Port Nelson Annual Report 2007 (pdf)

Port Nelson Annual Report 2007 (pdf)

Port Nelson Annual Report 2007 (pdf)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2 0 0 7 A N N U A L R E P O R T

H I G H L I G H T S F R O M T H E 2 0 0 7 F I N A N C I A L Y E A R<br />

JULY 2006<br />

Blessing of the Fleet at Wakefield Quay marking the centennial of the Cut,<br />

1906-2006.<br />

Marine Operations Manager Roy Skucek joined our staff, completing the<br />

new line up of executives.<br />

OCTOBER 2006<br />

Cruise ship The World makes a port call - selecting <strong>Nelson</strong> as ‘clean, friendly<br />

and a little bit different’.<br />

NOVEMBER<br />

2006<br />

Paving of Brunt Quay completed.<br />

The One Gate in Carkeek Street became fully operational, centralising<br />

services and enhancing security.<br />

Capital structure of the company reviewed, resulting in a share buy back,<br />

delivering $25 million to the two shareholders, <strong>Nelson</strong> City and Tasman<br />

District Councils.<br />

DECEMBER<br />

2006<br />

<strong>Port</strong> <strong>Nelson</strong> Santa Parade marks the beginning of the festive season in<br />

<strong>Nelson</strong> city.<br />

FEBRUARY <strong>2007</strong><br />

Open Day drew crowds to the port for displays and tours of the<br />

operational area.<br />

MARCH<br />

<strong>2007</strong><br />

<strong>Port</strong> call from HMNZS Te Kaha.<br />

<strong>Nelson</strong> Yacht Club celebrates 150 year anniversary.<br />

Achieved ACC tertiary accreditation.<br />

APRIL<br />

<strong>2007</strong><br />

Tanker Taiko makes her last visit to <strong>Nelson</strong> before being withdrawn from<br />

service.<br />

Delivery of new Hyster hi-stacker, capable of lifting two empties at once.<br />

Lifting record set by Liebherr cranes with 5749 moves for the month.<br />

Paving laid in former TNL log yard near the port company office.<br />

MAY<br />

<strong>2007</strong><br />

<strong>Port</strong> <strong>Nelson</strong> Blokes’ Day Out triathlon raced in wet conditions with<br />

high number of entries.<br />

JUNE <strong>2007</strong><br />

The derelict fishing vessel SZAP 5 left port to be scuttled in Cook Strait.<br />

2<br />

Record container numbers and cargo tonnes handled for a full<br />

financial year.

“During the Noise Variation process we have appreciated the support of many<br />

parties who understand and acknowledge the importance of the port to the<br />

wider community. It is pleasing to note this has come both from the business<br />

community and many private householders, including a large number of<br />

port hills residents themselves.”<br />

Martin Byrne, Chief Executive , <strong>Port</strong> <strong>Nelson</strong> Limited.<br />

R E P O R T C O N T E N T S<br />

Directors’ <strong>Report</strong> ..............................................................................................................................................................................4<br />

Chief Executive’s <strong>Report</strong> ...............................................................................................................................................................6<br />

<strong>Port</strong> <strong>Nelson</strong> in the Community ..................................................................................................................................................8<br />

Environmental Matters ............................................................................................................................................................... 10<br />

<strong>Port</strong> People ..................................................................................................................................................................................... 14<br />

Governance .................................................................................................................................................................................... 15<br />

Directors .......................................................................................................................................................................................... 16<br />

Financial & Trade Highlights ..................................................................................................................................................... 17<br />

Auditor’s <strong>Report</strong> ............................................................................................................................................................................ 18<br />

Statutory Information ................................................................................................................................................................. 19<br />

Statement of Corporate Intent ................................................................................................................................................ 21<br />

Statement of Financial Performance and<br />

Statement of Movements in Equity ....................................................................................................................................... 22<br />

Statement of Financial Position .............................................................................................................................................. 23<br />

Statement of Cashflows ............................................................................................................................................................. 24<br />

Statement of Accounting Policies .......................................................................................................................................... 26<br />

Notes to Accounts ........................................................................................................................................................................ 28<br />

Directory .......................................................................................................................................................................................... 35<br />

3

D I R E C T O R S ’ R E P O R T<br />

As Chairman of <strong>Port</strong> <strong>Nelson</strong> Limited I am<br />

pleased to report another encouraging<br />

result for the company during this past<br />

financial year.<br />

The net surplus after taxation and including<br />

unrealised investment property gains<br />

was $6.7 million, based around revenues<br />

that were some $2.4 million ahead of budget, with the associated<br />

operational expenses some $1.5 million higher than budget.<br />

The main factors behind the increased revenue were:<br />

• Higher than anticipated cargo volumes, particularly in the areas of<br />

logs, vehicles, dairy products and wine<br />

• A continued move towards further containerisation of cargo<br />

previously carried in break bulk form, such as sawn timber<br />

• A continued increase in property values, which then flowed through<br />

into higher rental income.<br />

The main areas of increase in operating expenses related to:<br />

• Plant hire and wages – offset by increased activity<br />

• Electricity charges – also offset by increased activity<br />

• Maintenance costs associated with the replacement of a crane winch<br />

gearbox on one of the Liebherr mobile cranes.<br />

former SSL Receiving and Delivery site required significant pavement<br />

improvements to deal with the increase in volumes being handled.<br />

This reflects the bigger picture that many of the paved areas within the<br />

port were not designed to handle the number of containers and heavy<br />

operating machinery that we now deal with.<br />

Aside from this work, the main investment was around the ‘One Gate’<br />

project which saw us bring staff from three separate operational sites<br />

into the new facility based at the Carkeek St entrance.<br />

That this project was completed on time and under budget, was a<br />

credit to all concerned. We have also continued to invest in new plant<br />

with the purchase of a Hyster ECH forklift; and have continued to<br />

upgrade our IT systems, flowing on from other projects in this area in<br />

recent years.<br />

The other major area of capital expenditure in the year related to<br />

the buy back of buildings and operational land which had been<br />

leased or owned by third parties. This was required to meet both<br />

current operational requirements and to ensure we have suitable<br />

developmental options open to us in the future.<br />

C A R G O A N D S H I P P I N G<br />

Cargo volumes were the highest in the history of the company,<br />

the final figure of 2.644 million tonnes being some 89,000 tonnes<br />

ahead of budget. Log, vehicle, dairy and wine volumes were strong,<br />

although once again slightly offset by lower than anticipated exports<br />

of processed wood products and fruit.<br />

The strong dairy and wine volumes, coupled with the movement of<br />

greater amounts of sawn timber into containerised form, meant the<br />

number of containers handled through the port exceeded 70,000 TEU<br />

(Twenty Foot Equivalent Units) for the first time. The final figure of<br />

71,815 is more than 10,000 TEU ahead of the previous twelve month<br />

period.<br />

4<br />

O P E R A T I O N A L M A T T E R S A N D P O R T<br />

D E V E L O P M E N T<br />

Unlike recent years with significant investment in wharf upgrades and<br />

the purchase of a new pilot boat, 2006/07 was very much focussed on<br />

limited capital expenditure, mainly around pavement areas required<br />

for container operations. The areas adjacent to Brunt Quay and on the

P E R F O R M A N C E R E V I E W - P O R T N E L S O N L T D G R O U P<br />

<strong>2007</strong> 2006 2005 2004 2003<br />

<strong>2007</strong> 2006 2005 2004 2003<br />

Operations<br />

Financial ($ Millions) ...continued<br />

Trade (Millions of Cargo Tonnes) 2.644 2.522 2.623 2.564 2.458<br />

Container Throughput (TEU’s)* 71,815 61,455 57,144 51,128 44,632<br />

Dividends Declared (Millions) $3.9 $5.3 $3.3 $9.2 $3.1<br />

Vessel Arrivals (Over 100GT) 997 1,012 1,178 1,267 1,470 Capital Expenditure $4.0 $2.9 $7.3 $3.2 $2.9<br />

Total Vessel GT Calling (Millions) 9.0 8.6 8.4 9.2 9.7 Net Interest Bearing Debt $42.0 $16.5 $19.0 $16.5 $15.0<br />

Employees (FTE’s) 132 141 143 125 121 Total Tangible Assets $152.3 $149.6 $117.2 $114.2 $113.7<br />

