Guidelines for Investment in Road Sector - National Highways ...

Guidelines for Investment in Road Sector - National Highways ...

Guidelines for Investment in Road Sector - National Highways ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Government of India<br />

M<strong>in</strong>istry of Shipp<strong>in</strong>g, <strong>Road</strong> Transport and <strong>Highways</strong><br />

<strong>Guidel<strong>in</strong>es</strong> <strong>for</strong> <strong>Investment</strong> <strong>in</strong><br />

<strong>Road</strong> <strong>Sector</strong><br />

Not just roads... build<strong>in</strong>g a NATION

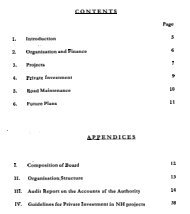

Index<br />

Executive Summary 4<br />

Current Scenario 5<br />

F<strong>in</strong>anc<strong>in</strong>g <strong>National</strong> Highway<br />

Projects 7<br />

Public Private Partnership <strong>in</strong><br />

Highway Development 10<br />

Revenue Risks and Mitigation 26<br />

Overview of Successful Projects 29<br />

Work Plan-II (2010-11) 31<br />

Policy Framework 35<br />

Foreign Direct <strong>Investment</strong> Policy 37<br />

Tax Environment 39<br />

Repatriation of <strong>Investment</strong>s<br />

and Profits Earned <strong>in</strong> India<br />

45<br />

Adm<strong>in</strong>istrative Framework 47<br />

About NHAI 49<br />

Annexure 51<br />

KPMG <strong>in</strong> India<br />

<strong>for</strong><br />

<strong>National</strong> <strong>Highways</strong> Authority of India<br />

The <strong>in</strong><strong>for</strong>mation conta<strong>in</strong>ed here<strong>in</strong> is of a general nature and is not <strong>in</strong>tended to<br />

address the circumstances of any particular <strong>in</strong>dividual or entity. Although we<br />

endeavor to provided accurate and timely <strong>in</strong><strong>for</strong>mation, there can be no<br />

guarantee that such <strong>in</strong><strong>for</strong>mation is accurate as of the date it is received or that<br />

it will cont<strong>in</strong>ue to be accurate <strong>in</strong> the future. No one should act on such<br />

<strong>in</strong><strong>for</strong>mation without appropriate professional advice after a thorough<br />

exam<strong>in</strong>ation of the particular situation.

4<br />

<strong>Guidel<strong>in</strong>es</strong> <strong>for</strong> <strong>Investment</strong> <strong>in</strong> <strong>Road</strong> <strong>Sector</strong><br />

Executive Summary<br />

The <strong>National</strong> Highway network of the country spans<br />

about 70,548 km. The <strong>National</strong> Highway Development<br />

Project (NHDP), cover<strong>in</strong>g a length of about 55,000 km<br />

of highways, is India's largest road development<br />

programme <strong>in</strong> its history. In many ways, this ambitious<br />

and path-break<strong>in</strong>g <strong>in</strong>itiative of the Government of<br />

India, which began <strong>in</strong> the last decade acknowledged<br />

the importance of private sector <strong>in</strong> India's<br />

<strong>in</strong>frastructure development.<br />

The consistent policy and <strong>in</strong>stitutional framework,<br />

which has been the backbone of the INR 3,00,000<br />

1<br />

Crore (USD 60 billion ) NHDP, also conveys the <strong>in</strong>tent<br />

and commitment of successive governments<br />

to encourage <strong>in</strong>creased private sector participation<br />

<strong>in</strong> develop<strong>in</strong>g the arterial road network of the country<br />

to world class standards. More than 60 percent of the<br />

estimated <strong>in</strong>vestment requirement is expected to be<br />

privately f<strong>in</strong>anced.<br />

The early success of Public-Private-Partnerships (PPP)<br />

<strong>in</strong> the NHDP, arguably, set the tone <strong>for</strong> similar<br />

<strong>in</strong>itiatives <strong>in</strong> other <strong>in</strong>frastructure sectors and has<br />

provided the s<strong>in</strong>gle largest opportunity <strong>for</strong> private<br />

f<strong>in</strong>anc<strong>in</strong>g and management of <strong>in</strong>frastructure services.<br />

Build Operate Transfer (BOT) concession contracts<br />

with an estimated value of USD 9.2 billion (<strong>in</strong>clud<strong>in</strong>g<br />

2<br />

BOT/DBFOT -Toll and BOT-Annuity contracts) have<br />

been awarded under various packages till date<br />

and these projects are expected to be fully operational<br />

by 2015-16.<br />

With several key projects on the anvil (<strong>in</strong>clud<strong>in</strong>g<br />

6- lan<strong>in</strong>g of 4-laned roads, expressways and<br />

port connectivity projects) and the <strong>in</strong>creas<strong>in</strong>g<br />

<strong>in</strong>terest ev<strong>in</strong>ced by domestic and <strong>for</strong>eign players <strong>in</strong> the<br />

sector, NHAI is happy to present to you, the <strong>Guidel<strong>in</strong>es</strong><br />

<strong>for</strong> <strong>Investment</strong> <strong>in</strong> the <strong>Road</strong> <strong>Sector</strong>, with specific focus<br />

on NHDP.<br />

NHAI believes that this document would serve as a<br />

useful guide <strong>for</strong> potential <strong>in</strong>vestors, developers and<br />

stakeholders <strong>in</strong>terested <strong>in</strong> participat<strong>in</strong>g <strong>in</strong> India's<br />

ambitious highway development programme.<br />

1. INR 50 = 1 USD : figures approximated<br />

2. Design Build F<strong>in</strong>ance Operate & Transfer<br />

(DBFOT)

<strong>Guidel<strong>in</strong>es</strong> <strong>for</strong> <strong>Investment</strong> <strong>in</strong> <strong>Road</strong> <strong>Sector</strong> 5<br />

Current Scenario<br />

India has an extensive road network of 3.3 million km –<br />

the second largest <strong>in</strong> the world. The <strong>National</strong><br />

<strong>Highways</strong> have a total length of 70,548 km and serve<br />

as the arterial road network of the country. It is<br />

estimated that more than 70 per cent of freight and 85<br />

per cent of passenger traffic <strong>in</strong> the country is be<strong>in</strong>g<br />

handled by roads. While <strong>Highways</strong>/ Expressways<br />

constitute only about 2 per cent of the length of all<br />

roads, they carry about 40 per cent of the road traffic<br />

lead<strong>in</strong>g to a stra<strong>in</strong> on their capacity. The number of<br />

vehicles on roads has been grow<strong>in</strong>g at compounded<br />

annual growth rate (CAGR) of over 8% <strong>in</strong> the last 5<br />

years (2003-04 to 2008-09).<br />

The development of <strong>National</strong> <strong>Highways</strong> is the<br />

responsibility of the Government of India. The<br />

Government of India has launched major <strong>in</strong>itiatives to<br />

upgrade and strengthen <strong>National</strong> <strong>Highways</strong> through<br />

various phases of the NHDP. NHDP is one of the<br />

largest road development programmes to be<br />

undertaken by a s<strong>in</strong>gle authority <strong>in</strong> the world and<br />

<strong>in</strong>volves widen<strong>in</strong>g, upgrad<strong>in</strong>g and rehabilitation of<br />

about 55,000 km, entail<strong>in</strong>g an estimated <strong>in</strong>vestment<br />

of INR 3,00,000 Crore (USD 60 billion).<br />

The <strong>National</strong> <strong>Highways</strong> Authority of India (NHAI) is<br />

mandated to implement the <strong>National</strong> <strong>Highways</strong><br />

Development Project (NHDP). Most of the projects<br />

have been developed or are under development on<br />

Public Private Partnership (PPP) basis through Build<br />

Operate and Transfer (BOT)-Annuity and BOT-Toll<br />

mode (these have been expla<strong>in</strong>ed <strong>in</strong> detail <strong>in</strong> later<br />

section of the brochure). Typically, <strong>in</strong> an annuity<br />

project, the project IRR is expected to be 12-14% and<br />

equity IRR would be 14 -16%. For toll projects, where<br />

the concessionaire assumes the traffic risk, the<br />

project IRR is expected to be around 14-16% and<br />

3<br />

equity IRR around 18-20% .<br />

The NHDP is be<strong>in</strong>g implemented under several<br />

phases:<br />

4-lan<strong>in</strong>g of the Golden Quadrilateral (GQ) and North-<br />

South and East- West (NS-EW) Corridors-(NHDP I & II)<br />

Phase I ma<strong>in</strong>ly <strong>in</strong>volves widen<strong>in</strong>g (to 4 lanes) and<br />

upgrad<strong>in</strong>g of 7,498 km of the national highway<br />

network and has four component packages:<br />

1.<br />

2.<br />

3.<br />

4.<br />

Highway network l<strong>in</strong>k<strong>in</strong>g the four metropolitan<br />

cities <strong>in</strong> India i.e. Delhi-Mumbai-Chennai-Kolkata,<br />

cover<strong>in</strong>g a length of 5,846 km, popularly known<br />

as the Golden Quadrilateral (GQ) project.<br />

<strong>Highways</strong> along the North-South (NS) and East-<br />

West (EW) corridors, cover<strong>in</strong>g a length of 981 km<br />

Port connectivity projects cover<strong>in</strong>g a length<br />

of 356 km; and<br />

Other highway projects, cover<strong>in</strong>g a length of 315<br />

km<br />

Phase-II <strong>in</strong>volves widen<strong>in</strong>g and improvement of the<br />

