NHAI Annual Report of 1989-90 TO 1995-96 - National Highways ...

NHAI Annual Report of 1989-90 TO 1995-96 - National Highways ...

NHAI Annual Report of 1989-90 TO 1995-96 - National Highways ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

1 . Ekkgroutid<br />

I<br />

2. Functions <strong>of</strong> the A;harity<br />

3. Organisation<br />

4. Technical Division<br />

5.:’ Finance & Administration Division<br />

6. Private Investment Division<br />

7. Planning & Information Systems Division<br />

8. Public Grievawes<br />

11<br />

12 -,<br />

14<br />

9. Advisory Committee 14<br />

10, Signing <strong>of</strong> Memorandum <strong>of</strong> understanding<br />

11. The Future vision <strong>of</strong> the Authority<br />

15<br />

15<br />

3

I. Composition <strong>of</strong> Board 17<br />

II. Organisational Structure 18<br />

III. Sanctioned Strength and Filled up vacancies 18<br />

IV. Audit <strong>Report</strong> on the Accounts <strong>of</strong> <strong>NHAI</strong><br />

A. For the period from 15* June, <strong>1989</strong> to 31.3.<strong>90</strong><br />

- Management Replies to Audit <strong>Report</strong><br />

- Balance Sheet as on 31.3.<strong>90</strong><br />

- Pr<strong>of</strong>it & Loss A/C<br />

B. For the year 19<strong>90</strong> - 91<br />

- Management Replies to Audit <strong>Report</strong><br />

- Balance Sheet as on 31.3.91<br />

- Pr<strong>of</strong>it & Loss A/C<br />

C . For the year 1991-92<br />

- Management Replies to Audit <strong>Report</strong><br />

- Balance Sheet as on 31.3.92<br />

- Pr<strong>of</strong>it & Loss A/C<br />

D. For the year 1992 - 93<br />

- Management Replies to Audit <strong>Report</strong><br />

- Balance Sheet as on 31.3.93<br />

- Pr<strong>of</strong>it & Loss A/C<br />

E. For the year 1993 --94<br />

- Management Replies to Audit <strong>Report</strong><br />

- Balance-sheet as on 31.3.94<br />

: - Pr<strong>of</strong>it & Loss A/C<br />

F. For the year 1994 - 95 I<br />

- Management Replies to Audit <strong>Report</strong><br />

- Balance Sheet as on 31.3.95<br />

- Pr<strong>of</strong>it: & Loss A/C<br />

G. For the year <strong>1995</strong> - <strong>96</strong><br />

- Management Replies to, Audit <strong>Report</strong><br />

- Balance Sheet as 6n 31.3.<strong>96</strong><br />

- Pr<strong>of</strong>it & Loss A/C<br />

V Composition <strong>of</strong> Advisory Committee<br />

r*<br />

19<br />

20<br />

21<br />

22<br />

23<br />

34<br />

36<br />

37<br />

38<br />

48<br />

50<br />

51<br />

52<br />

62<br />

64<br />

65<br />

66<br />

76<br />

78<br />

79<br />

80<br />

<strong>90</strong><br />

93<br />

94<br />

95<br />

106<br />

109<br />

110<br />

111<br />

121<br />

5

1. Background :<br />

The <strong>National</strong> <strong>Highways</strong> Authority <strong>of</strong> India (NI-IAI) was established in 1988 by an Act <strong>of</strong> Parliament, viz., the<br />

<strong>National</strong> <strong>Highways</strong> Authority <strong>of</strong> India Act, 1988 and it came into existence with effect from 15th June, <strong>1989</strong>. The<br />

Act provided for the constitution <strong>of</strong> the Authority for the development, maintenance and management <strong>of</strong> <strong>National</strong><br />

<strong>Highways</strong> and for matters connected therewith or incidental thereto. However, even though the Authority was<br />

created in 1988, it was operationalised only in Feb, <strong>1995</strong> with the appointment <strong>of</strong> a full-time Chairman and Members.<br />

In the Statement <strong>of</strong> Objects and Reasons <strong>of</strong> the Act setting up this Authority, it was mentioned that “the only<br />

alternative is for the Centre to take over development and maintenance <strong>of</strong> the <strong>National</strong> <strong>Highways</strong> system”. It is<br />

proposed that this Authority should take over, in a phased manner, the functions on <strong>National</strong> <strong>Highways</strong> presently<br />

being performed by the State Public Works Department.<br />

2. Functicms <strong>of</strong> the Authority :<br />

The <strong>National</strong> <strong>Highways</strong> Authority <strong>of</strong> India Act, 1988 states that, subject to the rules made by the Central<br />

Government in this behalf, it shall be the function <strong>of</strong> the authority to develop, maintain and manage the <strong>National</strong><br />

<strong>Highways</strong> and any other highways vested in or entrusted to it, by the Government. For the discharge <strong>of</strong> its<br />

functions, the Act empowers the Authority, inter alia, to :<br />

Y<br />

0) Survey, develop, maintain and manage highways vested in or entrusted to it;<br />

(ii><br />

(iii)<br />

(iv><br />

(v)<br />

(vi)<br />

(vii)<br />

(viii)<br />

(ix)<br />

Construct <strong>of</strong>fices or workshops and establish and maintain hotels, motels, restaurants and rest-rooms at<br />

or near the highways vested in or entrusted to it;<br />

Construct residential buildings and townships for its employees;<br />

Regulate and control the plying <strong>of</strong> vehicles on the highways vested in or entrusted to it for the proper<br />

management there<strong>of</strong>;<br />

Develop and provide consultancy and construction services in India and abroad and carry on research<br />

activities in relation to the development, maintenance and management <strong>of</strong> highways or any facilities<br />

thereat;<br />

Provide such facilities and amenities for the users <strong>of</strong> the highways vested in, or entrusted to it as are, in<br />

the opinion <strong>of</strong> the Authority, necessary for the smooth flow <strong>of</strong> tra%c on such highways;<br />

Form one or more companies under the Companies Act, 1956 to further the efficient discharge <strong>of</strong> the<br />

functions. imposed on it.<br />

Advise the Central Government on matters relating to highways;<br />

Assist, on such terms and conditions as may be mutually agreed upon, any State Government in the<br />

formulation and implementation <strong>of</strong> schemes for highway development; and<br />

($) Collect fees on behalf <strong>of</strong> the Central Government for services or benefits rendered under Section 7 <strong>of</strong> the<br />

<strong>National</strong> <strong>Highways</strong> Act, 1956, as amended from time to time, and such other fees on behalf <strong>of</strong> the State<br />

Governments on such terms and conditions as may be specified by such State Governments.

The Authority is, at psent, entrusted with the following functions by the Central Government :<br />

0) timely implegntation <strong>of</strong> all externally funded project involving modemisation and upgradation <strong>of</strong><br />

<strong>National</strong> <strong>Highways</strong>;, ,I 1<br />

J<br />

00 implementationbf’ti,e policy <strong>of</strong> privatisation in the <strong>National</strong> <strong>Highways</strong> Sector; and<br />

(iii) provision <strong>of</strong> am&n&ties on <strong>National</strong> <strong>Highways</strong>.<br />

3. Organisation <strong>of</strong> Authority<br />

The Authority is headed by the Chairman and has three full time functional members-Member (Technical),<br />

Member (Finance & Admn.) and Member (Private Investment) as indicated in Appendix-I. Organisational<br />

structure <strong>of</strong> the Authority is detailed in Appendix-IL The Corporate Office <strong>of</strong> the Authority is presently<br />

located at 1, Eastern Avenue, Maharani Bagh, New Delhi - 110 065.<br />

4. Technical’ Division :<br />

The Technical Division is presently headed by Member (Technical) who is <strong>of</strong> the rank <strong>of</strong> Chief Engineer. He is<br />

in-charge <strong>of</strong> the technical aspects pertaining to development, construction and maintenance <strong>of</strong> <strong>National</strong> <strong>Highways</strong><br />

according to the standards as set out by the Ministry <strong>of</strong> Surface Transport (MOST). Currently the Technical<br />

Division is engaged in the implementation <strong>of</strong> the ADB-III Project.<br />

4.1 ADB-III Project :<br />

The ADB III Project consists <strong>of</strong> upgradation & strengthening <strong>of</strong> 330 Kms <strong>of</strong> existing <strong>National</strong> <strong>Highways</strong> spread<br />

over the five States <strong>of</strong> Andhra Pradesh, Haryana, Rajasthan, Bihar and West Bengal. The stretches in these States<br />

have to be widened to four lanes and where necessary the existing pavements have to be strengthened. The total<br />

project cost is Es. 772 crores. It is divided into 5 contract segments for the 5 States. The development <strong>of</strong> the<br />

project was undertaken at the headquarters <strong>of</strong> the Authority in collaboration with the Ministry and the 3 General<br />

Managers are responsible for these 5 segments. The work is to be awarded some time in April/May 19<strong>96</strong> subject<br />

to approval <strong>of</strong> Ministry/ADB being received.’ It will be implemented through 3 Project Implementation Units<br />

which have been set up in Gurgaon (Haryana), Vijayawada @mlhra Pradesh) and Durgapur (West Bengal).<br />

The Project Implementation Units are headed by General Manager with a complement <strong>of</strong> staff consisting <strong>of</strong><br />