Financial ($ Millions)<br />

Shareholder Return Metrics<br />

Revenue** $33.0 $29.6 $27.7 $27.6 $25.4<br />

Earnings per Share (cents) 26.5 22.1 17.0 21.3 18.0<br />

EBITDA *** $15.8 $15.3 $12.2 $13.8 $12.5<br />

Earnings Before Interest<br />

Dividend per Share(cents) 15.3 17.1 11.0 30.0 10.3<br />

and Taxation (EBIT) $12.2 $11.6 $9.0 $10.6 $9.6 Net Assets per Share $4.31 $4.14 $3.15 $3.12 $3.18<br />

Net Interest Expense $2.5 $1.5 $1.3 $1.0 $1.3 Equity (%) 67.9% 82.1% 80.6% 81.2% 82.0%<br />

Taxation $3.0 $3.1 $2.5 $2.9 $2.7 Return on Average Equity (%) 5.6% 6.1% 5.4% 6.6% 6.0%<br />

Net Surplus After Taxation**** $6.7 $6.9 $5.2 $6.6 $5.6 Return on Average Assets (%) 7.7% 8.3% 7.5% 8.9% 8.4%<br />

F I N A N C I A L O U T T U R N A N D D I V I D E N D<br />

The net surplus after taxation, including unrealised investment<br />

property gains, resulted in a return on average shareholders funds<br />

of approximately 5.6%. Dividends declared for the year will be<br />

$3.9 million.<br />

As was reported in late October of 2006, the Board of <strong>Port</strong> <strong>Nelson</strong><br />

Limited recommended proceeding with a share buy back which saw<br />

a payment of $25 million being split between the two shareholders,<br />

<strong>Nelson</strong> City Council and Tasman District Council.<br />

This came as a result of a detailed review of the capital structure of<br />

the company, with the focus being to achieve a structure more in line<br />

with the port sector in general and to establish a level of shareholders’<br />

funds that was more appropriate to the nature of the risks associated<br />

with the port’s business.<br />

As was mentioned in the 2006 <strong>Annual</strong> <strong>Report</strong>, the continued<br />

rationalisation within the shipping industry remains a challenge for us,<br />

as it is for many New Zealand ports. This was highlighted in the second<br />

half of the financial year with the withdrawal of the Maersk Asian (NZ1)<br />

service from <strong>Port</strong> <strong>Nelson</strong>.<br />

We continue to make all efforts to ensure <strong>Nelson</strong> remains an attractive<br />

port of call for overseas shipping lines but are also realistic, that as vessels<br />

get larger there are likely to be further changes to existing services,<br />

particularly for the smaller regional operations such as ourselves.<br />

I would like to thank the senior management and all staff for the<br />

excellent efforts over the last 12 months.<br />

Our Finance Manager Murray Win retired after a number of years with<br />

<strong>Port</strong> <strong>Nelson</strong> and there were also changes in directors’ positions during<br />

the year.<br />

Murray Sturgeon and Bob Dickinson, both long serving directors,<br />

resigned during the latter half of 2006 and we thank them for the huge<br />

contribution they have made to <strong>Port</strong> <strong>Nelson</strong> Limited over many years.<br />

They have been replaced by Bronwyn Monopoli and Tim King and we<br />

look forward to their contributions to the growth of the business in<br />

coming years.<br />

To the shareholders and fellow directors I thank you for your support<br />

and commitment over the past year.<br />

Nick Patterson<br />

Chairman , <strong>Port</strong> <strong>Nelson</strong> Limited.<br />

5

C H I E F E X E C U T I V E ’ S R E P O R T<br />

6<br />

C A R G O<br />

Volumes through <strong>Port</strong> <strong>Nelson</strong> for the year<br />

were the highest on record with logs,<br />

motor vehicles, wine and dairy products<br />

being particularly strong performers.<br />

Total throughput for the 12 month period<br />

was 2,644,000 tonnes, some 89,000<br />

tonnes ahead of budget and around 122,000 tonnes up on the<br />

previous year.<br />

Log exports for the year were 22,000 tonnes ahead of budget at<br />

636,000 tonnes and reflected the strong overseas demand for wood<br />

throughout the majority of the financial year. Imported motor<br />

vehicles (new and used) totalled 167,000 revenue tonnes as against<br />

a budget of 136,000 tonnes and dairy (21,000 tonnes) and wine<br />

(30,000 tonnes) also showed healthy increases on the figures twelve<br />

months earlier.<br />

Processed forestry exports were some 60,000 tonnes below budget,<br />

with fruit exports and fertiliser and cement imports also being slightly<br />

lower than had been anticipated.<br />

Container numbers significantly increased once again with 71,815<br />

TEU handled during that period as against 61,455 TEU twelve<br />

months earlier.<br />

This increase was on the back of a number of factors including the<br />

following:<br />

• Greater volumes of sawn timber being shipped in containers rather<br />

than in break bulk form, particularly to the Asian region<br />

• Increased wine and dairy exports through the port<br />

• A further increase in LVL and MDF products being loaded into<br />

containers.<br />

S H I P P I N G<br />

Vessel arrivals were marginally lower with 1,001 vessels calling during<br />

the year as against 1,012 the previous year.<br />

In late December the fortnightly Tasman Orient Line (TOL) service<br />

ceased calling on the back of the traditional cargo base for this<br />

service moving principally to containers and around the same time<br />

the monthly Indotrans break bulk service to the US also ceased. In<br />

mid June the regular Maersk relay service to Asia also ceased as part<br />

of a nationwide review of their feedering service where they chose<br />

to commence utilising transhipment operations with existing coastal<br />

operators.<br />

S T O R A G E / R E C E I V A L A N D D E L I V E R Y /<br />

Q U A Y P A C K<br />

The purchase of land previously leased by a third party on the western<br />

side of Hay St in the second half of 2006 enabled us to secure extra<br />

land for the storage of containers, which was urgently needed given<br />

the significant growth in container traffic. Space was particularly<br />

at a premium during the <strong>2007</strong> fruit export season and the efficient<br />

operation of the Container Yard and Receiving and Delivery (R & D)<br />

systems was a credit to all the staff involved in the cargo logistics<br />

division of the business.<br />

Our Quaypack division continues to go from strength to strength with<br />

its packing and unpacking operations. The growth of wood products<br />

moving into containers has certainly seen added demand for their<br />

services.<br />

In late 2006 our Cargo Team moved into the ‘One Gate’ facility on<br />

Carkeek Street. The completion of this project on time and under<br />

budget was a credit to all involved. The benefits of having all cargo<br />

staff in one area have been everything we had hoped for and have<br />

certainly assisted us during the busy peaks we experience from March<br />

through to June.<br />

S T E V E D O R I N G<br />

In late 2006 a review was undertaken of our Stevedoring division,<br />

Tasman Bay Stevedoring (TBS) to ascertain how we could improve the<br />

performance of what has been for some time a marginal business. It is<br />

fair to say that all stevedoring companies in <strong>Nelson</strong> have a reputation<br />

for high levels of service and efficiency of operation but historically this<br />

service has not attracted the returns available for similar operations in<br />

other New Zealand ports. TBS has since worked through various issues<br />

to achieve mutual benefits, where our major customers know they<br />

have longevity of service and at the same time TBS is assured of the<br />

return that makes it worthwhile staying in this line of work. A huge<br />

amount of credit must go to Chris Shand, Digby Kynaston and the TBS<br />

team who have worked so hard in meeting the targets laid down for<br />

them, and I also express my sincere thanks for the efforts of our Chief<br />

Commercial Officer, Parke Pittar, in driving this review process.<br />

E N V I R O N M E N T A L I S S U E S<br />

The Noise variation to the <strong>Nelson</strong> City Council Resource Management<br />

