- Page 1: L A W S E M I N A R S I N T E R N A

- Page 4 and 5: Monday, February 08, 2010 Real Esta

- Page 6 and 7: John W. Hanley, Jr., Ste

- Page 8 and 9: Table of Contents Topic Speaker # L

- Page 10 and 11: Faculty for Real Estate Joint Ventu

- Page 13: L A W S E M I N A R S I N T E R N A

- Page 16 and 17: John W. Hanley, Jr. of Davis Wright

- Page 18 and 19: Steven L. Wood of Century Pacific,

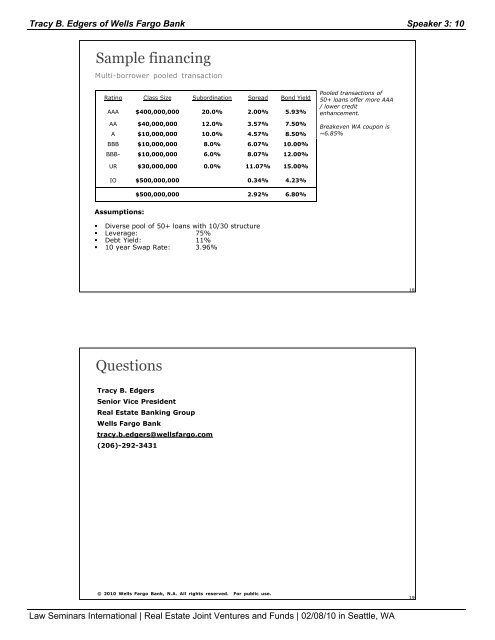

- Page 21 and 22: Tracy B. Edgers of Wells Fargo Bank

- Page 23 and 24: Tracy B. Edgers of Wells Fargo Bank

- Page 25 and 26: Tracy B. Edgers of Wells Fargo Bank

- Page 27 and 28: Tracy B. Edgers of Wells Fargo Bank

- Page 29: Tracy B. Edgers of Wells Fargo Bank

- Page 33: L A W S E M I N A R S I N T E R N A

- Page 36 and 37: Gregory K. Johnson of Wright Runsta

- Page 38 and 39: Gregory K. Johnson of Wright Runsta

- Page 40 and 41: Gregory K. Johnson of Wright Runsta

- Page 42 and 43: Gregory K. Johnson of Wright Runsta

- Page 44 and 45: Gregory K. Johnson of Wright Runsta

- Page 46 and 47: Gregory K. Johnson of Wright Runsta

- Page 49: L A W S E M I N A R S I N T E R N A

- Page 72 and 73: Joseph P. McCarthy of Stoel Rives L

- Page 74 and 75: Joseph P. McCarthy of Stoel Rives L

- Page 76 and 77: Joseph P. McCarthy of Stoel Rives L

- Page 78 and 79: Joseph P. McCarthy of Stoel Rives L

- Page 80 and 81:

Joseph P. McCarthy of Stoel Rives L

- Page 83:

L A W S E M I N A R S I N T E R N A

- Page 86 and 87:

David E. Myre, Jr. of Hillis Clark

- Page 88 and 89:

David E. Myre, Jr. of Hillis Clark

- Page 90 and 91:

David E. Myre, Jr. of Hillis Clark

- Page 92 and 93:

David E. Myre, Jr. of Hillis Clark

- Page 94 and 95:

David E. Myre, Jr. of Hillis Clark

- Page 96 and 97:

David E. Myre, Jr. of Hillis Clark

- Page 98 and 99:

David E. Myre, Jr. of Hillis Clark

- Page 101 and 102:

David E. Myre, Jr. of Hillis Clark

- Page 103:

L A W S E M I N A R S I N T E R N A

- Page 106 and 107:

Brian Todd of Davis Wright Tremaine

- Page 108 and 109:

Brian Todd of Davis Wright Tremaine

- Page 110 and 111:

Brian Todd of Davis Wright Tremaine

- Page 112 and 113:

Brian Todd of Davis Wright Tremaine

- Page 114 and 115:

Brian Todd of Davis Wright Tremaine

- Page 116 and 117:

Brian Todd of Davis Wright Tremaine

- Page 118 and 119:

Brian Todd of Davis Wright Tremaine

- Page 120 and 121:

Brian Todd of Davis Wright Tremaine

- Page 122 and 123:

Brian Todd of Davis Wright Tremaine

- Page 124 and 125:

Brian Todd of Davis Wright Tremaine

- Page 126 and 127:

Brian Todd of Davis Wright Tremaine

- Page 129:

L A W S E M I N A R S I N T E R N A

- Page 132 and 133:

John W. Hanley, Jr. of Davis Wright

- Page 134 and 135:

John W. Hanley, Jr. of Davis Wright

- Page 136 and 137:

John W. Hanley, Jr. of Davis Wright

- Page 138 and 139:

John W. Hanley, Jr. of Davis Wright

- Page 141 and 142:

John M. Parker of Kennedy Associate

- Page 143:

L A W S E M I N A R S I N T E R N A

- Page 146 and 147:

Quentin Kuhrau of Unico Properties

- Page 148 and 149:

Rodney A. Bench of RA Bench, Inc. S

- Page 151 and 152:

John W. Hanley, Jr. of Davis Wright

- Page 153 and 154:

John W. Hanley, Jr. of Davis Wright

- Page 155 and 156:

John W. Hanley, Jr. of Davis Wright

- Page 157 and 158:

John W. Hanley, Jr. of Davis Wright

- Page 159 and 160:

John W. Hanley, Jr. of Davis Wright

- Page 161 and 162:

John W. Hanley, Jr. of Davis Wright

- Page 163 and 164:

John W. Hanley, Jr. of Davis Wright

- Page 165 and 166:

John W. Hanley, Jr. of Davis Wright

- Page 167 and 168:

John W. Hanley, Jr. of Davis Wright

- Page 169 and 170:

John W. Hanley, Jr. of Davis Wright

- Page 171 and 172:

John W. Hanley, Jr. of Davis Wright

- Page 173 and 174:

John W. Hanley, Jr. of Davis Wright

- Page 175 and 176:

John W. Hanley, Jr. of Davis Wright

- Page 177 and 178:

John W. Hanley, Jr. of Davis Wright

- Page 179 and 180:

John W. Hanley, Jr. of Davis Wright

- Page 181 and 182:

John W. Hanley, Jr. of Davis Wright

- Page 183 and 184:

John W. Hanley, Jr. of Davis Wright

- Page 185 and 186:

John W. Hanley, Jr. of Davis Wright

- Page 187:

L A W S E M I N A R S I N T E R N A

- Page 190 and 191:

James E. Wreggelsworth of Davis Wri

- Page 193 and 194:

Erin Joyce Letey of Riddell William

- Page 195 and 196:

Erin Joyce Letey of Riddell William

- Page 197 and 198:

Erin Joyce Letey of Riddell William

- Page 199 and 200:

Erin Joyce Letey of Riddell William

- Page 201 and 202:

Erin Joyce Letey of Riddell William

- Page 203:

Erin Joyce Letey of Riddell William

- Page 207 and 208:

John Orehek of Security Properties

- Page 209 and 210:

Matthew G. Paddock of Metzler North

- Page 211 and 212:

Stephen P. Latimer of ING Clarion P

- Page 213:

L A W S E M I N A R S I N T E R N A

- Page 216 and 217:

John W. Hanley, Jr. of Davis Wright

- Page 218 and 219:

Donald E. Percival of Davis Wright

- Page 220 and 221:

Donald E. Percival of Davis Wright

- Page 222 and 223:

Donald E. Percival of Davis Wright

- Page 224 and 225:

Donald E. Percival of Davis Wright

- Page 226 and 227:

Donald E. Percival of Davis Wright

- Page 228:

Donald E. Percival of Davis Wright