Dy. General Manager and Managers, etc.<br />

The details <strong>of</strong> the project, statewise, are given below :<br />

0<br />

I<br />

(a><br />

Length <strong>of</strong> Stretch<br />

61 <strong>National</strong> Highway Nos. 5&9<br />

cc> Project Cost Rs. 202 crores<br />

(a> Length <strong>of</strong> Stretch<br />

0 ‘<strong>National</strong> Highway No.<br />

cc> Project cost Rs-298 crores<br />

4

(4 Length <strong>of</strong> Stretch -4$i9 Kms.‘ ’<br />

(b) <strong>National</strong> Highway No. 2 .<br />

$1 Project Cost Rs. 133.92 crores<br />

(4)<br />

(a> Length <strong>of</strong> Stretch 41.6 Kms.<br />

t 2<br />

t.bl <strong>National</strong> Highway No.<br />

(cl Project Cost Rs. 227.86 crores<br />

The actual implementation <strong>of</strong> the project will be supervised by Supervisory Consultants who are in the process<br />

<strong>of</strong> being appointed, on the basis <strong>of</strong> international bids invited for the purpose.<br />

4.2 World Bank-III Projects :<br />

The Authority has also started preparations for obtaining World Bank Loan III for upgradation <strong>of</strong> various<br />

sections <strong>of</strong> <strong>National</strong> <strong>Highways</strong> in a length <strong>of</strong> 1350 Kms. This involves stretches on NH-2and NH-45 covering<br />

the States <strong>of</strong> Uttar Pradesh, Bihar, West Bengal and Tamil Nadu.<br />

5. Finance % Administration Division :<br />

This Division is engaged in setting up <strong>of</strong> appropriate systems and procedures for administration and proper<br />

financial management <strong>of</strong> the Authority. ,The Division is headed by Member (Finance & Administration) and<br />

has a (Part-time> General Manager (Finance), Dy. General Manager (Finance), etc, On the Administration side,<br />

there is a General Manager (Administration) and (part time) Dy. General Manager (Administration). A statement<br />

indicating the sanctioned strength and <strong>of</strong>ficers in position as on 31.03.<strong>96</strong> is at Appendix-III.<br />

5.1. In line with the World Bank recommendations, Consultants were appointed to advise on the development <strong>of</strong><br />

the Authority and to design systems and procedures relating to :<br />

t<br />

(a> Finance accounting, accounting policies and cost accounting;<br />

(b) Capital and revenue budgets; and<br />

(c) Management Information Systems.<br />

5.2 The Government provided a revenue grant <strong>of</strong> Rs. 3 crores during 194-95 towards the cost <strong>of</strong> initial setting up<br />

<strong>of</strong> the <strong>of</strong>fice, renting <strong>of</strong>fice premises, purchase <strong>of</strong> <strong>of</strong>fice equipments, etc. A proposal to provide for an adequate<br />

capital base to the authority to enable it to discharge the various functions entrusted to it is under consideration<br />

<strong>of</strong> the Ministry <strong>of</strong> Surface Transport.<br />

5.3 The basic structure <strong>of</strong> the Authority is envisaged to be lean, automated and generally in keeping with a modem<br />

and efficient enterprise. Regulations have to be formulated under the <strong>NHAI</strong> Act, 1988 pertaining to various<br />

aspects <strong>of</strong> administration and financial management. Towards this end, the Authority has frnalised the following<br />

Regulations and these are now to be notified in the Gazette : -<br />

9

5.4<br />

(a)<br />

Conduct, Discipline & Appeal Regulations;<br />

0 Medical Attendance and Treatment Regulations;<br />

cc> Joining Time Regulations;<br />

0 Incentive Regulations;<br />

(e> L.T.C. Regulations;<br />

0) Leave Regulations; and<br />

@<br />

Recruitment, Seniority & Promotion Regulations.<br />

Further, Regulations relating to the following subjects are in the process <strong>of</strong> being formulated and are expected<br />

to be finalised and notified in 19<strong>96</strong>-97 :<br />

!L5<br />

i.6<br />

(a><br />

Conveyance Reimbursement Regulations;<br />

0$ Group Insurance Scheme Regulations;<br />

cc><br />

Transaction <strong>of</strong> Business Regulations;<br />

(4 Provident Fund and Pension Regulations; and<br />

(e><br />

Travelling Allowance & Daily Allowance Regulations.<br />

‘j, L.. ,<br />

In addition, the Authority is finalising Rules in consultation with the Ministry <strong>of</strong> Surface Transport<br />

on the following subjects :<br />

(i) <strong>NHAI</strong> (value <strong>of</strong> Contracts) Rules : ’<br />

(ii><br />

(iii)<br />

‘<strong>NHAI</strong> (Powers and Duties <strong>of</strong> Members) Rules; and<br />

<strong>NHAI</strong> (Terms & Conditions <strong>of</strong> Service <strong>of</strong> Members) Rules.<br />

The <strong>Annual</strong> Accounts <strong>of</strong> the Authority which were in arrears since <strong>1989</strong>, have been finalised for the years <strong>1989</strong>-<br />

<strong>90</strong> to <strong>1995</strong>-<strong>96</strong>. A statement indicating Receipts and Expenditure incurred by the Authority since its inception,<br />

i.e. <strong>1989</strong>-<strong>90</strong> to <strong>1995</strong>-<strong>96</strong> is as under : .I<br />

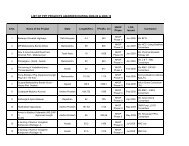

1 Year 1 Receipt from MOST 1 Expenditure 1<br />

~~.<br />

<strong>1989</strong>-<strong>90</strong> 2.00 2.66<br />

19<strong>90</strong>-91 10.00 4.<strong>96</strong><br />

1991-92 153.00 7.07<br />

1992-93 .++3.20*<br />

1993-94 1.22<br />

1994-95 3 0 0 . 0 0 2.32<br />

<strong>1995</strong>-<strong>96</strong> 2306.60 168.77<br />

* (In addition, Rs. 160 lakhs refunded to the Govt.)<br />

5.7 A copy each <strong>of</strong> the Audit <strong>Report</strong> on ;hs accounts <strong>of</strong> the Authority, Management Replies to Audit <strong>Report</strong>,<br />

Balance Sheet, Pr<strong>of</strong>it and Loss Account for the year <strong>1989</strong>-<strong>90</strong>,19<strong>90</strong>-91,1991-92,1992-93,1993-94,1994-95, and <strong>1995</strong>-<strong>96</strong><br />

is enclosed at Appendix - IV.<br />

1 0

6. Private Investment Divison :<br />

The Private Investment Divison is headed by Member (PI) with a General Manager (PI) working on part-time<br />

basis and a DGM (PI).<br />

6.1 why @ivatisation ?<br />

While the traffic has been growing at a fast pace, it has not been possible to provide matching investment on roads,<br />

due to competing demand from other sectors, which has led to a large number <strong>of</strong> deficiencies in the network.<br />

Many sections <strong>of</strong> the <strong>Highways</strong> are in need <strong>of</strong> capacity augmentation through addition <strong>of</strong> lanes, grade separation at<br />

intersections, construction <strong>of</strong> expressways, etc. There are congested routes through towns where bypasses are required<br />

to be constructed in order to reduce delays. Many old bridges are in need <strong>of</strong> replacement, or new construction is<br />

required. In order to supplement the Government’s services, it has been decided to invite private sector to invest<br />

their funds for improvement <strong>of</strong> Highway infrastructure.<br />

6.2 Scope <strong>of</strong> Private Participation:<br />

Participation on Build, Operate and Transfer (BOT) basis is sought in projects <strong>of</strong> undermentioned categories :<br />

(a3 Existhg~ ~~aticmal <strong>Highways</strong><br />

- Bridges<br />

- Railway Over -Bridges *<br />

- Elevated Sections through Urban areas<br />

- Interchanges<br />

-Widening <strong>of</strong> Roads<br />

(b) New Alignments<br />

- -<br />

- Super <strong>National</strong> <strong>Highways</strong> (Expressways)<br />

6.3 Legal Framework :<br />

The amendment to the <strong>National</strong> Highway Act 1956, made in June <strong>1995</strong>, provides the legal framework for private<br />

sector participation. Under the’amended <strong>National</strong> Highway Act, it is now possible to :<br />

.-<br />

. Assign to the private entrepreneur, implementation and operation <strong>of</strong> projects for a specified period by an<br />

agreement with the Government.<br />

. Author&e the entrepreneur to collect and retain fee from the users.<br />

. Authorise entrepreneur to regulate traffic on the BOT road.<br />

. Punish any person for encroachment <strong>of</strong> land and misuse <strong>of</strong> highway developed by the entrepreneur.<br />

11

6.4 progress ma& so far :<br />

0) The Authority is developing jointly with IL&FS, the Moradabad Bypass Project’in Uttar Pradesh and the<br />

Amravati Bypass Project in Maharashtra jointly with SCICI where the land has already been acquired.<br />