Plan was notified in early June this year and we expect to commence<br />

noise mitigation work on the affected properties in the coming<br />

months. While no solution will ever meet with universal support we

“We work in a hectic environment in the peak fruit season and can’t always stick<br />

to our plans. PNL staff understand our needs and allow for flexibility in working<br />

hours and cargo volumes. I really value the personal relationships we have built<br />

up over many years.”<br />

Hans Krabo, Logistics Manager, ENZA International.<br />

believe the variation in its current form offers a solution that all parties<br />

should be able to live with, and we remain committed to ensuring we<br />

do everything possible on an ongoing basis to keep noise created<br />

from port operations to an absolute minimum. During this process we<br />

have appreciated the support of many parties who understand and<br />

acknowledge the importance of the port to the wider community.<br />

It is pleasing to note this has come both from the business community<br />

and many private householders, including a large number of port hills<br />

residents themselves.<br />

The Environment Committee has continued to meet regularly over<br />

the last 12 months. Following on from the recommendations of the<br />

committee and our own board and management, the company<br />

was recently successful in gaining ISO 14001 certification for our<br />

environmental practices - the first major port in New Zealand to<br />

attain this standard. Special note should be made of the efforts of our<br />

Environmental Officer, Frances Woodhead, in driving this project to a<br />

successful conclusion.<br />

P L A N N I N G F O R T H E F U T U R E<br />

The withdrawal of one of the Maersk services in mid June highlighted<br />

the continued change apparent within the shipping industry in<br />

New Zealand and overseas. If there is one thing that is sure, it is that<br />

change will carry on for the foreseeable future. In 2001 P & O Nedlloyd<br />

announced the introduction of the 4100 TEU container vessels to NZ<br />

and Australia and now some lines are looking at bringing 6000 TEU<br />

vessels to this part of the world, which will in all likelihood result in<br />

fewer port calls and greater use of feedering services.<br />

At this stage we believe the short to medium term future for regional<br />

ports such as ours is one where there are a mix of direct callers and<br />

lines choosing to utilise feeder operations. The challenge for us is to<br />

ensure we have the facilities to handle those vessels, without over<br />

investing in infrastructure that will struggle to generate a reasonable<br />

return.<br />

A C K N O W L E D G E M E N T S<br />

I would like to once again express on behalf of myself and our<br />

Executive Team our thanks to the Board of <strong>Port</strong> <strong>Nelson</strong> Limited for their<br />

support and advice over the last twelve months and to thank our staff<br />

who have all contributed to another solid performance.<br />

As I have stated in previous years, I would also like to express our<br />

appreciation to the importers and exporters of the region for their<br />

support, and to the many shipping lines that PNL services. Your<br />

support is vital to our continued success.<br />

Martin Byrne<br />

Chief Executive, <strong>Port</strong> <strong>Nelson</strong> Ltd.<br />

7

P O R T N E L S O N I N T H E C O M M U N I T Y<br />

Export is the lifeblood of <strong>Nelson</strong>-Tasman and at <strong>Port</strong> <strong>Nelson</strong> we are<br />

aware of the vital role we play as the ‘region’s gateway to the world’.<br />

From forestry, seafood, fruit, wine and imports, the wellbeing of the<br />

region as a whole is intrinsically linked to <strong>Port</strong> <strong>Nelson</strong> in some way.<br />

The community ownership of <strong>Port</strong> <strong>Nelson</strong> Limited is reflected in the<br />

strong role the company plays in the region in sports, arts, community<br />

and business.<br />

We are one of the region’s largest sponsors putting over $150,000 a<br />

year into support for a number of events, groups and projects. This<br />

year we continued to develop partnerships themed around the youth<br />

in the community and saw excellent results - our funding of a coach for<br />

the <strong>Nelson</strong> Rowing Club has seen the squad win gold at the Mardi Cup<br />

and selected rowers competing for New Zealand in Beijing.<br />

We continued to build on the success of the entry level multisport<br />

event, the <strong>Port</strong> <strong>Nelson</strong> Blokes’ Day Out, with increased entries and<br />

a large contingent from our own staff; we are in our third year of<br />

sponsorship with the Tasman Makos as a First XV supporter of the<br />

combined <strong>Nelson</strong> Marlborough side.<br />

The third <strong>Nelson</strong> <strong>Port</strong> and Transport Industry Charity Golf Tournament<br />

was held in November, attracting a capacity field, and providing an<br />

opportunity for the industry to get together and raise money for the<br />

very worthwhile cause of sending the <strong>Nelson</strong> Special Olympic Squad<br />

to Beijing.<br />

Out in the streets of the city we maintain a high profile with support<br />

for the <strong>Port</strong> <strong>Nelson</strong> Santa Parade and the <strong>Port</strong> <strong>Nelson</strong> Masked Parade,<br />

which opens the <strong>Nelson</strong> Arts Festival every year. Drawing crowds in<br />

excess of 10,000 these are <strong>Nelson</strong>’s biggest participation events.<br />

The <strong>Port</strong> <strong>Nelson</strong> Trust helps a wide range of community groups.<br />

Over the past year funds were distributed by the trust to a range of<br />

sports, community and arts projects.<br />

In the business community our support for the <strong>Nelson</strong> economy<br />

continues as a key stakeholder in the <strong>Nelson</strong> Regional Economic<br />

Development Agency, a cornerstone sponsor of the <strong>Nelson</strong>-Tasman<br />

Chamber of Commerce and supporter of the <strong>Nelson</strong> Bays Educational<br />

Business partnership, with Infrastructure Manager Dick Carter chairing<br />

the <strong>Nelson</strong> Engineering Group.<br />

The amenities berth on Wakefield Quay is now home to the <strong>Nelson</strong><br />

Coast Guard, provided free of charge by <strong>Port</strong> <strong>Nelson</strong> to support this<br />

vital service to the community, and we continue to allow public access<br />

for fishing in this area.<br />

8 <strong>Port</strong> Open Day, February 07.

<strong>Port</strong> <strong>Nelson</strong>’s support of the <strong>Nelson</strong> Marlborough Rescue Helicopter Trust ensures<br />

that our volunteers receive vital training in water rescue and winch operation.<br />

Our family of sponsors and the support of the community help provide a free<br />

dedicated air rescue service, on call 24 hours a day, seven days a week.<br />

Paula Muddle , Marketing and Communications Manager, <strong>Nelson</strong> Marlborough Rescue Helicopter.<br />

P O R T N E L S O N S P O N S O R S H I P S<br />

Community<br />

Outward Bound youth programme<br />

<strong>Port</strong> <strong>Nelson</strong> Santa Parade<br />

Richmond Santa Parade<br />

Motueka Hospital Trust<br />

<strong>Port</strong> <strong>Nelson</strong> Masked Parade<br />

<strong>Nelson</strong>-Tasman Rescue Helicopter<br />

Blessing of the Fleet<br />

<strong>Nelson</strong> Bays Youth Team Racing<br />

School of Music Winter Festival<br />

Mouteka Yacht & Cruising Club<br />

Brightwater Food & Wine Festival<br />

<strong>Port</strong> <strong>Nelson</strong> Trust<br />

Business<br />

Latitude <strong>Nelson</strong><br />

Chamber of Commerce<br />

Fishing Association<br />

<strong>Nelson</strong> Bays Education Business Partnership<br />

Sealord Rescue Centre<br />

Marine Farming Conference<br />

Golfing Tournaments<br />

Wood Processing Association<br />

<strong>Nelson</strong> Engineering Cluster<br />

Sports<br />

Tasman Bay Rugby<br />

<strong>Nelson</strong> Rowing<br />

<strong>Port</strong> <strong>Nelson</strong> Big Bay Bike Ride<br />

Beach Volleyball<br />

<strong>Port</strong> <strong>Nelson</strong> Blokes Day Out<br />

Tasman Sports Awards<br />

<strong>Nelson</strong> Motor Cycle Racing<br />

<strong>Port</strong>ions of the <strong>Port</strong> <strong>Nelson</strong> information panels at Wakefield Quay.<br />

9

E N V I R O N M E N T A L M A T T E R S<br />

This year saw a significant progress in our environmental efforts at the<br />

port, as we worked towards ISO 14001 Environmental Management<br />

accreditation. The international standard is considered to be the most<br />

stringent of all the accreditation systems available in New Zealand<br />

for environmental management, and <strong>Port</strong> <strong>Nelson</strong> is the first major<br />

New Zealand port to make the commitment to externally audited<br />

continuous improvement in environmental management. Our first full<br />

audit was held at the end of the financial year and the final certification<br />

was issued some weeks later.<br />

Reaching this point has meant having a long hard look at our existing<br />

environmental management plan against the framework prescribed<br />

by the standard. The Environmental Consultative Committee has<br />

guided the process, advising on priority of environmental impacts and<br />

contributing several of the new quantitative performance indicators.<br />

As in previous years we extend a grateful thanks to this dedicated and<br />

knowledgeable team of volunteers.<br />

Auditors will continue to visit us on a regular basis to ensure we are<br />

gathering information related to the meeting of our targets and<br />

checking that procedures are working as described by the system.<br />

I S O A C T I V I T I E S T H R O U G H T H E Y E A R<br />

Environmental Policy Statement updated . . . . . . . . . . . . . . . . . . July 2006<br />

Environmental Aspects Register and<br />

scoring developed . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .August 2006<br />

Internal environmental team convened. . . . . . . . . . . . . .September 2006<br />

Staff training in auditing environmental<br />

management systems . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .October 2006<br />

Initial audit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . November 2006<br />

Baselines and performance targets reviewed . . . . . . . . . . February <strong>2007</strong><br />

Plastics, paper and cardboard recycling introduced . . . . . .March <strong>2007</strong><br />

