DRIVIN G ROWTH - Dr. Reddy's

DRIVIN G ROWTH - Dr. Reddy's

DRIVIN G ROWTH - Dr. Reddy's

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

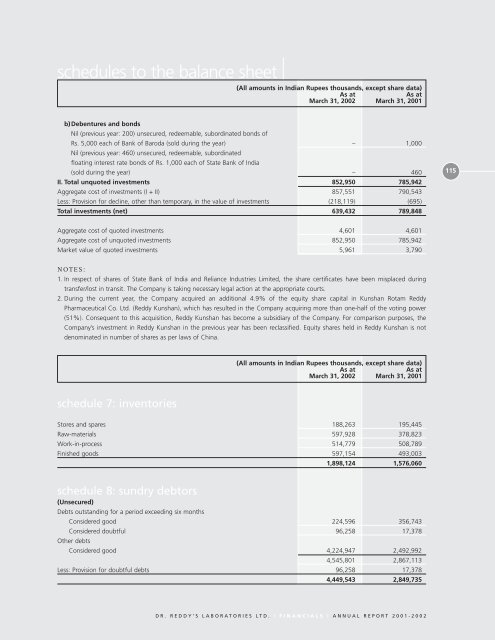

schedules to the balance sheet |<br />

(All amounts in Indian Rupees thousands, except share data)<br />

As at As at<br />

March 31, 2002 March 31, 2001<br />

b)Debentures and bonds<br />

Nil (previous year: 200) unsecured, redeemable, subordinated bonds of<br />

Rs. 5,000 each of Bank of Baroda (sold during the year)<br />

Nil (previous year: 460) unsecured, redeemable, subordinated<br />

floating interest rate bonds of Rs. 1,000 each of State Bank of India<br />

– 1,000<br />

(sold during the year) – 460<br />

II. Total unquoted investments 852,950 785,942<br />

Aggregate cost of investments (I + II) 857,551 790,543<br />

Less: Provision for decline, other than temporary, in the value of investments (218,119) (695)<br />

Total investments (net) 639,432 789,848<br />

Aggregate cost of quoted investments 4,601 4,601<br />

Aggregate cost of unquoted investments 852,950 785,942<br />

Market value of quoted investments 5,961 3,790<br />

NOTES:<br />

1. In respect of shares of State Bank of India and Reliance Industries Limited, the share certificates have been misplaced during<br />

transfer/lost in transit. The Company is taking necessary legal action at the appropriate courts.<br />

2. During the current year, the Company acquired an additional 4.9% of the equity share capital in Kunshan Rotam Reddy<br />

Pharmaceutical Co. Ltd. (Reddy Kunshan), which has resulted in the Company acquiring more than one-half of the voting power<br />

(51%). Consequent to this acquisition, Reddy Kunshan has become a subsidiary of the Company. For comparison purposes, the<br />

Company’s investment in Reddy Kunshan in the previous year has been reclassified. Equity shares held in Reddy Kunshan is not<br />

denominated in number of shares as per laws of China.<br />

schedule 7: inventories<br />

(All amounts in Indian Rupees thousands, except share data)<br />

As at As at<br />

March 31, 2002 March 31, 2001<br />

Stores and spares 188,263 195,445<br />

Raw-materials 597,928 378,823<br />

Work-in-process 514,779 508,789<br />

Finished goods 597,154 493,003<br />

schedule 8: sundry debtors<br />

(Unsecured)<br />

1,898,124 1,576,060<br />

Debts outstanding for a period exceeding six months<br />

Considered good 224,596 356,743<br />

Considered doubtful<br />

Other debts<br />

96,258 17,378<br />

Considered good 4,224,947 2,492,992<br />

4,545,801 2,867,113<br />

Less: Provision for doubtful debts 96,258 17,378<br />

4,449,543 2,849,735<br />

DR. REDDY’S LABORATORIES LTD. | FINANCIALS | ANNUAL REPORT 2001-2002<br />

115