Port Nelson Annual Report 2007 (pdf)

Port Nelson Annual Report 2007 (pdf)

Port Nelson Annual Report 2007 (pdf)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

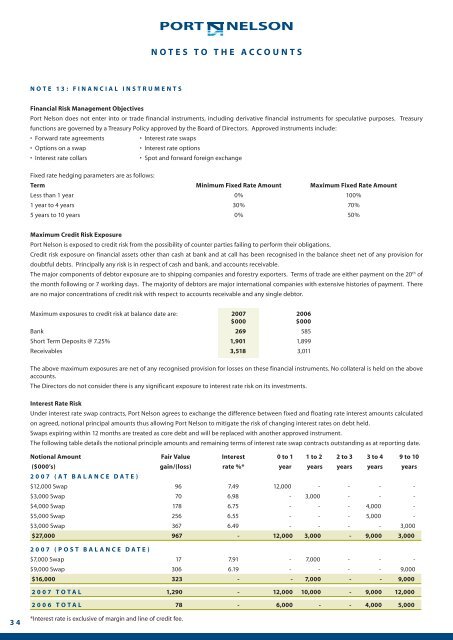

N O T E S T O T H E A C C O U N T S<br />

N O T E 1 3 : F I N A N C I A L I N S T R U M E N T S<br />

Financial Risk Management Objectives<br />

<strong>Port</strong> <strong>Nelson</strong> does not enter into or trade financial instruments, including derivative financial instruments for speculative purposes. Treasury<br />

functions are governed by a Treasury Policy approved by the Board of Directors. Approved instruments include:<br />

• Forward rate agreements<br />

• Interest rate swaps<br />

• Options on a swap<br />

• Interest rate options<br />

• Interest rate collars<br />

• Spot and forward foreign exchange<br />

Fixed rate hedging parameters are as follows:<br />

Term Minimum Fixed Rate Amount Maximum Fixed Rate Amount<br />

Less than 1 year 0% 100%<br />

1 year to 4 years 30% 70%<br />

5 years to 10 years 0% 50%<br />

Maximum Credit Risk Exposure<br />

<strong>Port</strong> <strong>Nelson</strong> is exposed to credit risk from the possibility of counter parties failing to perform their obligations.<br />

Credit risk exposure on financial assets other than cash at bank and at call has been recognised in the balance sheet net of any provision for<br />

doubtful debts. Principally any risk is in respect of cash and bank, and accounts receivable.<br />

The major components of debtor exposure are to shipping companies and forestry exporters. Terms of trade are either payment on the 20 th of<br />

the month following or 7 working days. The majority of debtors are major international companies with extensive histories of payment. There<br />

are no major concentrations of credit risk with respect to accounts receivable and any single debtor.<br />

Maximum exposures to credit risk at balance date are: <strong>2007</strong> 2006<br />

$000 $000<br />

Bank 269 585<br />

Short Term Deposits @ 7.25% 1,901 1,899<br />

Receivables 3,518 3,011<br />

The above maximum exposures are net of any recognised provision for losses on these financial instruments. No collateral is held on the above<br />

accounts.<br />

The Directors do not consider there is any significant exposure to interest rate risk on its investments.<br />

Interest Rate Risk<br />

Under interest rate swap contracts, <strong>Port</strong> <strong>Nelson</strong> agrees to exchange the difference between fixed and floating rate interest amounts calculated<br />

on agreed, notional principal amounts thus allowing <strong>Port</strong> <strong>Nelson</strong> to mitigate the risk of changing interest rates on debt held.<br />

Swaps expiring within 12 months are treated as core debt and will be replaced with another approved instrument.<br />

The following table details the notional principle amounts and remaining terms of interest rate swap contracts outstanding as at reporting date.<br />

Notional Amount Fair Value Interest 0 to 1 1 to 2 2 to 3 3 to 4 9 to 10<br />

($000’s) gain/(loss) rate %* year years years years years<br />

2 0 0 7 ( A T B A L A N C E D A T E )<br />

$12,000 Swap 96 7.49 12,000 - - - -<br />

$3,000 Swap 70 6.98 - 3,000 - - -<br />

$4,000 Swap 178 6.75 - - - 4,000 -<br />

$5,000 Swap 256 6.55 - - - 5,000 -<br />

$3,000 Swap 367 6.49 - - - - 3,000<br />

$27,000 967 - 12,000 3,000 - 9,000 3,000<br />

2 0 0 7 ( P O S T B A L A N C E D A T E )<br />

$7,000 Swap 17 7.91 - 7,000 - - -<br />

$9,000 Swap 306 6.19 - - - - 9,000<br />

$16,000 323 - - 7,000 - - 9,000<br />

2 0 0 7 T O T A L 1,290 - 12,000 10,000 - 9,000 12,000<br />

2 0 0 6 T O T A L 78 - 6,000 - - 4,000 5,000<br />

3 4<br />

*Interest rate is exclusive of margin and line of credit fee.