Review of documents and record keeping . . . . . . . . . . . . . . . . April <strong>2007</strong><br />

First full audit, update of Environmental Management Plan . . June <strong>2007</strong><br />

I N D I C A T O R S O F P R O G R E S S<br />

Our performance indicators are provided in both actual units and<br />

in TEU (twenty foot container equivalent) to provide a measure of<br />

efficiency improvements.<br />

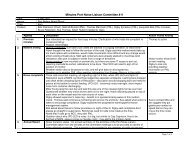

E N V I R O N M E N T A L M A N A G E M E N T P E R F O R M A N C E I N D I C A T O R S<br />

Aspect Indicator Baseline Baseline<br />

2005/6 2006/7<br />

Environmental Policy Percentage of new permanent employees receiving environmental induction 0 23%<br />

Fuel Fuel use (litres) per teu* of cargo handled. 8.34 (537,926 ) 8.08 (580,905)<br />

Power Electricity use (kw hours)/per teu of cargo handled 65.7 (4,234,445) 63.89 (4,591,509)<br />

Waste Waste generated per FTE **employee (m 3 ) 2.8 (397.5) 2.75 (363)<br />

Methyl Bromide<br />

Number of readings higher than the current OSH workplace standard<br />

(19/mg/m 3 ) in areas not cordoned off during fumigation or venting. 0 0<br />

Quantity of Methyl Bromide used at <strong>Port</strong> <strong>Nelson</strong> (tonnes) 2.491 2.286<br />

Noise Number of noise complaints 33 32<br />

Oil Spills Number of oil spills when bunkering 1 3<br />

Dust Number of dust complaints 8 9<br />

Codes of Practice Number of audit reports completed 7 13<br />

Number of non-conformances identified 6 7<br />

Number of non conformances resolved 5 6<br />

Continuous Improvement Number of targets reported on 4 15<br />

Number of new initiatives Not recorded 19<br />

Water Water use (m 3 )per teu (site use excl ships) 0.61 (39,478) 0.64*** (46,437)<br />

1 0<br />

* Twenty foot equivalent unit for 2005/6 = 64,455 for <strong>2007</strong>/7 = 71,865<br />

** Full time equivalent employees 2006/7 132<br />

*** Increase due to water leak.

“Watching the SZAP 5 descend beneath the waves accompanied by a<br />

tremendous crashing was a strangely beautiful experience. Thanks to our efforts,<br />

no debris accompanied her sea burial. We can take some pride that in doing a job<br />

we did not ask for, we managed to make the best of it.”<br />

Frances Woodhead, Environmental Officer, <strong>Port</strong> <strong>Nelson</strong> Limited.<br />

E N V I R O N M E N T A L I S S U E S R E G I S T E R 2 0 0 6 / 7<br />

A total of 61 incidents were recorded. The increase is due to improved<br />

reporting following a review of the Issues Register code of practice,<br />

and the introduction of the land-based spill trailer.<br />

S Z A P 5 D I S P O S A L<br />

The most unusual environmental project for the year was the sinking<br />

of the SZAP 5, an abandoned but fully equipped 60 metre fishing<br />

vessel - an undertaking that gave a whole new meaning to the concept<br />

of ‘waste management’.<br />

Following a long history of trying to get the owners to take responsibility<br />

for the vessel and eventually securing the legal right to dispose of her,<br />

our attempts to sell the vessel or get her broken up for scrap failed.<br />

We had a liability on our hands, in a deteriorating condition, and in<br />

December 2006 filed an application to Maritime New Zealand for a<br />

permit for disposal at sea. Conditions of the permit included removing<br />

all floatable items and contaminants - no small task on a fully equipped<br />

32 berth fishing vessel.<br />

The long process began with securing loose asbestos, pumping off<br />

refrigerant used in the fish processing plant, removing diesel oil (for<br />

recycling) from 13 fuel tanks and bilges and disposing of part-filled<br />

drums of lube and other contaminants. In February, everything that<br />

could float was removed from the ship. Serviceable items were resold,<br />

unusual artifacts ended up on Trade Me and <strong>Nelson</strong>ians picked up<br />

quirky Russian bargains at a garage sale. Stainless steel, metal and<br />

even the bronze alloy propeller, were removed for recycling.<br />

Preparations for towing included fitting bilge pump sensors and selfpowered<br />

navigation lights. There was a long wait for suitable weather<br />

for the tow to the approved dumping ground beyond Cape Palliser in<br />

Cook Strait, a 2000 metre trench used as a munitions dump. Disposal<br />

of redundant vessels is becoming an increasing problem around the<br />

world. The development of facilities to recycle ships and consideration<br />

of their end of life during construction is required. The SZAP 5 was built<br />

in Klaypeda, Russia in 1978.<br />

The new land-based spill trailer.<br />

1 1

E N V I R O N M E N T A L M A T T E R S<br />

N O I S E M A N A G E M E N T<br />

Despite handling more containers we have had fewer noise complaints,<br />

which is encouraging. However, clangs caused by empty containers are<br />

still the biggest source of complaints, followed by ships’ generators.<br />

Vigilance in stevedoring practices and training is ongoing. This year<br />

several complaints related to a particularly large vessel, the Cosco<br />

Melbourne; managing this ship will be easier when wharf repairs have<br />

improved the workability of Main Wharf South. Another notable<br />

noisy incident was an oil tanker inadvertently setting off her fire alarm<br />

system in the very early morning.<br />

Discussions continued with <strong>Nelson</strong> City Council on solutions to protect<br />

residents from noise. Further information was provided by <strong>Port</strong> <strong>Nelson</strong><br />

Ltd and the proposed variation to the <strong>Nelson</strong> Resource Management<br />

Plan has now been finalised for a public submission process.<br />

F U M I G A T I O N<br />

Numbers of shed fumigations remained the same, with a total of 12<br />

over the 2006 summer season, when fumigation of export timber<br />

to Australia is required. Additional health and safety monitoring<br />

was done, to help identify changes that may be needed to current<br />

operating practices.<br />

The <strong>Nelson</strong> Air Quality Plan suggestion that fumigation at <strong>Port</strong><br />

<strong>Nelson</strong> be subject to resource consent remains under review. Some<br />

progress was made through mediation between the operator and<br />

the submitters, but no compromise was reached and a decision by an<br />

Environment Court judge is awaited.<br />

D R E D G I N G C O N S E N T R E N E W A L<br />

Work has been underway to prepare an application to renew the port’s<br />

maintenance dredging consent. Over 277,204 m 3 of sediment are<br />

1 2

“When the topic of Environmental Management systems came up at the<br />

environment committee meetings we were able to indicate the benefits of<br />

having an externally audited system and to share our experience, as <strong>Nelson</strong> Pine<br />

Industries and TNL were both already ISO 14001 certified.”<br />

Philip Wilson, Environmental Engineer, <strong>Nelson</strong> Pine Industries.<br />

<strong>Port</strong> <strong>Nelson</strong> Environmental Committee.<br />

carried down the region’s rivers and into Tasman Bay each year. Some<br />

of this ends up in the channels and berth pockets making dredging an<br />

essential annual task.<br />

Dredging has been done since the early 1960s and careful study<br />

of the impacts of the activity are part of the stringent monitoring<br />

requirements of the existing resource consent, granted for 15 years in<br />

1993. The results show no negative effects at the dumping ground and<br />

have given us the confidence to apply for a 35 year consent, again with<br />

careful monitoring conditions and a review period.<br />

H A Z A R D O U S W A S T E S<br />

Certification to comply with the new requirements under the<br />

Hazardous Substances and New Organisms regulations was confirmed<br />

in August 2006.<br />

L O O K I N G A H E A D<br />

Investing in ISO 14001 certification has improved the frameworks we<br />

have in place. Over the coming year the focus will move from systems<br />

to action, as we make progress in the targets set for noise, waste<br />

minimisation, energy consumption and oil spill prevention.<br />

In the key area of noise we intend to make offers of insulation to the<br />

first 11 houses in the affected noise zone, by July 2008. Under the terms<br />

of the Noise Variation we will also establish a noise liaison committee;<br />

and budget provision has been made for reduction of noise at source.<br />

The new code of practice for fumigation will help to ensure that we<br />

continue to lead in minimising the risks associated with this aspect of<br />

cargo handling, as exporters address quarantine regulations imposed<br />

by overseas countries.<br />

Everyone’s contribution is vital to waste reduction initiatives.<br />

1 3

P O R T P E O P L E<br />

1 4<br />

<strong>Port</strong> <strong>Nelson</strong> has a proud track record of a stable and skilled workforce,<br />

