An overview of the Russell Sovereign Investment program - RETAIL ...

An overview of the Russell Sovereign Investment program - RETAIL ...

An overview of the Russell Sovereign Investment program - RETAIL ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

an <strong>overview</strong> <strong>of</strong> <strong>the</strong> RUSSELL SOVEREIGN INVESTMENT PROGRAM

RUSSELL INVESTMENTS.<br />

At <strong>Russell</strong>, we have a rich heritage <strong>of</strong> directing <strong>the</strong><br />

investments <strong>of</strong> some <strong>of</strong> <strong>the</strong> world’s largest investors—<br />

some <strong>of</strong> whom have billion-dollar portfolios. This kind <strong>of</strong><br />

investor cannot afford to be without a highly diversified<br />

portfolio. Nei<strong>the</strong>r can you.<br />

We believe success means making<br />

investment excellence easier to come by.<br />

We’re certain sophisticated solutions can be simplified<br />

and streng<strong>the</strong>ned at <strong>the</strong> same time. These solutions<br />

are designed to help meet your financial goals. We<br />

believe that by partnering with <strong>Russell</strong> you can benefit<br />

from a multi-asset approach to investing that combines<br />

global asset allocation, manager selection and dynamic<br />

portfolio management.<br />

WE’RE A WORLD AUTHORITY ON PEOPLE WHO<br />

MANAGE MONEY.<br />

With our money manager research experience and<br />

a dedicated team <strong>of</strong> manager research analysts,<br />

we perform <strong>the</strong> vital work to keep your investment<br />

diversified and balanced, in pursuit <strong>of</strong> your goals.<br />

<strong>Sovereign</strong> model<br />

portfolios<br />

Ask your advisor about <strong>Russell</strong>’s<br />

<strong>Sovereign</strong> model portfolios. These<br />

models are developed by <strong>Russell</strong>’s<br />

Capital Markets forecasting group<br />

and <strong>of</strong>fer various asset allocations<br />

to match your risk tolerance to help<br />

you achieve your investment goals.<br />

Utilize our nine model portfolios<br />

or customize your own portfolio<br />

and benefit from:<br />

› Customized asset allocations<br />

with exposure to a diverse set<br />

<strong>of</strong> asset classes.<br />

› Model portfolio updates based<br />

on <strong>Russell</strong>’s capital markets<br />

viewpoints.<br />

› Our automatic rebalancing<br />

service to keep your asset<br />

allocation on track.

Your<br />

Portfolio<br />

TALK TO YOUR ADVISOR.<br />

<strong>Sovereign</strong> is designed so your<br />

advisor can help you create a<br />

personal pr<strong>of</strong>ile and establish<br />

a tailored financial plan. Once<br />

you’ve implemented your plan,<br />

your advisor will continue to<br />

monitor your situation to help<br />

keep you on track with<br />

your goals.<br />

When investing outside <strong>of</strong> a<br />

registered retirement savings<br />

plan (RSP), you may be able<br />

to take advantage <strong>of</strong> <strong>the</strong><br />

Corporate Class structure<br />

to achieve more tax-efficient<br />

investment returns.<br />

CHOOSE FROM 16 POOLS<br />

TO build A PORTFOLIO<br />

RUSSELL balances<br />

INVESTMENT STYLES<br />

RUSSELL selects and monitors<br />

YOUR SUB-ADVISERS<br />

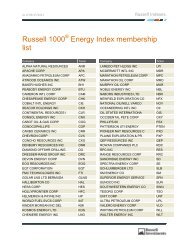

INVESTMENT POOL STYLE SUB-ADVISERS 1 SUB-ADVISER ACCOUNT Target pool<br />

SIze minimum 2 allocation<br />

<strong>Russell</strong> Money Market Pool Short-term <strong>Russell</strong> <strong>Investment</strong> Management Company* $10M 100%<br />

<strong>Russell</strong> Short Term Income Pool<br />

Multi-style (interest rate management, Phillips, Hager & North <strong>Investment</strong> Management $50M 40%<br />

sector and security selection)<br />

Credit security selection AEGON Capital Management Inc. $10M 40%<br />

Credit security selection Canso <strong>Investment</strong> Counsel Ltd $10M 20%<br />