NS-EW corridors (not covered under Phase-I) cover<strong>in</strong>g<br />

a distance of 6,647 km, besides provid<strong>in</strong>g connectivity<br />

to major ports on the east and west coasts of India and<br />

some other projects. This <strong>in</strong>cludes 6,161 km of NS-EW<br />

corridors and 486 km of other highways. The total<br />

length of the NS-EW network under Phases I & II is<br />

about 7,200 km.<br />

4-lan<strong>in</strong>g of the GQ has almost been completed. Phase<br />

II is expected to be largely completed by December<br />

2010.<br />

3. CRISIL Research

6<br />

<strong>Guidel<strong>in</strong>es</strong> <strong>for</strong> <strong>Investment</strong> <strong>in</strong> <strong>Road</strong> <strong>Sector</strong><br />

Upgradation of 12,109 km (NHDP-III)<br />

NHDP-III <strong>in</strong>volves upgradation of 12,109 km (ma<strong>in</strong>ly 4-<br />

lan<strong>in</strong>g) of high density national highways, through the<br />

Build, Operate & Transfer (BOT) mode at a cost of INR<br />

80,626 Crore (USD 16.1 billion).<br />

The project consists of stretches of <strong>National</strong><br />

<strong>Highways</strong> carry<strong>in</strong>g high volume of traffic, connect<strong>in</strong>g<br />

state capitals with the NHDP network under Phases I<br />

and II and provid<strong>in</strong>g connectivity to places of<br />

economic, commercial and tourist importance.<br />

2-lan<strong>in</strong>g of 20,000 km with paved shoulders (NHDP-IV)<br />

With a view to provid<strong>in</strong>g balanced and equitable<br />

distribution of the improved/widened highways<br />

network throughout the country, NHDP-IV envisages<br />

upgrad<strong>in</strong>g of 20,000 km of such highways <strong>in</strong>to 2-lane<br />

highways, at an <strong>in</strong>dicative cost of INR 27,800 Crore<br />

(USD 5.6 billion). This will ensure that their capacity,<br />

speed and safety match m<strong>in</strong>imum benchmarks <strong>for</strong><br />

national highways. The government has already<br />

approved strengthen<strong>in</strong>g of 5,000 km to 2-lane paved<br />

shoulders on BOT (Toll/ Annuity) under NHDP-IV A at a<br />

cost of INR 6,950 Crore (USD 1.4 billion).<br />

6-lan<strong>in</strong>g of 6,500 km (NHDP-V)<br />

Under NHDP-V, 6-lan<strong>in</strong>g of the 4-lane highways<br />

compris<strong>in</strong>g the GQ and certa<strong>in</strong> other high density<br />

stretches, will be implemented on BOT basis at an<br />

estimated cost of INR 41,210 Crore (USD 8.2 billion).<br />

These corridors have been 4-laned as part of the GQ <strong>in</strong><br />

Phase-I of NHDP. Implementation of <strong>in</strong>itial set of<br />

projects has already commenced and the entire<br />

package is expected to be completed by 2012. Of the<br />

6,500 km proposed under NHDP-V, about 5,700 km<br />

would be taken up <strong>in</strong> the GQ and the balance 800 km<br />

would be selected on the basis of predef<strong>in</strong>ed eligibility<br />

criteria.<br />

Development of 1,000 km of expressways (NHDP-VI)<br />

With the grow<strong>in</strong>g importance of urban centres of<br />

India, particularly those located with<strong>in</strong> a few hundred<br />

kilometers of each other, expressways would be both<br />

viable and beneficial. The Government has approved<br />

1,000 km of expressways to be developed on a BOT<br />

basis, at an <strong>in</strong>dicative cost of INR 16,680 Crore (USD<br />

3.3 billion). These expressways would be constructed<br />

on new alignments.<br />

Other Highway Projects of 700 km (NHDP-VII)<br />

The development of r<strong>in</strong>g roads, bypasses, grade<br />

separators and service roads are considered<br />

necessary <strong>for</strong> full utilisation of highway capacity as<br />

well as <strong>for</strong> enhanced safety and efficiency. For this, a<br />

programme <strong>for</strong> development of such features at an<br />

<strong>in</strong>dicative cost of INR 16,680 Crore has been approved<br />

by the Government. Apart from the high density<br />

corridors, a substantial part of the <strong>National</strong> <strong>Highways</strong><br />

network would also require development dur<strong>in</strong>g the<br />

11th Plan period. These sections are characterised by<br />

low density of traffic. Some of these stretches fall <strong>in</strong><br />

backward and <strong>in</strong>accessible areas and others are<br />

of strategic importance. The development of these<br />

categories of <strong>National</strong> <strong>Highways</strong> would be carried out<br />

primarily through budgetary resources.<br />

4<br />

Current Status of NHDP<br />

50000<br />

48829<br />

40000<br />

35000<br />

30000<br />

25000<br />

25549<br />

20000<br />

15000<br />

14250<br />

10000<br />

9030<br />

5000<br />

0<br />

Completed Work <strong>in</strong> Progress To be Awarded Total<br />

th<br />

4. As on 30 April, 2010.

<strong>Guidel<strong>in</strong>es</strong> <strong>for</strong> <strong>Investment</strong> <strong>in</strong> <strong>Road</strong> <strong>Sector</strong> 7<br />

F<strong>in</strong>anc<strong>in</strong>g <strong>National</strong> Highway Projects<br />

Traditionally, f<strong>in</strong>anc<strong>in</strong>g <strong>for</strong> development of <strong>National</strong><br />

<strong>Highways</strong> <strong>in</strong> India was from the budgetary resources<br />

of the Government of India. In order to augment the<br />

available resources, loans have also been raised from<br />

multilateral agencies like World Bank, Asian<br />

Development Bank (ADB) and Japan Bank of<br />

International Cooperation (JBIC).<br />

NHAI has earlier received loans directly from<br />

multilateral agencies (highway project). These loans<br />

are expected to be repaid through the toll <strong>in</strong>come from<br />

the project. The <strong>in</strong>terest rate <strong>for</strong> the project is<br />

determ<strong>in</strong>ed accord<strong>in</strong>g to ADB's pool based variable<br />

lend<strong>in</strong>g rate system <strong>for</strong> US dollar loans. Around 80 per<br />

cent of the external assistance is provided to NHAI as<br />

a grant by the Central government. The balance is<br />

made available as long-term loans to NHAI, with the<br />

Centre bear<strong>in</strong>g the <strong>for</strong>eign exchange risk. Such loans<br />

are usually provided <strong>for</strong> 15-25 years with a moratorium<br />

of 5 years.<br />

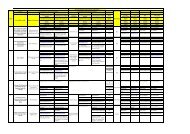

Summary of Externally Aided Projects<br />

Category<br />

Awarded<br />

Awarded<br />

Completed<br />

No. of Contracts Length <strong>in</strong> km Cost (INR Crore) No. of Contracts Length <strong>in</strong> km<br />

World Bank Funded Projects<br />

NHDP Phase I<br />

18<br />

983<br />

5538<br />

14<br />

699<br />

GQ<br />

18<br />

983<br />

5538<br />

14<br />

699<br />

Others<br />

-<br />

-<br />

-<br />

-<br />

-<br />

NHDP Phase II EW Corridors<br />

12<br />

482<br />

3208<br />

-<br />

-<br />

Sub-Total A<br />

30<br />

1465<br />

8746<br />

14<br />

699<br />

ADB Funded Projects<br />

NHDP Phase I<br />

13<br />

766<br />

2374<br />

10<br />

615<br />

GQ<br />

12<br />

718<br />

2315<br />

9<br />

567<br />

Others<br />

1<br />

48<br />

59<br />

1<br />

48<br />

NHDP Phase II NS & EW Corridors<br />

31<br />

1636<br />

7565<br />

14<br />

848<br />

Sub-Total B<br />

44<br />

2402<br />

9939<br />

24<br />

1463<br />

JBIC Funded Projects<br />

NHDP Phase I<br />

7<br />

150<br />

634<br />

7<br />

150<br />

GQ<br />

5<br />

111<br />

333<br />

5<br />

111<br />

Others<br />

2<br />

39<br />

301<br />

2<br />

39<br />

Sub-Total C<br />

7<br />

150<br />

634<br />

7<br />

150<br />

Grand Total (A+B+C)<br />

81<br />

4017<br />

19319<br />

45<br />

2312

8<br />

<strong>Guidel<strong>in</strong>es</strong> <strong>for</strong> <strong>Investment</strong> <strong>in</strong> <strong>Road</strong> <strong>Sector</strong><br />

Presently, the development and ma<strong>in</strong>tenance of<br />

<strong>National</strong> <strong>Highways</strong> is f<strong>in</strong>anced by follow<strong>in</strong>g modes:<br />

1.<br />

2.<br />

3.<br />

4.<br />

Government's general budgetary sources<br />

Dedicated accruals under the Central <strong>Road</strong> Fund<br />

(by levy of cess on fuel)<br />

Lend<strong>in</strong>g by <strong>in</strong>ternational <strong>in</strong>stitutions:<br />

