PROSPECTUS - check mail

PROSPECTUS - check mail

PROSPECTUS - check mail

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

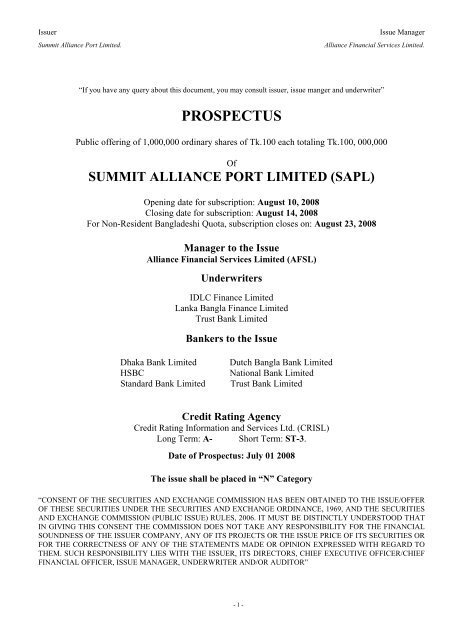

Issuer<br />

Summit Alliance Port Limited.<br />

Issue Manager<br />

Alliance Financial Services Limited.<br />

“If you have any query about this document, you may consult issuer, issue manger and underwriter”<br />

<strong>PROSPECTUS</strong><br />

Public offering of 1,000,000 ordinary shares of Tk.100 each totaling Tk.100, 000,000<br />

Of<br />

SUMMIT ALLIANCE PORT LIMITED (SAPL)<br />

Opening date for subscription: August 10, 2008<br />

Closing date for subscription: August 14, 2008<br />

For Non-Resident Bangladeshi Quota, subscription closes on: August 23, 2008<br />

Manager to the Issue<br />

Alliance Financial Services Limited (AFSL)<br />

Underwriters<br />

IDLC Finance Limited<br />

Lanka Bangla Finance Limited<br />

Trust Bank Limited<br />

Bankers to the Issue<br />

Dhaka Bank Limited<br />

HSBC<br />

Standard Bank Limited<br />

Dutch Bangla Bank Limited<br />

National Bank Limited<br />

Trust Bank Limited<br />

Credit Rating Agency<br />

Credit Rating Information and Services Ltd. (CRISL)<br />

Long Term: A- Short Term: ST-3.<br />

Date of Prospectus: July 01 2008<br />

The issue shall be placed in “N” Category<br />

“CONSENT OF THE SECURITIES AND EXCHANGE COMMISSION HAS BEEN OBTAINED TO THE ISSUE/OFFER<br />

OF THESE SECURITIES UNDER THE SECURITIES AND EXCHANGE ORDINANCE, 1969, AND THE SECURITIES<br />

AND EXCHANGE COMMISSION (PUBLIC ISSUE) RULES, 2006. IT MUST BE DISTINCTLY UNDERSTOOD THAT<br />

IN GIVING THIS CONSENT THE COMMISSION DOES NOT TAKE ANY RESPONSIBILITY FOR THE FINANCIAL<br />

SOUNDNESS OF THE ISSUER COMPANY, ANY OF ITS PROJECTS OR THE ISSUE PRICE OF ITS SECURITIES OR<br />

FOR THE CORRECTNESS OF ANY OF THE STATEMENTS MADE OR OPINION EXPRESSED WITH REGARD TO<br />

THEM. SUCH RESPONSIBILITY LIES WITH THE ISSUER, ITS DIRECTORS, CHIEF EXECUTIVE OFFICER/CHIEF<br />

FINANCIAL OFFICER, ISSUE MANAGER, UNDERWRITER AND/OR AUDITOR”<br />

- 1 -

Issuer<br />

Summit Alliance Port Limited.<br />

Issue Manager<br />

Alliance Financial Services Limited.<br />

SUMMIT ALLIANCE PORT LIMITED<br />

(A Public Company Limited by Shares)<br />

Katghar, North Patenga, Chittagong- 4204<br />

Availability of Prospectus<br />

Prospectus of Summit Alliance Port Limited may be obtained from the Issuer Company, Issue<br />

Manager, Underwriters and the Stock Exchange as follows:<br />

Company Contact Person Telephone<br />

number<br />

Summit Alliance Port Limited<br />

Corporate office Mr. Md. Abdullah Osman Sajid (Sajid) 88-02-9130845<br />

Summit Centre Accounts Executive 01730-025057<br />

18 Kawran Bazar C/A<br />

Dhaka- 1215<br />

Registered office & project Mr. Ratan Kumar Nath FCMA 031-800104-6 (PABX Line)<br />

Katghar, North Patenga Senior Manager 01714-094532<br />

Chittagong- 4204<br />

Manager to the Issue<br />

Alliance Financial Services Limited Mr. Muhammad Nazrul Islam, ACMA 88-02-9554756, 9556752<br />

Rahman Chamber Manager 01914 -566039<br />

12-13 Motijheel C/A, Dhaka- 1000<br />

Underwriters<br />

IDLC Finance Limited<br />

Bay’s Gallary,(1 st Floor) Mr. Mahmudul Bari 88-02-8834990-94<br />

57 Gulshan Avenue, Gulshan – 1 DGM, Merchant Banking Division<br />

Dhaka-1212<br />

Lankabangla Finance Limited<br />

20 Kemal Ataturk Avenue Mr. Shakil Islam Bhuiyan 88-02-9883701-10<br />

Safura Tower (11 th Floor), Banani Assistant Vice President<br />

Dhaka- 1213<br />

Trust Bank Limited<br />

Peoples Insurance Bhaban Mr. Mohammad Saleh Ahmed 88-02-9570261, 9570263<br />

36 Dilkusha C/A, Dhaka – 1000 Senior Executive officer 01713-193396<br />

Stock Exchanges<br />

Dhaka Stock Exchange Limited DSE Library 88-02-9564601-7<br />

9/F, Motijheel C/A, Dhaka-1000<br />

Chittagong Stock Exchange Limited<br />

CSE Building, 1080 Sheikh Mujib<br />

Road, Agrabad, Chittagong-4100<br />

CSE Library (031)714632-3<br />

(031)720871-3<br />

Prospectus is also available on the websites www.secbd.org, www.saplbd.com. www.allfin.org, www.dsebd.org,<br />

www.csebd.com and Public Reference room of the Securities and Exchange Commission (SEC) for<br />

reading and study.<br />

- 2 -

Issuer<br />

Summit Alliance Port Limited.<br />

Issue Manager<br />

Alliance Financial Services Limited.<br />

Corporate Directory<br />

Registered office<br />

Katghar, North Patenga<br />

Chittagong- 4204<br />

Tel: 031-800104-6 (PABX Line)<br />

Fax: 880-2-740667<br />

Corporate office<br />

Summit Centre<br />

18 Kawran Bazar C/A<br />

Dhaka- 1215<br />

Tel: 880-2-9130845<br />

Fax: 880-2-9130853-54<br />

www.saplbd.com<br />

Project location:<br />

Katghar, South Patenga<br />

Chittagong- 4204<br />

Auditors<br />

Basu Banerjee Nath & Co<br />

Taher Chamber (Ground Floor)<br />

10 Agrabad Commercial Area<br />

Chittagong- 4100<br />

Tel : 031-2512931<br />

Fax : 880-031-721201<br />

Manager to the Issue<br />

Alliance Financial Services Limited.<br />

Rahman Chamber<br />

12-13 Motijheel C/A, Dhaka- 1000<br />

Tel : 9567778,9561817<br />

Fax: 880-2-9559895<br />

www.allfin.org<br />

- 3 -

Issuer<br />

Summit Alliance Port Limited.<br />

Issue Manager<br />

Alliance Financial Services Limited.<br />

Table of Contents<br />

Item<br />

Page No<br />

Acronyms 6<br />

Disclosure in respect of issuance of securities in demat form 7<br />

Conditions under Section 2CC of the Securities and Exchange Ordinance, 1969 7<br />

General information 10<br />

Declarations and due diligence certificates 11<br />

Declaration about the responsibility of the Directors including the CEO of the Company<br />

in respect of the prospectus 11<br />

Consent of the Directors to Serve 12<br />

Declaration about filing of prospectus with the Registrar of Joint Stock Companies & Firms 12<br />