(ii)<br />

(iii)<br />

(iv)<br />

(v)<br />

The Author&y has also taken up the Durg Bypass project on NH-6 in Madhya Pradesh for construction on BOT<br />

basis and has invited privatesector investors for pre-qualification.<br />

The Authority is also developing 6 ROB Projects in Rajasthan on NH Nos. 8,11,12 & 14 and the project will be<br />

advertised soon thereafter.<br />

It is also proposed to develop a 30 Km. .stretch <strong>of</strong> NH 8 near Surat as a Public Sector toll Project after 4 laning<br />

<strong>of</strong> the sections. The Authority will raise commercial loan for this project and repay the debt with interest<br />

through tolls.<br />

Once these small projects are successfully awarded to private investors, it will help gain experience and form the<br />

basis for undertaking further projects for privatisation and also construction <strong>of</strong> Public Toll Roads.<br />

6.5 Development <strong>of</strong> Super <strong>National</strong> <strong>Highways</strong> :<br />

At the instance <strong>of</strong> the Central Govt., the Authority in July, <strong>1995</strong> invited proposals from the private entrepreneurs<br />

for undertaking feasibility studies <strong>of</strong> the identified sections <strong>of</strong> the proposed Super <strong>National</strong> <strong>Highways</strong>. This project<br />

involves the construction <strong>of</strong> 13,000 kms <strong>of</strong> new expressways on alignments other than the existing <strong>National</strong> <strong>Highways</strong>.<br />

These are planned to be 4 laned <strong>Highways</strong> <strong>of</strong> standards comparable to highways elsewhere in the world. All expenses<br />

<strong>of</strong> preparation <strong>of</strong> feasibility studies am to be borne by the Private sector investors themselves. A total <strong>of</strong> 22 proposals<br />

-were received from reputed companies including some international companies in response to the invitation.<br />

The Finance Ministry had indicated that a detailed formulation <strong>of</strong> privatisation policy was further essential for<br />

notifying to private sector investors. In response, the Authority has formulated a detailed policy for privatisation<br />

and a draft Note for Cabinet has been forwarded to Ministry for further necessary action at their end.<br />

6.6 Highway Development Pund :<br />

It has also been envisaged that even if private sector investors were to be invited for construction <strong>of</strong> various sections<br />

<strong>of</strong> <strong>National</strong> <strong>Highways</strong>, bypasses, ROBS and other bridges, Government/Authority would have to undertake feasibility<br />

study and acquire land for the projects. As such funds would be required by the Authority for the purpose <strong>of</strong><br />

undertaking feasibility studies and acquiring land where necessary.<br />

Towards this end, the Authority has proposed the creation <strong>of</strong> a <strong>Highways</strong> Development Fund by charging cess on<br />

petrol and diesel. This fund will go a long way in taking care <strong>of</strong> feasibility studies and the acquisition <strong>of</strong> land where<br />

necessary in addition to undertaking public sector Toll Road Projects. The Authority has also entered into MOUs<br />

with SCICI, and HUDCO for undertaking development <strong>of</strong> private sector investments projects on BOT basis or any<br />

<strong>of</strong> its variant jointly, sharing the risks so that the projects that are viable could be implemented through financing by<br />

these financial institutions.<br />

7. Planning and Information Systems Division :<br />

Planning and Information Systems Division is to be headed by Member (P&IS). Presently Member (Finance &<br />

Admn.) is looking after this division with DGM (I&PS) in ,place. The activities <strong>of</strong> this Division are as follows :<br />

12

7.1 Computerisation :<br />

The <strong>National</strong> <strong>Highways</strong> Authority <strong>of</strong> India (<strong>NHAI</strong>) is computerising its entire working. It is also planning to link<br />

up with the international network through Internet & E-Mail to ensure speedy communication with its external<br />

funding agencies, the World Bank and the Asian Development Bank.<br />

The need for computerisation has acquired urgency in view <strong>of</strong> the fact that highway projects in the country have<br />

been suffering long delays and this has been causing concern both to the Central Government as well as the foreign<br />

funding agencies. The Authority is also going to introduce computer aided designing for its road projects.<br />

Computerlsation is going to be an indispensable aid in planning the future road network particularly the ambitious<br />

13,000 Kms <strong>National</strong> Super Highway Network (SNH).<br />

In pursuance <strong>of</strong> the above, 18 computers. <strong>of</strong> 486 Dx 2 and one Pentium have been installed in the headquarters.<br />

7.2 Library :<br />

<strong>NHAI</strong> is building up a pr<strong>of</strong>essional library to keep pace with the latest developments in Management and the Road<br />

Construction sector. Selective books, on subjects like administration, policy planning, financing as also technical<br />

books are available in the Library for reference purposes.<br />

Countrywise literature on BOT project, including legislation, financing <strong>of</strong> project and other available data <strong>of</strong> Highway<br />

Department in other countries has also been arranged and the same has been kept in the library for reference.<br />

The literature pertaining to the following countries is, as such, available for reference purposes : United States <strong>of</strong><br />

America, Australia, Canada, France, Hungary, Mexico, Malaysia, United Kingdom, Pakistan, China<br />

7.3 Technical Training, Meetings, Symposia Courses Networks etc. during 95 - <strong>96</strong> :<br />

In order to develop managerial, pr<strong>of</strong>essional skills <strong>of</strong> <strong>of</strong>ficers <strong>of</strong> the Authority, <strong>of</strong>ficers have been deputed to attend<br />

courses/seminars/workshops being conducted by various leading organisations in India and abroad. The following<br />

would indicate the various courses attended by the <strong>of</strong>ficers :<br />

(0 1st Seminar on Construction and Financing <strong>of</strong> Roads and Bridges on BOT basis jointly organised by<br />

ASSOCHAM, Authority and IL & FS on 13th - 14th September, <strong>1995</strong> at New Delhi.<br />

0 Seminar on Private sector participation in Highway Development organised by IRC in cooperation with MOST<br />

etc. at Delhi on 28th & 29th September, <strong>1995</strong>.<br />

(iii) 56th .<strong>Annual</strong> IRC Session at Lucknow from 6th to 9th November, <strong>1995</strong>.<br />

(iv) International Conference on Road and Road Transport Problems organised by Centre <strong>of</strong> Transport Engineering<br />

(COTE), Deptt. <strong>of</strong> Civil Engineering, University <strong>of</strong> Roorkee (ICORT-95) at Delhi from 11-14th December,<br />

<strong>1995</strong>.<br />

(v)<br />

<strong>National</strong> Get-together on Road Research and its utilisation organ%ed by CRRI on 34th January, 19<strong>96</strong> at New Delhi.<br />

(vi) Seminar on “High Performance Concrete” organised jointly by Cement Manufacturers Association,<br />

The Federal Highway Administration <strong>of</strong> USA and the CRRI on 5-6th February, 19<strong>96</strong> at New Delhi.<br />

(vii) “<strong>National</strong> Get-together on Road Research and its utilisation” organised by CRRI at Delhi on January 3/4,13<strong>96</strong><br />

(viii) A Workshop organised by ADB on “Procurement Services” at Delhi from February 22-29,19<strong>96</strong>.<br />

(i$I A Seminar on “Ready Mix Concrete” Organised by Cement Manufacturers Association at Madras on<br />

March 15,X?%.<br />

13

($ “Advanced Management Programme” organized by Deptt. <strong>of</strong> Programme Implementation in October, <strong>1995</strong>.<br />

@ “<strong>National</strong> Get-together on Road Research & its utilization” Organized by CRRI on 3/4th January, 19<strong>96</strong>.<br />

Visits:<br />

@<br />

Canada from 28 May, 95 to 2nd June, 95 in connection with inspecting the construction <strong>of</strong> a new highway No,<br />

407 and other BOT facilities.<br />

0 Australia to inspect BOT and other normal road projects.<br />

(4 Washington from 30th August, 95 to 1st September, 95, on issues relating to the <strong>National</strong> <strong>Highways</strong> as well as<br />

the current status <strong>of</strong> the Bank assisted <strong>National</strong> Highway Project.<br />

(iv) Malaysia from August 3-6th’ 95 in connection with the signing <strong>of</strong> MOU with the Malasiya Government relating<br />

to mutual assistance cooperation between Govt. and Government <strong>of</strong> Malaysia for development <strong>of</strong> Super <strong>National</strong><br />

<strong>Highways</strong>.<br />

(v)<br />

UK from 7.8.95 to 11.8.95 in connection with the Indo-British multi sectoral infrastructure workshops and<br />

to see U.K.‘s experience in toll road projects,<br />

Q London & Paris from 22nd to 25th Sept., 95 to participate in the meet organized in U. K. by the Institute for<br />

Infrastructure Finance and to study the tolling system <strong>of</strong> France.<br />

8. I?ublic Grievances :<br />

In response to the Department <strong>of</strong> Administrative Reforms and Public Grievances for activating the<br />

machinery for redressal <strong>of</strong> Public Grievances, the Authority has designated DGM (Admn.) as the Staff<br />

Grievance Officer for the Authority. Officers have been asked to analyse grievances received by them<br />

with a view to find the major grievance-prone areas and take corrective measures to reduce recurrence <strong>of</strong><br />

such grievances. They have been able to ensure that grievance petitions are disposed <strong>of</strong> as far as possible<br />

within 15 days <strong>of</strong> their receipt. The Grievance Officer has been vested with powers to call for papers/<br />

documents <strong>of</strong> cases pending more than 3 months with the approval <strong>of</strong> Chairman. Also a complaint/<br />

suggestion box has been placed in the reception.<br />

9. Advisory Cdmmittee :<br />

With the approval <strong>of</strong> the Ministry <strong>of</strong> Surface Transport, an Advisory Committee for the Authority has<br />

been constituted to serve as an institutionalised forum for giving suggestions to aid and advise’the<br />