• World Bank<br />

• ADB<br />

• JBIC<br />

Private f<strong>in</strong>anc<strong>in</strong>g under PPP frameworks<br />

• Build Operate and Transfer/Design Build<br />

5<br />

F<strong>in</strong>ance Operate and Transfer (DBFOT) -<br />

<strong>Investment</strong> by private firm and return through<br />

levy and retention of user fee<br />

• Build Operate and Transfer (Annuity) - BOT<br />

(Annuity) - <strong>Investment</strong> by private firm and<br />

return through semi-annual payments from<br />

NHAI as per bid.<br />

• Special Purpose Vehicle – SPV (with equity<br />

participation by NHAI)<br />

• Market Borrow<strong>in</strong>gs<br />

NHAI also has a provision <strong>for</strong> provid<strong>in</strong>g grant upto 40%<br />

of the project cost to make projects commercially<br />

viable. However, the quantum of grant is decided on a<br />

case to case basis and typically constitutes the bid<br />

parameter <strong>in</strong> BOT projects generally not viable based<br />

on toll revenues alone. The disbursement of such<br />

grant is subject to provisions of the project concession<br />

agreements (please refer CD <strong>for</strong> provisions <strong>in</strong> the<br />

Model Concession Agreement).<br />

st<br />

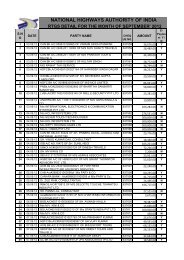

Approved F<strong>in</strong>anc<strong>in</strong>g Plan of NHDP (as on 31 March, 2009)<br />

Phase Particulars<br />

Projected For (Kms) INR Crore<br />

Cess and Market Borrow<strong>in</strong>gs<br />

18,846<br />

NHDP-I<br />

External Assistance<br />

BOT/SPV<br />

7862<br />

3592<br />

Total (At 1999 Prices)<br />

7498<br />

30300<br />

NHDP-II<br />

Cess and Market Borrow<strong>in</strong>gs<br />

External Assistance<br />

23420<br />

7609<br />

BOT/SPV<br />

Total (At 2002 Prices)<br />

6647<br />

3310<br />

34339<br />

NHDP-III<br />

Budgetary Support<br />

Cess and Market Borrow<strong>in</strong>gs<br />

12809<br />

17688<br />

BOT/SPV<br />

Total (At 2004 Prices)<br />

12109<br />

50129<br />

80626<br />

NHDP-IV A<br />

Private <strong>Sector</strong><br />

Government Spend<strong>in</strong>g<br />

4608<br />

2342<br />

Total (At 2006 Prices)<br />

5000<br />

6950<br />

NHDP-V<br />

Cess and Market Borrow<strong>in</strong>gs<br />

BOT/SPV<br />

Total (At 2006 Prices)<br />

6500<br />

5519<br />

35691<br />

41210<br />

NHDP-VI<br />

Cess and Market Borrow<strong>in</strong>gs<br />

BOT/SPV<br />

Total (At 2006 Prices)<br />

1000<br />

7680<br />

9000<br />

16680<br />

NHDP-VII<br />

Cess and Market Borrow<strong>in</strong>gs<br />

BOT/SPV<br />

Total (At 2007 Prices)<br />

700<br />

6302<br />

10378<br />

16680<br />

5. The developer has flexibility <strong>in</strong> project design so long as the build and service quality is <strong>in</strong> l<strong>in</strong>e with<br />

prescribed standards set out <strong>in</strong> the Standards and Specification Manuals.

<strong>Guidel<strong>in</strong>es</strong> <strong>for</strong> <strong>Investment</strong> <strong>in</strong> <strong>Road</strong> <strong>Sector</strong> 9<br />

NHAI projects, with higher traffic volumes, have also been bid out on the basis of Negative Grant (upfront<br />

payment payable by successful bidder to NHAI). However, under the revised MCA, projects under BOT/<br />

DBFOT framework have also been awarded on a revenue share basis, where the bidder offer<strong>in</strong>g the highest<br />

revenue share (subject to technical qualification) is awarded the project.<br />

Projects awarded on Negative Grant<br />

<strong>Road</strong> Section<br />

Length (Km.)<br />

Estimated<br />

Cost<br />

(INR Crore)<br />

Estimated<br />

Cost<br />

(USD Million)<br />

Grant<br />

(INR Crore)<br />

Grant<br />

(USD Million)<br />

Delhi-Gurgaon<br />

28<br />

710<br />

142<br />

61<br />

12<br />

Rajkot Bypass-Jetpur<br />

36<br />

388<br />

77<br />

59<br />

12<br />

Panipat elevated <strong>Highways</strong><br />

10<br />

270<br />

54<br />

96<br />

19<br />

Salem- Karur<br />

42<br />

253<br />

51<br />

46<br />

9<br />

Krishnagiri - Thopurghat<br />

62<br />

372<br />

74<br />

140<br />

28<br />

T<strong>in</strong>divanam-Ulundurpet<br />

71<br />

480<br />

96<br />

152<br />

30<br />

Thirssur-Angamali<br />

40<br />

312<br />

62<br />

84<br />

17<br />

Jalandhar- Amritsar<br />

49<br />

263<br />

60<br />

7<br />

1<br />

Ambala-Zirakpur<br />

36<br />

298<br />

60<br />

106<br />

21<br />

Dhule-Pimpalgaon<br />

118<br />

556<br />

111<br />

59<br />

12<br />

Vadodara Bharuch<br />

83<br />

660<br />

132<br />

471<br />

94<br />

Bharuch-Surat<br />

65<br />

492<br />

118<br />

504<br />

101<br />

Projects awarded on Revenue Share Basis<br />

<strong>Road</strong> Section<br />

Length (Km.)<br />

Estimated<br />

Cost<br />

(INR Crore)<br />

Estimated<br />

Cost<br />

(USD Million)<br />

Revenue Share (%)<br />

Surat-Dahisar<br />

239<br />

2600<br />

619<br />

38%<br />

Gurgaon-Jaipur<br />

225<br />

1900<br />

452<br />

48%<br />

Panipat-Jalandhar<br />

291<br />

2200<br />

523<br />

20%<br />

Chennai-Tada<br />

42<br />

317<br />

76<br />

17%<br />

Vijayawada-Chilkaluripet<br />

85<br />

1173<br />

280<br />

2%

10<br />

<strong>Guidel<strong>in</strong>es</strong> <strong>for</strong> <strong>Investment</strong> <strong>in</strong> <strong>Road</strong> <strong>Sector</strong><br />

Public Private Partnership <strong>in</strong><br />

Highway Development<br />

Public Private Partnerships (PPP) are go<strong>in</strong>g to be the<br />

ma<strong>in</strong> mode of delivery <strong>for</strong> future phases of NHDP.<br />

While there are a number of <strong>for</strong>ms of PPP, the<br />

common <strong>for</strong>ms that are popular <strong>in</strong> India and have been<br />

used <strong>for</strong> development of <strong>National</strong> <strong>Highways</strong> are:<br />

•<br />

•<br />

•<br />

Build, Operate and Transfer (Toll) Model<br />

Build, Operate and Transfer (Annuity) Model<br />

Special Purpose Vehicle (SPV) <strong>for</strong> Port<br />

Connectivity Projects<br />

NHAI is also propos<strong>in</strong>g to award projects under a long<br />

term Operations, Ma<strong>in</strong>tenance and Transfer (OMT)<br />

concession.<br />

BOT (Toll)<br />

Private developers/ operators, who <strong>in</strong>vest <strong>in</strong> tollable<br />

highway projects, are entitled to collect and reta<strong>in</strong> toll<br />

revenues <strong>for</strong> the tenure of the project concession<br />

period. The tolls are prescribed by NHAI on a per<br />

vehicle per km basis <strong>for</strong> different types of vehicles.The<br />

Government <strong>in</strong> the year 1995 passed the necessary<br />

legislation on collection of toll. (Refer the <strong>National</strong><br />

<strong>Highways</strong> Fee [Determ<strong>in</strong>ation of Rates and Collection]<br />

Rules 2008).<br />

A Model Concession Agreement (MCA) has been<br />

developed to facilitate speedy award of contracts.This<br />

framework has been successfully used <strong>for</strong> award of<br />

BOT concessions.The MCA has been revised recently<br />

and current projects are be<strong>in</strong>g awarded under the<br />

revised MCA (refer enclosed CD <strong>for</strong> overview of MCA<br />

framework).<br />

BOT (Annuity)<br />

The concessionaire bids <strong>for</strong> annuity payments from<br />

NHAI that would cover his cost (construction,<br />

operations and ma<strong>in</strong>tenance) and an expected return<br />

on the <strong>in</strong>vestment. The bidder quot<strong>in</strong>g the lowest<br />

annuity is awarded the project. The annuities are paid<br />

semi-annually by NHAI to the concessionaire and<br />

l<strong>in</strong>ked to per<strong>for</strong>mance covenants. The concessionaire<br />

does not bear the traffic/ toll<strong>in</strong>g risk <strong>in</strong> these contracts.<br />