Due Diligence Certificate of the Manger to the Issue 13<br />

Due Diligence Certificate of the Underwriter(s) 13<br />

Risk factors & management’s perception about the risks 14<br />

Financial structure 16<br />

Use of IPO proceeds 16<br />

Description of business 16<br />

Company at a glance 16<br />

Important date 16<br />

Nature of business 17<br />

Background 17<br />

Principal products and services 17<br />

Market for SAPL services 18<br />

Relative contribution to income (as per audited accounts) 18<br />

Business plan and Marketing strategy 18<br />

Internal Control System 19<br />

Management Information System 20<br />

Associate subsidiary/related holding company and Core areas of business 20<br />

Distribution of products/services 21<br />

Competitive condition of business 21<br />

Sources and availability of raw materials and principal suppliers 21<br />

Sources of and requirement for power, gas and water or any other utilities 21<br />

Customer providing 10% or more revenues 21<br />

Contract with principal customers and suppliers 22<br />

Material patents, trademarks, license or royalty agreements 22<br />

Number of employees (as per audited accounts) 22<br />

Capacity and current utilization of facility 22<br />

Description of property 22<br />

Plan of operation and discussion of financial condition 23<br />

Internal and external sources of cash (as per audited accounts) 23<br />

Material commitment for capital expenditure 23<br />

Causes for material changes 23<br />

Seasonal aspect of the Company’s business 23<br />

Known trends, events or uncertainties 23<br />

Change in the assets of the Company used to pay off any liabilities 23<br />

Loan taken from holding/parent company or subsidiary company 24<br />

Loan given to holding/parent company or subsidiary company 24<br />

Future contractual liabilities 24<br />

Future capital expenditure 24<br />

VAT, income tax, customs duty or other tax liability 24<br />

Operating lese agreement 24<br />

Financial lease commitment 24<br />

Personnel related scheme 24<br />

Training 25<br />

Breakdown of issue expenses 25<br />

Revaluation of assets 25<br />

Transactions with subsidiary/holding company or associate companies 26<br />

- 4 -

Issuer<br />

Summit Alliance Port Limited.<br />

Issue Manager<br />

Alliance Financial Services Limited.<br />

Item<br />

Page No<br />

Auditors certificate regarding allotment of shares to promoters or<br />

Sponsor shareholders for consideration other than in cash 26<br />

Material information which is likely to have an impact 26<br />

Directors and officers 26<br />

Information regarding directorship 26<br />

Directors involvement in other organization 27<br />

Family relationship among directors and top five officers 28<br />

Short bio-data of the directors 28<br />

Credit information Bureau (CIB) report 30<br />

Involvement of Directors and officers in certain legal proceedings 30<br />

Description of senior executive and departmental heads 30<br />

Certain Relationships and Related Transactions 31<br />

Transaction with related parties 31<br />

Directors Facilities 31<br />

Executive compensation 31<br />

Remuneration paid to top five officers 31<br />

Aggregate amount of remuneration paid to directors and officers (as per audited accounts) 31<br />

Remuneration paid to Director who was not an officer 31<br />

Future compensation to Director and others 31<br />

Pay increase intention 32<br />

Options granted to Directors, officers and employees 32<br />

Transaction with the Directors and subscribers to the Memorandum 32<br />

Tangible assets per share as of 31 December 2007 32<br />

Ownership of the Company’s securities 32<br />

Shareholding structure as on April 3, 2008 32<br />

Securities owned by the officers 33<br />

Determination of offering price 33<br />

Market for the securities being offered 33<br />

Declaration about listing of shares with Stock Exchange 33<br />

Trading and settlement 33<br />

Description of Securities outstanding or being offered 33<br />

Dividend, voting, pre-emption rights 33<br />

Conversion and liquidation rights 33<br />

Dividend policy 34<br />

Other rights of shareholders 34<br />

Debt securities 34<br />

Lock-in on sponsors share 34<br />

Refund of subscription money 35<br />

Subscription by and refund to non-resident Bangladeshis (NRB) 35<br />

Availability of securities 35<br />

The Offer 35<br />

Application for subscription 36<br />

Allotment 37<br />

Underwriting of shares 37<br />

Principal terms and conditions of underwriting agreement 37<br />

Underwriter’s right to represent in the Board of Directors of the Company 37<br />

Auditors report to the shareholders 38<br />

Audited Financial Statements 39<br />

Calculation of Ratio Analysis 55<br />

Auditor’s Additional Disclosures 56<br />

Auditors report under section 135(1), Para 24(1) of part II 58<br />

of schedule III to Companies Act, 1994<br />

Credit rating report of SAPL 63<br />

Application forms 79<br />

Additional disclosures regarding land of Summit Alliance Port Limited 83<br />

- 5 -

Issuer<br />

Summit Alliance Port Limited.<br />

Issue Manager<br />

Alliance Financial Services Limited.<br />

Acronyms<br />

BAS<br />

SAPL<br />

CRISL<br />

IPO<br />

NRB<br />

ICD<br />

CFS<br />

OCL<br />

TEU<br />

SEC<br />

CPA<br />

DSE<br />

CSE<br />

FC<br />

FI<br />

RJSC<br />

Bangladesh Accounting Standard<br />

Summit Alliance Port Limited<br />

Credit Rating Information and Services Limited<br />

Initial Public Offering<br />

Non-Residential Bangladeshi<br />

Inland Container depot<br />

Container Freight Station<br />

Ocean Containers Limited<br />

Twenty Equivalent Units<br />

Securities and Exchange Commission<br />

Chittagong Port Authority<br />

Dhaka Stock Exchange Limited<br />

Chittagong Stock Exchange Limited<br />

Foreign Currency<br />

Financial Institution<br />

Registrar of Joint Stock Companies & Firms<br />

- 6 -

Issuer<br />

Summit Alliance Port Limited.<br />

- 7 -<br />

Issue Manager<br />

Alliance Financial Services Limited.<br />

Disclosure in respect of issuance of security in Demat Form<br />

As per provision of the Depository Act, 1999 and regulations made there under, shares will only be issued in dematerialized<br />

condition. All transfer/transmission/splitting will take place in the Central Depository Bangladesh Ltd. (CDBL) system and<br />

any further issuance of shares (right/bonus) will be issued in dematerialized form only.<br />

Conditions under Section 2CC of the Securities and Exchange Ordinance, 1969<br />

Part A<br />

1. The company shall go for Initial Public Offer (IPO) for 10, 00,000.00 ordinary shares of Taka 100.00 (taka one hundred)<br />

each at par worth Taka 10, 00, 00,000.00 (Taka ten crore) only following the Securities and Exchange Commission (Public<br />

Issue) Rules, 2006, the Depository Act, 1999 and regulations made there under.<br />

2. The abridged version of the prospectus, as approved by the Commission, shall be published by the issuer in four national<br />

daily newspapers (in two Bangla and two English), within 03 (three) working days of issuance of this letter. The issuer shall<br />

post the full prospectus vetted by the Securities and Exchange Commission in the issuer’s website and shall also put on the<br />

websites of the Commission, stock exchanges, and the issue managers within 03 (three) working days from the date of<br />

issuance of this letter which shall remain posted till the closure of the subscription list. The issuer shall submit to SEC, the<br />

stock exchanges and the issue managers a diskette containing the text of the vetted prospectus in “MS -Word” format.<br />

3. Sufficient copies of prospectus shall be made available by the issuer so that any person requesting a copy may receive one.<br />

A notice shall be placed on the front of the application form distributed in connection with the offering, informing that<br />

interested persons are entitled to a prospectus, if they so desire, and that copies of prospectus may be obtained from the issuer<br />

and the issue managers. The subscription application shall indicate in bold type that no sale of securities shall be made, nor<br />

shall any money be taken from any person, in connection with such sale until twenty five days after the prospectus has been<br />

published.<br />

4. The company shall submit 40 (forty) copies of the printed prospectus to the Securities and Exchange Commission for<br />

official record within 5 (Five) working days from the date of publication of the abridged version of the prospectus in the<br />

newspaper.<br />

5. The issuer company and the issue managers shall ensure transmission of the prospectus, abridged version of the prospectus<br />

and relevant application forms for NRBs through e-<strong>mail</strong>, simultaneously with publication of the abridged version of the<br />

prospectus, to the Bangladesh Embassies and Missions abroad and shall also ensure sending of the printed copies of abridged<br />

version of the prospectus and application forms to the said Embassies and Missions within five working days of the<br />

publication date by express <strong>mail</strong> service (EMS) of the postal department. A compliance report shall be submitted in this<br />

respect to the SEC jointly by the issuer and the issue managers within two working days from the date of said dispatch of the<br />

prospectus & the forms.<br />

6. The paper clipping of the published abridged version of the prospectus, as mentioned at condition 2 above, shall be<br />

submitted to the Commission within 24 hours of the publication thereof.<br />

7. The company shall maintain separate bank account(s) for collecting proceeds of the Initial Public Offering and shall also<br />

open FC account(s) to deposit the application money of the Non-Resident Bangladeshis (NRBs) for IPO purpose, and shall<br />

incorporate full particulars of said FC account(s) in the prospectus. The company shall open the abovementioned accounts for<br />

