Zero Hours Contract Presentation - the University Offices

Zero Hours Contract Presentation - the University Offices

Zero Hours Contract Presentation - the University Offices

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Pensions Auto-enrolment<br />

Towards implementation<br />

February 2013<br />

nick.smith@admin.cam.ac.uk<br />

Human Resources Division<br />

1

Welcome<br />

Nick Smith - Project Manager, Auto-enrolment<br />

Sue Curryer – Head of Pensions Administration<br />

Andy Harnwell - Pensions Accountant<br />

<strong>Presentation</strong> will be placed on Pensions Section website<br />

Do ask questions during <strong>the</strong> presentation<br />

We cannot give financial advice<br />

2

Background<br />

• Objective is to provide a workplace pension for all<br />

• Create <strong>the</strong> opportunity to save for retirement<br />

• Additional to State pension provision<br />

• Legal requirement for all organisations to auto-enrol those not in a<br />

pension scheme<br />

• Includes not eligible or opted out previously<br />

• Phased introduction from October 2012 to 2017 dependent on<br />

organisation size (“staging date”)<br />

• Our implementation date is 1 March 2013<br />

3

Workplace pension overview<br />

• Eligibility criteria for auto-enrolment pension is age and earnings related<br />

• If eligible auto-enrolled. Onus on individual to opt out<br />

• Using “postponement” of enrolment into pension scheme<br />

• Structured workplace pensions process covers:<br />

• Required information & when documents distributed<br />

• How & when individual can opt out & who can provide opt out forms<br />

• Individual can opt back out within 90 days<br />

• Opt outs re-enrolled every three years<br />

4

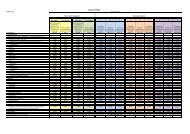

Workplace pension eligibility (from 6 April 2013)<br />

Under lower earnings<br />

threshold (< £5668 pa)<br />

Between lower earnings<br />

threshold and earnings<br />

trigger for automatic<br />

enrolment (£5668 & £9439<br />

pa)<br />

Age 16-21<br />

Age 22-State<br />

Pension Age<br />

State Pension<br />

Age-Age 74<br />

Entitled worker Entitled worker Entitled worker<br />

Non-eligible<br />

jobholder<br />

Non-eligible<br />

jobholder<br />

Non-eligible<br />

jobholder<br />

Over earnings trigger for<br />

automatic enrolment of<br />

£9440 (and up to £41450<br />

pa)<br />

Non-eligible<br />

jobholder<br />

Eligible<br />

jobholder<br />

Non-eligible<br />

jobholder<br />

Definitions. Eligible Jobholders are “eligible” to join a scheme and must be auto-enrolled under <strong>the</strong> legislation. Non-eligible jobholders will<br />

not be auto-enrolled as <strong>the</strong>y do not qualify but have <strong>the</strong> right to opt-in to an auto-enrolment scheme. Entitled Workers are “entitled” to join<br />

an auto-enrolment scheme but would not receive any contributions.<br />

5

Joining Process & Eligibility Criteria<br />

• Will use <strong>the</strong> “postponement” option under <strong>the</strong> legislation<br />

• Reduces <strong>the</strong> likelihood of very small pension pots due to short work periods<br />

• Postpone automatic enrolment for 3 months after staging date to 1 June<br />

2013. Known as <strong>the</strong> “Deferral Date”<br />

• At Deferral Date, will automatically enrol any worker if <strong>the</strong>y are:<br />

• are 22 or more years old;<br />

• are younger than <strong>the</strong> State Pension Age;<br />

• are earning £9,440 (2013/14) or more a year on a pro-rata basis; and<br />

• are not already a member of a qualifying workplace pension scheme.<br />

• x 6

Joining Process & Eligibility Criteria (cont.)<br />

• Following <strong>the</strong> Deferral Date, if automatically enrolled into relevant<br />

pension scheme will receive a joiner pack to confirm membership<br />

• Do not need to do anything in respect of automatic enrolment unless<br />

wish to join <strong>the</strong> relevant scheme before <strong>the</strong> Deferral Date<br />

• Can opt in on request<br />

• Cannot opt out of workplace pension until automatically enrolled and<br />

received a joiner pack<br />

• The joiner pack will provide details of how to opt out<br />

• Opt out period is 3 months from receipt of joiner pack<br />

• If opt out after 3 month period <strong>the</strong>n have leavers options<br />

7

Which Pension Scheme?<br />

• Three schemes in future:<br />

• Universities Superannuation Scheme (USS)<br />

• Cambridge <strong>University</strong> Assistant’s Contributory Pension Scheme,<br />

Hybrid Section (CPS)<br />

• NOW: Pensions. New workplace pension for those not covered<br />

above<br />

• Scheme eligibility confirmed in individual communications<br />

8

Pension Contribution Levels<br />

• Contributions are based on pensionable pay<br />

• USS scheme - 16% from <strong>the</strong> employer, 6.5% from member<br />

• CPS scheme - 20.3% from <strong>the</strong> employer, 3% from <strong>the</strong> member<br />

• NOW: Pensions - Following legislation, 1% each from employer &<br />

member, escalating over time<br />

• Receive tax relief on contributions<br />

9

Process steps<br />

• Formal workplace pension individual letters sent - early March<br />

• Auto-enrolled in appropriate scheme if Eligible Jobholder - 1 June<br />

• Joiner pack will follow from Scheme Administrators<br />

• Opt out forms available - 1 June<br />

• USS from USS website at http://www.uss.co.uk/SchemeGuide/Autoenrolment/Pages/default.aspx<br />

• CPS from www.admin.cam.ac.uk/offices/pensions/autoenrolment/ or request<br />

from Pensions Section in writing<br />

• All opt out forms to be returned to Pensions Section<br />

• Forms received by 12 th of month - no deductions. Opt outs after 12 th<br />

reimbursed in next payroll<br />

10

Key points<br />

• Will automatically be enrolled into a pension scheme on 1 June 2013 if<br />

eligible<br />

• Joiner pack will follow<br />

• Contributions commence in June payroll<br />

• If wish to opt out get form & return to Pensions Section:<br />

• If miss payroll cut-offs reimbursement in next payroll<br />

• Have until 1 September 2013 to opt out<br />

• After 1 September normal leaver<br />

• Those not eligible assessed each month & enrolled if criteria met<br />

11

Questions?<br />

12