Authority in the discharge <strong>of</strong> the functions assigned to it by the Government. The idea is to interact<br />

with various Chambers <strong>of</strong> Commerce as well as road users interested in development <strong>of</strong> roads, road<br />

safety etc. to advise the Authority on the activities to be taken up to implement the main objectives <strong>of</strong><br />

road development programmes. Keeping in view the fact that it will be useful for the Authority to<br />

interact with members <strong>of</strong> the public as well as technical institutions dealing with road construction, it<br />

was considered desirable to have the meeting <strong>of</strong> the Advisory Committee,pf the <strong>NHAI</strong> once in three<br />

months or even earlier, if necessary, to discuss issues concerning <strong>National</strong> <strong>Highways</strong>.<br />

Such topics as constructions <strong>of</strong> amenities on <strong>National</strong> <strong>Highways</strong>, new routes on which expressway should be constructed,<br />

terms and conditions on which private investors should be invited for BOT projects are discussed. The list <strong>of</strong> Members<br />

<strong>of</strong> the Advisory Committee is given in Appendix V. The terms & cenditions <strong>of</strong> this Committee are as follows :<br />

14

@<br />

to advise the Authority in the formulation and implementation <strong>of</strong> BOT policy in privatisation <strong>of</strong> roads;<br />

0 to advise the Authority in the formulation <strong>of</strong> a perspective plan for the development <strong>of</strong> <strong>National</strong> <strong>Highways</strong> and<br />

Super <strong>National</strong> <strong>Highways</strong> in the country;<br />

(iii) to advise the Authority on the specification for expressways and quality control in road construction; and<br />

(iv) to advise the Authority on aspects <strong>of</strong> road safety, traffic movements, provision <strong>of</strong> wayside amenities, effective<br />

utilisation <strong>of</strong> air space along the <strong>National</strong> Highway.<br />

The Advisory Committee held three meetings and the suggestions <strong>of</strong> the members were <strong>of</strong> immense help in<br />

formulating the policies <strong>of</strong> the Authority in its first year <strong>of</strong> operation.<br />

10. Signing <strong>of</strong> Memorandum <strong>of</strong> Understanding :<br />

In its attempts to take the initiative to speed up highway infrastructure development, the Authority has teamed up<br />

with the SCICI (Shipping Credit and Investment Corporation <strong>of</strong> India Ltd.), the IL&FS (Infrastructure Leasing and<br />

Financial Services Ltd.) and HUDCO to promote various road projects.<br />

MOUs with them have been signed and it is proposed to take up with each some projects jointly for the construction<br />

<strong>of</strong> bypasses, ROBS and certain expressways.<br />

11. The Future Vision <strong>of</strong> the Authority :<br />

The Authority seeks for itself the role <strong>of</strong> a coordinator in collaboration with the Ministry <strong>of</strong> Surface Transport for<br />

the transfer <strong>of</strong> modem construction technology including machine oriented construction <strong>of</strong> long enduring roads.<br />

The Authority also wants to serve as a Think Tank for the Ministry for innovations in development <strong>of</strong> highways and<br />

highway related user facilities.<br />

The Highway Authority also seeks for itself, the position <strong>of</strong> a leader in highway development, management and<br />

construction in the entire SAARC region to develop highways to enable faster growth <strong>of</strong> commerce and trade in the<br />

SAARC countries <strong>of</strong> the sub-continent. This would be possible by gaining international experience through visits<br />

and studies <strong>of</strong> the state-<strong>of</strong>-the-art techniques evolved in the developed countries.<br />

. .<br />

The Authority wants itself to be a thin and lean Organisation which should be <strong>of</strong>ficer oriented and develop its <strong>of</strong>fice<br />

procedures with the aid <strong>of</strong> computer technology. It can remain thin by developing its own expertise while<br />

simultaneously selectively outsoucring its work.<br />

As far as privatisation <strong>of</strong> highways is concerned, the Authority would like to take the leadership in the country for<br />

evolving model BOT contract documents, bid documents etc. so as to enable it to act as a guide to other States and<br />

also to bring about a uniformity in the Privatisation Policy in highways in the entire country. For this purpose, the<br />

Authority intends to build up a repository <strong>of</strong> knowledge <strong>of</strong> the BOZpregr%mm es in roads, highways and bridges<br />

which have been or are being executed all over the world. Towards this end, the Authority would be interacting<br />

with various international organisations and the road building departments <strong>of</strong> the various countries in the world<br />

where such programmes are going on. The Authority would also like to send its <strong>of</strong>ficers abroad for gaining experience<br />

in this field and thus become the focal point for disseminating knowledge on BOT procedure etc. to the neighbouring<br />

countries.<br />

15

The Authority also wants to build up a dedicated and highly motivated cadre <strong>of</strong> Officers from the talent available<br />

both from the priyate sector as well as the Government and the public sector. These people should be such as are<br />

capable <strong>of</strong> introducing fresh ideas ln this field <strong>of</strong> highway management, development and construction and can be<br />

eventually developed as leaders in their pr<strong>of</strong>ession.<br />

The Authority would also aim to introduce a new work cul$re in the <strong>of</strong>ficers and staff <strong>of</strong> the organisation and make<br />

them result oriented and conscious <strong>of</strong> avoiding cost over runs and time over runs in the execution <strong>of</strong> projects.<br />

Towards this end, the Authority will endeavour to create a culture where each <strong>of</strong>ficer <strong>of</strong> the Authority becomes a<br />

decentralised point <strong>of</strong> responsibility to enable each <strong>of</strong>ficer to give his best. The functioning <strong>of</strong> this Authority will be<br />

based on trust <strong>of</strong> each <strong>of</strong>ficer. Accounting procedures will have to be organised accordingly.<br />

The Authority would also endeavour to become financially independent by raising new sources <strong>of</strong> income which<br />

would enable it to stand on its own legs rather than depending on Govt. budgetary support. In the initial years, the<br />

Authority will <strong>of</strong> course have to depend on Govt. guarantees whenever it raises loans or Govt. budgetary support,<br />

but its ultimate aim would be to make the road programme in India financially independent <strong>of</strong> the budget and<br />

ensuring development <strong>of</strong> future road programmes through resources raised by it rather than depend on the Govt.<br />

Towards this end, it will give various suggestions to the Govt. on how to commercialise roads and how to raise<br />

resources for future road programmes.<br />

The Authority will also motivate its <strong>of</strong>ficers to pursue academic research and bring out papers based on their experience<br />

in highway construction so as to enable others to share the knowledge so gained. It will also try to ensure that the<br />

international funding agencies are motivated to give more funds to the roads sector by introducing new methods <strong>of</strong><br />

efficient project execution so that the complaints <strong>of</strong> the international funding agencies on time over runs and cost<br />

over runs are avoided.<br />

The Authority will also collaborate with the international and national organisations in this field and selectively<br />

adopt techniques and procedures from various parts <strong>of</strong> the world which can be adopted in India for streamlining<br />

execution <strong>of</strong> highway projects.<br />

The Authority will also endeavour to take over management and maintenance <strong>of</strong> the entire <strong>National</strong> Highway<br />

system in phased manner. Towards this end, it will also endeavour to motivate young motivated engineers from the<br />

State PWDs as well as directly from the Institutes <strong>of</strong> Engineering like IITs, Engineering Colleges etc. to join the<br />

Organisation.<br />

The Authority will also introduce new techniques for automatic counting <strong>of</strong> vehicles on roads to enable better<br />

planning <strong>of</strong> road development in the future. Together with this, it will also endeavour to have the latest signages<br />

technology on highways and roads introduced in the country.<br />

The Authority will also study the various systems <strong>of</strong> collecting tolls, prevalent abroad. It will try Eo introduce the<br />

latest technologies <strong>of</strong> collecting tolls with a view point <strong>of</strong> ensuring satisfaction to the road user and avoiding wastage<br />

<strong>of</strong> time. Manual methods <strong>of</strong> collecting tolls will be gradually phased out and the ultimate aim would be to evolve<br />

automatic electronic methods for collecting road user charges on stretches <strong>of</strong> highways which wil!. come under<br />

toll systems.<br />

With this vision in view <strong>National</strong> Highway Authority <strong>of</strong> India has organized its activities ln its first year <strong>of</strong> operation.