IPO purpose; and close these accounts after refund of over-subscription. Non- Resident Bangladeshi (NRB) means<br />

Bangladeshi citizens staying abroad including all those who have dual citizenship (provided they have a valid Bangladeshi<br />

passport) or those, whose foreign passport bear a stamp from the concerned Bangladesh Embassy to the effect that no visa is<br />

required to travel to Bangladesh.<br />

8. The issuer company shall apply to all the stock exchanges in Bangladesh for listing within 07(seven) working days from<br />

the date of issuance of this letter and shall simultaneously submit the vetted prospectus with all exhibits, as submitted to SEC,<br />

to the stock exchanges.<br />

9. The following declaration shall be made by the company in the prospectus, namely: -<br />

“Declaration about Listing of Shares with the Stock Exchange(s):<br />

None of the stock exchange(s), if for any reason, grants listing within 75 days from the closure of subscription, any allotment<br />

in terms of this prospectus shall be void and the company shall refund the subscription money within fifteen days from the<br />

date of refusal for listing by the stock exchanges, or from the date of expiry of the said 75 (seventy five) days, as the case may<br />

be. In case of non -refund of the subscription money within the aforesaid fifteen days, the company directors, in addition to<br />

the issuer company, shall be collectively and severally liable for refund of the subscription money, with interest at the rate of<br />

2% (two percent) per month above the bank rate, to the subscribers concerned. The issue managers, in addition to the issuer<br />

company, shall ensure due compliance of the above mentioned conditions and shall submit compliance report thereon to the<br />

Commission within seven days of expiry of the aforesaid fifteen days time period allowed for refund of the subscription<br />

money.”

Issuer<br />

Summit Alliance Port Limited.<br />

- 8 -<br />

Issue Manager<br />

Alliance Financial Services Limited.<br />

10. The subscription list shall be opened and the sale of securities commenced after 25 (twenty five) days of the publication<br />

of the abridged version of the prospectus and shall remain open for 5 (Five) consecutive banking days.<br />

11. A non-resident Bangladeshi shall apply either directly by enclosing a foreign demand draft drawn on a bank payable at<br />

Dhaka, or through a nominee by paying out of foreign currency deposit account maintained in Bangladesh or in Taka,<br />

supported by foreign currency encashment certificate issued by the concerned bank, for the value of securities applied for<br />

through crossed bank cheque marking “Account Payee only”. The NRB applicants shall send applications to the issuer<br />

company within the closing date of the subscription so as to reach the same to the company by the closing date plus nine days.<br />

Applications received by the company after the above time period will not be considered for allotment purpose.<br />

12. The company shall apply the spot buying rate (TT clean) in US Dollar, UK Pound Sterling and Euro of Sonali Bank,<br />

which shall be mentioned in the Prospectus, as prevailed on the date of opening of the subscription for the purpose of<br />

application of the NRBs and other non-Bangladeshi persons, where applicable.<br />

13. The company and the issue managers shall ensure prompt collection/clearance of the foreign remittances of NRBs and<br />

other non-Bangladeshis, if applicable, for allotment of shares.<br />

14. Upon completion of the period of subscription for securities the issuer and the issue managers shall jointly provide the<br />

Commission and the stock exchanges with the preliminary status of the subscription within 05 (five) working days, in respect<br />

of the following matters, namely: -<br />

(a) Total number of securities for which subscription has been received;<br />

(b) Amount received from the subscription; and<br />

(c) Amount of commission paid to the banker to the issue.<br />

15. The issuer and the issue managers shall jointly provide the Commission and the stock exchanges with the list of valid and<br />

invalid applicants (i.e. final status of subscription) to the Commission within 3 (three) weeks after the closure of the<br />

subscription along with bank statement (original), branch-wise subscription statement, NRB application forms (photocopy<br />

attested by the CEOs of the issuer company and the issue managers). The list of valid and invalid applicants shall be finalized<br />

after examination with the CDBL in respect of BO accounts and particulars thereof.<br />

16. The IPO shall stand cancelled and the application money shall be refunded immediately (but not later than 6(six) weeks<br />

from the date of the subscription closure) if any of the following events occur:<br />

(a) Upon closing of the subscription list it is found that the total number of valid applications (in case of under subscription<br />

including the number of the underwriter) is less than the minimum requirement as specified in the listing regulations of the<br />

stock exchange(s) concerned; or<br />

(b) At least 50% of the IPO is not subscribed.<br />

17. 10% of total public offering shall be reserved for non-resident Bangladeshi (NRB) and 10% for mutual funds and<br />

collective investment schemes registered with the Commission, and the remaining 80% shall be open for subscription by the<br />

general public. In case of under subscription under any of the 10% categories mentioned above, the unsubscribed portion shall<br />

be added to the general public category and, if after such addition, there is over subscription in the general public category, the<br />

issuer and the issue managers shall jointly conduct an open lottery of all the applicants added together.<br />

18. All the applicants shall first be treated as applied for one minimum market lot of 50 shares worth Tk.5000/-. If, on this<br />

basis, there is over subscription, then lottery shall be held amongst the applicants allocating one identification number for each<br />

application, irrespective of the application money. In case of over-subscription under any of the categories mentioned<br />

hereinabove, the issuer and the issue managers shall jointly conduct an open lottery of all the applications received under each<br />

category separately in presence of representatives from the issuer, the stock exchanges and the applicants, if there be any.<br />

19. An applicant cannot submit more than two applicants, one in his/her own name and another jointly with another<br />

person. In case an applicant makes more than two applications, all applications will be treated as invalid and will not<br />

be considered for allotment purpose. In addition, whole or part of application money may be forfeited by the<br />

Commission.<br />

20. The primary shares allotted to an applicant through IPO may be forfeited by SEC, if the BO account of the said<br />

applicant is found closed at the time of allotment of shares. All IPO applicants are required to keep their BO accounts<br />

operational till allotment of IPO shares.<br />

21. Lottery (if applicable) shall be held within 5 (five) weeks from closure of the subscription date.<br />

22. The company shall issue share allotment letters to all successful applicants within 6 (six) weeks from the date of the<br />

subscription closing date. Within the same time, Refund to the unsuccessful applicants shall be made in the currency in which

Issuer<br />

Summit Alliance Port Limited.<br />

Issue Manager<br />

Alliance Financial Services Limited.<br />

the value of securities was paid for by the applicants without any interest, through direct deposit to the applicant’s bank<br />

account as far as possible/ Account Payee Cheque/ refund warrants with bank account number, bank’s name and Branch as<br />

indicated in the securities application forms payable at Dhaka/ Chittagong/ Khulna/ Rajshahi/ Barisal/ Sylhet/ Bogra, as the<br />

case may be subject to condition 19 above.<br />

Refund money of the unsuccessful applicants shall be credited directly to their respective bank accounts, who have<br />

mentioned in the IPO application forms, bank account numbers with the bankers to the issue and other banks as<br />

disclosed in the prospectus. A compliance report in this regard shall be submitted to the Commission within 7(seven) weeks<br />

from the date of closure of subscription.<br />

23. The company shall furnish the List of Allotees to the Commission and the stock exchange(s) simultaneously in which the<br />

shares will be listed, within 24 (twenty four) hours of allotment.<br />

24. In the event of under-subscription of the public offering, the unsubscribed portion of securities shall be taken up by the<br />

underwriter(s) (subject to para -16 above). The issuer must notify the underwriter to take up the underwritten shares within 10<br />

(ten) days of the subscription closing date on full payment of the share money within 15(fifteen) days of the issuer’s notice.<br />

The underwriter shall not share any underwriting fee with the issue managers, other underwriters, issuer or the sponsor group.<br />

25. All issued shares of the issuer at the time of according this consent shall be subject to a lock - in period of three years<br />

from the date of issuance of prospectus or commercial operation, whichever comes later:<br />

