Child Support Enforcement - Sarpy County Nebraska

Child Support Enforcement - Sarpy County Nebraska

Child Support Enforcement - Sarpy County Nebraska

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

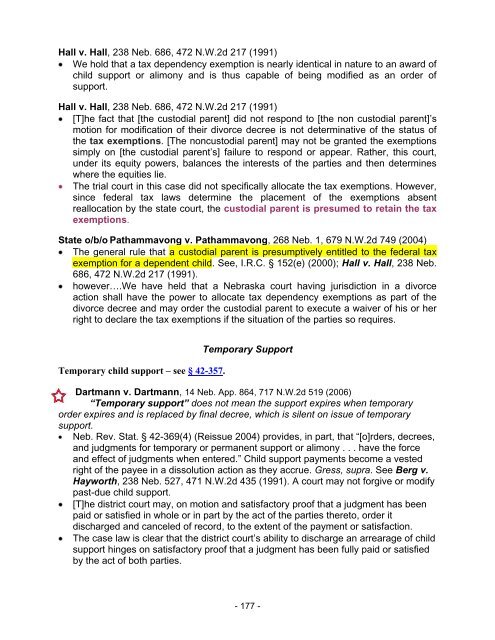

Hall v. Hall, 238 Neb. 686, 472 N.W.2d 217 (1991)<br />

We hold that a tax dependency exemption is nearly identical in nature to an award of<br />

child support or alimony and is thus capable of being modified as an order of<br />

support.<br />

Hall v. Hall, 238 Neb. 686, 472 N.W.2d 217 (1991)<br />

[T]he fact that [the custodial parent] did not respond to [the non custodial parent]’s<br />

motion for modification of their divorce decree is not determinative of the status of<br />

the tax exemptions. [The noncustodial parent] may not be granted the exemptions<br />

simply on [the custodial parent’s] failure to respond or appear. Rather, this court,<br />

under its equity powers, balances the interests of the parties and then determines<br />

where the equities lie.<br />

The trial court in this case did not specifically allocate the tax exemptions. However,<br />

since federal tax laws determine the placement of the exemptions absent<br />

reallocation by the state court, the custodial parent is presumed to retain the tax<br />

exemptions.<br />

State o/b/o Pathammavong v. Pathammavong, 268 Neb. 1, 679 N.W.2d 749 (2004)<br />

The general rule that a custodial parent is presumptively entitled to the federal tax<br />

exemption for a dependent child. See, I.R.C. § 152(e) (2000); Hall v. Hall, 238 Neb.<br />

686, 472 N.W.2d 217 (1991).<br />

however….We have held that a <strong>Nebraska</strong> court having jurisdiction in a divorce<br />

action shall have the power to allocate tax dependency exemptions as part of the<br />

divorce decree and may order the custodial parent to execute a waiver of his or her<br />

right to declare the tax exemptions if the situation of the parties so requires.<br />

Temporary child support – see § 42-357.<br />

Temporary <strong>Support</strong><br />

Dartmann v. Dartmann, 14 Neb. App. 864, 717 N.W.2d 519 (2006)<br />

“Temporary support” does not mean the support expires when temporary<br />

order expires and is replaced by final decree, which is silent on issue of temporary<br />

support.<br />

Neb. Rev. Stat. § 42-369(4) (Reissue 2004) provides, in part, that “[o]rders, decrees,<br />

and judgments for temporary or permanent support or alimony . . . have the force<br />

and effect of judgments when entered.” <strong>Child</strong> support payments become a vested<br />

right of the payee in a dissolution action as they accrue. Gress, supra. See Berg v.<br />

Hayworth, 238 Neb. 527, 471 N.W.2d 435 (1991). A court may not forgive or modify<br />

past-due child support.<br />

[T]he district court may, on motion and satisfactory proof that a judgment has been<br />

paid or satisfied in whole or in part by the act of the parties thereto, order it<br />

discharged and canceled of record, to the extent of the payment or satisfaction.<br />

The case law is clear that the district court’s ability to discharge an arrearage of child<br />

support hinges on satisfactory proof that a judgment has been fully paid or satisfied<br />

by the act of both parties.<br />

- 177 -