Operate, Ma<strong>in</strong>ta<strong>in</strong> and Transfer (OMT) Concession<br />

NHAI has recently taken up award of select highway<br />

projects to private sector players under an OMT<br />

Concession. Till recently, the tasks of toll collection<br />

and highway ma<strong>in</strong>tenance were entrusted with toll<strong>in</strong>g<br />

agents/ operators and subcontractors, respectively.<br />

These tasks have been <strong>in</strong>tegrated under the OMT<br />

concession. Under the concession private operators<br />

would be eligible to collect tolls on these stretches <strong>for</strong><br />

ma<strong>in</strong>ta<strong>in</strong><strong>in</strong>g highways and provid<strong>in</strong>g essential<br />

services (such as emergency/ safety services).<br />

Special Purpose Vehicle <strong>for</strong> Port Connectivity<br />

Projects<br />

NHAI has also taken up development of port<br />

connectivity projects by sett<strong>in</strong>g up Special Purpose<br />

Vehicles (SPVs) where<strong>in</strong> NHAI contributes upto 30%<br />

of the project cost as equity.The SPVs also have equity<br />

participation by port trusts, State Governments or their<br />

representative entities. The SPVs also raise loans <strong>for</strong><br />

f<strong>in</strong>anc<strong>in</strong>g the projects. SPVs are authorised to collect<br />

user fee on the developed stretches to cover<br />

repayment of debts and <strong>for</strong> meet<strong>in</strong>g the costs of<br />

operations and ma<strong>in</strong>tenance.<br />

International Competitive Bidd<strong>in</strong>g Process<br />

General procedure <strong>for</strong> selection of concessionaires<br />

adopted by NHAI is a two-stage bidd<strong>in</strong>g process.<br />

Projects are awarded as per the model documents-<br />

Request <strong>for</strong> Qualification (RFQ), Request <strong>for</strong> Proposal<br />

(RFP) and Concession Agreement - provided by the<br />

M<strong>in</strong>istry of F<strong>in</strong>ance. NHAI amends the model<br />

documents based on project specific requirements.<br />

(Please refer CD <strong>for</strong> these model documents). The<br />

processes <strong>in</strong>volved <strong>in</strong> both stages are set out as<br />

follows:

<strong>Guidel<strong>in</strong>es</strong> <strong>for</strong> <strong>Investment</strong> <strong>in</strong> <strong>Road</strong> <strong>Sector</strong> 11<br />

Stage 1: Pre-qualification on the basis of Technical and<br />

F<strong>in</strong>ancial expertise of the firm and its track record <strong>in</strong><br />

similar projects which meets the threshold technical<br />

and f<strong>in</strong>ancial criteria set out <strong>in</strong> the RFQ Document.<br />

Some of the recent significant amendments <strong>in</strong> the pre<br />

qualification document are set out below:<br />

1. Determ<strong>in</strong>ation of technical and f<strong>in</strong>ancial capacity of<br />

consortium applicants <strong>in</strong> proportion to the<br />

committed equity hold<strong>in</strong>g of each consortium<br />

member <strong>in</strong> the project SPV. For illustration-<br />

- If Company A has been assessed to have an<br />

experience score (measured <strong>in</strong> terms of<br />

payments made/received and/or revenues<br />

received <strong>for</strong> eligible projects) of 5000 and<br />

Company B has been assessed to have an<br />

experience score of 2500, <strong>in</strong> a Consortium with<br />

sharehold<strong>in</strong>g of A as 60% and B as 40%, then<br />

the weighted experience score of the<br />

Consortium shall be:<br />

5000*60%+2500* 40%=800<br />

- If Company A with a net worth of INR 1000<br />

Crore (USD 200 million) & Company B with a<br />

net worth of INR 500 Crore (USD 100 million)<br />

are bidd<strong>in</strong>g together as a Consortium with<br />

sharehold<strong>in</strong>g of A as 60% and B as 40% then<br />

the weighted f<strong>in</strong>ancial score of the Consortium<br />

shall be:<br />

1000*60%+500*40%= INR 800 Crore (USD<br />

160 million)<br />

2. In case of <strong>for</strong>eign companies, a certificate from a<br />

qualified external auditor who audits the books of<br />

accounts of the Applicant or the Consortium<br />

Member <strong>in</strong> the <strong>for</strong>mats provided <strong>in</strong> the country<br />

where the project has been executed shall be<br />

accepted, provided it conta<strong>in</strong>s all the <strong>in</strong><strong>for</strong>mation<br />

as required <strong>in</strong> the prescribed <strong>for</strong>mat of the RFQ.<br />

3. Applicants/Bidders would need to provide an<br />

undertak<strong>in</strong>g to NHAI that the EPC works of the<br />

project would be executed only by such EPC<br />

Contractors who have completed atleast a s<strong>in</strong>gle<br />

highway project of more than 20% of the<br />

estimated project cost of the project or INR 500<br />

Crore (USD 100 million) which ever is less <strong>in</strong> the<br />

preced<strong>in</strong>g 5 f<strong>in</strong>ancial years from the application<br />

due date.<br />

Notice <strong>in</strong>vit<strong>in</strong>g tenders is posted on the web site and<br />

published <strong>in</strong> lead<strong>in</strong>g newspapers<br />

Stage 2: Commercial bids from pre-qualified bidders<br />

are <strong>in</strong>vited through issue of RFP. Generally, the<br />

duration between Stage 1 and 2 is about 30-45 days.<br />

Wide publicity is given to NHAI tenders so as to attract<br />

attention of lead<strong>in</strong>g contractors/ developers/<br />

consultants.<br />

The Government has put <strong>in</strong> place appropriate policy,<br />

<strong>in</strong>stitutional and regulatory mechanisms <strong>in</strong>clud<strong>in</strong>g<br />

a set of fiscal and f<strong>in</strong>ancial <strong>in</strong>centives to<br />

encourage <strong>in</strong>creased private sector participation <strong>in</strong><br />

road sector.<br />

Summary of recent policy changes <strong>in</strong> the project<br />

development and award process are set out<br />

below:<br />

1. All applicants meet<strong>in</strong>g the threshold technical and<br />

f<strong>in</strong>ancial experience criteria set out <strong>in</strong> the RFQ shall<br />

be eligible to participate <strong>in</strong> the RFP stage. Earlier<br />

only the top 5-6 applicants shortlisted based on<br />

qualification criteria were eligible to submit<br />

f<strong>in</strong>ancial bids <strong>for</strong> projects.<br />

2. NHAI is empowered to accept s<strong>in</strong>gle bids based on<br />

assessment of reasonableness of the bids.<br />

3. Overall cap on Viability Gap Fund<strong>in</strong>g (VGF)<br />

<strong>in</strong>creased from 5% to 10% <strong>for</strong> the entire six-lan<strong>in</strong>g<br />

programme (5080 km).<br />

4. For <strong>in</strong>dividual projects with low traffic <strong>in</strong> the Golden<br />

Quadrilateral (GQ) corridors, VGF cap has been

12<br />

<strong>Guidel<strong>in</strong>es</strong> <strong>for</strong> <strong>Investment</strong> <strong>in</strong> <strong>Road</strong> <strong>Sector</strong><br />

<strong>in</strong>creased upto 20% of the project cost with an<br />

overall cap of 500 km of roads <strong>in</strong> the project<br />

network.<br />

5. Equity Support under VGF has been <strong>in</strong>creased to<br />

40% of project cost. Earlier, 20% of project cost<br />

was provided as equity support <strong>in</strong> construction<br />

phase and 20% as Operations & Ma<strong>in</strong>tenance<br />

Support<br />

6. Modifications <strong>in</strong> Standard RFQ, RFP and<br />

Concession Agreement structures <strong>for</strong> <strong>National</strong><br />

Highway Projects<br />

a. Term<strong>in</strong>ation provisions under capacity<br />

augmentation situations modified to give more<br />

com<strong>for</strong>t to <strong>in</strong>vestors and lenders. The<br />

concession period can be extended upto 5<br />

years to yield a post tax equity IRR of 16%, <strong>in</strong><br />

the event of capacity augmentation option<br />

exercised by the concessionaire.<br />

b. Exit option allowed <strong>for</strong> pr<strong>in</strong>cipal promoters of<br />

road SPVs after two years from commercial<br />

operations date (COD). Promoters were earlier<br />

required to hold a m<strong>in</strong>imum of 26% of the<br />

SPV’s sharehold<strong>in</strong>g at all times dur<strong>in</strong>g the<br />

tenure of the Concession.<br />

c. Threshold limit <strong>for</strong> common control<br />

(sharehold<strong>in</strong>g) of entities <strong>in</strong> compet<strong>in</strong>g<br />