Provided that the persons, other than directors and those who hold 5% or more, who have subscribed to the shares of the<br />

company within immediately preceding two years of according consent, shall be subject to a lock -in period of one year from<br />

the date of issuance of prospectus or commercial operation, whichever comes later.<br />

26. Either a Jumbo Share (one for each of the existing Sponsors/ Directors/ Shareholders) in respect of the shares already<br />

issued shall be issued covering together respective total holding, which shall contain the expiry date of lock-in period or<br />

Sponsors/Directors/Promoters/Shareholders’ shareholding shall be converted into demat form but shall be locked-in as per<br />

the condition at para-25 above.<br />

27. In case of Jumbo Share Certificate issued to the existing Sponsors/ Directors/Shareholders, the said share certificates shall<br />

be kept under custody of a security custodian bank registered with SEC during the lock-in period. The name and branch of the<br />

bank shall be furnished to the Commission jointly by the issuer and the issue managers, along with a confirmation thereof<br />

from the custodian bank, within one week of listing of the shares with the stock exchange(s).<br />

28. In case of dematerialization of shares held by the existing Sponsors/ Directors/Shareholders, the copy of dematerialization<br />

confirmation report generated by CDBL and attested by the managing director of the company along with lock-in<br />

confirmation shall be submitted to SEC within one week of listing of the shares with the stock exchange(s).<br />

29. The company shall apply to the stock exchanges for listing within 7(seven) working days of issuance of this letter and<br />

shall simultaneously submit to the Commission attested copies of the application filed with the stock exchanges.<br />

30. The company shall not declare any benefit other than cash dividend based on the financial statement for the year ended<br />

December 31, 2007.<br />

Part-B<br />

1. The issue managers (i.e., Alliance Financial Services Limited) shall ensure that the abridged version of the prospectus and<br />

the full prospectus is published correctly and in strict conformity without any error/omission, as vetted by the Securities and<br />

Exchange Commission.<br />

2. The issue managers shall carefully examine and compare the published abridged version of prospectus on the date of<br />

publication with the copy vetted by SEC. If any discrepancy/inconsistency is found, both the issuer and the issue managers<br />

shall jointly publish a corrigendum immediately in the same newspapers concerned, simultaneously endorsing copies thereof<br />

to SEC and the stock exchange(s) concerned, correcting the discrepancy/inconsistency as required under ‘Due Diligence<br />

Certificates’ provided with SEC.<br />

3. Both the issuer company and the issue managers shall, immediately after publication of the prospectus and its abridged<br />

version, jointly inform the Commission in writing that the published prospectus and its abridged version are verbatim copies<br />

of the same as vetted by the Commission.<br />

4. The fund collected through IPO shall not be utilized prior to listing with stock exchange and that utilization of the said fund<br />

shall be effected through banking channel, i.e. through account payee cheque, pay order or bank drafts etc.<br />

5. The company shall furnish report to the Commission on utilization of IPO proceeds within 15 days of the closing of each<br />

quarter until such fund is fully utilized, as mentioned in the schedule contained in the prospectus, and in the event of any<br />

irregularity or inconsistency, the Commission may employ or engage any person, at issuer’s cost, to examine whether the<br />

issuer has utilized the proceeds for the purpose disclosed in the prospectus.<br />

6. All transactions, excluding petty cash expenses, shall be effected through the company’s bank account(s).<br />

7. Proceeds of the IPO shall not be used for any purpose other than those specified in the prospectus. Any deviation in this<br />

respect must have prior approval of the shareholders in the General Meeting under intimation to SEC and stock exchange(s).<br />

- 9 -

Issuer<br />

Summit Alliance Port Limited.<br />

Issue Manager<br />

Alliance Financial Services Limited.<br />

Part C<br />

1. All the above conditions imposed under section 2CC of the Securities and Exchange Ordinance, 1969 shall be incorporated<br />

in the prospectus immediately after the page of the table of contents, with a reference in the table of contents, prior to its<br />

publication.<br />

2. The Commission may impose further conditions/restrictions etc. from time to time as and when considered necessary,<br />

which shall also be binding upon the issuer company.<br />

Part D<br />

1. As per provision of the Depository Act, 1999 and regulations made there under, shares will only be issued in dematerialized<br />

condition. All transfer/transmission/splitting will take place in the Central Depository Bangladesh Ltd. (CDBL) system and<br />

any further issuance of shares (including right/bonus) will be issued in dematerialized form only. An applicant (including<br />

NRB) shall not be able to apply for allotment of shares without beneficial owner account (BO account).<br />

2. The issue managers shall also ensure due compliance of all above.<br />

GENERAL INFORMATION<br />

Alliance Financial Services Limited has prepared the Prospectus from information supplied by Summit Alliance Port Limited<br />

(the Issuer Company) and also after several discussions with the Chairman, Managing Director, Directors and concerned<br />

executives of the Bank. The Directors of both Summit Alliance Port Limited and Alliance Financial Services Limited<br />

collectively and individually, having made all reasonable inquiries, confirm that to the best of their knowledge and belief, the<br />

information contained herein is true and correct in all material aspects and that there are no other material facts, the omission<br />

of which, would make any statement herein misleading. No person is authorized to give any information or to make any<br />

representation not contained in this Prospectus and if given or made, any such information and representation must not be<br />

relied upon as having been authorized by the Bank or Alliance Financial Services Limited. The Issue as contemplated in this<br />

Prospectus is made in Bangladesh and is subject to the exclusive jurisdiction of the Courts of Bangladesh. Forwarding this<br />

Prospectus to any person<br />

Resident outside Bangladesh in no way implies that the Issue is made in accordance with the laws of that country or is subject<br />

to the jurisdiction of the laws of that country. A copy of this Prospectus can be obtained from the Corporate Head Office of<br />

Summit Alliance Port Limited, Alliance Financial Services Limited, the Underwriters and the Stock Exchanges where the<br />

securities will be traded.<br />

- 10 -

Issuer<br />

Summit Alliance Port Limited.<br />

Issue Manager<br />

Alliance Financial Services Limited.<br />

Declarations and Due Diligence Certificates<br />

Declaration about the Responsibility of the Directors, including the CEO<br />

of the Company “Summit Alliance Port Limited” in Respect of the Prospectus<br />

This prospectus has been prepared, seen and approved by us, and we, individually and collectively, accept full responsibility<br />

for the authenticity and accuracy of the statements made, information given in the prospectus, documents, financial<br />

statements, exhibits, annexes, papers submitted to the Commission in support thereof, and confirm, after making all<br />

reasonable inquiries that all conditions concerning this public issue and prospectus have been met and that there are no other<br />

information or documents the omission of which make any information or statements therein misleading for which the<br />

Commission may take any civil, criminal or administrative action against any or all of us as it may deem fit.<br />

We also confirm that full and fair disclosure has been made in this prospectus to enable the investors to make a well-informed<br />

decision for investment.<br />

Sd/<br />

Anjuman Aziz Khan<br />

Chairperson<br />

Sd/-<br />

Syed Ali Jowher Rizvi<br />

Managing Director<br />

Sd/-<br />

Sobera Ahmed Rizvi<br />

Director<br />

Sd/-<br />

Mohammed Latif Khan<br />

Director<br />

sd/-<br />

Dr. Syed Ali Gowher Rizvi<br />

Director<br />

Sd/-<br />

Ayesha Aziz Khan<br />

Director<br />

Sd/<br />

Faisal Karim Khan<br />

Director<br />

Sd/-<br />

Adeeba Aziz Khan<br />

Director<br />

Sd/-<br />

Syed Yasser Haider Rizvi<br />

Director<br />

Sd/-<br />

Syed Nasser Haider Rizvi<br />

Director<br />

- 11 -

Issuer<br />

Summit Alliance Port Limited.<br />

Consent of the Directors to Serve<br />

Issue Manager<br />

Alliance Financial Services Limited.<br />

We hereby agree that we have been serving as Director(s) of “Summit Alliance Port Limited" and continue to act as<br />

Director of the Company.<br />

Sd/<br />

Anjuman Aziz Khan<br />

Chairperson<br />

Sd/-<br />

Syed Ali Jowher Rizvi<br />

Managing Director<br />

Sd/-<br />

Sobera Ahmed Rizvi<br />

Director<br />

Sd/-<br />

Mohammed Latif Khan<br />

Director<br />

sd/-<br />

Dr. Syed Ali Gowher Rizvi<br />

Director<br />

Sd/-<br />

Ayesha Aziz Khan<br />

Director<br />

Sd/<br />

Faisal Karim Khan<br />

Director<br />

Sd/-<br />

Adeeba Aziz Khan<br />

Director<br />

Sd/-<br />

Syed Yasser Haider Rizvi<br />

Director<br />

Sd/-<br />

Syed Nasser Haider Rizvi<br />

Director<br />

Declaration about filling of Prospectus with the Registrar of Joint Stock Companies & Firms<br />