with staff numbers steady over the past year with 93 permanent, fixed<br />

term and part-time staff. Casual staff boosted the total hours worked to<br />

the equivalent of 132 full-time equivalents. This year three staff members<br />

reached the milestone of 25 years service bringing the total number of<br />

‘silver servers’ to nine, one of whom has clocked up 44 years service.<br />

H E A L T H A N D S A F E T Y<br />

<strong>Port</strong> <strong>Nelson</strong> values its reputation for speed and efficiency in vessel<br />

turnaround, but never at the expense of compromising the safety<br />

of staff and on-site contractors. The Health and Safety Committee’s<br />

‘bottom up’ approach encourages input and suggestions from all<br />

staff members and ensures buy-in to safe working practices. The<br />

committee has been operating now for over 17 years and represents<br />

employees from all worksites within the port, as well as the CEO and<br />

three members of the Executive Team.<br />

L I F E S T Y L E P R O G R A M M E S<br />

A range of health checks are offered to staff. All permanent staff and<br />

some casuals have their hearing and vision checked annually by an<br />

occupational health provider. Identified employees in certain work<br />

areas are given lung function tests and some employees have regular<br />

blood tests to detect substances such as heavy metals or fumigants. A<br />

new initiative this year was ergonomic assessments for all the forklift<br />

drivers in the Cargo Logistics division.<br />

In 2006 we trialled a ‘Health and Wellbeing’ programme, where all<br />

permanent staff and qualifying casuals could claim $500 to improve<br />

their physical health, educational and personal development or<br />

emotional wellbeing. There has been an excellent uptake with staff<br />

applying to spend their wellness dollars on such items as gym<br />

memberships, computer equipment, tramping gear, massage therapy,<br />

life coaching, night school fees and bicycles.<br />

For several years we have undertaken pre-employment drug tests for<br />

permanent and casual staff; as well as ‘incident and reasonable cause’<br />

drug and alcohol testing, to further enhance workplace safety standards.<br />

In early autumn each year we offer free ‘flu injections’ to all permanent<br />

staff, and in late spring staff are offered a melanoma skin check at an<br />

on-site GP clinic. Other Sun Smart measures are the provision of hats<br />

and sunscreen to outdoor workers.<br />

Our Employee Assistance Programme continues to support staff with<br />

counselling services for work or other matters. This service is offered<br />

to employees at no cost by a contracted professional organisation.<br />

We have a subsidized medical insurance scheme in place, we continue to<br />

offer a number of retirement seminars each year and we offer companysubsidised<br />

superannuation schemes for all permanent waged staff.<br />

L O S T T I M E I N J U R I E S ( L T I ’ S )<br />

We are pleased to report a small decrease in LTI’s over the past year,<br />

down from twelve to nine. Our target LTI frequency rate of 1.5% was<br />

not met, with an end of year result of 3.27%. A port is a workplace with<br />

inherent dangers and the potential for ‘human error’. Any accidents<br />

are thoroughly investigated and new safety measures are added to our<br />

prevention programme where necessary. We remain committed to our<br />

long-term company goal of ‘Together towards Zero’ (LTI’s).<br />

A C C I D E N T C O M P E N S A T I O N<br />

<strong>Port</strong> <strong>Nelson</strong> Ltd is an Accredited Employer in the Work Safety and<br />

Management Practices Programme, and successfully met the tertiary<br />

level for the first time when we were audited in early <strong>2007</strong> - an<br />

achievement that gives us a great sense of pride and accomplishment.<br />

We continue to be a ‘reimbursing employer’ and we value the ability to<br />

have employees remain on the payroll system with all wage and salary<br />

deductions continuing without interruption.<br />

S U P P O R T I N G S T A F F E N D E A V O U R S<br />

The number of sports events that we compete in as a company is<br />

growing. In May a large staff team competed in the third <strong>Port</strong> <strong>Nelson</strong><br />

Blokes’ Day Out, with a social event to follow; and we supported<br />

female staff to enter the Taylors’ Women’s Triathlon. Staff were helped<br />

to attend out of town representative sports events and to support<br />

local sports clubs and teams. Staff were also given support to attend<br />

professional and personal development courses.<br />

C O M M U N I C A T I O N<br />

All staff receive the company magazine Re<strong>Port</strong> <strong>Nelson</strong>, which includes<br />

the ‘Safe Harbour’ feature, with a focus on health and safety matters.<br />

Safe Harbour includes the results of a scheme that rewards staff<br />

who report ‘near misses’ by putting them in a draw for a night<br />

out at the movies complete with a café voucher. This year we<br />

introduced an internal newsletter with input from all departments.<br />

This has been well received and covers a wider range of subjects<br />

- from new machinery to the results of sports’ sweepstakes.<br />

Summaries of monthly incident reporting are regularly posted on staff<br />

noticeboards along with safety messages. We have had good feedback<br />

on the noticeboard at the port gate, which records the number of days<br />

since the last lost time injury.

“I’m proud to work for a company that takes good care of its people and provides<br />

an all-round engaging, stimulating, positive work environment.<br />

There are challenges, but our people are the heart of the company - we’ve got<br />

strong social networks and we have fun!”<br />

Karen Barnett, HR & Quality Manager, <strong>Port</strong> <strong>Nelson</strong> Limited (left)<br />

with team members Jim Lane and Suzanne Thompson.<br />

T R A I N I N G<br />

We undertook organisation-wide training with a management<br />

consultant at the end of 2006, with the aim of improving our internal<br />

communications and enhancing our workplace culture. The staff<br />

newsletter was one result and we also went through a ‘starfish’<br />

exercise, where staff were challenged to come up with a six week<br />

project that would make a positive difference in their work area. There<br />

have been ongoing updates for forklift drivers, first aid certification<br />

refresher training, seasonal induction for casual staff, and staff have<br />

also attended business, administration, supervisory, legal compliance<br />

and administration courses throughout the year. Marine staff have<br />

been to Launceston in Australia for port simulator training, senior staff<br />

have been supported in tertiary study in commerce and engineering,<br />

and we have continued to send two staff members per year to the<br />

Outward Bound eight day ‘Navigator’ course.<br />

G O V E R N A N C E<br />

The Finance and Risk Committee and Remuneration Committees met<br />

as required by their respective Terms of Reference and have been<br />

effective in terms of dealing with matters that may not warrant full<br />

Board attention. Both committees report to the Board.<br />

D I R E C T O R C H A N G E S<br />

During the year two well known directors retired, Messrs Dickinson and<br />

Sturgeon. Mr Dickinson had served on the <strong>Port</strong> <strong>Nelson</strong> Board for 12 years<br />

and Mr Sturgeon 16 years. In September 2006 Mr Sturgeon was replaced<br />

by Bronwyn Monopoli and in December Mr Dickinson was replaced by<br />

Tim King. Ms Monopoli is a <strong>Nelson</strong> based Chartered Accountant and Mr<br />

King Deputy Mayor of Tasman District Council. Both new Directors bring<br />

considerable complementary experience to the Board.<br />

B O A R D A N D S U B C O M M I T T E E C O M P O S I T I O N<br />

A S A T 3 0 J U N E 2 0 0 7<br />

Board<br />

Nick Patterson (Chair)<br />

Phil Lough<br />

(Deputy Chair)<br />

Tim King<br />

(Deputy Mayor Tasman District Council)<br />

Paul Matheson (Mayor <strong>Nelson</strong> City Council)<br />

Peter Schuyt (CFO NZ Post Group)<br />

Bronwyn Monopoli (Principal – Bronwyn Monopoli Chartered<br />

Accountants)<br />

Finance and Risk Committee<br />

Peter Schuyt (Chair)<br />

Bronwyn Monopoli (Director)<br />

Martin Byrne (Chief Executive Officer)<br />

Parke Pittar (Chief Commercial Officer, Company Secretary)<br />

Remuneration Committee<br />

Nick Patterson (Chair)<br />

Phil Lough<br />

(Director)<br />

Meeting attendance<br />

Meeting type Board Finance and Risk Remuneration<br />

Meetings held. . . . . . . . . . . 11 . . . . . . . . . . . . . . 3 . . . . . . . . . . . . . . . . . .1<br />

B Dickinson* . . . . . . . . . . . . 5 . . . . . . . . . . . . . . . 2 . . . . . . . . . . . . . . . . . .<br />

T King*. . . . . . . . . . . . . . . . . . 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .<br />

P Lough. . . . . . . . . . . . . . . . . 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1<br />

P Matheson* . . . . . . . . . . . .10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .<br />