Chairzwn<br />

Shri Yogendra Narain, IAS<br />

Members<br />

Smt. Neelam Nath, IAS<br />

Shri S. Chatterjee, IAS<br />

Shri A. D. Narain<br />

Shri Prem Bajaj<br />

17

APPENDIX - II<br />

ORGANISATIONAL STRUCTURE OF<br />

NATIONAL HIGHWAYS AUTHORITY OF INDIA<br />

1 CHAIRMAN 1<br />

I<br />

MEMBER<br />

TECHNICAL<br />

L<br />

I<br />

I 1<br />

G. M. G. M.<br />

PU WB<br />

I I I<br />

MEMBER MEMBER MEMBER<br />

FIN. & ADMN. CF&IT PVT. INVEST<br />

I<br />

I<br />

I<br />

G. M. G. M. G. M. G. M.<br />

FIN % ACCT. ADMN. INFOR TECH<br />

D.G.M. D.G.M. D.G.M. D.G.M.<br />

FIN 4 ACCT. ADMN<br />

I .<br />

I I .<br />

MANAGER FIELD UNIT MANAGER MANAGER<br />

G.M.<br />

D.G.M.<br />

STATEMENT INDICATING THE SANCTIONED<br />

STAFF STRENGTH VIS - A - VIS VACANCIES FILLED UP<br />

AS ON- 31.03.19<strong>96</strong><br />

APPENDIX - III<br />

Group ‘A’<br />

Group ‘B’<br />

Group ‘C<br />

Group ‘D’<br />

Total<br />

Sanctioned<br />

23 33<br />

21<br />

7 89<br />

Filled up<br />

15 13<br />

3<br />

2 33<br />

18

The Secretary to the Govt. <strong>of</strong> India<br />

Ministry <strong>of</strong> Surface Transport,<br />

Transport Bhawan,<br />

Sansad Marg,<br />

New Delhi.- 110 001.<br />

Subject:Audit<strong>Report</strong>ontheAccamta <strong>of</strong> Natbnd Highway Authority <strong>of</strong> India,<br />

NewD&1ifortheyurended31stMarch,19<strong>90</strong>.<br />

S i r ,<br />

I am to forward herewith a copy <strong>of</strong> the accounts <strong>of</strong> the <strong>National</strong> <strong>Highways</strong> Authority <strong>of</strong> India for the year <strong>1989</strong>-<strong>90</strong> duly certified<br />

together with the Audit <strong>Report</strong> thereon for necessary action under Section 24 <strong>of</strong> the <strong>National</strong> <strong>Highways</strong> Authority <strong>of</strong> India Act, 1988.<br />

2. It is requested that the date <strong>of</strong> presentation <strong>of</strong> the Accounts and the Audit <strong>Report</strong> to Parliament may kindly be intimated. After the<br />

<strong>Report</strong> is presented to Parliament, 25 copies <strong>of</strong> these documents as presented may kindly be furnished to this <strong>of</strong>fice and one copy may<br />

also be sent to the Office <strong>of</strong> the Comptroller and Auditor General <strong>of</strong> India.<br />

3. The receipt <strong>of</strong> this letter may kindly be acknowledged.<br />

Yours faithfully,<br />

CT. G. SRINIVASANI<br />

Principal Director <strong>of</strong> Commercial<br />

Audit and Rx-<strong>of</strong>ficio Member, Audit Board - I,<br />

New Delhi<br />

Encl.AsAbove<br />

No. RS/<strong>NHAI</strong>/4-21/<strong>90</strong>-91/Vol.I1/621 Dated : 22.3.<strong>96</strong><br />

Copy together with a copy <strong>of</strong> Audit <strong>Report</strong> as issued to the Government <strong>of</strong> India, Ministry <strong>of</strong> Surface Transport, New Delhi forwarded<br />

to the Chairman, <strong>National</strong> <strong>Highways</strong> Authority <strong>of</strong> India, l-A, Eastern Avenue, Maharani Bagh, New Delhi. It is requested that the said<br />

<strong>Report</strong> may kindly be treated as secret till the same is presented to the Parliament as required under Section 24 <strong>of</strong> the <strong>National</strong> <strong>Highways</strong><br />

Authority <strong>of</strong> India Act, 1988.<br />

scv-<br />

sd/-<br />

(T. G. SRINIVASAN)<br />

Principal Director <strong>of</strong> Commercial<br />

Audit and Bx-Officio Member, Audit Board - I,<br />

New Delhi.<br />

19

1. Introduction<br />

AUDIT REPORT ON THE ACCOUNTS OF<br />

NATIONAL HIGHWAYS AUTHORITY OF INDIA<br />

FOR THE PERIOD FROM 15 JUNE <strong>1989</strong> <strong>TO</strong> 31 MARCH, 19<strong>90</strong><br />

APPENDIX - IV A<br />

The <strong>National</strong> <strong>Highways</strong> Authority <strong>of</strong> India (the Authority) was constituted on 15 June <strong>1989</strong> under Section 3 (1) <strong>of</strong> the <strong>National</strong><br />

<strong>Highways</strong> Authority <strong>of</strong> India Act, 1988 (the <strong>NHAI</strong> Act) mainly to survey, develop, maintain and manage the <strong>National</strong> <strong>Highways</strong>, to<br />

construct <strong>of</strong>fices or workshops, to establish and maintain hotels, restaurants and rest rooms at or near the highways vested in or<br />

entrusted to it, to regulate and control the plying <strong>of</strong> vehicles, to develop and provide consultancy and construction services and collect<br />

fees for services or benefits rendered, in accordance with Section 16 <strong>of</strong> the Act.<br />

The audit <strong>of</strong> accounts <strong>of</strong> the Authority has been done under section 19(2) <strong>of</strong> the Comptroller and Auditor General’s (DPC) Act, 1971<br />

2. Capital Structure<br />

The <strong>NHAI</strong> Act (Section 12) provides that all non-recurring expenditure incurred by or for the Central Government for or in connection<br />

with the purpose <strong>of</strong> any <strong>National</strong> Highway or any stretch there<strong>of</strong>, so vested in or entrusted to the Authority and declared to be capital<br />

expenditure by the Central Government would be treated as Capital provided by the Central Government to the Authority. No other<br />

source <strong>of</strong> Additional Capital by Central Government or otherwise was provided in the Act. During the year there was no entrustment <strong>of</strong><br />

highways by the Government to the Authority in terms <strong>of</strong> Section 12 <strong>of</strong> the Act. Therefore, there was no capital at the end <strong>of</strong> the year.<br />

3. <strong>NHAI</strong> Fund<br />

The Act provides for creation <strong>of</strong> the <strong>National</strong> <strong>Highways</strong> Authority <strong>of</strong> India Fund (<strong>NHAI</strong> Fund) into which shall be credited grants,<br />

loans, borrowings and any other sum received by the Authority. Expenses <strong>of</strong> the Authority in discharge <strong>of</strong> its functions, expenditure on<br />

establishment and other expenses am to be met from this Fund having regard to the purpose for which such grants, loans or borrowings<br />

are received. However no such Fund was created during the year. The Government <strong>of</strong> India sanctioned and released grants <strong>of</strong> Rs. 12.00<br />

lakhs (Rs. 2.00 lakhs in Jan. 19<strong>90</strong> and Rs. 10.00 lakhs in March 19<strong>90</strong>), but the Authority has accounted for only the grant <strong>of</strong> Rs. 2.00<br />

lakhs during the year.<br />

4. Source <strong>of</strong> Income<br />

During the year there was no business activity. The Authority incurred an expenditure <strong>of</strong> Rs. 2.66 lakhs on its establishment against the<br />

grant <strong>of</strong> Rs. 2.00 lakhs accounted for by it.<br />

5. &unmarked Financial Results<br />

AMOUNT@s. in Lahbs)<br />

al<br />

bl<br />

cl<br />

dl<br />

Capital<br />

Reserves & Surplus<br />

Borrowings<br />

Current Liabilities & Provisions<br />

Total<br />

-<br />

-<br />

-<br />

2.09<br />

2.09<br />

al Fixed Assets<br />

bl Investments<br />

cl Current Assets, Loans<br />

and Advances (Cash 8r Bank balance)<br />

dl<br />

Misc. Expenditure (Debit<br />

Balance <strong>of</strong> Pr<strong>of</strong>it 8r Loss A/ C><br />

‘TCit4<br />

Capital Employed<br />

Net Worth<br />

-<br />

-<br />

1.43<br />

0.66<br />

< 2.09<br />

c-1 0.66<br />

Nil<br />

20

6. Liquidity<br />

0 The percentage <strong>of</strong> Current Assets to Current Liabilities which is a measure <strong>of</strong> liquidity<br />

was 68.4 as at the end <strong>of</strong> <strong>1989</strong>+0.<br />

ii)<br />

The percentage <strong>of</strong> Quick Assets to Current Liabilities which is another measure<br />

<strong>of</strong> liquidity was 68.4 as at the end <strong>of</strong> <strong>1989</strong>-<strong>90</strong>.<br />

7. General<br />

The Authority has not framed its Accounting Policies, Accounting Manual, tariff for services, and system <strong>of</strong> Internal Control.<br />

8. Comments on Accounts<br />

other Income-Rs. 2.00 lakhs (Sch. 11)<br />

Grant <strong>of</strong> Rs. 10.00 lakhs sanctioned by the Government <strong>of</strong> India, Ministry <strong>of</strong> Surface Transport, in March 19<strong>90</strong> and received by the<br />

Authority vide cheque dated 31.03.19<strong>90</strong> to meet the expenditure on the establishment <strong>of</strong> the Authority has not been accounted for in<br />

the current year. As stipulated in Section 18 <strong>of</strong> the <strong>NHAI</strong> Act, 1988, it should have been credited to the <strong>NHAI</strong> Fund and recognised in<br />

the Pr<strong>of</strong>it and Loss Account to the extent it matched with the related costs. This has resulted in understatement <strong>of</strong> ‘other income’ by the<br />