Applicants and/ or their Associates <strong>for</strong> the<br />

purposes of determ<strong>in</strong><strong>in</strong>g Conflict of <strong>in</strong>terest,<br />

raised from 5% to 25%. Any such conflict of<br />

<strong>in</strong>terest aris<strong>in</strong>g at the prequalification stage<br />

shall be deemed to subsist at the bidd<strong>in</strong>g stage<br />

only if such applicants attract<strong>in</strong>g the conflict of<br />

<strong>in</strong>terest provisions submit their bids.<br />

d. Threshold technical capability <strong>for</strong> claim<strong>in</strong>g<br />

eligible project experience has been reduced to<br />

a range between 5-10% of estimated project<br />

cost of the subject project <strong>in</strong> lieu of 10-20% of<br />

estimated project cost of the subject project<br />

earlier.<br />

e. The threshold technical experience score <strong>for</strong><br />

the purpose of prequalification will be equal to<br />

the estimated project cost of the earlier subject<br />

project. This was, earlier equal to twice the<br />

estimated project cost of the subject project.<br />

f. Where the projects are bid out on a revenue<br />

share basis, the base premium (fixed amount)<br />

(revenue share proposed by the successful<br />

bidder) will be <strong>in</strong>creased at the rate of 5 per cent<br />

year on year with respect to the immediately<br />

preceed<strong>in</strong>g year <strong>for</strong> the entire tenure of the<br />

concession.<br />

6<br />

The a<strong>for</strong>esaid changes are expected to further<br />

<strong>in</strong>centivise private <strong>in</strong>vestment <strong>in</strong> road/highway<br />

projects.<br />

Opportunities <strong>for</strong> Private Investors/ Developers<br />

More than 60% of the projected <strong>in</strong>vestment<br />

requirement <strong>for</strong> the NHDP (USD 60 billion) is expected<br />

to be privately f<strong>in</strong>anced, primarily through the<br />

BOT/DBFOT (Toll) route, offer<strong>in</strong>g enormous<br />

opportunities. With a large number of new projects on<br />

offer under PPP <strong>in</strong> the road sector, there exists several<br />

<strong>in</strong>vestment opportunities <strong>for</strong> <strong>in</strong>vestors and companies<br />

with diverse bus<strong>in</strong>ess l<strong>in</strong>es such as eng<strong>in</strong>eer<strong>in</strong>g<br />

companies, civil work contractors, O&M contractors,<br />

toll operators, construction equipment manufacturers<br />

etc. and other stakeholders such as advisors,<br />

f<strong>in</strong>anciers and sector professionals. Only about 15 per<br />

cent of the total highways <strong>in</strong> India are 4-laned and the<br />

sheer potential <strong>for</strong> <strong>in</strong>vestments <strong>in</strong> this sector is likely<br />

to create opportunities <strong>in</strong> the core construction<br />

<strong>in</strong>dustry which may also be attractive <strong>for</strong> <strong>for</strong>eign<br />

players.<br />

The opportunity <strong>for</strong> private players <strong>in</strong> the road sector<br />

can be broadly categorised <strong>in</strong> two segments:<br />

a) Infrastructure Development<br />

6. As per recommendations of B K Chaturvedi Committee

<strong>Guidel<strong>in</strong>es</strong> <strong>for</strong> <strong>Investment</strong> <strong>in</strong> <strong>Road</strong> <strong>Sector</strong> 13<br />

Development<br />

Projects<br />

BOT/<br />

DBFOT - Toll<br />

BOT -<br />

Annuity<br />

OMT<br />

SPV<br />

Construction<br />

Equipment<br />

Material<br />

Technology<br />

Ma<strong>in</strong>tenance<br />

Toll<strong>in</strong>g<br />

Services<br />

Equipment<br />

Infrastructure Development<br />

<strong>Road</strong>s<br />

Urban<br />

Transportation<br />

Pvt Bus<br />

Service<br />

Truck<strong>in</strong>g<br />

Perishables<br />

Conta<strong>in</strong>ers<br />

Bulk<br />

Logistics & Services<br />

Tourism<br />

Luxury<br />

Buses<br />

Risk Framework of Model Concession Agreement<br />

The MCA has been developed <strong>in</strong> consultation with all<br />

stakeholders based on <strong>in</strong>ternationally accepted<br />

pr<strong>in</strong>ciples and best practices. Throughout, it seeks to<br />

achieve reasonable balance of risks and rewards <strong>for</strong> all<br />

the participants.<br />

As an underly<strong>in</strong>g pr<strong>in</strong>ciple, risks have been allocated to<br />

the parties that are best suited to manage them.<br />

Project risks have, there<strong>for</strong>e, been assigned to<br />

the private sector to the extent it is capable of<br />

manag<strong>in</strong>g them. The transfer of such risks and<br />

responsibilities to the private sector would <strong>in</strong>crease<br />

the scope of <strong>in</strong>novation lead<strong>in</strong>g to efficiencies <strong>in</strong> cost<br />

and services.<br />

Model Concession Agreement (MCA) <strong>for</strong> PPP<br />

Projects<br />

The highways sector <strong>in</strong> India has witnessed significant<br />

<strong>in</strong>vestment <strong>in</strong> recent years. For susta<strong>in</strong><strong>in</strong>g the <strong>in</strong>terest<br />

of private participants, a clear risk-shar<strong>in</strong>g and<br />

regulatory framework has been spelt out <strong>in</strong> the Model<br />

Concession Agreement (MCA). The MCA has been<br />

developed to facilitate speedy award of contracts. This<br />

framework has been successfully used <strong>for</strong> award of<br />

BOT concessions. The MCA has been revised and<br />

current projects are be<strong>in</strong>g awarded under the<br />

revised MCA. This framework addresses the issues,<br />

which are typically important <strong>for</strong> PPP, such as<br />

unbundl<strong>in</strong>g of risks and rewards, symmetry of<br />

obligations between the pr<strong>in</strong>cipal parties, equitable<br />

shar<strong>in</strong>g of costs and obligations, and risk mitigation<br />

options under various scenarios <strong>in</strong>clud<strong>in</strong>g <strong>for</strong>ce<br />

majeure and term<strong>in</strong>ation, under transparent and fair<br />

procedures.<br />

With the <strong>in</strong>troduction of the MCA, the risks <strong>in</strong>volved <strong>in</strong><br />

project and contractual issues, hitherto, have been<br />

assuaged, and the entire process from <strong>in</strong>vitation to bid<br />

to implementation of the project is transparent.<br />

MCA's risk framework is briefly discussed below:<br />

The commercial and technical risks relat<strong>in</strong>g to<br />

construction, operation and ma<strong>in</strong>tenance are<br />

allocated to the concessionaire, as it is best suited to<br />

manage them. Other commercial risks, such as the<br />

rate of growth of traffic, are also allocated to the<br />

concessionaire.<br />

Key Concessionaire Risk/Obligations<br />

• Construction Risk - The concessionaire is required<br />

to commence construction works when the<br />

f<strong>in</strong>ancial close is achieved or earlier date that the<br />

parties may determ<strong>in</strong>e by mutual consent. The<br />

concessionaire shall not be entitled to seek<br />

compensation <strong>for</strong> any prior commencement and<br />

shall do it solely at his own risk.<br />

• O & M Risk - Concessionaire to operate and<br />

ma<strong>in</strong>ta<strong>in</strong> the project facility (<strong>in</strong>cludes road and<br />

road <strong>in</strong>frastructure as specified <strong>in</strong> the concession<br />

agreement). Failure to repair and rectify any defect<br />

or deficiency with<strong>in</strong> specified period shall be<br />

considered as breach of responsibility.<br />

• F<strong>in</strong>ancial Risk -The concessionaire shall at its cost,<br />

expenses and risk make such f<strong>in</strong>anc<strong>in</strong>g<br />

arrangement as would be necessary to f<strong>in</strong>ance<br />

the cost of the project and to meet project<br />

requirements and other obligations under the<br />

agreement, <strong>in</strong> a timely manner.

14<br />

<strong>Guidel<strong>in</strong>es</strong> <strong>for</strong> <strong>Investment</strong> <strong>in</strong> <strong>Road</strong> <strong>Sector</strong><br />

• Traffic Risk - The MCA provides <strong>for</strong> <strong>in</strong>crease or<br />

decrease of the concession period <strong>in</strong> the event the<br />

actual traffic falls short or exceeds the target<br />

traffic. NHAI stipulates the target traffic dur<strong>in</strong>g the<br />

year specified <strong>in</strong> project specific concession<br />

th<br />

agreement, which is usually around the 10 year<br />

from the date of sign<strong>in</strong>g of the agreement. The<br />

target traffic is determ<strong>in</strong>ed based on 5%<br />

Compounded Annual Growth Rate (CAGR) over<br />

the base year traffic <strong>for</strong> the project. MCA also<br />

provides <strong>for</strong> term<strong>in</strong>ation of the agreement if the<br />

average daily traffic <strong>in</strong> any account<strong>in</strong>g year<br />

exceeds the design capacity and cont<strong>in</strong>ues to<br />

exceed <strong>for</strong> three subsequent account<strong>in</strong>g years.<br />

Term<strong>in</strong>ation payments under this scenario will be<br />

commensurate to those applicable under an<br />

Indirect Political Event (See table <strong>in</strong> next section on<br />

page 26).<br />

An overview of revenue risks and mitigation<br />

(<strong>in</strong>clud<strong>in</strong>g Term<strong>in</strong>ation Payment) under the MCA is<br />

provided <strong>in</strong> the next section.<br />

Key NHAI Risk/Obligations<br />

• Land Acquisition Risk: NHAI is responsible <strong>for</strong><br />

acquir<strong>in</strong>g the requisite land <strong>for</strong> the project highway<br />