A dated and signed copy of the Prospectus has been filed for registration with the Registrar of Joint Stock Companies &<br />

Firms, Government of the Peoples’ Republic of Bangladesh, as required under Section 138(1) of the Companies Act, 1994,<br />

vide RJSC’s Receipt No: 0175800 dated: 01/07/2008<br />

- 12 -

Issuer<br />

Summit Alliance Port Limited.<br />

Issue Manager<br />

Alliance Financial Services Limited.<br />

Due Diligence Certificate of Manager to the Issue<br />

Subject: Public offer of 1,000,000 Ordinary Shares of Tk.100/= each of Summit Alliance Port Limited.<br />

We, the under-noted Manger to the Issue to the above mentioned forthcoming issue, state as follows:<br />

1. We, while finalizing the draft prospectus pertaining to the said issue, have examined various documents and other<br />

materials as relevant for adequate disclosures to the investors, and<br />

2. On the basis of such examination and the discussions with the issuer company, it’s directors and officers, and other<br />

agencies; independent verification of the statements concerning objects of the issue and the contents of the<br />

documents and other materials furnished by the issuer company.<br />

WE CONFIRM THAT:<br />

(a) The draft prospectus forwarded to the Commission is in conformity with the documents, materials and papers<br />

relevant to the issue;<br />

(b) All the legal requirements connected with the said issue have been duly complied with; and<br />

(c) The disclosures made in the draft prospectus are true, fair and adequate to enable the investors to make a well<br />

informed decision for investment in the proposed issue.<br />

For Manager to the Issue<br />

Sd/<br />

Tapan K Podder<br />

Managing Director<br />

Alliance Financial Services Limited<br />

April 21, 2008<br />

Due Diligence Certificate of the Underwriter(s)<br />

Subject: Public offer of 1,000,000 Ordinary Shares of Tk.100/= each of Summit Alliance Port Limited<br />

We, the under-noted Underwriter(s) to the above mentioned forthcoming issue, state individually and collectively as follows:<br />

1. We, while underwriting the above mentioned issue on a firm commitment basis, have examined the draft prospectus, other<br />

documents and materials as relevant to our underwriting decision, and<br />

2. On the basis of such examination and the discussions with the issuer company, it’s directors and officers, and other<br />

agencies; independent verification of the statements concerning objects of the issue and the contents of the documents and<br />

other materials furnished by the issuer company.<br />

WE CONFIRM THAT:<br />

a. All information as are relevant to our underwriting decision have been received by us and the draft prospectus forwarded to<br />

the Commission has been approved by us.<br />

b. We shall subscribe and take up the un-subscribed securities against the above mentioned public issue within 15 (fifteen)<br />

days of calling up thereof by the issuer; and<br />

c. This underwriting commitment is unequivocal and irrevocable.<br />

For Underwriters<br />

Sd/- Sd/- Sd/-<br />

CEO & Managing Director Managing Director Managing Director<br />

IDLC Finance Ltd. Lanka Bangla Finance Ltd. Trust Bank Ltd.<br />

- 13 -

Issuer<br />

Issue Manager<br />

Summit Alliance Port Limited.<br />

Alliance Financial Services Limited.<br />

Risk factors & Management's perception about the risks<br />

Investment in stocks involves a high degree of risk. Investors should carefully consider all the risks and uncertainties<br />

associated to the company along with all the information provided in this prospectus before taking decision to invest in shares<br />

of SAPL.<br />

Competition may increase<br />

Off-dock services in the private sector can be operated only by the license holders provided by the Government of<br />

Bangladesh. Competition will increase in case Government issues licenses to many new operators.<br />

Management Perception<br />

Sponsors of SAPL started Off-dock business long 13 years back through its first concern Ocean Containers Limited (OCL)<br />

and has established itself as highly experienced operator in the country. Considering long relationships with the major<br />

shipping lines/agents and freight forwarding/logistic companies operating in the country and the fast growing volume of<br />

container movements (growing at double digit for the last ten years) through Chittagong Port it is expected that the company<br />

will be able to grow as well as retain its position whatever the competition arises.<br />

Full dependency on Chittagong Port<br />

Business of SAPL depends solely on operation of the Chittagong Port. Any disruption in operation of Chittagong Port will<br />

directly affect the business of the company.<br />

Management Perception<br />

Almost 90% of the trading of the country is operated through the Chittagong Port and the same situation will continue in<br />

future. The group being one of the largest and highly experienced operators shall always enjoy monopolistic role in this<br />

sector. Furthermore Bangladesh being highly import based country shall continue to be dependent on international trade<br />

despite any temporary disruption in its operation.<br />

Full dependency on International Trade<br />

Entire business of the company relates to international trade. Any disruption in international trade with Bangladesh will affect<br />

income of the company.<br />

Management Perception<br />

Due to country's high dependency on the international trade and Chittagong Port being the operator of 90% containers it is<br />

expected that no disruption in the port's operation shall remain unresolved for long.<br />

Market and technology-related risks<br />

In the global market of 21 st century, developed technology, products and services obsoletes the old service and product<br />

strategy. So the existing organization may be unable to cope up with the future needs and demands.<br />

Management Perception<br />

The management of SAPL is very much aware about this issue. They have already developed a highly qualified technical team<br />

with modern technology system and have developed one of the finest software for its operations. Management is always<br />

committed to secure best available technology in its operation.<br />

Potential change in government regulations<br />

Government regulations always have a direct impact on organizations productivity and profitability. Imposition of restriction<br />

on unstuffing and delivery of certain products by the government at any time will affect company’s profitability.<br />

Management Perception<br />

The Company’s operation is governed by the changes in regulation that occur from time to time by Chittagong Port Authority<br />

(CPA) and Customs House of Chittagong (NBR). Restriction on any rules regarding unstuffing and stuffing shall not affect a<br />

particular company but the whole Off-Dock service industry by and large.<br />

Potential changes in global trading regulations<br />

Any kind of restrictions by the export agencies/countries to use the Chittagong Port has the adverse impact on the overall<br />

business of the company.<br />

- 14 -

Issuer<br />

Summit Alliance Port Limited.<br />

Issue Manager<br />

Alliance Financial Services Limited.<br />

Management Perception<br />

General restriction is not usual and can be treated as a national crisis. These situation demands top priority of any Government<br />

to resolve.<br />

Political unrest will affect the operation of the port<br />

Any unrest in the Chittagong port operation and/or transportation within the country will affect revenue of the company.<br />

Management Perception<br />

Considering the country's high dependency on the international trade vis a vis the Chittagong Port this kind of situation for<br />

long period is very much unusual.<br />

Natural disaster may disrupt the normal operation<br />

The project being close to Bay of Bengal and possibility to be affected by sea driven natural disaster like High- tide, Tsunami,<br />

etc. are very high.<br />

Management Perception<br />

The project is located inside the protection embankment constructed by the Bangladesh water development board and hence<br />

the risk of the project being affected by high- tide/ tsunami is comparatively lower. However in order to cover loses from<br />

associated risks the company has taken insurance policy for all its movable assets.<br />

Profitability of the company may reduce<br />

Net profit for the year 2007 was recorded without charging salary and benefits of Senior Management team as well as service<br />

charge for using OCL's equipment. Considering the initial stage of the company these were not charged for SAPL. Board of<br />

Directors of OCL has taken a decision not to charge for Management team up to 31 December 2007 and for equipments up<br />

to 30 June 2008 and the company has obtained the resolution from OCL.<br />

Significant increase in operational expenses of SAPL due to charging aforesaid expenses shall reduce the profitability of the<br />

company during FY 2008 and onwards.<br />

Management Perception<br />

Assuming the management expenses borne by SAPL, Net profit and EPS during the year 2007 stands at Tk.77, 800,292 and<br />

Tk.27.79 thus reducing by Tk. 4,908,000 and TK. 1.75 respectively. Considering the growing income potential of the<br />

company, impact of the said expenses will be insignificant to the profitability.<br />

Charges on the use OCL's equipment and facilities are variable depending on use. All major equipments have already been<br />

purchased by SAPL and hence use of OCL's equipment will be needed in special situations only.<br />