Rs. 0.66 lakhs, <strong>NHAI</strong> Pund by Rs. 9.34 lakhs and Current Assets by Rs. 10.00 lakhs.<br />

sd/-<br />

DATED : 22 MARCH, 19<strong>96</strong><br />

PLACE : NEW DELHI.<br />

(T. G. SRINIVASAN)<br />

Principal Director <strong>of</strong> Commercial Audit<br />

And Ex.-Officio Member, Audit Board - I,<br />

New Delhi<br />

I have examined the foregoing Accounts and Balance Sheet <strong>of</strong> the <strong>National</strong> <strong>Highways</strong> Authority <strong>of</strong> India. I have obtained all the<br />

information and explanations that I have required and subject to the observations in the separate Audit <strong>Report</strong>, I certify as a result <strong>of</strong> my<br />

audit that, in my opinion these Accounts and Balance Sheet are properly drawn up so as to exhibit a true and fair view <strong>of</strong> the state <strong>of</strong><br />

affairs <strong>of</strong> the Authority according to the best <strong>of</strong> my information and explanations given to me and as shown by the books <strong>of</strong> the<br />

Authority.<br />

scw-<br />

DATED : 22 MARCH 19<strong>96</strong>.<br />

PLACE : NEW DELHI.<br />

MANAGEMENT REPLIES <strong>TO</strong> AUDIT REPORT<br />

ON ACCOUNTS FOR THE FINANCIAL YEAR <strong>1989</strong>-<strong>90</strong><br />

(T. G. SRINIVASAN)<br />

Principal Director <strong>of</strong> Commercial Audit<br />

And Ex-Officio Member, Audit Board - I,<br />

New Delhi<br />

SL. No. 1 to 7 is i&maw.<br />

Sl. No. :- 8 In the 11th Board meeting held on 24.01.1997 the Authority has revised its Accounting policy No. 1 and to conform to<br />

accrual concept <strong>of</strong> accounting as observed by audit, Grants will now be accounted for on accrual basis.<br />

21

NATIONAL HIGHWAYS AUTHORITY OF INDIA<br />

(Jidnism <strong>of</strong> Surface Transport)<br />

Balane Sheet as at Mst March, 15<strong>90</strong><br />

Sl.No<br />

Capltaland Schedule Current PrcviolM Plopeqalld Current PreviouS<br />

IAlhlliw Yept YaU Assets.<br />

YF<br />

No. Ok> Qle.1 Sl.No.<br />

1. Capital 1<br />

- - 5.<br />

Fixed Assets<br />

7 - -<br />

2. Reserve & 2<br />

Surplus<br />

- -<br />

Gross Block<br />

Less : Depreciation<br />

Net Block<br />

3. Borrowings<br />

Secured Loans 3<br />

4<br />

6.<br />

-<br />

- 7.<br />

Investment<br />

(At cost)<br />

Current Assets,<br />

Loans<br />

& Advances.<br />

8 - -<br />

9<br />

Un-Secured Loans 4<br />

a> Inventories<br />

b> Sundry debtors<br />

- -<br />

- -<br />

4. Current Liabilities<br />

and provisions<br />

c) Deposits, Loans &<br />

advances<br />

- -<br />

Current Liabilites 5<br />

2,08,898.65<br />

d) Interest accrued on<br />

Investments<br />

- -<br />

Provisions 6<br />

e) Cash & Bank<br />

1,42,519.25<br />

8.<br />

Misc. Expenditure<br />

(To the extent not<br />

written <strong>of</strong>f or adjusted)<br />

10 - -<br />

9.<br />

Pr<strong>of</strong>it & Loss<br />

Account<br />

66,379.40<br />

(Debit balance if any.)<br />

TUtd<br />

WWH3.65 -<br />

2,08,@8.65 -<br />

SCWc--m’<br />

Subject to Notes atached.<br />

22

NATIONAL HIGHWAYS AUTHORITY OF INDIA<br />

(lbfhWy <strong>of</strong> Surface Tramport)<br />

PROFIT AND LOSS ACCOUNT FOR THE PERIOD<br />

15TH JUNE, <strong>1989</strong> <strong>TO</strong> 31ST MARCH, 19<strong>90</strong>.<br />

I. INCOME<br />

Value <strong>of</strong> Work done<br />

Other income<br />

Interest (Gross)<br />

Net Increase/Decrease in<br />

Work-in-progress ( + > / ( - ><br />

II. EXPENDITURE<br />

Construction Stores/<br />

Material Consumed.<br />

Other stores, spares and<br />

tools etc. consumed<br />

Works Expenses<br />

Personnel & Administrative<br />

Finance Charges<br />

Depreciation.<br />

Pr<strong>of</strong>kJLoss before Taxation<br />

Less/Add: Provision for Taxation<br />

Pr<strong>of</strong>it/Loss after Taxation<br />

Add/Less : Prior period items (new) (+> (-1<br />

Pr<strong>of</strong>it / Loss<br />

Less : Transfer to Capital Reserve<br />

Less : Transfer to other specific<br />

Reserve/Fund 7 9<br />

Less/Add: Transfer to/Transfer from<br />

General Reserve (+> (-1<br />

Add/Less : Surplus/Deficit brought<br />

forward from previous year (+> c-1<br />

Surplus/Deficit carried to Balance Sheet<br />

- -<br />

11 2,00,000.00<br />

12 -<br />

13<br />

-<br />

- -<br />

14 -<br />

2,00,000.00<br />

15 2,66,379.40<br />

16 -<br />

07 -<br />

Total<br />

2X$,379.40<br />

(4 66,379.M<br />

(-> 66,379.40<br />

-<br />

c-1 66,379.40<br />

-<br />

-<br />

-<br />

C-1 66,379.40<br />

-<br />

-<br />

-<br />

-<br />

-<br />

-<br />

-<br />

-<br />

-<br />

-<br />

-<br />

-<br />

-<br />

-<br />

-<br />

-<br />

-<br />

-<br />

-<br />

sd/-<br />

CHAIRMAN, <strong>NHAI</strong>.<br />

23

SCHEDULE FORMING PART OF THE<br />

BALANCE SHEET AS. AT MARCH, 31, 19<strong>90</strong>.<br />

1<br />

i) Capital<br />

ii) N. H. A. I. Pund<br />

(Additions and deductions since last balance<br />

sheet to be shown under each <strong>of</strong> the specified heads)<br />

i) Capital Reserves<br />

ii) General Reserves<br />

iii) Any other Reserves/Fund (Nature to be specified)<br />

iv) Credit balance in P & L A / C.<br />

- -<br />

- -<br />

i) Loans from Govt. <strong>of</strong> India<br />

ii) Loans from Banks<br />

iii) Other Loans<br />

(Interest accrued and due to be shown separately.<br />

Nature <strong>of</strong> security to be specified)<br />

i) Loans from Govt. <strong>of</strong> India<br />

ii) Loans from Banks<br />

iii) Other Loans<br />

(Interest accrued and due to be shown separately)<br />

i) Liability for sundry creditors<br />

ii) Other liabilities<br />

iii) Grants received in surplus<br />

iv) Deposits held on account <strong>of</strong> others (if applicable)<br />

a) Employees<br />

b) Sundry parties<br />

ci) Contractors<br />

d) Suppliers<br />

v) Others (to be specified)<br />

- -<br />

2,08,898.65 -<br />

- -<br />

-<br />

-<br />

-<br />

2,08,898.65<br />

-<br />

-<br />

-<br />

-<br />

-<br />

i) Provisions for taxes<br />

ii) Provisions for gratuity<br />

iii) Provisions for Leave<br />

Salary and Pension Contributions<br />

iv) Other provisions.<br />

- -<br />

- -<br />

Sd/-<br />

CHAIRMAN;, <strong>NHAI</strong>.<br />

24

7<br />

GrQss~oekatco!3t Depnciatlon NetBlQck<br />

As at Additions Adjustment/ Total. As at For the Adjuetcd/ Totar At<br />

156.89 DedlmiQ?ls catas 15.6.89 year rhduaed Dep. 15.6.89 3&o<br />

for the at WQ<br />

yepr 31.3.<strong>90</strong> 31.3.<strong>90</strong><br />

5.<br />

6.<br />

aI/-<br />

CHAIRMAN N.H.A.I.<br />

25

investment -.<br />

i) Govt. Securities<br />

iii Other than Govt. Securities (Nature to be specified)<br />

- - -<br />

- -<br />

As taken valued & certified by the management)<br />

i) Tools<br />

ii) Stores & Spares (including intransit)<br />

iii) Construction Stores/materials<br />

iv) Work-in-Progress<br />

- -<br />

- -<br />

- -<br />

- -<br />

- -<br />

(Specify separately more than six months and less than six months)<br />

-Consideredgood<br />

(Specify separately more than six<br />

months and less than six months)<br />

- Considered doubtful Less : Provision for doubtful debts<br />

- -<br />

i) Deposits<br />

ii) Advances to Staff<br />

iii) Advances_to<br />

a) Mobilisation Advance<br />

b) Material Advance<br />

iv) Advance to Suppliers<br />

v) Claims recoverable<br />

vi) Prepaid expenses<br />

vii) Advance Taxes<br />

viii) Security deposits & retention money<br />

ix) Claims recoverable<br />

- -<br />

- -<br />

- -<br />

- -<br />

- -<br />

- -<br />

-<br />

-<br />

-<br />

-<br />

-<br />

26

i) Cash & Cheques in hand 1,ooo.oo -<br />

- -<br />

- -<br />

including stamps<br />

ii) Balance with Scheduled Banks<br />

- On deposits accounts<br />

(Including interest accrued & due)<br />

On current accounts<br />

On margin money account<br />

iii) Balances with Non scheduled banks<br />

- On deposits accounts<br />

(Including interest accrued)<br />

- On current accounts<br />

- On margin money account<br />

- Remittance in transit<br />

1,41,519.25 -<br />

- -<br />

\ - -<br />

- -<br />

- -<br />

- -<br />

- -<br />

1,42,519.25 -<br />

( Misc. Expenditure to the extent not written <strong>of</strong>f.<br />

Sd/-<br />

CHAIRMAN - NHAX<br />

SCHEDULES FORMING PART OF .THE PROFIT AND LOSS<br />

ACCOUfiT FOR THE PERIOD<br />

FROM 15TH JUNE, <strong>1989</strong> <strong>TO</strong> 31ST MARCH, 19<strong>90</strong>.<br />

