Comprehensive Annual Financial Report - City of Santa Monica

Comprehensive Annual Financial Report - City of Santa Monica

Comprehensive Annual Financial Report - City of Santa Monica

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

CITY OF SANTA MONICA, CALIFORNIA<br />

Notes to Basic <strong>Financial</strong> Statements, Continued<br />

For the fiscal year ended June 30, 2009<br />

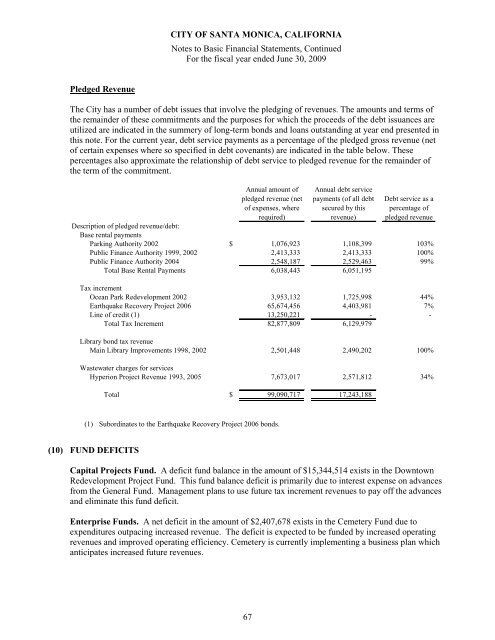

Pledged Revenue<br />

The <strong>City</strong> has a number <strong>of</strong> debt issues that involve the pledging <strong>of</strong> revenues. The amounts and terms <strong>of</strong><br />

the remainder <strong>of</strong> these commitments and the purposes for which the proceeds <strong>of</strong> the debt issuances are<br />

utilized are indicated in the summery <strong>of</strong> long-term bonds and loans outstanding at year end presented in<br />

this note. For the current year, debt service payments as a percentage <strong>of</strong> the pledged gross revenue (net<br />

<strong>of</strong> certain expenses where so specified in debt covenants) are indicated in the table below. These<br />

percentages also approximate the relationship <strong>of</strong> debt service to pledged revenue for the remainder <strong>of</strong><br />

the term <strong>of</strong> the commitment.<br />

<strong>Annual</strong> amount <strong>of</strong><br />

pledged revenue (net<br />

<strong>of</strong> expenses, where<br />

required)<br />

<strong>Annual</strong> debt service<br />

payments (<strong>of</strong> all debt<br />

secured by this<br />

revenue)<br />

Debt service as a<br />

percentage <strong>of</strong><br />

pledged revenue<br />

Description <strong>of</strong> pledged revenue/debt:<br />

Base rental payments<br />

Parking Authority 2002 $ 1,076,923 1,108,399 103%<br />

Public Finance Authority 1999, 2002 2,413,333 2,413,333 100%<br />

Public Finance Authority 2004 2,548,187 2,529,463 99%<br />

Total Base Rental Payments 6,038,443 6,051,195<br />

Tax increment<br />

Ocean Park Redevelopment 2002 3,953,132 1,725,998 44%<br />

Earthquake Recovery Project 2006 65,674,456 4,403,981 7%<br />

Line <strong>of</strong> credit (1) 13,250,221 - -<br />

Total Tax Increment 82,877,809 6,129,979<br />

Library bond tax revenue<br />

Main Library Improvements 1998, 2002 2,501,448 2,490,202 100%<br />

Wastewater charges for services<br />

Hyperion Project Revenue 1993, 2005 7,673,017 2,571,812 34%<br />

Total $ 99,090,717 17,243,188<br />

(1) Subordinates to the Earthquake Recovery Project 2006 bonds.<br />

(10) FUND DEFICITS<br />

Capital Projects Fund. A deficit fund balance in the amount <strong>of</strong> $15,344,514 exists in the Downtown<br />

Redevelopment Project Fund. This fund balance deficit is primarily due to interest expense on advances<br />

from the General Fund. Management plans to use future tax increment revenues to pay <strong>of</strong>f the advances<br />

and eliminate this fund deficit.<br />

Enterprise Funds. A net deficit in the amount <strong>of</strong> $2,407,678 exists in the Cemetery Fund due to<br />

expenditures outpacing increased revenue. The deficit is expected to be funded by increased operating<br />

revenues and improved operating efficiency. Cemetery is currently implementing a business plan which<br />

anticipates increased future revenues.<br />

67