B Monopoli . . . . . . . . . . . . . 7 . . . . . . . . . . . . . . . 1 . . . . . . . . . . . . . . . . . .<br />

N Patterson . . . . . . . . . . . . . 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1<br />

P Schuyt . . . . . . . . . . . . . . . . 11 . . . . . . . . . . . . . . 3 . . . . . . . . . . . . . . . . . .<br />

M Sturgeon . . . . . . . . . . . . . 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1<br />

* Attendance includes any meeting attended by alternates.<br />

F U R T H E R G O V E R N A N C E P R O G R E S S<br />

During the year a Delegated Authorities Policy was developed. The<br />

policy’s aim is to ensure there is appropriate control over expenditure<br />

limits and provide for delegation when key Authorised Signatories<br />

may be absent. The policy brought together some existing policy<br />

directives in addition to allowing for a review of best practice as it<br />

related to <strong>Port</strong> <strong>Nelson</strong> Ltd.<br />

Additionally, in September 2006 the Risk Framework was finalised<br />

providing management and the Board with an up to date risk profile<br />

related to <strong>Port</strong> <strong>Nelson</strong>’s specific risks.<br />

At the end of the Financial Year the final stages were being completed<br />

on an updated Fraud Policy, thus ensuring that an appropriate<br />

framework is in place to manage any suspected fraudulent events<br />

should they occur.<br />

<strong>Port</strong> <strong>Nelson</strong>’s Governance Framework continues to be reviewed and<br />

enhanced where appropriate on an annual basis.<br />

1 5

D I R E C T O R S<br />

N I C K P A T T E R S O N<br />

Nick is the Managing Director of Wai-West Horticulture Ltd, which has extensive<br />

horticultural plantings and post harvest facilities. Wai-West manages Fruit Logistics<br />

(<strong>Nelson</strong>) Ltd, providing coolstorage and associated services for around 25% of the<br />

<strong>Nelson</strong> pipfruit industry.<br />

P A U L M A T H E S O N<br />

Paul is the Mayor of <strong>Nelson</strong> City and an experienced business manager.<br />

His ex officio positions include directorships of <strong>Nelson</strong> Airport Ltd and Trustee of<br />

Cawthron Institute. He chairs the nationwide Mayors’ Taskforce for Jobs and is actively<br />

involved in many wider community organisations.<br />

P H I L L O U G H<br />

Phil is currently Chair of NZ Trade & Enterprise and a range of other NZ companies.<br />

He was previously CEO of the Sealord Group and is based in <strong>Nelson</strong>.<br />

T I M K I N G<br />

Tim is Deputy Mayor of the Tasman District Council and chairs their Corporate<br />

Services committee. He farms on the Waimea Plains and has governance roles on a<br />

range of community organisations including chairing the Waimea Rural Fire<br />

Authority and the Wakefield & Community Health Centre Trust.<br />

P E T E R S C H U Y T<br />

Peter is Chief Financial Officer for the New Zealand Post Group. He is also a director of a<br />

number of companies in that group. Prior to his current role, Peter was CFO of the New<br />

Zealand Dairy Board.<br />

B R O N W Y N M O N O P O L I<br />

Bronwyn is a chartered accountant, with her Richmond based practice<br />

providing specialist accounting and financial advice to mainly rural businesses.<br />

She is also a director of a number of Crown and other companies, and a trustee of<br />

various arts-related organisations.<br />

1 6

F I N A N C I A L R E P O R T 2 0 0 7<br />

FINANCIAL HIGHLIGHTS<br />

<strong>2007</strong> 2006<br />

$Millions $Millions<br />

Revenue $33.0 $29.6<br />

Net Surplus After Taxation* $6.7 $7.6<br />

Dividend $3.9 $5.3<br />

Basic Earnings per Ordinary Share 26.5¢ 22.1¢<br />

Return on Average Shareholders’ Funds 5.6% 6.1%<br />

Net Asset Backing per Share $4.31 $4.14¢<br />

Dividend - Recommended per Share 15.3¢ 17.1¢<br />

Return on Average Total Assets** 7.7% 8.3%<br />

Ratio of Shareholders’ Funds to<br />

Total Assets 67.9% 82.1%<br />

TRADE HIGHLIGHTS<br />

<strong>2007</strong> 2006<br />

Cargo Tonnes 2.64M 2.52M<br />

Vessel Arrivals 997 1,012<br />

Container Throughput (TEU’s) 71,815 61,455<br />

* Including Investment Property Revaluation<br />

** Based on EBIT<br />

1 7

AUDIT REPORT<br />

TO THE READERS OF PORT NELSON LIMITED’S FINANCIAL STATEMENTS FOR THE YEAR ENDED 30 JUNE <strong>2007</strong><br />

The Auditor-General is the auditor of <strong>Port</strong> <strong>Nelson</strong> Limited (the company). The Auditor-General has appointed me, Scott Tobin, using<br />

the staff and resources of Audit New Zealand, to carry out the audit of the financial statements of the company, on his behalf, for the<br />

year ended 30 June <strong>2007</strong>.<br />

Unqualified opinion<br />

In our opinion:<br />

• The financial statements of the company on pages 22 to 42:<br />

- comply with generally accepted accounting practice in New Zealand; and<br />

- give a true and fair view of:<br />

• the company’s financial position as at 30 June <strong>2007</strong>; and<br />

• the results of its operations and cash flows for the year ended on that date.<br />

• Based on our examination the company kept proper accounting records.<br />

The audit was completed on 10 September <strong>2007</strong>, and is the date at which our opinion is expressed.<br />

The basis of our opinion is explained below. In addition, we outline the responsibilities of the Board of Directors and the Auditor, and<br />

explain our independence.<br />

Basis of opinion<br />

We carried out the audit in accordance with the Auditor-General’s Auditing Standards, which incorporate the New Zealand Auditing<br />

Standards.<br />

We planned and performed the audit to obtain all the information and explanations we considered necessary in order to obtain reasonable<br />

assurance that the financial statements did not have material misstatements, whether caused by fraud or error.<br />

Material misstatements are differences or omissions of amounts and disclosures that would affect a reader’s overall understanding of the<br />

financial statements. If we had found material misstatements that were not corrected, we would have referred to them in our opinion.<br />

The audit involved performing procedures to test the information presented in the financial statements. We assessed the results of<br />

those procedures in forming our opinion.<br />

Audit procedures generally include:<br />

• determining whether significant financial and management controls are working and can be relied on to produce complete and<br />

accurate data;<br />

• verifying samples of transactions and account balances;<br />

• performing analyses to identify anomalies in the reported data;<br />

• reviewing significant estimates and judgements made by the Board of Directors;<br />

• confirming year-end balances;<br />

• determining whether accounting policies are appropriate and consistently applied; and<br />

• determining whether all financial statement disclosures are adequate.<br />

We did not examine every transaction, nor do we guarantee complete accuracy of the financial statements.<br />

We evaluated the overall adequacy of the presentation of information in the financial statements. We obtained all the information and<br />

explanations we required to support our opinion above.<br />

Responsibilities of the Board of Directors and the Auditor<br />

The Board of Directors is responsible for preparing financial statements in accordance with generally accepted accounting practice<br />

in New Zealand. Those financial statements must give a true and fair view of the financial position of the company as at 30 June <strong>2007</strong>.<br />

They must also give a true and fair view of the results of its operations and cash flows for the year ended on that date. The Board of<br />

Directors’ responsibilities arise from the <strong>Port</strong> Companies Act 1988 and the Financial <strong>Report</strong>ing Act 1993.<br />

We are responsible for expressing an independent opinion on the financial statements and reporting that opinion to you. This<br />

responsibility arises from section 15 of the Public Audit Act 2001 and section 19 of the <strong>Port</strong> Companies Act 1988.<br />

Independence<br />

When carrying out the audit we followed the independence requirements of the Auditor-General, which incorporate the<br />

independence requirements of the Institute of Chartered Accountants of New Zealand.<br />

Other than the audit, we have no relationship with or interests in the company.<br />

1 8<br />

S M Tobin<br />

Audit New Zealand<br />

On behalf of the Auditor-General<br />

Christchurch, New Zealand

S T A T U T O R Y I N F O R M A T I O N<br />

T o s h a r e h o l d e r s , o n t h e a f f a i r s o f P o r t N e l s o n L i m i t e d<br />

f o r t h e Y e a r E n d e d 3 0 J u n e 2 0 0 7<br />

P R I N C I P A L A C T I V I T I E S<br />

<strong>Port</strong> <strong>Nelson</strong> Limited (“the Company” or “<strong>Port</strong> <strong>Nelson</strong>”) is primarily engaged in the commercial operation of the <strong>Port</strong> of <strong>Nelson</strong>. There has been<br />

no significant change in the nature of the Company’s business during the year.<br />