<strong>Russell</strong> Fixed Income Pool Interest rate management Beutel, Goodman & Company, Ltd. $15M 50%<br />

Security selection Canso <strong>Investment</strong> Counsel, Ltd. $2M 25%<br />

Global Pacific <strong>Investment</strong> Mgmt. Company LLC (PIMCO) $2M 25%<br />

<strong>Russell</strong> Core Plus Fixed Income Pool Security selection and global Goldman Sachs Asset Management, LP $50M 33%<br />

Sector selection and global AllianceBernstein Canada, Inc. $35M 33%<br />

Interest rate management and global Pacific <strong>Investment</strong> Mgmt. Company LLC (PIMCO) $2M 34%<br />

<strong>Russell</strong> Global High Income Bond Pool US high yield bond specialist DDJ Capital Management, LLC $25M 20%<br />

Global high yield bond specialist Logan Circle <strong>Investment</strong> Partners LLC $25M 40%<br />

Emerging markets debt specialist Stone Harbor <strong>Investment</strong> Partners LP $50M 40%<br />

<strong>Russell</strong> Canadian Dividend Pool Value Foyston, Gordon & Payne, Inc. $25M 45%<br />

Value GCIC, Ltd. $25M 50%<br />

<strong>Investment</strong> Strategy Portfolio <strong>Russell</strong> Implementation Services 5%<br />

<strong>Russell</strong> Focused Canadian Equity Pool Defensive Rondeau Capital Inc. $1M 30%<br />

Value QV Investors Inc. $10M 26%<br />

Growth at a price CGOV Asset management $10M 40%<br />

<strong>Investment</strong> strategy <strong>Russell</strong> Implementation Services $50M 4%<br />

<strong>Russell</strong> Canadian Equity Pool Value Foyston, Gordon & Payne, Inc. $25M 28%<br />

Market-oriented Aurion Capital Management, Inc. $20M 18%<br />

Market-oriented ClariVest Asset Management LLC $50M 17%<br />

Growth Picton Mahoney Asset Management $20M 27%<br />

Growth GCIC, Ltd. $25M 7%<br />

<strong>Investment</strong> Strategy Portfolio <strong>Russell</strong> Implementation Services 3%<br />

<strong>Russell</strong> Smaller Companies Pool Multi-style Hillsdale <strong>Investment</strong> Management, Inc. $25M 50%<br />

Growth GCIC, Ltd. $25M 50%<br />

<strong>Russell</strong> Focused US Equity Pool Value/market-oriented Lazard Asset Management, Inc. (Canada) $5M 34%<br />

Value/market-oriented Levin Capital Strategies LP $1M 34%<br />

Growth/market-oriented Mar Vista <strong>Investment</strong> Partners LLC $1M 33%<br />

<strong>Russell</strong> US Equity Pool Value Institutional Capital Corporation $10M 22%<br />

Value Aronson + Johnson + Ortiz LP $50M 17%<br />

Market-oriented Levin Capital Strategies LP $50M 12%<br />

Market-oriented First Eagle <strong>Investment</strong> Management LLC $100M 11%<br />

Growth Cornerstone Capital Management, Inc. $25M 16%<br />

Growth Sustainable Growth Advisors LP $25M 17%<br />

Small cap PENN Capital Management Company, Inc. $2M 5%<br />

<strong>Russell</strong> Overseas Equity Pool Value Barrow, Hanley, Mewhinney & Strauss, Inc. $50M 20%<br />

Value Mondrian <strong>Investment</strong> Partners ,Ltd. $50M 20%<br />

Market-oriented Arrowstreet Capital LP $75M 20%<br />

Growth MFS Institutional Advisors, Inc. $50M 20%<br />

Growth William Blair & Company LLC $20M 20%<br />

<strong>Russell</strong> Global Equity Pool Value Harris Associates LP $100M 15%<br />

