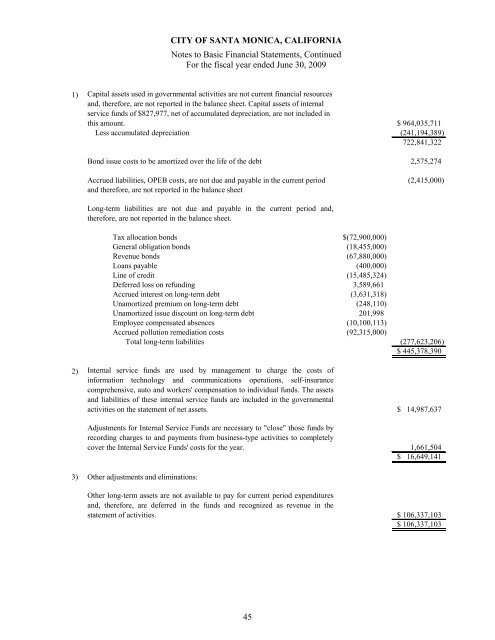

CITY OF SANTA MONICA, CALIFORNIA Notes to Basic <strong>Financial</strong> Statements, Continued For the fiscal year ended June 30, 2009 1) Capital assets used in governmental activities are not current financial resources and, therefore, are not reported in the balance sheet. Capital assets <strong>of</strong> internal service funds <strong>of</strong> $827,977, net <strong>of</strong> accumulated depreciation, are not included in this amount. $ 964,035,711 Less accumulated depreciation (241,194,389) 722,841,322 Bond issue costs to be amortized over the life <strong>of</strong> the debt 2,575,274 Accrued liabilities, OPEB costs, are not due and payable in the current period (2,415,000) and therefore, are not reported in the balance sheet Long-term liabilities are not due and payable in the current period and, therefore, are not reported in the balance sheet. Tax allocation bonds $ (72,900,000) General obligation bonds (18,455,000) Revenue bonds (67,880,000) Loans payable (400,000) Line <strong>of</strong> credit (15,485,324) Deferred loss on refunding 3,589,661 Accrued interest on long-term debt (3,631,318) Unamortized premium on long-term debt (248,110) Unamortized issue discount on long-term debt 201,998 Employee compensated absences (10,100,113) Accrued pollution remediation costs (92,315,000) Total long-term liabilities (277,623,206) $ 445,378,390 2) Internal service funds are used by management to charge the costs <strong>of</strong> information technology and communications operations, self-insurance comprehensive, auto and workers' compensation to individual funds. The assets and liabilities <strong>of</strong> these internal service funds are included in the governmental activities on the statement <strong>of</strong> net assets. $ 14,987,637 Adjustments for Internal Service Funds are necessary to "close" those funds by recording charges to and payments from business-type activities to completely cover the Internal Service Funds' costs for the year. $ 1,661,504 16,649,141 3) Other adjustments and eliminations: Other long-term assets are not available to pay for current period expenditures and, therefore, are deferred in the funds and recognized as revenue in the statement <strong>of</strong> activities. $ 106,337,103 $ 106,337,103 45

CITY OF SANTA MONICA, CALIFORNIA Notes to Basic <strong>Financial</strong> Statements, Continued For the fiscal year ended June 30, 2009 Amounts reported for business-type activities in the government-wide statement <strong>of</strong> net assets are different from those reported for enterprise funds in the fund statement <strong>of</strong> net assets. The following provides a reconciliation <strong>of</strong> those differences: Assets Total business- Other Total type internal adjustments Statement <strong>of</strong> enterprise service and net assets funds funds (1) eliminations totals Cash and investments $ 88,647,667 29,207,138 — 117,854,805 Receivables (net, where applicable, <strong>of</strong> allowances for uncollectibles): Accounts 19,809,832 28,863 — 19,838,695 Interest 609,295 167,503 — 776,798 Internal balances — (1,661,504) (13,973,539) (15,635,043) Inventory 1,064,726 52,219 — 1,116,945 Prepaids 130,146 — — 130,146 Restricted cash and investments 17,523,919 — — 17,523,919 Restricted cash with fiscal agent 513,406 — — 513,406 Due from other governments, restricted 543,783 — — 543,783 Advances to other funds 88,875 — (88,875) — Bond issuance costs, net 429,116 — — 429,116 Capital assets, net 430,579,750 13,683,780 — 444,263,530 Total assets 559,940,515 41,477,999 (14,062,414) 587,356,100 Liabilities Accounts payable $ 6,475,283 659,576 — 7,134,859 Accrued liabilities 5,383,100 — (2,912,807) 2,470,293 Accrued interest payable 539,917 — — 539,917 Contracts payable (retained percentage) 363,237 — — 363,237 Due to other governments 2,700,000 — — 2,700,000 Due to other funds 1,376,554 — (1,376,554) — Deferred revenue 1,812,279 — — 1,812,279 Liabilities payable from restricted assets 8,094,494 — — 8,094,494 Advances from other funds 12,685,860 — (12,685,860) — Compensated absences due within one year — — 1,909,237 1,909,237 Compensated absences due in more than one year — — 1,003,570 1,003,570 Claims payable due within one year — 1,938,009 — 1,938,009 Claims payable due in more than one year — 968,414 — 968,414 Long-term debt due within one year 1,811,008 — — 1,811,008 Long-term debt due in more than one year 24,724,102 — — 24,724,102 Total liabilities 65,965,834 3,565,999 (14,062,414) 55,469,419 Net Assets $ 493,974,681 37,912,000 — 531,886,681 1) Internal service funds are used by management to charge the costs <strong>of</strong> vehicle management, information technology and risk management to individual funds. The assets and liabilities <strong>of</strong> the vehicle management and self-insurance bus internal service funds are included in business-type activities in the statement <strong>of</strong> net assets. $ 39,573,504 Adjustment for Internal Service Funds are necessary to "close" those funds for charges to and payments from participating governmental-type activities to completely cover the Internal Service Funds' costs for the year. $ (1,661,504) 46