R E V I E W O F A C T I V I T I E S<br />

A review of the year’s operations is contained in the Chairman’s <strong>Report</strong> and the Chief Executive Officer’s Review.<br />

R E V I E W O F O P E R A T I O N S<br />

The surplus for the Company for the year was $6.725 million. (2006 $7.587 million)<br />

D I V I D E N D S<br />

Dividends of $6,600,000 were paid or provided for during the year. ($2,700,000 final dividend for 2006 financial year, $1,000,000 interim dividend<br />

for <strong>2007</strong> financial year, and a provision for $2,900,000 final for <strong>2007</strong> financial year)<br />

D I R E C T O R S<br />

In accordance with the Company’s constitution Messrs P K Matheson and T B King will retire by rotation.<br />

R E M U N E R A T I O N O F D I R E C T O R S<br />

Fees paid to Directors during the year were as follows:<br />

A O Patterson $43,045<br />

R G Dickinson $11,423<br />

T B King $11,500<br />

P V Lough $23,395<br />

P K Matheson $21,925<br />

B A Monopoli $17,880<br />

M G Sturgeon $5,725<br />

P M Schuyt $23,868<br />

TOTAL $158,761<br />

M G Sturgeon resigned in September 2006.<br />

B A Monopoli was appointed in September 2006.<br />

R G Dickinson resigned in December 2006.<br />

T B King was appointed in December 2006.<br />

D I R E C T O R S ’ I N S U R A N C E<br />

The Company has arranged policies of Directors’ Liability Insurance to ensure that as far as possible Directors will not personally incur any<br />

monetary loss as a result of actions undertaken by them as Directors. Certain actions are specifically excluded, for example the incurring of<br />

penalties and fines that may be imposed in respect of breaches of the law.<br />

D I R E C T O R S ’ I N T E R E S T<br />

The following notices have been received from Directors disclosing their interests in other companies with whom the group may have<br />

transactions. All transactions with these companies are conducted on normal commercial terms.<br />

• Mr T B King is Deputy Mayor of Tasman District Council, which is a shareholder of the Company.<br />

• Mr P K Matheson is Mayor of <strong>Nelson</strong> City, which is a shareholder of the Company.<br />

• Ms B A Monopoli is a Director of the Cawthron Institute that sell services to the Company.<br />

• Mr A O Patterson is a Director of Cold Storage <strong>Nelson</strong> Ltd that leases land and purchases services from the Company.<br />

• Mr P M Schuyt is a Director of ECN Ltd and Express Couriers Ltd that sell services to the Company.<br />

D I R E C T O R S ’ L O A N S<br />

There were no loans by the Company to Directors.<br />

The Statement of Accounting Policies and Notes to the Accounts on pages 26 to 42 form part of these Financial Statements.<br />

1 9

S T A T U T O R Y I N F O R M A T I O N<br />

T o s h a r e h o l d e r s , o n t h e a f f a i r s o f P o r t N e l s o n L i m i t e d<br />

f o r t h e Y e a r E n d e d 3 0 J u n e 2 0 0 7<br />

S H A R E H O L D I N G B Y D I R E C T O R S<br />

No Directors hold shares in the Company.<br />

U S E O F C O M P A N Y I N F O R M A T I O N<br />

During the year the Board received no notices from Directors requesting to use Company information received in their capacity as Directors that<br />

would not otherwise have been available to them.<br />

C O M M I T T E E S O F T H E B O A R D<br />

The Board has established a Finance and Risk Committee to assist the Board in carrying out its responsibilities under the Companies Act 1993 and<br />

the Financial <strong>Report</strong>ing Act 1993, and a Remuneration Committee.<br />

A U D I T O R S<br />

Under section 15 of the Public Audit Act 2001 and section 19 of the <strong>Port</strong> Companies Act 1988, the Auditor General is the Auditor of the Company.<br />

The Auditor General has appointed Audit New Zealand to undertake the audit on its behalf. Fees paid to the Auditors are disclosed in the<br />

Financial Statements.<br />

P E R F O R M A N C E I N D I C A T O R S<br />

As required under Section 16 of the <strong>Port</strong> Companies Act 1988, performance indicators in the Statement of Corporate Intent are given on<br />

page 21.<br />

D O N A T I O N S<br />

Donations made during the year are disclosed in the Financial Statements.<br />

E M P L O Y E E R E M U N E R A T I O N<br />

The Company has remuneration agreements including benefits with employees in excess of $100,000 per annum in the following bands:<br />

Remuneration<br />

Number of Employees<br />

<strong>2007</strong> 2006<br />

$100,000 to $110,000 3 3<br />

$110,000 to $120,000 - 1<br />

$120,000 to $130,000 3 2<br />

$130,000 to $140,000 1 -<br />

$150,000 to $160,000 - 1<br />

$160,000 to $170,000 1 -<br />

$190,000 to $200,000 - 1*<br />

$210,000 to $220,000 1* -<br />

$240,000 to $250,000 1 1<br />

* Employee retired during year<br />

C H A N G E S I N A C C O U N T I N G P O L I C I E S<br />

There have been no changes in accounting policies during the financial year.<br />

Chairman of Directors<br />

For and on behalf of the Board<br />

Date: 7 September <strong>2007</strong><br />

Director<br />

2 0<br />

The Statement of Accounting Policies and Notes to the Accounts on pages 26 to 42 form part of these Financial Statements.

S T A T E M E N T O F C O R P O R A T E I N T E N T<br />

M I S S I O N S T A T E M E N T<br />

• To operate the Company as a successful business providing cost efficient, effective and competitive services and facilities for port users and<br />

shippers.<br />

• To provide for the present and future needs of the Company in ways that are sensitive to people, use resources wisely, and are in harmony with<br />

the environment of an export port.<br />

O B J E C T I V E S<br />

1. To operate as a successful business.<br />

2. To be a good employer.<br />

3. The debt equity ratio not to exceed 66.67% (40/60).<br />

4. To aim to grow the business through stimulation of throughput, added value services and related business activities, so leading to increased<br />

revenue.<br />

5. To achieve a commercially acceptable rate of return on shareholders’ funds in accordance with meeting the objectives herein.<br />

6. To ensure that <strong>Port</strong> development takes place which meets the needs of the region.<br />

7. To ensure that adequate environmental standards are maintained.<br />

8. To strive for continuous improvement in everything that we do.<br />

M E A S U R E O F P E R F O R M A N C E A G A I N S T O B J E C T I V E S<br />

The 2005 figures are not comparable with 2006 and <strong>2007</strong> as the 2006 and <strong>2007</strong> financial information was prepared in accordance with NZ IFRS.<br />

Target <strong>2007</strong> 2006 2005 Target Met?<br />

Lost Time Injury Frequency Rate *

I N C O M E S T A T E M E N T<br />

f o r t h e Y e a r E n d e d 3 0 J u n e 2 0 0 7<br />

R E V E N U E<br />

Notes <strong>2007</strong> 2006<br />

$000 $000<br />

Operations 27,864 25,364<br />

Property 5,159 4,902<br />

TOTAL REVENUE 1 33,023 30,266<br />

E X P E N S E S<br />

Operations and Property 20,767 18,673<br />

Financing 2,513 1,564<br />

TOTAL EXPENSES 2 23,280 20,237<br />

O P E R A T I N G S U R P L U S 9,743 10,029<br />

Reversal of Prior Year Building Asset Write Down Impairment - 699<br />

NET SURPLUS BEFORE TAXATION 9,743 10,728<br />

Less Taxation Expense 3 3,018 3,141<br />

N E T S U R P L U S 6,725 7,587<br />

S T A T E M E N T O F M O V E M E N T S I N E Q U I T Y<br />

f o r t h e Y e a r E n d e d 3 0 J u n e 2 0 0 7<br />

<strong>2007</strong> 2006<br />

$000 $000<br />

Opening Equity 128,405 128,380<br />

Movements in Hedging Reserve 6h 812 139<br />

Revaluations 6f 2,563 -<br />

Net Surplus 6,725 7,587<br />

Total Recognised Revenues and Expenses for the Period 10,100 7,726<br />

Distribution to Owners 6b (3,900) (7,700)<br />

Share Repurchase 6a (25,000) -<br />

C L O S I N G E Q U I T Y 109,605 128,405<br />

2 2<br />

The Statement of Accounting Policies and Notes to the Accounts on pages 26 to 42 form part of these Financial Statements.