1. * Hire Charges<br />

2. Grants-in-aid received from Govt. during the year<br />

3. Consultancy fee etc.<br />

‘4. Fee for service rendered<br />

5. Agency charges<br />

6. Surplus from seminars and trainings<br />

organised (Net)<br />

7. Pr<strong>of</strong>it on sale <strong>of</strong> fixed assets<br />

written <strong>of</strong>f<br />

8. Misc. Receipts.<br />

SCHEDULE<br />

Intenst<br />

i> From banks on deposits<br />

ii) From employees on advances<br />

iii> From others<br />

.<br />

27<br />

- -<br />

2,00,000.00 -<br />

- -<br />

- -<br />

- -<br />

- -<br />

- -<br />

- -<br />

2,00,000.00 -<br />

- -<br />

- -<br />

- ’ -

Work - in - progress<br />

L e s s : -<br />

_ -<br />

Net Increase / Decrease<br />

a3m<br />

Electricity Power & Fuel<br />

survey Expenses<br />

Consultancy Expenses<br />

Payment’ to Contractors<br />

Escalation Claims<br />

b> ReDair<br />

Roads & bhdges<br />

Buildings<br />

Plant, Machinery & Equipment<br />

dQlh!xs<br />

Insurance :<br />

(Plant, Machinery & equipment)<br />

Technical studies & Consultancy charges<br />

Research & Development expenses.<br />

-<br />

-<br />

-<br />

-<br />

- -<br />

- -<br />

Salaries, wages, allowances &<br />

bonus, Workman Staff Welfare expenses.<br />

Provident Pund<br />

Pension & leave salary<br />

Others<br />

Rent for Office accommodation<br />

Rates and Taxes<br />

Repairs & Maintenance - Others<br />

xnsurance<br />

Honoraria fee and other<br />

Pr<strong>of</strong>essional charges.<br />

Agency LB Commission charges<br />

69J339.75<br />

141.65<br />

6!3,5%1.40<br />

-<br />

6,942.OO<br />

-<br />

-<br />

76,923-b<br />

1,69,598.00 -<br />

- -<br />

- -<br />

- -<br />

2<strong>90</strong>0.00 -<br />

\ - -<br />

28

13,202.00 ,<br />

%hmJ -<br />

-<br />

191.00 -<br />

*<br />

- rC<br />

-<br />

- -<br />

,<br />

-<br />

-<br />

- -<br />

t<br />

scu-<br />

CHAIRMAN - NNAI<br />

.:”<br />

‘1<br />

29

GROUPIMGLE -<br />

Sub-Total(Rs.)<br />

Total OW<br />

i) Water for Works - -<br />

ii) Electricity for works - -<br />

iii) Power & Fuel - -<br />

(Heavy vehicles & Equipments)<br />

i) Tyres, Tubes, Batteries as<br />

per Grouping Schedule No. 2 -<br />

- -<br />

ii) Other expenses. - -<br />

i) Insurance<br />

Construction works - -<br />

Plant & Machinery/Heavy vehicles - -<br />

ii) Registration expenses Works) - -<br />

iii) Registration expenses (Plant, Machinery / Heavy vehicles. - -<br />

G-ROUPING SCHEDULE - Sub-Total (lb.)<br />

Total (Rp.1<br />

b.<br />

i) Salaries & Wages & other staff benefits 61,533.75<br />

ii) Daily wages -<br />

iii) Over Time Allowance -<br />

iv) Rent for residence/ Licence fee<br />

8,306.OO<br />

v) Bonus -<br />

vi) Incentives -<br />

vii) Transport subsidy -<br />

viii) Leave Encashment -<br />

i) Medical reimbursement 141.65<br />

ii) Staff Welfare :<br />

Welfare expenses -<br />

Kitchen, Utensil & appliances -<br />

iii) Seminar / Training expenses -<br />

iv) L. T. C. -<br />

v) Liveries -<br />

30<br />

69,839.75<br />

* 141.65

Sub-Total 6.)<br />

Total Qrs.1<br />

to:<br />

i) Provident Fund<br />

ii) Pension & Leave salary<br />

iii) Others<br />

-<br />

6,942.OO<br />

-<br />

6,942.OO<br />

i) Office Equipment -<br />

ii> j&ht Vehr&s -<br />

Petrol, Oil & Lubricants as per grouping schedule No. 2 -<br />

Tyres, tubes, batteries as per grouping schedule No. 2 -<br />

Others -<br />

i> Light vehicles -<br />

ii) Others -<br />

i><br />

ii)<br />

iii)<br />

iv)<br />

VI<br />

Fee <strong>of</strong> liaison work<br />

Consultancy fee<br />

Honoraria fee<br />

Light & Statutory fee<br />

Pr<strong>of</strong>essional Charges<br />

-<br />

-<br />

2,<strong>90</strong>0.OO<br />

-<br />

-<br />

2<strong>90</strong>0.00<br />

6<br />

0<br />

ii)<br />

iii)<br />

Local conveyance<br />

Travelling Expenses (India)<br />

Travelling Expenses (Abroad)<br />

2,581.OO<br />

-<br />

-<br />

2,581.OO<br />

Printing & Stationery<br />

Postage, Telegram including air freight<br />

Telephones & telex<br />

178.00<br />

-<br />

13.024.00<br />

13,202.OO<br />

8<br />

Audit fee<br />

a) For taxation<br />

b) For other services<br />

Reimbursement <strong>of</strong> Travelling & out <strong>of</strong> pocket expenses.<br />

-<br />

i) Entertainment Expenses<br />

ii) Tender bond expenses<br />

iii) Member fee<br />

iv> Publications<br />

v) Other Miscellaneous expenses<br />

vi) Sundry balances written <strong>of</strong>f<br />

vii) Staff recruitment expenses<br />

viii) Deficit from Seminars/Training Organised (Net)<br />

-<br />

191.00<br />

-<br />

_.. 3 3<br />

, 191.00

GROUPINGSCHEDULE -<br />

Sub-Total (l&s.><br />

Total tRs.1<br />

NCE CHARGES<br />

3-<br />

i> Interest on deferred credits<br />

ii) Penal interest on deferred credits<br />

b) P<br />

9 Guarantee commission,<br />

ii> .Bankcharges<br />

dprior<br />

a) Debits (Iteniwise)<br />

b) Credits (Itemwise)<br />

c) Net Balance (a - b)<br />

- -<br />

- -<br />

- -<br />

- -<br />

- -<br />

- -<br />

- -<br />

sd/-<br />

CHAIRMAN - <strong>NHAI</strong><br />

NATIONAL HIGHWAYS AUTHORITY OF INDIA<br />

Wnistry<strong>of</strong>StnfaceTranspcut)<br />

NOTES FORMING THE PART OF BALANCE SHEET<br />

& PROFIT & LOSS ACCOUNT<br />

Note1 - No debts/Loans and Advances were due from Members <strong>of</strong> the Authority<br />

Note2 - The maximum amount due from Members <strong>of</strong> the Authority at any time during the year is ‘Nil’.<br />

Note3 ‘- Grants in aid received during <strong>1989</strong>-<strong>90</strong> has been treated as other Income under Schedule 11.<br />

N-4 - Payment <strong>of</strong> rent in respect <strong>of</strong> <strong>of</strong>fice accommodation has been accounted/made on provisional basis to IRCC Ltd.<br />

Note5 - Payment made on account <strong>of</strong> telephones includes, telephone charges prior to 15 June <strong>1989</strong> 1. e. prior to the period<br />

<strong>of</strong> incorporation <strong>of</strong> the Authority.<br />

Note6 - Previous year’s figures have not been given as this is the fii year’s account.<br />

TQ,<br />

Sd/-<br />

CHAIRMAN - <strong>NHAI</strong><br />

32

The Secretary to the Govt. <strong>of</strong> India<br />

Ministry <strong>of</strong> Surface Transport,<br />

Transport Bhawan, Sansad Marg,<br />

New Delhi - 110 001.<br />

Sir,<br />

SUbjCCt:AUditRepaa(OtlthC acco&mm<strong>of</strong><strong>National</strong>~~~Au~<strong>of</strong>India,<br />

