DRIVIN G ROWTH - Dr. Reddy's

DRIVIN G ROWTH - Dr. Reddy's

DRIVIN G ROWTH - Dr. Reddy's

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

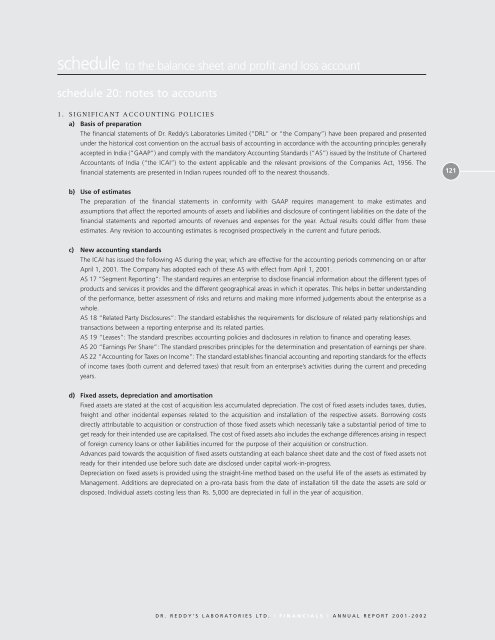

schedule to the balance sheet and profit and loss account<br />

schedule 20: notes to accounts<br />

1. SIGNIFICANT ACCOUNTING POLICIES<br />

a) Basis of preparation<br />

The financial statements of <strong>Dr</strong>. Reddy’s Laboratories Limited (“DRL” or “the Company”) have been prepared and presented<br />

under the historical cost convention on the accrual basis of accounting in accordance with the accounting principles generally<br />

accepted in India (“GAAP”) and comply with the mandatory Accounting Standards (“AS”) issued by the Institute of Chartered<br />

Accountants of India (“the ICAI”) to the extent applicable and the relevant provisions of the Companies Act, 1956. The<br />

financial statements are presented in Indian rupees rounded off to the nearest thousands.<br />

b) Use of estimates<br />

The preparation of the financial statements in conformity with GAAP requires management to make estimates and<br />

assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent liabilities on the date of the<br />

financial statements and reported amounts of revenues and expenses for the year. Actual results could differ from these<br />

estimates. Any revision to accounting estimates is recognised prospectively in the current and future periods.<br />

c) New accounting standards<br />

The ICAI has issued the following AS during the year, which are effective for the accounting periods commencing on or after<br />

April 1, 2001. The Company has adopted each of these AS with effect from April 1, 2001.<br />

AS 17 “Segment Reporting”: The standard requires an enterprise to disclose financial information about the different types of<br />

products and services it provides and the different geographical areas in which it operates. This helps in better understanding<br />

of the performance, better assessment of risks and returns and making more informed judgements about the enterprise as a<br />

whole.<br />

AS 18 “Related Party Disclosures”: The standard establishes the requirements for disclosure of related party relationships and<br />

transactions between a reporting enterprise and its related parties.<br />

AS 19 “Leases”: The standard prescribes accounting policies and disclosures in relation to finance and operating leases.<br />

AS 20 “Earnings Per Share”: The standard prescribes principles for the determination and presentation of earnings per share.<br />

AS 22 “Accounting for Taxes on Income”: The standard establishes financial accounting and reporting standards for the effects<br />

of income taxes (both current and deferred taxes) that result from an enterprise’s activities during the current and preceding<br />

years.<br />

d) Fixed assets, depreciation and amortisation<br />

Fixed assets are stated at the cost of acquisition less accumulated depreciation. The cost of fixed assets includes taxes, duties,<br />

freight and other incidental expenses related to the acquisition and installation of the respective assets. Borrowing costs<br />

directly attributable to acquisition or construction of those fixed assets which necessarily take a substantial period of time to<br />

get ready for their intended use are capitalised. The cost of fixed assets also includes the exchange differences arising in respect<br />

of foreign currency loans or other liabilities incurred for the purpose of their acquisition or construction.<br />

Advances paid towards the acquisition of fixed assets outstanding at each balance sheet date and the cost of fixed assets not<br />

ready for their intended use before such date are disclosed under capital work-in-progress.<br />

Depreciation on fixed assets is provided using the straight-line method based on the useful life of the assets as estimated by<br />

Management. Additions are depreciated on a pro-rata basis from the date of installation till the date the assets are sold or<br />

disposed. Individual assets costing less than Rs. 5,000 are depreciated in full in the year of acquisition.<br />

DR. REDDY’S LABORATORIES LTD. | FINANCIALS | ANNUAL REPORT 2001-2002<br />

121