Value Sanders Capital Management LLC $50M 17.5%<br />

Market-oriented Arrowstreet Capital LP $75M 15%<br />

Market-oriented MFS Institutional Advisors, Inc. $50M 20%<br />

Growth Sustainable Growth Advisers, LP $100M 17.5%<br />

Growth McKinley Capital Management, Inc. $10M 15%<br />

<strong>Russell</strong> Emerging Markets Equity Pool Value AllianceBernstein Canada, Inc. $35M 30%<br />

Value (core) Delaware <strong>Investment</strong> Advisors $50M 25%<br />

Market-oriented/quality growth Harding Loevner, LP $50M 45%<br />

<strong>Russell</strong> Global Infrastructure Pool Growth at a price Colonial First State Asset Management Australia $50M 50%<br />

Value Nuveen Asset Management LLC $20M 50%<br />

<strong>Russell</strong> Global Real Estate Pool Value AEW Capital Management, L.P. $100M 50%<br />

Multi-style RREEF America L.L.C. $35M 50%<br />

ASSET<br />

WE DIVERSIFY YOUR PORTFOLIO<br />

INTO MULTIPLE ASSET CLASSES BY<br />

UP TO SIXTEEN RUSSELL POOLS.<br />

STYLE<br />

THEN WE DIVERSIFY<br />

EACH POOL INTO MULTIPLE<br />

INVESTMENT STYLES.<br />

Sub-Advisers<br />

THEN WE USE MULTIPLE<br />

Sub-Advisers TO DIVERSIFY<br />

EVEN FURTHER.<br />

*<strong>Russell</strong> <strong>Investment</strong> Management Company is an affiliate <strong>of</strong> <strong>Russell</strong> <strong>Investment</strong>s Canada Limited.<br />

The <strong>Russell</strong> Strategy<br />

Your <strong>Sovereign</strong> Portfolio

Think <strong>of</strong> this<br />

as customized<br />

diversification.<br />

THE RUSSELL SOVEREIGN INVESTMENT PROGRAM.<br />

Toge<strong>the</strong>r with your investment advisor, <strong>Sovereign</strong><br />

provides a complete portfolio solution. Customized.<br />

Designed to meet your investment needs.<br />

WE MANAGE SUB-ADVISERS TO BRING YOU <strong>Russell</strong> researched<br />

“BEST-OF-BREED” INVESTMENTS.<br />

We actively monitor more than 5,400 manager products, <strong>of</strong> which less than 6%<br />

(as <strong>of</strong> December 2011) receive an assignment in a <strong>Russell</strong> fund.<br />

OUR RESEARCH LOOKS FORWARD.<br />

Everyone studies performance. But performance tracking is, by definition,<br />

backwards-looking. At <strong>Russell</strong>, we get to know managers well enough so we have<br />

<strong>the</strong> ability to see developing trends long before performance tracking will reveal<br />

<strong>the</strong>m. Then we move swiftly and cost-effectively when changes are needed.<br />

YOUR NEEDS DETERMINE OUR DESIGN.<br />

<strong>Sovereign</strong> can be customized to meet your personal investment objectives and<br />

changing life circumstances.<br />

A NOTE ABOUT RISKS.<br />

As with all mutual funds, investment in <strong>the</strong> <strong>Russell</strong> Funds contains risks that may<br />

make it unsuitable for you, depending on your investment objectives and risk<br />

tolerance. If <strong>the</strong> funds do not perform as intended, you may experience a loss <strong>of</strong><br />

part or all <strong>of</strong> your principal invested. Please read <strong>the</strong> <strong>Russell</strong> Funds prospectus<br />

for a detailed description <strong>of</strong> <strong>the</strong> risks involved before making a decision to invest<br />

in <strong>the</strong> <strong>Russell</strong> Funds.