- Page 1:

Comprehensive Annual Financial Repo

- Page 5 and 6:

CITY OF SANTA MONICA, CALIFORNIA Co

- Page 7:

THIS PAGE INTENTIONALLY LEFT BLANK.

- Page 10 and 11:

amount of borrowed property taxes i

- Page 12 and 13:

five-year forecasts, and an underst

- Page 14 and 15:

Cash Management Policies and Practi

- Page 16 and 17: OFFICIALS OF THE CITY OF SANTA MONI

- Page 18 and 19: Certificate of Achievement for Exce

- Page 23 and 24: CITY OF SANTA MONICA, CALIFORNIA Ma

- Page 25 and 26: CITY OF SANTA MONICA, CALIFORNIA Ma

- Page 27 and 28: CITY OF SANTA MONICA, CALIFORNIA Ma

- Page 29 and 30: CITY OF SANTA MONICA, CALIFORNIA Ma

- Page 31 and 32: CITY OF SANTA MONICA, CALIFORNIA Ma

- Page 33 and 34: CITY OF SANTA MONICA, CALIFORNIA Ma

- Page 36 and 37: CITY OF SANTA MONICA, CALIFORNIA St

- Page 38 and 39: CITY OF SANTA MONICA, CALIFORNIA Ma

- Page 40 and 41: CITY OF SANTA MONICA, CALIFORNIA St

- Page 42 and 43: CITY OF SANTA MONICA, CALIFORNIA St

- Page 44 and 45: CITY OF SANTA MONICA, CALIFORNIA St

- Page 46 and 47: CITY OF SANTA MONICA, CALIFORNIA St

- Page 48 and 49: CITY OF SANTA MONICA, CALIFORNIA Pr

- Page 50 and 51: CITY OF SANTA MONICA, CALIFORNIA St

- Page 52 and 53: CITY OF SANTA MONICA, CALIFORNIA St

- Page 54 and 55: CITY OF SANTA MONICA, CALIFORNIA Fi

- Page 56 and 57: CITY OF SANTA MONICA, CALIFORNIA No

- Page 58 and 59: CITY OF SANTA MONICA, CALIFORNIA No

- Page 60 and 61: CITY OF SANTA MONICA, CALIFORNIA No

- Page 62 and 63: CITY OF SANTA MONICA, CALIFORNIA No

- Page 64 and 65: CITY OF SANTA MONICA, CALIFORNIA No

- Page 68 and 69: CITY OF SANTA MONICA, CALIFORNIA No

- Page 70 and 71: CITY OF SANTA MONICA, CALIFORNIA No

- Page 72 and 73: CITY OF SANTA MONICA, CALIFORNIA No

- Page 74 and 75: CITY OF SANTA MONICA, CALIFORNIA No

- Page 76 and 77: CITY OF SANTA MONICA, CALIFORNIA No

- Page 78 and 79: CITY OF SANTA MONICA, CALIFORNIA No

- Page 80 and 81: CITY OF SANTA MONICA, CALIFORNIA No

- Page 82 and 83: CITY OF SANTA MONICA, CALIFORNIA No

- Page 84 and 85: CITY OF SANTA MONICA, CALIFORNIA No

- Page 86 and 87: CITY OF SANTA MONICA, CALIFORNIA No

- Page 88 and 89: CITY OF SANTA MONICA, CALIFORNIA No

- Page 90 and 91: CITY OF SANTA MONICA, CALIFORNIA No

- Page 92 and 93: CITY OF SANTA MONICA, CALIFORNIA No

- Page 94 and 95: CITY OF SANTA MONICA, CALIFORNIA No

- Page 96 and 97: CITY OF SANTA MONICA, CALIFORNIA No

- Page 98 and 99: CITY OF SANTA MONICA, CALIFORNIA No

- Page 100 and 101: CITY OF SANTA MONICA, CALIFORNIA No

- Page 102 and 103: CITY OF SANTA MONICA, CALIFORNIA No

- Page 104 and 105: CITY OF SANTA MONICA, CALIFORNIA No

- Page 106 and 107: CITY OF SANTA MONICA, CALIFORNIA No

- Page 108 and 109: CITY OF SANTA MONICA, CALIFORNIA No

- Page 110 and 111: City of Santa Monica, California Ye

- Page 112 and 113: CITY OF SANTA MONICA, CALIFORNIA Ca

- Page 114 and 115: CITY OF SANTA MONICA, CALIFORNIA Co

- Page 116 and 117:

CITY OF SANTA MONICA, CALIFORNIA Co

- Page 118 and 119:

CITY OF SANTA MONICA, CALIFORNIA Co

- Page 120 and 121:

CITY OF SANTA MONICA, CALIFORNIA Sc

- Page 122 and 123:

CITY OF SANTA MONICA, CALIFORNIA Sc

- Page 124 and 125:

CITY OF SANTA MONICA, CALIFORNIA Sc

- Page 126 and 127:

CITY OF SANTA MONICA, CALIFORNIA Sc

- Page 128 and 129:

CITY OF SANTA MONICA, CALIFORNIA Sc

- Page 130 and 131:

CITY OF SANTA MONICA, CALIFORNIA Sc

- Page 132 and 133:

CITY OF SANTA MONICA, CALIFORNIA Co

- Page 134 and 135:

CITY OF SANTA MONICA, CALIFORNIA Sc

- Page 136 and 137:

CITY OF SANTA MONICA, CALIFORNIA Sc

- Page 138 and 139:

CITY OF SANTA MONICA, CALIFORNIA Sc

- Page 140 and 141:

CITY OF SANTA MONICA, CALIFORNIA Co

- Page 142 and 143:

CITY OF SANTA MONICA, CALIFORNIA Co

- Page 144 and 145:

THIS PAGE INTENTIONALLY LEFT BLANK

- Page 146 and 147:

CITY OF SANTA MONICA, CALIFORNIA St

- Page 148 and 149:

CITY OF SANTA MONICA, CALIFORNIA St

- Page 150 and 151:

CITY OF SANTA MONICA, CALIFORNIA St

- Page 152 and 153:

CITY OF SANTA MONICA, CALIFORNIA St

- Page 154 and 155:

CITY OF SANTA MONICA, CALIFORNIA St

- Page 156 and 157:

CITY OF SANTA MONICA, CALIFORNIA Co

- Page 158:

THIS PAGE INTENTIONALLY LEFT BLANK

- Page 161 and 162:

CITY OF SANTA MONICA, CALIFORNIA Fo

- Page 163 and 164:

CITY OF SANTA MONICA, CALIFORNIA Ch

- Page 165 and 166:

CITY OF SANTA MONICA, CALIFORNIA Ch

- Page 167 and 168:

CITY OF SANTA MONICA, CALIFORNIA Ch

- Page 169 and 170:

CITY OF SANTA MONICA, CALIFORNIA Ge

- Page 171 and 172:

CITY OF SANTA MONICA, CALIFORNIA Di

- Page 173 and 174:

CITY OF SANTA MONICA, CALIFORNIA Pr

- Page 175 and 176:

CITY OF SANTA MONICA, CALIFORNIA Ra

- Page 177 and 178:

CITY OF SANTA MONICA, CALIFORNIA Di

- Page 179 and 180:

CITY OF SANTA MONICA, CALIFORNIA Wa

- Page 181 and 182:

CITY OF SANTA MONICA, CALIFORNIA Re

- Page 183 and 184:

CITY OF SANTA MONICA, CALIFORNIA Pr

- Page 185 and 186:

CITY OF SANTA MONICA, CALIFORNIA Op

- Page 187:

THIS PAGE INTENTIONALLY LEFT BLANK