Project land may be acquired by Civil Aviation Authority<br />

Part of the project land (3.7536 acres) of the East port could not be muted as yet due to an acquisition orders of the Civil<br />

Aviation Authority vide L.A Case no: 10/95-96 dated 21-09-1995. Although the order is challenged in the High Court by<br />

some of the victims, there is a possibility to lose the said land which will reduce the storage capacity of the project.<br />

Management Perception:<br />

Huge population as well as residential houses is affected by this order and hence the authority appears not very serious about<br />

the acquisition as it is pending for about 13 years. On the other hand the management of SAPL has continuous effort to<br />

expand the area vis a vis capacity of the Port depending on demand. Assuming the acquisition of the Govt may be effected in<br />

the long run the company can expand its west port by purchasing and developing additional land so that operation cannot be<br />

affected.<br />

- 15 -

Issuer<br />

Summit Alliance Port Limited.<br />

Financial structure<br />

Issue Manager<br />

Alliance Financial Services Limited.<br />

Financial Structure prior to IPO<br />

Taka<br />

Issued & Fully Paid up Capital as on 31 December 2007<br />

200,000,000<br />

Bonus Shares Issued on 28 February 2008<br />

80,000,000<br />

Right Shares Issued on 03 April 2008<br />

120,000,000<br />

Total 400,000,000<br />

Financial structure after IPO<br />

Ordinary shares<br />

i) Issued & fully paid up capital<br />

ii) IPO (Initial Public Offering)<br />

400,000,000<br />

100,000,000<br />

Total Capital after IPO will be 500,000,000<br />

Use of IPO proceeds and Implementation Target<br />

The proceeds of proposed offering along with the recent raising of capital from the sponsors aggregating Tk.220 million<br />

(Right Issue Tk. 120 mil. & IPO Tk. 100 mil.) shall be utilized for meeting the company’s expansion program during FY 2008<br />

as under:<br />

Particulars<br />

A. Land and Land Development<br />

Amount (Tk.)<br />

Implementation<br />

Target<br />

Land 375 Gonda @ Tk.500,000 per gonda-West 187,500,000 End October ‘08<br />

B. Warehouse:<br />

RCC Import Yard 15,000 sft civil construction-East 32,500,000 September ‘08<br />

C. Total Capital Expenditure (A+B) 220,000,000<br />

Sd/<br />

(Syed Ali Jowher Rizvi)<br />

Managing Director<br />

Company at a glance<br />

Description of business<br />

Sd/<br />

(Syed Fazlul Haque)<br />

Director (Fin. & HR)<br />

Summit Alliance Port Limited (SAPL) is one of the valuable additions to the ever expanding industry of the off-docks in the<br />

country. The company established by the Summit group in collaboration with Alliance group. SAPL is custom built to provide<br />

both ICD (Inland Container Depot) and CFS (Container Freight Station) services, offers a bonded area spread over 14.5269<br />

acres of land, 6.5 kms away from the multi-purpose berths of the Chittagong Port. After establishing the first company Ocean<br />

Containers Limited (OCL) in a leading position and gaining reasonable management expertise, SAPL is ventured in 2003 as a<br />

private limited company which was subsequently converted as public limited company on 6 March 2008.<br />

Important dates<br />

_________________________________________________________________________________________________<br />

Date of Incorporation 6 th December 2003<br />

Bond Ware House license 5 th February 2007<br />

Date of Commercial operation 20 th February 2007<br />

Conversion to Public Limited Company 06 th March 2008<br />

_________________________________________________________________________________________________<br />

- 16 -

Issuer<br />

Summit Alliance Port Limited.<br />

Nature of business<br />

Issue Manager<br />

Alliance Financial Services Limited.<br />

The principal activity of the Company is to provide Off-Dock services with Inland Container Depot (ICD) and Container<br />

freight station (CFS) having facilities for handling of both import and export cargo.<br />

Background<br />

Unlike most other global ports, the Chittagong port Authority (CPA) pursued with the storage of empty containers till the<br />

early 90’s. Considering the mammoth amount of cargo handling prospects, the government acknowledged challenges in terms<br />

of space with the CPA and paved a way for private sponsors to run off-docs. Initially the permission was issued in the year<br />

1995 for storage of empty containers alone called ICD (Inland Container Depot). Then in the year 2000 further relaxation<br />

were endorsed in the form of granting approval of CFS (Container Freight Station) activities. From February 2007, CPA<br />

approved to handle 9 imported items for all private off-dock ports.<br />

After getting permission from Chittagong Port Authority (CPA) and Customs Authority the first private off-dock company<br />

started Empty Container handling in 1985 followed by the second company Ocean Containers Ltd. (OCL), a sister concern of<br />

Summit Alliance Port Limited (SAPL) that commenced operation in 1987. In the year 2001, Ocean Containers Ltd. (OCL)<br />

commenced its CFS business.<br />

The project is located in South Patenga, Chittagong which is divided into two blocks namely East block and West block. The<br />

beach road divides the project into two blocks. East block is primarily used for handling empty containers while the west<br />

block is used for both the import & export cargos.<br />

Principal products and services<br />

Class of services<br />

Types of services/ Revenues<br />

1. Storage of empty containers (ICD) (i) Ground rent<br />

(ii)Transportation<br />

(iii)Lift on/off<br />

(iv)Documentation<br />

2. Un stuffing of import cargo (CFS-Import)<br />

(i) Cargo handling<br />

(ii) Transportation<br />

(iii) Container ground rent<br />

(iv) Lift on/off<br />

(v) Survey<br />

(vi) With/without Movement charges<br />

3. Stuffing of Warehouse and Open Yard cargo (i) Stuffing charge<br />

(CFS-Export)<br />

(ii) Labor service<br />

(iii) Ship landing (Stand by labor service)<br />

(iv) Shut out<br />

4. General Services (i) Transportation service<br />

(Prime mover & Trailer rent)<br />

Essentials of the aforesaid services provided by the company may be elaborated as under:<br />

1. Storage of empty containers (ICD)<br />

In order to ensure smooth, cheap and prompt flow of containerized exports, it is vital for container line operators to<br />

enjoy storage of Containers at a location that offers adequate space, planned storage system for easy and on demand<br />

accessibility and also affordable. These are the factors that allow cheaper freight and SAPL is pledge bound to<br />

assuring the best service levels at all times. SAPL's purpose built ICD makes room for storage up to 4,000 TEUs at<br />

any given period of time added with clear bay distinctions that permits container movements in FIFO (First In First<br />

Out) basis. SAPL deployed world class heavy duty equipment supported by a modern IT (Information Technology)<br />

platform. These services are the essential for cheaper freights which is mandatory for exporters to extract any benefit<br />

in terms of transportation cost. Presently SAPL has an Empty stock of approximately 4000, TEUs.<br />

- 17 -

Issuer<br />

Summit Alliance Port Limited.<br />

2. Un stuffing of import cargo (CFS-Import)<br />

Issue Manager<br />

Alliance Financial Services Limited.<br />

In a country which is highly dependent on imports, consignees can not afford to pay extra amount or incur delay in<br />

the discharge of cargo. As high import cost would be reflected in dearer commodity prices for the people, it is<br />

mandatory to have such services at very reasonable rates. Moreover it has been noted that most of the cargo which<br />

arrives in conventional port facilities is subjected to cargo damage due to negligence. SAPL specializes its services<br />

by deploying extra labor and proper equipment for unloading without any extra charge. Realizing the need for an<br />

ideal infrastructure, SAPL's investment in this sector reiterates on cleanliness and efficiency of facility area aimed to<br />

negate any such undesired possibilities where consignees may suffer.<br />

3. Stuffing of Warehouse and Open Yard cargo (CFS-Export)<br />

Considered as the impetus for venturing into the off-dock business, SAPL service provisions comprise of a clientwise<br />

customized service package. Total safety of cargo, extreme care in cargo handling and promptness in keeping<br />

shipping schedules is the core philosophy of the company. Acknowledging the necessity of maintaining timely<br />

shipment of goods, the company has invested heavily on manpower with the deployment of icons in the industry;<br />

heavy equipment like cranes, reach stackers, top loaders, fork lifts etc; latest software to allow real time information;<br />

a state of art facility; and last but not the least, a highly experienced and competent management.<br />