S T A T E M E N T O F F I N A N C I A L P O S I T I O N<br />

f o r t h e Y e a r E n d e d 3 0 J u n e 2 0 0 7<br />

C U R R E N T A S S E T S<br />

Notes <strong>2007</strong> 2006<br />

$000 $000<br />

Cash and Cash Equivalents 7 2,170 2,484<br />

Trade and Other Receivables 8 3,518 3,011<br />

Inventories 9 394 363<br />

Prepayments and Accruals 361 343<br />

Tax Refund Due - 32<br />

Properties Intended for Sale 5 394 -<br />

Hedging Asset 13 1,290 78<br />

L E S S C U R R E N T L I A B I L I T I E S<br />

8,127 6,311<br />

Trade and Other Payables 10 1,721 1,452<br />

Employee Benefit Liabilities 17 1,103 1,050<br />

Tax Payable 69 -<br />

Dividend Payable 6b 2,900 2,700<br />

5,793 5,203<br />

W O R K I N G C A P I T A L 2,334 1,108<br />

N O N - C U R R E N T A S S E T S<br />

Property, Plant and Equipment 11 137,960 135,627<br />

Intangible Assets 12 742 709<br />

Investment Properties 5 14,311 13,983<br />

N O N - C U R R E N T L I A B I L I T I E S<br />

153,013 150,319<br />

Employee Benefit Liabilities 17 190 202<br />

Deferred Tax liability 4 3,552 3,820<br />

Term Loan 13, 14 42,000 19,000<br />

45,742 23,022<br />

T O T A L N E T A S S E T S 109,605 128,405<br />

S H A R E H O L D E R S F U N D S<br />

Issued Capital 6a 6,046 31,046<br />

Retained Earnings 6b 31,860 29,035<br />

Asset Revaluation Reserves 6f 70,835 68,272<br />

Hedging Reserve 6h 864 52<br />

T O T A L S H A R E H O L D E R S ’ F U N D S 109,605 128,405<br />

Chairman of Directors<br />

Director<br />

For and on behalf of the Board<br />

Date: 7 September <strong>2007</strong><br />

The Statement of Accounting Policies and Notes to the Accounts on pages 26 to 42 form part of these Financial Statements.<br />

2 3

S T A T E M E N T O F C A S H F L O W S<br />

f o r t h e Y e a r E n d e d 3 0 J u n e 2 0 0 7<br />

C A S H F L O W S F R O M O P E R A T I N G A C T I V I T I E S<br />

<strong>2007</strong> 2006<br />

$000 $000<br />

Cash was provided from:<br />

Receipts from Customers 27,241 25,851<br />

Rent Received 4,447 4,187<br />

Interest Received 107 67<br />

31,795 30,105<br />

Cash was applied to:<br />

Payments to Suppliers and Employees (16,693) (15,020)<br />

Interest Paid (2,604) (1,540)<br />

Taxes Paid (3,176) (3,310)<br />

Net GST Paid (70) 115<br />

(22,543) (19,755)<br />

Net Cash In Flows from Operating Activities 9,252 10,350<br />

C A S H F L O W S F R O M I N V E S T I N G A C T I V I T I E S<br />

Cash was provided from:<br />

Property Plant and Equipment Sold 170 42<br />

Cash was applied to:<br />

Purchase of Property Plant Equipment and Intangibles (4,036) (2,891)<br />

Net Cash Out Flows from Investing Activities (3,866) (2,849)<br />

C A S H F L O W S F R O M F I N A N C I N G A C T I V I T I E S<br />

Cash was provided from:<br />

Loans Raised 25,000 -<br />

Cash was applied to:<br />

Loans Paid (2,000) -<br />

Shares Purchased and Cancelled (25,000) -<br />

Dividend Paid (3,700) (5,000)<br />

Net Cash Out Flows from Financing Activities (5,700) (5,000)<br />

Net Increase/(Decrease) in Cash Held (314) 2,501<br />

Cash at 1 July 2,484 (17)<br />

C A S H A T 3 0 J U N E 2,170 2,484<br />

Represented by:<br />

Cash at Bank 269 585<br />

Deposits 1,901 1,899<br />

C A S H A T 3 0 J U N E 2,170 2,484<br />

2 4<br />

The Statement of Accounting Policies and Notes to the Accounts on pages 26 to 42 form part of these Financial Statements.

S T A T E M E N T O F C A S H F L O W S<br />

f o r t h e Y e a r E n d e d 3 0 J u n e 2 0 0 7<br />

<strong>2007</strong> 2006<br />

$000 $000<br />

R E C O N C I L I A T I O N W I T H N E T S U R P L U S<br />

Net Surplus 6,725 7,587<br />

Add Non Cash Items:<br />

Depreciation and Amortisation 3,636 3,736<br />

Impairment - 194<br />

Increase (Decrease) in Deferred Tax (268) (143)<br />

Deferred Tax Movement Taken Direct to Equity 9 -<br />

Less:<br />

Reversal of Prior Year Building Asset Write Down Impairment - (699)<br />

Unrealised Gains (722) (712)<br />

2,655 2,376<br />

Add (Less) Movements in Other Working Capital Items:<br />

(Increase)/Decrease in Accounts Receivable (451) 583<br />

Increase/(Decrease) in Accounts Payable (excluding Assets Payable) 372 (144)<br />

Increase/(Decrease) in Current and Non Current Employee Benefit Liabilities (12) (87)<br />

Increase/(Decrease) in Tax Payable 101 (26)<br />

(Increase)/Decrease in Inventory (31) 73<br />

(Increase)/Decrease in Net GST (70) 115<br />

(Increase)/Decrease in Prepayments and Accruals (18) (99)<br />

(109) 415<br />

Add (Less) Items Classified as Investing Activities:<br />

(Profit) Loss on Sale of Assets (19) (28)<br />

N E T C A S H I N F L O W F R O M O P E R A T I N G A C T I V I T I E S 9,252 10,350<br />

The Statement of Accounting Policies and Notes to the Accounts on pages 26 to 42 form part of these Financial Statements.<br />

2 5

S T A T E M E N T O F A C C O U N T I N G P O L I C I E S<br />

R E P O R T I N G E N T I T Y<br />

<strong>Port</strong> <strong>Nelson</strong> Limited is a public company registered under the Companies Act 1993 and created pursuant to the <strong>Port</strong> Companies Act 1988.<br />

<strong>Port</strong> <strong>Nelson</strong> is a reporting entity in terms of the Financial <strong>Report</strong>ing Act 1993. The financial statements of <strong>Port</strong> <strong>Nelson</strong> have been prepared in<br />

accordance with the Financial <strong>Report</strong>ing Act 1993.<br />

B A S I S O F P R E P A R A T I O N<br />

The financial statements have been prepared in accordance with Generally Accepted Accounting Practice in New Zealand (‘NZ GAAP’). They<br />

comply with New Zealand equivalents to International Financial <strong>Report</strong>ing Standards (‘NZ IFRS’) and other applicable reporting standards as<br />

appropriate for profit orientated entities.<br />

The financial statements are presented in New Zealand dollars and the functional currency of <strong>Port</strong> <strong>Nelson</strong> is New Zealand dollars.<br />

The financial statements were authorised for issue by the Directors on the 7 September <strong>2007</strong>.<br />

S T A N D A R D S A N D I N T E R P R E T A T I O N S I S S U E D A N D N O T Y E T A D O P T E D<br />

There are no standards, interpretations and amendments that have been issued, but are not yet effective other than NZ IFRS 7 and 8, that <strong>Port</strong><br />

<strong>Nelson</strong> has not yet applied. When effective these standards will require additional disclosures in the financial statements.<br />

A C C O U N T I N G P O L I C I E S<br />

Unless otherwise stated, all accounting policies applied are consistent with those of the prior year. Where appropriate, comparative figures have<br />

been amended to accord with the current year’s presentation and disclosure.<br />

M E A S U R E M E N T S Y S T E M<br />

Those accounting principles considered appropriate by the New Zealand Institute of Chartered Accountants for the measurement and reporting<br />

of results and financial position under the historical cost method, modified by the revaluation of land, buildings, wharves, and investment<br />

property, have been followed.<br />

R O U N D I N G O F A M O U N T S<br />

Amounts in this report have, unless otherwise indicated, been rounded to the nearest one thousand dollars.<br />

S P E C I F I C A C C O U N T I N G P O L I C I E S<br />

The accounting policies adopted in the financial statements, which have a significant effect on the result and the financial position disclosed are<br />

set out below:<br />

1.1 Revenue Recognition<br />