• Approvals: NHAI will provide all reasonable<br />

support and assistance to the concessionaire <strong>in</strong><br />

procur<strong>in</strong>g applicable permits required from any<br />

Government Instrumentality.<br />

Key Common Risk<br />

• Force Majeure Risk - Force Majeure shall mean<br />

occurrence <strong>in</strong> India of any or all of Non-Political<br />

Event(s), Indirect Political Event(s) and Political<br />

Event(s), which <strong>in</strong>clude the follow<strong>in</strong>g:<br />

Non-Political Event:<br />

• act of God, epidemic, extremely adverse<br />

weather conditions or radioactive contam<strong>in</strong>ation<br />

or ionis<strong>in</strong>g radiation, fire or explosion;<br />

• strikes or boycotts<br />

• the discovery of geological conditions, toxic<br />

contam<strong>in</strong>ation or archaeological rema<strong>in</strong>s on the<br />

Site; or<br />

• any event or circumstances of a nature<br />

analogous to any of the <strong>for</strong>ego<strong>in</strong>g.<br />

Indirect Political Event<br />

• an act of war, <strong>in</strong>vasion, armed conflict or act of<br />

<strong>for</strong>eign enemy, blockade, embargo, riot,<br />

<strong>in</strong>surrection, terrorist or military action,<br />

• civil commotion or politically motivated<br />

sabotage which prevents collection of toll/<br />

fees,<br />

• <strong>in</strong>dustry-wide or state-wide or India-wide<br />

strikes or <strong>in</strong>dustrial action which prevent<br />

collection of toll/ fees,<br />

• any public agitation which prevents collection<br />

of toll/ fees

<strong>Guidel<strong>in</strong>es</strong> <strong>for</strong> <strong>Investment</strong> <strong>in</strong> <strong>Road</strong> <strong>Sector</strong> 15<br />

Political Event<br />

• Change <strong>in</strong> Law,<br />

• compulsory acquisition by any governmental<br />

agency of any project assets or rights of<br />

concessionaire or of the Contractors; or<br />

• unlawful or unauthorised or without jurisdiction<br />

revocation of or refusal to renew or grant<br />

without valid cause any consent or approval<br />

required by developer<br />

Salient features of the MCA<br />

• Substantial part of the project site free from<br />

encumbrances would be handed over to the<br />

concessionaire till the Appo<strong>in</strong>ted Date. Additional<br />

land <strong>in</strong> case of change of scope will need to be<br />

acquired by concessionaire on behalf of the<br />

Authority.<br />

• Additional tollway will not be commissioned<br />

with<strong>in</strong> a specified year, depend<strong>in</strong>g upon the<br />

concession period. M<strong>in</strong>imum user fee <strong>for</strong><br />

additional tollway will be at least 25% higher than<br />

the toll fee on project. Any alternate road,<br />

exceed<strong>in</strong>g 20% of the length of the project<br />

highway, shall not be considered as an additional<br />

tollway.<br />

• The concessionaire will be entitled to nullify any<br />

change of scope order if it causes the cumulative<br />

cost relat<strong>in</strong>g to all change of scope orders to<br />

exceed 5% of the Total Project Cost (TPC) <strong>in</strong> any<br />

cont<strong>in</strong>uous period of 3 years immediately<br />

preced<strong>in</strong>g the date of such Change of Scope<br />

order, or if such cumulative cost exceeds 20% of<br />

the TPC at any time dur<strong>in</strong>g the concession period.<br />

• F<strong>in</strong>ancial close is to be achieved with<strong>in</strong> 180 days<br />

from date of agreement. NHAI may allow<br />

additional period <strong>for</strong> f<strong>in</strong>ancial close on a project<br />

specific basis.<br />

• Grant (upto 40% of TPC) to the concessionaire by<br />

way of equity support and operations &<br />

ma<strong>in</strong>tenance support <strong>in</strong> quarterly <strong>in</strong>stallments.<br />

(B.K.Chaturvedi Committee has recommended<br />

that the entire grant [upto 40% of TPC] can be<br />

provided as equity support).

16<br />

<strong>Guidel<strong>in</strong>es</strong> <strong>for</strong> <strong>Investment</strong> <strong>in</strong> <strong>Road</strong> <strong>Sector</strong><br />

• Concessionaire to pay nom<strong>in</strong>al fee of INR 1 (USD<br />

0.02) per annum throughout the concession<br />

period.<br />

• There is an optional provision <strong>for</strong> capacity<br />

augmentation of exist<strong>in</strong>g 4-lan<strong>in</strong>g to 6-lan<strong>in</strong>g. If<br />

capacity augmentation is not done with<strong>in</strong> the<br />

specified period, the concession period gets<br />

reduced to the number of years specified <strong>in</strong> the<br />

project specific agreement. The option to excuse<br />

from 6-lan<strong>in</strong>g of the Project Highway is available<br />

with both the concessionaire and the Authority<br />

be<strong>for</strong>e the pre-specified 6-lan<strong>in</strong>g date <strong>in</strong> the<br />

concession agreement.<br />

Implementation steps of Project<br />

• Completion of preparatory works <strong>for</strong> the identified<br />

projects<br />

• F<strong>in</strong>alisation of Bidd<strong>in</strong>g Documents<br />

• Invitation of Bids<br />

• Pre bid Conference<br />

• Evaluation of Bids<br />

• Award of Concession<br />

• Sign<strong>in</strong>g of the Agreement<br />

Dispute Resolution<br />

Any dispute aris<strong>in</strong>g out of or <strong>in</strong> relation to the<br />

concession agreement, between the parties is<br />

required to be resolved as per the Dispute Resolution<br />

Procedure (see below) prescribed <strong>in</strong> the Agreement. It<br />

specifies that the parties should attempt to resolve the<br />

dispute amicably and <strong>for</strong> this purpose, the mandate<br />

has been given to an Independent Eng<strong>in</strong>eer to<br />

mediate and assist the parties to arrive at a<br />

settlement. The procedure has been laid out <strong>in</strong><br />

sufficient detail there<strong>in</strong>.<br />

However, upon the failure of such conciliatory<br />

measure, the parties shall resort to Arbitration, which<br />

shall be held <strong>in</strong> accordance with Arbitration and<br />

Conciliation Act, 1996 (based on United Nations<br />

Commission on International Trade Laws - UNCITRAL<br />

model). The seat of arbitration <strong>for</strong> all concession<br />

agreements perta<strong>in</strong><strong>in</strong>g to <strong>National</strong> <strong>Highways</strong> shall<br />

ord<strong>in</strong>arily be at Delhi, however, the place may be<br />

changed by mutual consent of the parties. Each party<br />

is free to nom<strong>in</strong>ate its arbitrator who <strong>in</strong> turn, will<br />

appo<strong>in</strong>t a presid<strong>in</strong>g arbitrator. The Arbitration Tribunal<br />

so constituted can adjudicate any dispute referred to<br />

it, and any other question of law aris<strong>in</strong>g out of such<br />

dispute, <strong>in</strong>clud<strong>in</strong>g its own jurisdiction. The award<br />

passed by such Tribunal, has the sanctity of a 'Decree'<br />

under Indian Law and can be challenged on very<br />

limited counts.<br />

Dispute Resolution Procedure <strong>for</strong> projects under<br />

BOT and Consultancy<br />

• Mediation by the Independent Eng<strong>in</strong>eer: If any<br />

dispute arises between the parties, it is <strong>in</strong> the first<br />

place resolved by the mediation of the<br />

Independent Eng<strong>in</strong>eer. Any dispute, which is not<br />

resolved by mediation of the Independent<br />

Eng<strong>in</strong>eer, is resolved by amicable resolution.<br />

• Amicable Resolution: Any dispute, difference or<br />

controversy of whatever nature between the<br />

parties, aris<strong>in</strong>g under, out of or <strong>in</strong> relation to the<br />

Project Concession Agreement (PCA) is<br />

attempted to be resolved amicably <strong>in</strong> accordance<br />

with the procedure set <strong>for</strong>th <strong>in</strong> the dispute<br />

resolution mechanism. Either party may require<br />

such dispute to be referred to the Chairman, NHAI<br />

and the Chief Executive Officer of the<br />

concessionaire <strong>in</strong> the <strong>in</strong>terim, <strong>for</strong> amicable<br />

settlement. Upon such reference, the two shall<br />

meet at the earliest mutual convenience and <strong>in</strong> any<br />

event not later than 15 days of such reference to<br />

discuss and attempt to amicably resolve the<br />

dispute. If the dispute is not amicably settled<br />

with<strong>in</strong> 15 (fifteen) days of such meet<strong>in</strong>g between<br />

the two, either party may refer the dispute to<br />

arbitration <strong>in</strong> accordance with the provisions of the<br />

PCA.<br />

• Arbitration: Any dispute, which is not resolved<br />

amicably, shall be f<strong>in</strong>ally settled by b<strong>in</strong>d<strong>in</strong>g<br />

arbitration under The Arbitration Act. The<br />

arbitration shall be carried out by a panel of three<br />

arbitrators, one to be appo<strong>in</strong>ted by each party and

<strong>Guidel<strong>in</strong>es</strong> <strong>for</strong> <strong>Investment</strong> <strong>in</strong> <strong>Road</strong> <strong>Sector</strong> 17<br />

the third to be appo<strong>in</strong>ted by the two arbitrators<br />

appo<strong>in</strong>ted by the parties. The party requir<strong>in</strong>g<br />

arbitration shall appo<strong>in</strong>t an arbitrator <strong>in</strong> writ<strong>in</strong>g,<br />

