Port Nelson Annual Report 2012 (pdf)

Port Nelson Annual Report 2012 (pdf)

Port Nelson Annual Report 2012 (pdf)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

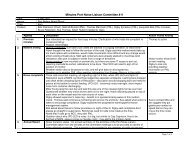

notes to the accounts<br />

notes<br />

note 7: investment in associates<br />

Investment in Unimar Group<br />

<strong>2012</strong> 2011<br />

$000 $000<br />

Total 3,477 693<br />

Movements in the Carrying Amount of Investment in Associate<br />

Opening Balance 693 1,707<br />

New Investments 666 -<br />

Disposal of Investments - -<br />

Share in Revaluation Reserve Movement (35) (606)<br />

Goodwill Write-off - (259)<br />

Gain on conversion of notes 272 -<br />

Share of recognised revenues and expenses 1,881 (149)<br />

Closing Balance 3,477 693<br />

Summarised Financial Information of Associate Company<br />

Assets 15,039 19,100<br />

Liabilities 7,094 16,649<br />

Revenues 50,899 13,221<br />

Surplus (deficit) for <strong>2012</strong> 4,298 (596)<br />

<strong>Port</strong> <strong>Nelson</strong> Interest 44% 25%<br />

<strong>2012</strong><br />

Unimar had a trading surplus of $4,298,000. Additionally during the year the vessel Marsol Pride was sold realising the equity portion<br />

invested via the financial lease on the vessel. <strong>Port</strong> <strong>Nelson</strong> also exercised its conversion rights on the convertible notes realising a gain<br />

on conversion of $272,000.<br />

2011<br />

Unimar had a trading deficit of $595,637. Unimar undertook a Convertible Notes issue in 2010 to assist with funding operations. The<br />

vessel leased by Unimar has a conditional back to back purchase and sales contract on it which will see Unimar realise the investment<br />

in the vessel accrued from the time of lease to date of sale. The funds realised will allow Unimar to continue operating and provide<br />

for the repayment of the Convertible Notes.<br />

note 8: advance to associate<br />

Advance to Unimar Group<br />

<strong>2012</strong> 2011<br />

$000 $000<br />

Total - 611<br />

Movements in Advance to Associate<br />

Opening Balance 611 -<br />

Capitalisation of interest 53 -<br />

Conversion of notes (664) -<br />

Advance - 611<br />

Closing Balance - 611<br />

<strong>2012</strong><br />

On the 9th December 2011 <strong>Port</strong> <strong>Nelson</strong> converted the first tranche of convertible notes at an exercise price of $0.75 per share. The amount<br />

converted consisted of $333,000 advance and $53,645 interest receivable capitalised resulting in the issuing of 515,527 shares and taking <strong>Port</strong><br />

<strong>Nelson</strong>’s shareholding to 39.69%. On the 31st May <strong>2012</strong> <strong>Port</strong> <strong>Nelson</strong> converted the second tranche at an exercise price of $0.75 per share. The<br />

amount converted was $277,778 resulting in the issuing of a further 370,371 shares and taking <strong>Port</strong> <strong>Nelson</strong>’s shareholding to 43.76%.<br />

2011<br />

Advances were made to Unimar totalling $610,778 by way of two tranches. These were made on the 15th October 2010 ($333,000) and<br />

the 31st March 2011 ($277,778). The advances are in the form of Convertible Notes. The Convertible Notes have an exercise price of $0.75c<br />

per share and attract an interest rate of 14.0% per annum. The Convertible Notes are convertible at the option of the note holder. It is not<br />

anticipated that any further advances will have to be made.<br />

30