NewD&fnrtheyeara19<strong>90</strong>-91~1994-!25.<br />

.<br />

,,<br />

I am to forward herewith a copy <strong>of</strong> the account&<strong>of</strong> the <strong>National</strong> <strong>Highways</strong> Authority <strong>of</strong> India for the years 19<strong>90</strong>-91 to 199495 duly certified<br />

together with the Audit <strong>Report</strong> thereon for necessary action under Section 24 <strong>of</strong> the <strong>National</strong> <strong>Highways</strong> Authority bf India Act, 198%<br />

2. It is requested that the date <strong>of</strong> presentation <strong>of</strong> the Accounts and the Audit <strong>Report</strong> to Parliament may kindly be Intimated. After the<br />

<strong>Report</strong> is presented to Parliament, 25 copies <strong>of</strong> these documents as presented may kindly be furnished to this <strong>of</strong>fice and one copy may also<br />

be sent to the <strong>of</strong>fice <strong>of</strong> the Comptroller & Auditor General <strong>of</strong> India.<br />

~ 3. The receipt <strong>of</strong> this letter may kindly be acknowledged.<br />

Yours faithfully,<br />

(Rekha Guzi<br />

Principal Director <strong>of</strong> Commercial Audit<br />

And Ex-<strong>of</strong>ficio Member, Audit Board - I,<br />

New Delhi.<br />

Encl : As above.<br />

No. RS/4-24/95-<strong>96</strong>/<strong>NHAI</strong>/A/C’s/710.<br />

Dated : 2Q.02.1997<br />

1. Copy toge(her with a copy <strong>of</strong> the Audit <strong>Report</strong> as issued to the Govt. <strong>of</strong> India, Ministry <strong>of</strong> Surface Transport, New D&i farwarded to<br />

the<br />

India, New Delhi, It is requested that the said report may kindly be tr~ted as secret till the<br />

same is presented to‘Parliament as required under Section 24 <strong>of</strong> the <strong>National</strong> <strong>Highways</strong> Authority <strong>of</strong> India Act, 1988.<br />

Sd/-<br />

tRekha Gupta)<br />

Principal Director <strong>of</strong> Commercial Audit<br />

And I.?x-<strong>of</strong>ficIo Member, Audit Board - I,<br />

New Delhi<br />

33

1. Introduction<br />

AUDIT REPORT ON THE ACCOUNTS OF<br />

‘NATIONAL HIGHWAYS AUTHORITY OF INDIA FOR THE YEAR 19<strong>90</strong>-91.<br />

APPENDIX - IV B<br />

The <strong>National</strong> <strong>Highways</strong> Authority <strong>of</strong> India (the Authority) was constituted on 13 June <strong>1989</strong> under Section 3(l) <strong>of</strong> the <strong>National</strong> <strong>Highways</strong><br />

Authority <strong>of</strong> India Act, 1988&e <strong>NHAI</strong> Act) mainly to survey, develop, maintain and manage the <strong>National</strong> <strong>Highways</strong>, to construct <strong>of</strong>fices<br />

or workshops, to establish and maintain hotels, restaurants and rest rooms at or near the highways vested in or entrusted to it, to regulate<br />

and control the plying <strong>of</strong> vehicles, to develop and provide consultancy and construction services and collect fee for services or benefits<br />

rendered, in accordance with Section 16 <strong>of</strong> the Act.<br />

The audit <strong>of</strong> accounts <strong>of</strong> the Authority has been carried out under Section 19(2) <strong>of</strong> the Comp$.oller and Auditor General’s (DPC) Act, 1971.<br />

I_<br />

2. capital smcture<br />

The <strong>NHAI</strong> Act (Section 12) provides that all non-recurring expenditure incurred by or for the Central Government or in connection with<br />

the purpose <strong>of</strong> any <strong>National</strong> Highway or any stretch there<strong>of</strong>, so vested in or entrusted to the Authority and declared to be capital expenditure<br />

by the Central Government would. be treated as Capital provided by the Central Government to the Authority. No other source <strong>of</strong><br />

additional capital by Central Government or otherwise was provided in the Act. Since its incorporation (<strong>1989</strong>-<strong>90</strong>), no national highway or<br />

stretch there<strong>of</strong> has been vested in or entrusted to the Authority by the Government in terms <strong>of</strong> Section 11 <strong>of</strong> the Act. Therefore, there was<br />

no capital at the end <strong>of</strong> the year.<br />

3. Fund<br />

’ The Act provides for creation <strong>of</strong> the <strong>National</strong> <strong>Highways</strong> Authority <strong>of</strong> India Fund (<strong>NHAI</strong> Fund) into which shall be credited grants, loans,<br />

borrowings and any other sum received by the Author&y. Expenses <strong>of</strong> t.hqAuthorlty in d&charge <strong>of</strong> its functions, expenditure on establishment<br />

and other expenses are to be met from this fund having regard to the purpose for which such grants, loans or borrowings are received.<br />

Accordingly <strong>NHAI</strong> Fund was created during the year and expenditure <strong>of</strong> the Authority met out <strong>of</strong> it.<br />

4. Source <strong>of</strong> Income<br />

During this year also there-was no business activity. The Authority incurred an expenditure <strong>of</strong> Rs. 5.48 lakhs on its establishmentagainst the<br />

grant <strong>of</strong> Rs. 10.00 lakhs accounted for by it on receipt basis.<br />

5. s-FlnandalReaults<br />

The summarised financial results <strong>of</strong> the Authority during the last two years were as under :<br />

IJAB= 15 June <strong>1989</strong> to 19<strong>90</strong>-91<br />

31-March 19<strong>90</strong><br />

Capital<br />

Reserves & Surplus<br />

4.81<br />

3<br />

:<br />

Borrowings<br />

cunentIiabilities% F?cw%om(exdudingprovlsionfor~~.<br />

2.09 1.41<br />

Provision for gratuity<br />

Total<br />

s<br />

2.09 6.22<br />

ASSETS<br />

FIXED ASSETS - Gross Block<br />

Less Accumulated Depreciation<br />

Net Block<br />

Investments<br />

Current Assets, Loans and Advances<br />

Misc.Expenditllm@&itBalance<strong>of</strong>FloRt&LossL4/c~<br />

Capital Employed (h + j - d><br />

NetWorth(a+b-k)<br />

Working Capital (j - d)<br />

1.43<br />

0.66<br />

2.09<br />

(-)0.66<br />

[j ;:gj<br />

cRupeesInhkhS~<br />

1.08<br />

0.11<br />

0.97<br />

5.25<br />

6.22<br />

4.81<br />

4.81<br />

3.84<br />

34

6. uquidity<br />

The percentage <strong>of</strong> Current Assets to Current Liabilities increased from 68.4 at the end <strong>of</strong> <strong>1989</strong>-<strong>90</strong> to 332.3 at the end <strong>of</strong> 19<strong>90</strong>-91.<br />

7. Sour&s and Wlisati~ <strong>of</strong> Funds<br />

Funds amounting to Rs. 5.58 lakhs from internal and external sources were generated and utilised by the Authority during the,year as under:<br />

PARTICULARS<br />

I. sources<strong>of</strong>fllnds<br />

Funds from operation<br />

Pr<strong>of</strong>it before tax<br />

Add depreciation<br />

Total<br />

II. Utulsatlon<strong>of</strong> F u n d s<br />

Increase in fixed assets<br />

Increase in working capital<br />

Total<br />

8. System <strong>of</strong> Accounting And internal Control<br />

, The Authority has nk framed its Accounting Manual, Tariff for services, and system <strong>of</strong> Internal control.<br />

,9. Comments on Accounts .’<br />

5.47<br />

0.11<br />

AMOUNT (Rs. in L+hs><br />

5.58<br />

1.08<br />

4.50<br />

5.58<br />

Income<br />

Other Income (Schedule 11) Rs. 10.00 lakhs<br />

The above amount representing grant sanctioned and released by the Government <strong>of</strong> India, Ministry <strong>of</strong> Surface Transport in March<br />

19<strong>90</strong> for meeting expenditure on establishment <strong>of</strong> the Authority for the financial year <strong>1989</strong>-<strong>90</strong> as also mentioned in Para 8 <strong>of</strong> the<br />

Audit <strong>Report</strong> on the accounts <strong>of</strong> the ‘Authority for <strong>1989</strong>-<strong>90</strong>, should have been credited to <strong>NHAI</strong> fund as per Seaon 18 <strong>of</strong> the N H<br />

A I Act 1988 instead <strong>of</strong> crediting the grant to P&L Account. /1<br />

The Authority has not furnished the utilisation certificate <strong>of</strong> grant to Government <strong>of</strong> India as required in<br />

.r<br />

terms <strong>of</strong> the sanction and<br />

sought the orders <strong>of</strong> the sanctioning authority on unutilized grant.<br />

The grant sanctioned to meet the expenditure for the year <strong>1989</strong>-<strong>90</strong> was utilized for meeting the establishment expendimre for the year<br />

19<strong>90</strong>-91 without the approval <strong>of</strong> the Sanctioning Authority.<br />

Though the Authority has not been exempted from paying income tax yet it has neither filed incoine tax return nor disclosed this<br />