: MANAGEMENT REPORT | 11 > of Coach,

- Page 99 and 100: MANAGEMENT REPORT | 13 > Please fin

- Page 101 and 102: MANAGEMENT REPORT | 15 > Adjusted n

- Page 103 and 104: MANAGEMENT REPORT | 17 > The income

- Page 105 and 106: MANAGEMENT REPORT | 19 > Operating

- Page 107 and 108: MANAGEMENT REPORT | 21 > Other Inco

- Page 109 and 110: MANAGEMENT REPORT | 23 > Cash used

- Page 111 and 112: MANAGEMENT REPORT | 25 > As of Dece

- Page 113 and 114: MANAGEMENT REPORT | 27 > Capital ex

- Page 115 and 116: MANAGEMENT REPORT | 29 > Implementa

- Page 117 and 118: MANAGEMENT REPORT | 31 > consequent

- Page 119 and 120: MANAGEMENT REPORT | 33 > Risks Rela

- Page 121 and 122: MANAGEMENT REPORT | 35 > 31, 2012 a

- Page 123 and 124: MANAGEMENT REPORT | 37 > n) If we w

- Page 125 and 126: MANAGEMENT REPORT | 39 > of the U.S

- Page 127: MANAGEMENT REPORT | 41 > growing at

- Page 131 and 132: MANAGEMENT REPORT - APPENDIX | 45 >

- Page 133 and 134: MANAGEMENT REPORT - APPENDIX | 47 >

- Page 135 and 136: MANAGEMENT REPORT - APPENDIX | 49 >

- Page 137 and 138: MANAGEMENT REPORT - APPENDIX | 51 >

- Page 139 and 140: REPORT ON CORPORATE GOVERNANCE AND

- Page 141 and 142: REPORT ON CORPORATE GOVERNANCE AND

- Page 143 and 144: REPORT ON CORPORATE GOVERNANCE AND

- Page 145 and 146: REPORT ON CORPORATE GOVERNANCE AND

- Page 147 and 148: REPORT ON CORPORATE GOVERNANCE AND

- Page 149 and 150: REPORT ON CORPORATE GOVERNANCE AND

- Page 151 and 152: REPORT ON CORPORATE GOVERNANCE AND

- Page 153 and 154: REPORT ON CORPORATE GOVERNANCE AND

- Page 155 and 156: REPORT ON CORPORATE GOVERNANCE AND

- Page 157 and 158: REPORT ON CORPORATE GOVERNANCE AND

- Page 159 and 160: REPORT ON CORPORATE GOVERNANCE AND

- Page 161 and 162: REPORT ON CORPORATE GOVERNANCE AND

- Page 163 and 164: REPORT ON CORPORATE GOVERNANCE AND

- Page 165 and 166: REPORT ON CORPORATE GOVERNANCE AND

- Page 167 and 168: REPORT ON CORPORATE GOVERNANCE AND

- Page 169 and 170: REPORT ON CORPORATE GOVERNANCE AND

- Page 171 and 172: REPORT ON CORPORATE GOVERNANCE AND

- Page 173 and 174: REPORT ON CORPORATE GOVERNANCE AND

- Page 175 and 176: REPORT ON CORPORATE GOVERNANCE AND

- Page 177 and 178: REPORT ON CORPORATE GOVERNANCE AND

42 |<br />

ANNUAL REPORT <strong>2012</strong><br />

more detail in the corporate governance report.<br />

5. The Company has made a world-wide and national group tax election (sections<br />

117-129 of the Italian Tax Code). Under this election, <strong>Luxottica</strong> Group S.p.A., as the<br />

head of the tax group for the Group’s principal Italian companies, calculates a single<br />

taxable base by offsetting taxable income against tax losses reported by participating<br />

companies in the same year.<br />

On January 29, <strong>2012</strong> the Company elected to avail itself of the options provided by<br />

Article 70, Section 8, and Article 71, Section 1-bis, of Consob Issuers’ Regulations and,<br />

consequently, will no longer comply with the obligation to make available to the public an<br />

information memorandum in connection with transactions involving significant mergers,<br />

spin-offs, increases in capital through contributions in kind, acquisitions and disposals.<br />

Appendix<br />

RECONCILIATION BETWEEN PARENT COMPANY NET INCOME AND STOCKHOLDERS’<br />

EQUITY AND CONSOLIDATED NET INCOME AND STOCKHOLDERS’ EQUITY<br />

(thousands of Euro)<br />

Net income<br />

December 31, <strong>2012</strong><br />

Stockholders’<br />

equity<br />

December 31, <strong>2012</strong><br />

Parent company financial statements 354,027 2,254,709<br />

Elimination of intragroup dividends (73,416)<br />

Trademarks and other intangible assets (net of tax effect) (39,217) (857,325)<br />

Elimination of internal profits on inventories (net of tax effect) (39.309) (152.224)<br />

Difference between value of investments in consolidated<br />

companies and related share of stockholders' equity - 2.745.705<br />

Net income of consolidated companies 344.525 -<br />

Other consolidation adjustments (729) (26)<br />

Minority interests (4,181) (11,868)<br />

Consolidated financial statements 541,700 3,981,372