Market for the SAPL Services<br />

Main Line Operators (MLO), Shipping Agencies, Freight Forwarders, C&F Agents, Importers and Exporters are the<br />

customers of SAPL<br />

Relative contribution to Sales and Income<br />

(As per audited accounts of FY 2007)<br />

Services Revenue % to total revenue<br />

Storage of empty containers (ICD) 74,090,482 33.25<br />

Un stuffing of import cargo (CFS-Import) 110,323,824<br />

Stuffing of Warehouse and Open Yard cargo (CFS-Export) 35,252,890<br />

General Service<br />

3,175,019<br />

Total<br />

222,842,215<br />

49.51<br />

15.82<br />

1.42<br />

100.00<br />

Business Plan & Marketing Strategy<br />

A business plan is undoubtedly the most important document of any corporate entity. Business plan of SAPL is considered the<br />

guide for the company to uphold its day to day operations duly supported by financial and sales projections which forms the<br />

blue print for the company’s venture into the business fraternity. The business plan thus incorporates:<br />

a. Management<br />

a. Management<br />

b. Finance<br />

c. Marketing<br />

Based on the principles of forming a strong management that ultimately represent the company, SAPL is formed by sponsors<br />

whose reputation is well renowned in the market. Without any inclination towards questionable personnel, the sponsors of the<br />

SAPL has picked each and every member of the management team who are not only capable of discharging duties in<br />

outstanding fashion but also holds the credentials to align themselves with any expatriate considered icons in their respective<br />

trade.<br />

- 18 -

Issuer<br />

Summit Alliance Port Limited.<br />

b. Finance<br />

Issue Manager<br />

Alliance Financial Services Limited.<br />

SAPL launched itself with a paid up capital of Tk.5 lac, which subsequently increased in several occasions to adopt the<br />

financial requirements during the development stages of the company.<br />

The constant injection of Capital from sponsors ensured the developments in personnel, infrastructure, information<br />

technology, equipment, so on and so forth. A huge contingent fund was not only allocated but was made available on call<br />

basis for smooth, fast and timely completion of development works. This led to the development of the whole facility within<br />

few months of commencement. To date the company’s paid up capital stands at Tk. 400 million.<br />

c. Marketing<br />

The ultimate action shall shape the company. A faulty marketing plan is mostly to take its toll on the organization as without<br />

revenue a company can not sustain. Aided by charismatic personalities, the marketing plan of SAPL focus on sales based<br />

public relation which complimented by the state of the art facility, a price effective service package beneficial to both<br />

customers and the company it self, an array of added services and last but not the least a commitment to fast and prompt<br />

service rendering.<br />

The marketing strategy also put due emphasis on competitors activities and insists on altering and adapting to any specific<br />

requirement of the market forces which has not already been contemplated by the company.<br />

The marketing gurus of the company also keep constant watch of the global market in view of offering or creating scope for<br />

niche added services that ultimately endorse trust of the customers along with their confidence.<br />

The company has already established a track record by virtue of its facility, equipment support, IT backbone and personnel in<br />

the initial stages that have set the platform for a FULL strategy. SAPL corporate philosophy in continuing service excellence<br />

without any exception is duly supplemented by the management’s effort to improve at every section thus setting a bench mark<br />

of its own with the aim to negate any prospect of competition from others.<br />

Internal control systems are in force in following areas<br />

1. Payments<br />

2. Receipts<br />

3. Procurement and others<br />

Payments<br />

Internal Control System<br />

Before payment all vouchers are signed by Departmental head and then approved by Director Finance. After approval it is<br />

forwarded to accounts department, voucher is <strong>check</strong>ed in details and subsequently accounts department arranges for payment<br />

by crossed cheque jointly signed by Head of Finance and Managing Director.<br />

Receipts<br />

In case of Cash receipt, bills of various services prepared by Accounts Department on the basis of input data of software<br />

(Software entries are given by operation department) and after realization of bill by accounts Department, two copies of paid<br />

bill are given to the clients. One copy of them is submitted to Operations department for clearance. Operation department<br />

<strong>check</strong>s the aforesaid bill and arrange for clearance. Services are given to the clients in a predetermined rate. In case of credit<br />

business, Operation Department prepares the bill and forward to Accounts department for realization. Accounts department<br />

<strong>check</strong> the bill and send to the clients for realization within due time.<br />

Procurement and others<br />

In case of procurement of various goods in cash, respective departments take permission in writing from Executive Director.<br />

In case of credit purchase respective department place written order to the supplier after taking permission from ED.<br />

Budgetary control system also followed by the company. Actual and budgeted performance report analyzed in every month<br />

and submitted to higher authority for consideration. No payment is made without fund sanctioned by respective higher<br />

authority.<br />

- 19 -

Issuer<br />

Summit Alliance Port Limited.<br />

Operational Activity<br />

Management Information System (MIS)<br />

Issue Manager<br />

Alliance Financial Services Limited.<br />

At present any type of container movement is recorded and maintained by the software. This is for both empty containers and<br />

laden containers going in and coming out of the depot. Along with container movement, all types of cargo which is entering in<br />

our premises are also kept in our records through the software. Through this it is easy to print all official documents through a<br />

print option from the software, such as: Terminal receipt (TR), Equipment Interchange Receipt (EIR), Landing and Labor<br />

money receipt, Prattayan Patra etc.<br />

Accounts and HR<br />

Accounts and HR also maintains all types of required data in the software.<br />

Data Store and Backup:<br />

SAPL centrally uses one Dell 2600 server to keep all software data. For data backup the organization is using Tape drive in<br />

the server. An extra CD writer is included in the server so that any information can copy at any point in time. Another server<br />

is installed at a different location with mirroring and thus if by any chance main server goes down, it is possible to retrieve<br />

data from the mirror server.<br />

Along with the multiple backup facilities, MIS department also routinely (end of each week) makes CD all of the database and<br />

hand over to Executive Director-Operations. This CD is also being kept outside depot premises and hence data can be<br />

retrieved (if needed) at any time.<br />

Computerization of Accounts and Operation<br />

Following software are using for accounts and operations:<br />

Accounts<br />

1. Vista GL<br />

Operations<br />

1. Container Management Software<br />

2. CFS Cargo Management Software<br />

Associate, subsidiary/related Holdings Company and Core areas of business<br />

The company established jointly by the Summit Group and Alliance Group. The sponsors of SAPL have significant control on<br />

the following associated companies:<br />

Summit Group<br />

Company name<br />

Summit Power Limited<br />

United Summit Costal Oil Limited<br />

Summit Industrial & Mercantile Corporation Pvt. Ltd.<br />

Cosmopolitan Traders Pvt. Ltd.<br />

Summit Shipping Ltd.<br />

Marble Di Currara Pvt. Ltd.<br />

Khulna Power Co. Ltd.<br />

Ocean Containers Ltd.<br />

Core business area<br />

Power Generation<br />

Supply of Fuel Oil<br />

Investment & power Generation<br />

Trading<br />

Trading<br />

Marble Products Trading<br />

Power Generation<br />

Off-dock services<br />

- 20 -

Issuer<br />

Summit Alliance Port Limited.<br />

Alliance Group<br />

Company name<br />

Alliance Holdings Ltd.<br />

Global Beverage Company Ltd.<br />

Ocean Containers Ltd.<br />

Alliance Knit Composite Limited<br />

Alliance Media Limited<br />

Alliance Properties Limited<br />

Ejab Alliance Limited<br />

PEB Steel Alliance Limited<br />

Union Accessories Limited<br />

Union Knitting & Dyeing Limited<br />

Issue Manager<br />

Alliance Financial Services Limited.<br />

Core Business area<br />

Investment<br />

Carbonated Soft drinks<br />

Off-dock services<br />

Knit Garments Export<br />

Media & Advertisement<br />

Real Estate Developer<br />

Artificial Insemination of Cattle/Bull Station<br />

Fabrication of Steel Building Materials<br />

Narrow Fabric Weaving<br />

Knit Garment Export<br />

SAPL does not have any Subsidiary/related Holding company.<br />

Distribution of product/services<br />

Main customers of the company include Main Line Operators (MLO), Shipping Agencies, Freight Forwarders, C&F Agents,<br />

Importers and Exporters. The company provides its services from its depots located in Chittagong. Marketing activities are<br />

provided from both the Chittagong Registered office and Dhaka Corporate office.<br />

Competitive Condition of the business<br />

The following twelve companies are operating in the off-dock industry:<br />

Sl No. Name of Private Depot Location<br />

01 Sea Farers Ltd. North Patenga<br />

02 Ocean Containers Ltd. Katghar, Patenga<br />

03 Summit Alliance Port Ltd. Katghar, Patenga<br />

04 Fisco Bangladesh Ltd. North Patenga<br />

05 QNS Container Services Ltd. CEPZ<br />

06 Iqbal Enterprise(Depot) Ltd. Kalurghat<br />

07 Shafi Motors Ltd. Sagorika Road<br />

08 K & T Logistics Ltd. Chittagong EPZ<br />

09 Esack Brothers Ind’s Ltd. Port Market<br />

10 Shah Majidia Rahmani Container Terminal Patenga<br />

11 Port Link Bhatiary<br />

12 Chittagong Container Transportation Company Ltd. Port Market<br />

Sources and availability of raw materials and principal suppliers<br />

Off-dock is a service based on infrastructure and hence no need for any raw material.<br />

Sources of, and requirement for power, gas and water or any other utilities<br />

The company requires electricity for operation and general purpose. Main source of Electricity is Bangladesh Power<br />

Development Board (BPDB), but the company has Power Generating sets to meet the emergency in case of BPDB failure.<br />

Water, Gas and other utility services are provided by related government authorities.<br />

Customers providing 10% or more revenues<br />

The company has the following one major customer who provided more than 10% revenue during the first year of operation:<br />

Name Address Contribution to Total % of Contribution<br />

Revenue<br />

APL Bangladesh Pvt. Ltd<br />

Finlay House, Agrabad,<br />

Chittagong<br />

31,773,331 14.26%<br />

- 21 -

Issuer<br />

Summit Alliance Port Limited.<br />

Contract with principal customers and suppliers<br />

Issue Manager<br />

Alliance Financial Services Limited.<br />

The Company provides its off-dock services to APL Bangladesh Ltd., Finlay House, Agrabad, Chittagong as per the agreed<br />

terms between the parties. Features of the agreed terms with APL are:<br />

1. Period : 5 Years<br />

2. Minimum Volume : 700 TEUs / Month<br />

3. Rate : Fixed Tk. 3.412 million per month.<br />

4. Volume exceeding minimum target : Tk. 4200 for every 20 feet container.<br />

Tk. 5800 for every 40 feet container.<br />

No contract exists with any of the suppliers of the organization.<br />

Material patents, trademarks, licenses or royalty agreements<br />

The company has taken following licenses to provide off- dock services<br />

Licenses<br />

Import Registration<br />

Bonded Ware House License (East & West)<br />

Issuing Authority<br />

Import & Exports Authority, Chittagong<br />

Customs House, Chittagong<br />

In addition general licenses like Trade License, Clearance from Environment, Fire License etc. has taken by the company as<br />

usual requirement.<br />

Number of employees<br />

(As on 31 December, 2007)<br />

Full-time of employees 80<br />

Temporary employees 31<br />

Total Employees 121<br />

Capacity and current utilization of the facility<br />

(As on 31 December, 2007)<br />

Service Category<br />

Capacity in TEUs<br />

Utilization in 2007 % of Capacity<br />

East West Total<br />

(TEUs)<br />

Utilization<br />

Empty Container 4,000<br />

71,077<br />

(At any time) -- 4,000<br />

(In & Out)<br />

N/A<br />

Export Container<br />

-- 12,000 12,000 7,000 58<br />

Import Container<br />

-- 24,000 24,000 12,795 53<br />

Note: Capacity shown above represents for 12 months while the utilization shown for 10 months.<br />

Description of property<br />

A) The Company owns the following fixed assets at written down value as on December 31, 2008<br />

(As per audited accounts)<br />

Name of the Assets<br />

Written Down Value<br />

As at 31 st December 2007<br />

Land and Land Development 523,046,665<br />

Building and Prefabricated Steel 19,025,657<br />

Plant and Equipment 33,718,082<br />

Furniture and Fixtures 344,964<br />

Vehicle 10,891,851<br />

Office Equipment 638,654<br />

Total 587,665,873<br />

B) All the above-mentioned assets are situated at Company’s project site and office premises and are in good operating<br />

condition.<br />

C) The company does not have plant & machinery as it’s operation is based on Land, Structure & Handling Equipment.<br />

- 22 -

Issuer<br />

Summit Alliance Port Limited.<br />

Issue Manager<br />

Alliance Financial Services Limited.<br />

D) All the assets of the Company are in its own name except -<br />

(i) Out of total 14.5269 acres of the land owned by the company mutation could be completed for 10.47 acres as of<br />

30 April 2008 and 0.3033 acres are under process of mutation.<br />

Balance land aggregating 3.7536 acres got registered in the name of SAPL based on correct ownership and duly<br />

muted documents in the name of sellers. AC land rejected to receive documents for mutation verbally saying that the<br />

Civil Aviation authority acquisitioned the lands vide L.A Case No. 10/95-96 dated 21-09-95. However some of the<br />

land owners have gone for challenging the acquisition order.<br />

(ii) Pre-fabricated structure as well as plant & machineries acquired under lease Finance from IIDFC. For Prefabricated<br />

Steel Components, Kato Crane, TCM Forklifts (2 units) lease, the lessor is Industrial Infrastructure<br />

Development Finance Company Limited (IIDFC). The term of the lease is 5 Years (60 Months) and starting from 25<br />

July 2006 and will be expired on 25 June 2011.<br />

E) For mortgage of properties against borrowings from banks please refer to note- 36 of the audited financial statements.<br />

Plan of Operation and Discussion on Financial Condition<br />

Internal and external sources of fund<br />

Internal sources<br />

(As per audited accounts)<br />

31 December 07 (Amount in Taka)<br />

Share capital 200,000,000<br />

Capital reserve 224,811,727<br />

Tax- Holiday reserve 55,138,861<br />

Proposed dividend 80,000,000<br />

Retained earnings 2,708,292<br />

Sub-total 562,658,880<br />

External Sources<br />

Bank Loan (Net of current maturity) 52,555,381<br />

Sub-total 52,555,381<br />

Total 615,214,261<br />

Bank Loan was taken from HSBC, Dhaka Branch against two Term Loan agreements. The tenure of the loan was 3 Years<br />

payable in 36 equal monthly installments effective from April 2005. The loan bears interest @ 2.10% p.a bellow the banks<br />

lending rate. First agreement amounting Tk. 150 million already been fully amortized in March 2008 and the other will expire<br />

after March 2009.<br />

Material commitment for capital expenditure<br />

The followings are the capital expenditure Commitments for year 2008 to be met from the proceeds of recent right issue and<br />

IPO:<br />

a. Land : Tk. 187,500,000<br />

b. Ware House : Tk. 32,500,000<br />

Total : Tk. 220,000,000<br />

Causes for material changes<br />

Year 2007 was the first year of operation and hence no material changes in operation could be identified.<br />

Seasonal aspect of the company’s business<br />

With the increase/ decrease in imports and exports through Chittagong Port, the business of the company also changes.<br />

Known trends, events or uncertainties<br />

Country's international trade has been growing very fast. Political unrest, flood and natural calamities are the known events<br />

that may affect the business operations of the company.<br />

Changes in the assets of the company used to pay off any liabilities<br />

No asset of the company has been disposed off to pay liabilities of the company.<br />

- 23 -

Issuer<br />

Summit Alliance Port Limited.<br />

Loan taken from Holdings/parent Company or subsidiary company<br />

Issue Manager<br />

Alliance Financial Services Limited.<br />

The Company has no Holdings/ Parent company or subsidiary company and hence there is no question of taking loan.<br />

Loan given to Holdings/parent Company or subsidiary company<br />

The Company has no Holdings/ Parent company or subsidiary company and has not given any loan from such party.<br />

Future contractual liabilities<br />

The company has not, as on 31 st December 2007, entered into any future contractual liability and has no plan to enter into any<br />

such contractual obligation with in next 1 year other than normal course of business.<br />

Future capital expenditure<br />

The company does not have any capital expenditure plan during FY 2008 except the details of utilization plan given under the<br />

“Use of IPO proceeds and Implementation Target”.<br />

VAT, income tax, customs duty or other tax liability<br />

VAT<br />

SAPL does not have any outstanding VAT up to December 2007 and there is no pending VAT liability against operations of<br />

the company.<br />

Income tax<br />

The company commenced its operation on 20 th February 2007 and applied for Tax holiday on 28/6/2007, which is rejected by<br />

the National Board of Revenue (NBR) 28/8/2007. But the company has submitted review application against rejection of taxholiday<br />

on 23/3/2008. Lately on 22 June 2008 approved the Tax holiday of the company up to 31 January 2011. However<br />