SCMTD February 2004 Board of Directors Agendas - Santa Cruz ...

SCMTD February 2004 Board of Directors Agendas - Santa Cruz ... SCMTD February 2004 Board of Directors Agendas - Santa Cruz ...

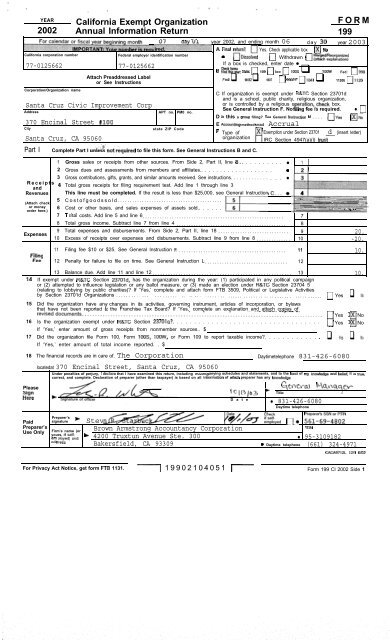

2002 Federal Statements Client 74043 Santa Cnrz Civic Improvement Corp B/l 5103 Statement 5 Form 990-EZ, Part V Regarding Transfers Associated with Personal Benefit Contracts !a). Did the organization, during the year, receive any funds directly or indirectly, to pay premiums on a personal benefit contract?...: (b) Did the organization, during the year, pay premiums, directly"or""""." indirectly, on a personal benefit contract?.................................................. Page 2 n-01 25662 08:48AM No No

Santa Cruz Civic Improvement Corp Address 370 Encinal Street #lo0 City APT no. PM0 no. state ZIP Code C If organization is exempt under R&TC Section 23701d and is a school, public charity, religious organization, or is controlled by a religious o eration,.check box. See General Instruction F. No P- llrng fee IS required. • 0 D 1s this a group filing? see General tnstruction M . . . . 0Ye.s ~NO E Accounting method USHI Accrual Santa Cruz, CA 95060 . . Part I Complete Part I II&& not.r&uired to file this form. See General Instructions B and C. 1 2 3 Receipts 4 and Revenues (Attach check or money order here.) Expenses 14 YEAR California Exempt Organization FORM 2002 Annual Information Return 199 California corporation number ‘!kg 5 6 7 Federal employer identification number 07 da 01 year 2002, and ending month 06 ~~~~~~~~~ A Fina, ret"r"?. ’ 0 HDissoti 77-0125662 77-0125662 If a box is checked, enter date • Corporation/Organization name 15 16 17 18 Please it,9:, Attach Preaddressed Label or See Instructions d (insert letter) IRC Section 4947(a)(l) trusl F Type of Exemption under Section 23701 organization Gross sales or receipts from other sources. From Side 2, Part II, line 8.. . . . . . . . . . • 1 1 Gross dues and assessments from members and affiliates.. . . . . . . . . . . . . . . . . . . 0 12) Gross contributions, gifts, grants, and similar amounts received. See instructions. . . . . . . . . . . . . . . . • ............. 3 .............. :::::j :.:.:.:. =: ‘:::::~:~:~:::i~~:~~~:~~ ___,,,(,, (., ........................ Total gross receipts for filing requirement test. Add line 1 through line 3 :‘.,:“::::~:: ‘::::.:.:.‘i.:.:.:.~:.:.:.::” ~~~~~:~:~~~:~:~:i~:~:~:~~~:~~:~:~:~~:~:~:~~ :.:.: ............... ............................................ ...........“.............~...‘.~....:::::::::::::::::::::: This line must be completed. If the result is less than $25,000, see General Instruction E4 Costofgoodssold........................................... :.:.:.: : : : : ;:.:.(:.:.: : : :.:.:,:,:.:,:::;::::::.:.:;.:~.:~.:.:~.:.:. .A. .. ...................... ..... ;::::::::.:.:.:.:.:.:.:.:,;.:,~~:::~ .......... :.:.:. .............. ....................... ............................. ....... :::..;..:...:.:::::: ..“““i.............................. .:. _ ...................................................................... i.......... ., ,, _,. ...................... _, :.:,:,:.:,:,: ‘...........‘.....~.~.~...~.~..:.:.:.:..:::...:.:.:.:.:.:.~:.:::.:.:.:.~.:.:.:.:.:.:.:.:.:.:.:.:.:.:.~:.:.: ..~...~.. Cost or other basis, and sales expenses of assets sold.. . . . . . ‘.:

- Page 134 and 135: (iii) a change in the officer(s), e

- Page 136 and 137: An Offeror may seek FTA review of t

- Page 138 and 139: . SANTA CRUZ METROPOLITAN TRANSIT D

- Page 140 and 141: Peter C. Brown, CPA Burton H. Armst

- Page 142 and 143: SANTA CRUZ METROPOLITAN TRANSIT DIS

- Page 144 and 145: Statement of Net Assets A compariso

- Page 146 and 147: SANTA CRUZ METROPOLITAN TRANSIT DIS

- Page 148 and 149: SANTA CRUZ METROPOLITAN TRANSIT DIS

- Page 150 and 151: SANTA CRUZ METROPOLITAN TRANSIT DIS

- Page 152 and 153: NOTE 1 - OPERATIONS AND SUMMARY OF

- Page 154 and 155: NOTE 1 - OPERATIONS AND SUMMARY OF

- Page 156 and 157: NOTE 3 - RECEIVABLES Receivables at

- Page 158 and 159: NOTE 6 - CAPITAL GRANTS The Distric

- Page 160 and 161: NOTE 11 - DEFINED BENEFIT PENSION P

- Page 162 and 163: NOTE 15 -TRANSPORTATION DEVELOPMENT

- Page 164 and 165: SANTA CRUZ METROPOLITAN TRANSIT DIS

- Page 166 and 167: SANTA CRUZ METROPOLITAN TRANSIT DIS

- Page 168 and 169: Peter C. Brown, CPA Burton H. Armst

- Page 170 and 171: Peter C. Brown, CPA Burton H. Armst

- Page 172 and 173: Peter C. Brown, CPA Burton H. Armst

- Page 174 and 175: SANTA CRUZ METROPOLITAN TRANSIT DIS

- Page 176 and 177: Form990-EZ(2002) Santa Cruz Civic I

- Page 178 and 179: Schedule A (Form 990 or 990-W) 2002

- Page 180 and 181: Santa Cruz Civic Improvement Carp o

- Page 182 and 183: Schedule A (Form 990 or 990-EZ) 200

- Page 186 and 187: Santa Cruz Civic I&rovement Corp 77

- Page 188 and 189: c-s MAIL TO: Registry of Charitable

- Page 190 and 191: BROWN ARMSTRONG PAULDEN McCOWN STAR

- Page 192 and 193: BROWN ARMSTRONG PAULDEN MCCOWN STAR

- Page 194 and 195: j Santa Cruz Metropolitan Transit D

- Page 196 and 197: Santa Cruz Metropolitan Transit Dis

- Page 198 and 199: TECHNICAL AUDIT A.PPROACH e3kd [~~~

- Page 200 and 201: Santa Cruz Metropolitan Transit Dis

- Page 202 and 203: Santa Cruz Metropolitan Transit Dis

- Page 204 and 205: Santa Cruz Metropolitan Transit Dis

- Page 206 and 207: Santa Cruz Metropolitan Transit Dis

- Page 208 and 209: Santa Cruz Metropolitan Transit Dis

- Page 210 and 211: TECHNICAL AUDIT A.PPROACH e3kd [~~~

- Page 212 and 213: Santa Cruz Metropolitan Transit Dis

- Page 214 and 215: Santa Cruz Metropolitan Transit Dis

- Page 216 and 217: Santa Cruz Metropolitan Transit Dis

- Page 218 and 219: Santa Cruz Metropolitan Transit Dis

- Page 220 and 221: I Santa Cruz Metropolitan Transit D

- Page 222 and 223: Resume of Steven R. Starbuck, CPA ,

- Page 224 and 225: Resume of Thomas M. Young, CPA Audi

- Page 226 and 227: Resume of Adriana C. Belt Staff Acc

- Page 228 and 229: Santa Cruz Metropolitan Transit Dis

- Page 230 and 231: ‘&Vi ‘146 l#&llj; F e b 0 4 0 4

- Page 232 and 233: Signed on _________________________

<strong>Santa</strong> <strong>Cruz</strong> Civic Improvement Corp<br />

Address<br />

370 Encinal Street #lo0<br />

City<br />

APT no. PM0 no.<br />

state ZIP Code<br />

C If organization is exempt under R&TC Section 23701d<br />