Our commitment to you.<br />

With <strong>the</strong> help <strong>of</strong> your advisor, we will<br />

help you replace <strong>the</strong> hunches, hope<br />

and guesswork with a solid investment<br />

discipline that puts some <strong>of</strong> <strong>the</strong> world’s<br />

best money managers at your disposal.<br />

Our approach has been tested over time<br />

and it is brought to you by selected<br />

investment experts in your own<br />

community. Learn more at<br />

www.russell.com/ca.<br />

1<br />

The sub-advisers listed and <strong>the</strong>ir weight in <strong>the</strong> respective pools<br />

are current as <strong>of</strong> <strong>the</strong> time <strong>of</strong> publication. <strong>Russell</strong> may hire, dismiss<br />

or replace sub-advisers at any time. For a list <strong>of</strong> current subadvisers,<br />

please call 888-509-1792.<br />

2<br />

These are minimum account sizes required by <strong>the</strong> stated subadviser<br />

to open an institutional, separate account. This is <strong>the</strong><br />

type <strong>of</strong> account managed by <strong>the</strong> sub-adviser for <strong>Russell</strong> in <strong>the</strong><br />

respective <strong>Russell</strong> Pools. The minimum account requirements<br />

for <strong>the</strong> Canadian sub-advisers are in C$ and all o<strong>the</strong>r account<br />

minimums are in US$.<br />

COMMISSIONS, TRAILING COMMISSIONS, MANAGEMENT<br />

FEES AND EXPENSES ALL MAY BE ASSOCIATED WITH<br />

MUTUAL FUND INVESTMENTS. PLEASE READ THE<br />

PROSPECTUS BEFORE INVESTING. Mutual funds are not<br />

guaranteed, <strong>the</strong>ir values change frequently and past performance<br />

may not be repeated. Nothing in this publication is intended<br />

to constitute legal, tax, securities or investment advice, nor an<br />

opinion regarding <strong>the</strong> appropriateness <strong>of</strong> any investment, nor a<br />

solicitation <strong>of</strong> any type. This information is made available on an<br />

“as is” basis. <strong>Russell</strong> <strong>Investment</strong>s Canada Limited does not make<br />

any warranty or representation regarding <strong>the</strong> information.<br />

RUSSELL BY THE NUMBERS.<br />

• 1936<br />

Founded in Tacoma, WA<br />

• $162.2 billion<br />

Global assets under management<br />

(as <strong>of</strong> December 31, 2012)<br />

• 2400+<br />

Institutional clients and millions <strong>of</strong><br />

individual shareholders worldwide<br />

• 350+<br />

<strong>Russell</strong> funds and multi-asset investment<br />

solutions globally<br />

• 35+<br />

Client countries<br />

• 20+<br />

Offices around <strong>the</strong> world, including Calgary,<br />

Montreal, Toronto and Vancouver<br />

Unless o<strong>the</strong>rwise indicated, all data is as <strong>of</strong><br />

December 31, 2011.<br />

<strong>Sovereign</strong> <strong>Investment</strong> Program, <strong>Sovereign</strong> and <strong>the</strong> <strong>Russell</strong><br />

<strong>Investment</strong>s logo are ei<strong>the</strong>r registered trademarks or<br />

trademarks <strong>of</strong> Frank <strong>Russell</strong> Company and are used under<br />

license by <strong>Russell</strong> <strong>Investment</strong>s Canada Limited.<br />

<strong>Russell</strong> <strong>Investment</strong>s Canada Limited is a wholly owned<br />

subsidiary <strong>of</strong> Frank <strong>Russell</strong> Company and was established in<br />

1985. <strong>Russell</strong> <strong>Investment</strong>s Canada Limited and its affiliates,<br />

including Frank <strong>Russell</strong> Company, are collectively known as<br />

“<strong>Russell</strong> <strong>Investment</strong>s”.<br />

®Phillips, Hager & North is a registered trademark <strong>of</strong> Royal Bank<br />

<strong>of</strong> Canada. Used under license.<br />

Copyright © <strong>Russell</strong> <strong>Investment</strong>s Canada Limited 2013.<br />

All rights reserved.<br />

Date <strong>of</strong> first publication: January 2013<br />

PCG-SOV-COL-001E (1 01/13)<br />

<strong>RETAIL</strong>-2013-01-20-0407 (EXP-01-2014)