<strong>in</strong><strong>for</strong>m the other party about such appo<strong>in</strong>tment<br />

and call upon the other party to appo<strong>in</strong>t its<br />

arbitrator. If with<strong>in</strong> 15 days of receipt of such<br />

<strong>in</strong>timation the other party fails to appo<strong>in</strong>t its<br />

arbitrator, the party seek<strong>in</strong>g appo<strong>in</strong>tment of<br />

arbitrator may take further steps <strong>in</strong> accordance<br />

with the Arbitration Act.<br />

The Dispute Resolution Procedure <strong>for</strong> EPC<br />

Projects does not <strong>in</strong>volve amicable settlement.<br />

The disputes are referred to the Dispute Review<br />

Board.<br />

• Dispute Review Board: The Board shall comprise<br />

of three members, experienced with the type of<br />

construction <strong>in</strong>volved <strong>in</strong> road works, and with the<br />

<strong>in</strong>terpretation of contractual documents. If, dur<strong>in</strong>g<br />

the contract period, either of the parties is of the<br />

op<strong>in</strong>ion that the Dispute Review Board is not<br />

per<strong>for</strong>m<strong>in</strong>g its functions properly, they may<br />

together disband the Board and reconstitute it.<br />

• Dispute <strong>in</strong>volv<strong>in</strong>g Foreign Contractor(s): In the<br />

case of a dispute with a <strong>for</strong>eign contractor, the<br />

dispute shall be settled <strong>in</strong> accordance with the<br />

provisions of the UNCITRAL Arbitration Rules. The<br />

arbitral tribunal shall consist of three arbitrators,<br />

one each to be appo<strong>in</strong>ted by the employer and the<br />

contractor and the third arbitrator chosen by the<br />

two arbitrators so appo<strong>in</strong>ted by the parties, who<br />

shall further act as the Presid<strong>in</strong>g Arbitrator.<br />

A “Foreign Contractor” means a contractor who is<br />

not registered <strong>in</strong> India and is not a juridical person<br />

under Indian Law.<br />

General Trends <strong>in</strong> Dispute Resolution<br />

The Courts <strong>in</strong> India have been very neutral <strong>in</strong><br />

constru<strong>in</strong>g the documents, <strong>in</strong> the cases aris<strong>in</strong>g out of<br />

tender processes and rely upon terms and conditions<br />

agreed between the parties under the tender<br />

documents. The provisions of the Contract Act and<br />

other legal provisions, cover<strong>in</strong>g the <strong>in</strong>tricate<br />

commercial aspects of the dispute are looked <strong>in</strong>to<br />

very m<strong>in</strong>utely be<strong>for</strong>e pass<strong>in</strong>g any order. The Courts<br />

have, however, been very cautious <strong>in</strong> pass<strong>in</strong>g any<br />

<strong>in</strong>junctive relief <strong>in</strong> disputes aris<strong>in</strong>g out of tender<br />

process and pays due regard to the fairness <strong>in</strong> the<br />

process of issu<strong>in</strong>g tender and selection of bidders,<br />

stage of <strong>in</strong>frastructure development and stakes<br />

(public money) <strong>in</strong>volved. Where complex f<strong>in</strong>ancial<br />

issues are <strong>in</strong>volved, the Courts also seek advice of an<br />

expert committee and consider various factors like<br />

price <strong>in</strong>dex, quality of work, past per<strong>for</strong>mance of<br />

parties, market reputation, etc. The decision <strong>in</strong> each<br />

case may however differ, depend<strong>in</strong>g upon facts of<br />

each case.<br />

OMT Concessions<br />

• The OMT concession would be <strong>for</strong> a maximum<br />

period of 9 years<br />

• The private sector will be selected on the basis of a<br />

competitive bidd<strong>in</strong>g process. The successful<br />

bidder would be the one offer<strong>in</strong>g the highest<br />

7<br />

concession fee to NHAI<br />

• The concessionaire is allowed a period of 45 days<br />

from the date of sign<strong>in</strong>g of the concession<br />

agreement to commence commercial operations<br />

• The OMT concessionaire will pay a fixed<br />

concession fee to NHAI every month and<br />

undertake tasks of toll collection and mobilisation<br />

of funds <strong>for</strong> improvement, operation and<br />

ma<strong>in</strong>tenance of highways<br />

NHAI has identified eight highway sections which are<br />

expected to be completed <strong>in</strong> the next 6 months to be<br />

awarded on OMT basis. The concession<br />

agreements <strong>for</strong> two highway sections have been<br />

signed and the pre-qualification of bidders <strong>for</strong> the<br />

rema<strong>in</strong><strong>in</strong>g six sections is under process. More<br />

sections, where project completion is anticipated <strong>in</strong><br />

the next 6-12 months, are be<strong>in</strong>g planned <strong>for</strong> OMT<br />

concessions.<br />

7. The bidder offer<strong>in</strong>g the maximum amount of first year concession fee or m<strong>in</strong>imum<br />

amount of first year quarter O&M support (<strong>in</strong> case no bidder offers the concession fee).

18<br />

<strong>Guidel<strong>in</strong>es</strong> <strong>for</strong> <strong>Investment</strong> <strong>in</strong> <strong>Road</strong> <strong>Sector</strong><br />

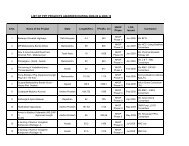

Opportunities <strong>for</strong> <strong>Investment</strong>-State-Wise Projects Under NHDP Phase II<br />

S. No. Stretch NH<br />

Length<br />

(Km)<br />

Estimated Project Cost<br />

(INR Crore)<br />

(USD Million)<br />

STATE: Assam<br />

1<br />

Udarband to Harangajo 54 31 202 40<br />

STATE: Jammu & Kashmir<br />

1<br />

STATE: Kerala<br />

Two Tunnels on Udhampur-Banihal-<br />

Sr<strong>in</strong>agar Section<br />

1A 19 5000 1000<br />

1<br />

Walayar-Vadakkancherry 47 55 600 120<br />

STATE: Punjab<br />

1<br />

Jallandhar-Amritsar<br />

1<br />

20<br />

190<br />

36<br />

STATE: Tamil Nadu<br />

1<br />

Salem-Coimbatore Kerala<br />

Border Section<br />

47<br />

82<br />

540<br />

108<br />

STATE: Uttar Pardesh<br />

1<br />

Agra Bypass Km176-800 of NH-2 to<br />

Km 13.03.0 of NH-3<br />

23<br />

33<br />

345<br />

69

<strong>Guidel<strong>in</strong>es</strong> <strong>for</strong> <strong>Investment</strong> <strong>in</strong> <strong>Road</strong> <strong>Sector</strong> 19<br />

Opportunities <strong>for</strong> <strong>Investment</strong>-State-Wise Projects Under NHDP Phase III-A<br />

S. No. Stretch NH<br />

Length<br />

(Km)<br />

Estimated Project Cost<br />

(INR Crore)<br />

(USD Million)<br />

STATE: Andhra Pradesh<br />

1<br />

Vijaywada-Machhlipatnam<br />

9<br />

65<br />

424<br />

85<br />

STATE: Bihar<br />

1<br />

Patna-Bakhtiarpur<br />

30<br />

53<br />

346<br />

69<br />

STATE: Haryana<br />

1<br />

Rohtak-Hissar<br />

10<br />

80<br />

522<br />

104<br />

STATE: Karnataka<br />

1<br />

Mulbagal-Kamataka/AP Border<br />

4<br />

11<br />

72<br />

14<br />

2<br />

Balgaum-Goa/KNT Border<br />

4A<br />

84<br />

548<br />

110<br />

3<br />

Mangalore-KNT/Kerala Border<br />

17<br />

18<br />

117<br />

23<br />

STATE: Kerala<br />

1<br />

Ottira-Thiruvananthapuram<br />

47<br />

123<br />

805<br />

161<br />

2<br />

Trivendrum-Kerala/Tamil Nadu Border<br />

47<br />

43<br />

280<br />

56<br />

3<br />

Kerala/Tamil Nadu Border Kanyakumari<br />

47<br />

70<br />

456<br />

91

20<br />

<strong>Guidel<strong>in</strong>es</strong> <strong>for</strong> <strong>Investment</strong> <strong>in</strong> <strong>Road</strong> <strong>Sector</strong><br />

S. No. Stretch NH<br />

Length<br />

(Km)<br />

Estimated Project Cost<br />

(INR Crore)<br />

(USD Million)<br />

STATE: Maharashtra<br />

1<br />

Nagpur-Wa<strong>in</strong>ganga Br<br />

6<br />

60<br />

391<br />

78<br />

STATE: Orissa<br />

1<br />

Chandikhole-Duburi<br />

200<br />

39<br />

254<br />

51<br />

2<br />

Panikoili-Roxy<br />

215<br />

249<br />

1623<br />

325<br />

3<br />

Duburi-Talcher<br />

200<br />

98<br />

639<br />

128<br />

STATE: Punjab<br />

1<br />

Chandigarh-Kurali<br />

21<br />

30<br />

195<br />

39<br />

2<br />

Parwanoo-Shimla (Punjab,<br />

Haryana and HP)<br />

22<br />

110<br />

717<br />

143<br />

STATE: Rajasthan<br />

1<br />

Reengus-Sikar<br />

11<br />

41<br />

267<br />

53<br />

2<br />

Deoli-Jhalawar<br />

12<br />

178<br />

1161<br />

232<br />

STATE: Tamil Nadu<br />

1<br />

Nagapatnam-Thanjavur<br />

67<br />

74<br />

482<br />

96<br />

2<br />

Krishnagiri-T<strong>in</strong>divaram<br />

66<br />

170<br />

1108<br />

222<br />

STATE: West Bengal<br />

1<br />

Barasat-Bangaon 35 60 391 78

<strong>Guidel<strong>in</strong>es</strong> <strong>for</strong> <strong>Investment</strong> <strong>in</strong> <strong>Road</strong> <strong>Sector</strong> 21<br />

Opportunities <strong>for</strong> <strong>Investment</strong>-State-Wise Projects Under NHDP Phase III-B<br />

S. No. Stretch NH<br />

Length<br />

(Km)<br />

Estimated Project Cost<br />

(INR Crore)<br />

(USD Million)<br />

STATE: Arunachal Pradesh<br />

1<br />

Itanagar-Arunachal Pradesh/<br />

Assam Border<br />

52A<br />

22<br />

143<br />

29<br />

STATE: Assam<br />

1<br />

Doboka-Assam/Nagaland<br />

Border-Dimapur<br />

36<br />

124<br />

808<br />

162<br />

2<br />

Baihata Chariali-Banderdewa<br />

52<br />

314<br />

2047<br />

409<br />

3<br />

Badardewa-Assam/<br />

Arunachal Pradesh Border<br />

52A<br />

9<br />

59<br />

12<br />

4<br />

Assam/Meghalaya Border to Assam/<br />

Tripura Boder<br />

44<br />

116<br />

756<br />

151<br />

5<br />

Silchar-Assam/Mizoram Border<br />

54<br />

50<br />

326<br />

65<br />

STATE: Bihar<br />

1<br />

Muzaffarpur-Sonbasra<br />

77<br />

89<br />

580<br />

116<br />

2<br />

Motihari-Raxaul<br />

28A<br />

67<br />

437<br />

87<br />

3<br />

Bakhtiarpur-Begusarai-Khagarai-Purnea<br />

31<br />

255<br />

1663<br />

333<br />

4<br />

Forbesganj-Jogwani 57A 13 85 17<br />

5<br />

Patna-Buxar<br />

84<br />

130<br />

848<br />

170<br />

STATE: Chhatisgarh<br />

1<br />

Kumud-Dhamtari<br />

43<br />

23<br />

150<br />

30<br />

2<br />

Raipur-Simga<br />

200<br />

28<br />

183<br />

37

22<br />

<strong>Guidel<strong>in</strong>es</strong> <strong>for</strong> <strong>Investment</strong> <strong>in</strong> <strong>Road</strong> <strong>Sector</strong><br />

S. No. Stretch NH<br />

Length<br />

(Km)<br />

Estimated Project Cost<br />

(INR Crore)<br />

(USD Million)<br />

STATE: Gujarat<br />

1<br />

Jetpur-Somnath<br />

8D<br />

127<br />

828<br />

166<br />

2<br />

Gujarat/Maharashtra Border-Surat<br />

6<br />

84<br />

548<br />

110<br />

3<br />

Gujarat/MP Border-Ahmedabad<br />

59<br />

210<br />

1369<br />

274<br />

STATE: Jammu & Kashmir<br />

1<br />

Sr<strong>in</strong>agar-Baramula-Uri<br />

1A<br />

101<br />

659<br />

132<br />

STATE: Kerala<br />

1<br />

KNT/Kerala Border-Khozikode-Eddapally<br />

17<br />

451<br />

2941<br />

588<br />

STATE: Maharashtra<br />

1<br />

Kalamboli-Mumbra (6 Lan<strong>in</strong>g)<br />

4<br />

20<br />

130<br />

26<br />

2<br />

Panvel-Indapur<br />

17<br />

84<br />

548<br />

110<br />

STATE: Madhya Pradesh<br />

1<br />

Bhopal-Rajmarg Cross<strong>in</strong>g-Jabalpur<br />

12<br />

297<br />

1936<br />

387<br />

2<br />

Obaiduliaganj-Bheembetka<br />

69<br />

13<br />

85<br />

17<br />

3<br />

Jhansi-Khajuraho<br />

75<br />

100<br />

652<br />

130<br />

STATE: Manipur<br />

1<br />

Nagaland/Manipur Border-Imphal<br />

39<br />

140<br />

913<br />

183<br />

STATE: Mizoram<br />

1<br />

Assam/Mizoram Border-Aizawi<br />

54<br />

113<br />

737<br />

147

<strong>Guidel<strong>in</strong>es</strong> <strong>for</strong> <strong>Investment</strong> <strong>in</strong> <strong>Road</strong> <strong>Sector</strong> 23<br />

S. No. Stretch NH<br />

Length<br />

(Km)<br />

Estimated Project Cost<br />

(INR Crore)<br />

(USD Million)<br />

STATE: Meghalya<br />

1<br />

Shillong (exclud<strong>in</strong>g Shillong Bypass)-<br />

Assam / Meghalaya Border<br />

44<br />

136<br />

887<br />

177<br />

STATE: Nagaland<br />

1<br />

Kohima-Nagaland-Manipur Border<br />

39<br />

28<br />

183<br />

37<br />

STATE: Punjab<br />

1<br />

Amritsar 15 101 659 132<br />

STATE: Rajasthan<br />

1<br />

Beawar-Pali-P<strong>in</strong>dwara 14 246 1604 321<br />

STATE: Tripura<br />

1<br />

Tripura/Assam Border to Agartala 44 195 1271 254<br />

STATE: Tamil Nadu<br />

1<br />

Madurai-Ramnathpuram-<br />

49<br />

186<br />

1213<br />

243<br />

Rameshwaram-Dhanushodi<br />

2<br />

Coimbatore-Mettupalayam<br />

67(Ext.)<br />

45<br />

293<br />

59<br />

3<br />

Theni-Kumili<br />

220<br />

57<br />

372<br />

74

24<br />

<strong>Guidel<strong>in</strong>es</strong> <strong>for</strong> <strong>Investment</strong> <strong>in</strong> <strong>Road</strong> <strong>Sector</strong><br />

Opportunities <strong>for</strong> <strong>Investment</strong>-State-Wise Projects Under NHDP Phase V<br />

S. No. Stretch NH<br />

Length<br />

(Km)<br />

Estimated Project Cost<br />

(INR Crore)<br />

(USD Million)<br />

STATE: Andhra Pradesh<br />

1<br />

Chilkaluripet-Vijayawada-Elluru-<br />

Rajamundri<br />

5<br />

270<br />

1712<br />

342<br />

2<br />

Tada-Neliore Bypass<br />

5<br />

130<br />

824<br />

165<br />

3<br />

Vishakapatnam-Ankapalli-Rajamundri<br />

5<br />

200<br />

1268<br />

254<br />

4<br />

Srikakulam-Vishakhapatnam Ankapalli<br />

5<br />

100<br />

634<br />

127<br />

5<br />

Icchapuram-Srikakulam<br />

5<br />

140<br />

888<br />

178<br />

STATE: Bihar<br />

1<br />

Aurangabad-Barwa Adda<br />

2<br />

70<br />

444<br />

89<br />

STATE: Gujarat<br />

1<br />

Ahmedabad-Vadodara Expressway NE-1 95 602 120<br />

2 Udaipur-Ahmedabad<br />

8<br />

140<br />

888<br />

178<br />

STATE: Jharkhand<br />

1<br />

Barwa Adda-Panagarh<br />

2<br />

100<br />

634<br />

127<br />

2<br />

Aurangabad-Barwa Adda<br />

2<br />

150<br />

951<br />

190

<strong>Guidel<strong>in</strong>es</strong> <strong>for</strong> <strong>Investment</strong> <strong>in</strong> <strong>Road</strong> <strong>Sector</strong> 25<br />

S. No. Stretch NH<br />

Length<br />

(Km)<br />

Estimated Project Cost<br />

(INR Crore)<br />

(USD Million)<br />

STATE: Karnataka<br />

1<br />

Bangalore-Tumkur<br />

4<br />

65<br />

412<br />

82<br />

2<br />

Hubli-Chitradurga<br />

4<br />

200<br />

1268<br />

254<br />

3<br />

Bangalore-Krishnagiri<br />

7<br />

55<br />

349<br />

70<br />

4<br />

Belgaum-Hubli<br />

4<br />

110<br />

697<br />

139<br />

5<br />

Kagal-Belgaum<br />

4<br />

77<br />

488<br />

98<br />

STATE: Maharashtra<br />

1<br />

Satara-Kagal-Belgaum<br />

4<br />

133<br />

843<br />

169

26<br />