and is a school, public charity, religious organization,<br />

or is controlled by a religious o eration,.check box.<br />

See General Instruction F. No P- llrng fee IS required. • 0<br />

D 1s this a group filing? see General tnstruction M . . . . 0Ye.s ~NO<br />

E Accounting method USHI Accrual<br />

<strong>Santa</strong> <strong>Cruz</strong>, CA 95060<br />

. .<br />

Part I Complete Part I II&& not.r&uired to file this form. See General Instructions B and C.<br />

1<br />

2<br />

3<br />

Receipts 4<br />

and<br />

Revenues<br />

(Attach check<br />

or money<br />

order here.)<br />

Expenses<br />

14<br />

YEAR<br />

California Exempt Organization FORM<br />

2002 Annual Information Return 199<br />

California corporation number<br />

‘!kg<br />

5<br />

6<br />

7<br />

Federal employer identification number<br />

07 da 01 year 2002, and ending month 06<br />

~~~~~~~~~ A Fina, ret"r"?.<br />

’ 0 HDissoti<br />

77-0125662 77-0125662<br />

If a box is checked, enter date •<br />

Corporation/Organization name<br />

15<br />

16<br />

17<br />

18<br />

Please<br />

it,9:,<br />

Attach Preaddressed Label<br />

or See Instructions<br />

d (insert letter)<br />

IRC Section 4947(a)(l) trusl<br />

F Type <strong>of</strong> Exemption under Section 23701<br />

organization<br />

Gross sales or receipts from other sources. From Side 2, Part II, line 8.. . . . . . . . . . • 1 1<br />

Gross dues and assessments from members and affiliates.. . . . . . . . . . . . . . . . . . . 0 12)<br />

Gross contributions, gifts, grants, and similar amounts received. See instructions. . . . . . . . . . . . . . . . •<br />

.............<br />

3<br />

..............<br />

:::::j :.:.:.:. =: ‘:::::~:~:~:::i~~:~~~:~~ ___,,,(,, (., ........................<br />

Total gross receipts for filing requirement test. Add line 1 through line 3<br />

:‘.,:“::::~:: ‘::::.:.:.‘i.:.:.:.~:.:.:.::”<br />

~~~~~:~:~~~:~:~:i~:~:~:~~~:~~:~:~:~~:~:~:~~<br />

:.:.: ............... ............................................<br />

...........“.............~...‘.~....::::::::::::::::::::::<br />

This line must be completed. If the result is less than $25,000, see General Instruction E4<br />

Cost<strong>of</strong>goodssold...........................................<br />

:.:.:.: : : : : ;:.:.(:.:.: : : :.:.:,:,:.:,:::;::::::.:.:;.:~.:~.:.:~.:.:. .A. .. ...................... ..... ;::::::::.:.:.:.:.:.:.:.:,;.:,~~:::~ .......... :.:.:.<br />

.............. ....................... .............................<br />

.......<br />

:::..;..:...:.:::::: ..“““i.............................. .:. _<br />

...................................................................... i.......... ., ,, _,. ......................<br />

_,<br />

:.:,:,:.:,:,:<br />

‘...........‘.....~.~.~...~.~..:.:.:.:..:::...:.:.:.:.:.:.~:.:::.:.:.:.~.:.:.:.:.:.:.:.:.:.:.:.:.:.:.~:.:.:<br />

..~...~..<br />

Cost or other basis, and sales expenses <strong>of</strong> assets sold.. . . . . .<br />

‘.: