issue 1 - Roland Berger

issue 1 - Roland Berger

issue 1 - Roland Berger

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

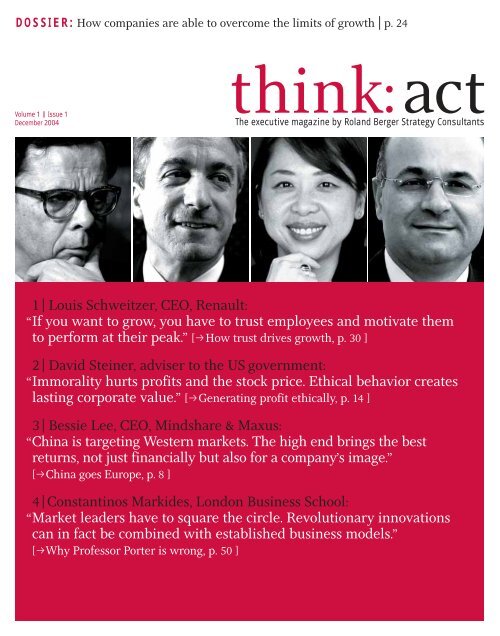

DOSSIER: How companies are able to overcome the limits of growth p. 24<br />

Volume 1 Issue 1<br />

December 2004<br />

think:act<br />

The executive magazine by <strong>Roland</strong> <strong>Berger</strong> Strategy Consultants<br />

1 Louis Schweitzer, CEO, Renault:<br />

“If you want to grow, you have to trust employees and motivate them<br />

to perform at their peak.” [pHow trust drives growth, p. 30 ]<br />

2 David Steiner, adviser to the US government:<br />

“Immorality hurts profits and the stock price. Ethical behavior creates<br />

lasting corporate value.” [pGenerating profit ethically, p. 14 ]<br />

3 Bessie Lee, CEO, Mindshare & Maxus:<br />

“China is targeting Western markets. The high end brings the best<br />

returns, not just financially but also for a company’s image.”<br />

[pChina goes Europe, p. 8 ]<br />

4 Constantinos Markides, London Business School:<br />

“Market leaders have to square the circle. Revolutionary innovations<br />

can in fact be combined with established business models.”<br />

[pWhy Professor Porter is wrong, p. 50 ]

PARIS OFFICE, ROLAND BERGER STRATEGY CONSULTANTS, 16 Avenue George V, 75008 Paris, France,<br />

Tel: +33 1 53670-320, Fax: +33 1 53670-375, E-Mail: office_paris@rolandberger.com

think: act the executive magazine from roland berger strategy consultants volume 1 december 2004 first views f<br />

think:act is our magazine for an exclusive<br />

group of decision-makers from business and politics around<br />

the world. It is my pleasure to introduce it to you.<br />

The title think: act reflects our vision of consulting: firstclass<br />

analysis, sophisticated concepts, high quality and the<br />

greatest impact for our clients, as embodied in our value<br />

proposition, “Creative strategies that work.”<br />

<strong>Roland</strong> <strong>Berger</strong> Strategy Consultants applies this philosophy<br />

to support the firm’s clients in Europe, Asia, North America<br />

and South America from 31 offices in 22 countries. Based<br />

on the knowledge and experience of this international<br />

network, we will use this magazine to present to you the<br />

most important strategic challenges and options for their<br />

solution every four months.<br />

Demanding readers have a right to expect that a high<br />

degree of usefulness will be accompanied by a sophisticated<br />

presentation. We have a first-class team to meet those<br />

expectations. Internationally experienced business journalists and management experts have<br />

researched the magazine’s topics and present them in articles, background reports and exclusive<br />

interviews in think: act.<br />

For this inaugural edition, we have placed the topic of growth front and center. Despite determined<br />

restructuring and systematic cost cutting, many companies have still not yet reached their<br />

goals for growth. With that in mind, our dossier presents suitable strategies, appropriate measures,<br />

and examples of success. It demonstrates how to build a company’s ability to grow, along with its<br />

preparedness to grow; that is, how to create both the hard and allegedly soft factors for sustainable<br />

success.<br />

China is our second key topic. We would like to draw your attention to the growing interest that<br />

Chinese entrepreneurs, scientists, students and tourists are showing in Europe.<br />

I hope that you enjoy this first <strong>issue</strong> of think: act.<br />

Sincerely,<br />

Dr. Burkhard Schwenker<br />

CEO <strong>Roland</strong> <strong>Berger</strong> Strategy Consultants<br />

think: act 3

p contents<br />

New high-tech centers with an international impact are emerging in<br />

China’s northeast. Yet in some parts of the country electric lights are still<br />

considered cutting-edge technology.<br />

page 6 page 24<br />

Peter Brabeck-Letmathe, CEO of Nestlé, has found new growth<br />

opportunities for the Swiss food giant in both high-tech nutrition and<br />

designer foods.<br />

Automobile manufacturers are bowing to cost pressures and<br />

increasingly outsourcing development work to their suppliers—a successful<br />

model for both sides.<br />

page 40 page 54<br />

Gérard Depardieu has turned his great passion for wine into a<br />

second career. The fruits of his vineyards are now drawing praise, even<br />

from Robert Parker.<br />

4<br />

think: act

contents f<br />

food for thought<br />

dossier<br />

business culture<br />

6<br />

8<br />

12<br />

14<br />

16<br />

High tech and electric lights<br />

Is China on its way to becoming<br />

a key center for research?<br />

China goes Europe<br />

How the Middle Kingdom is<br />

moving into Western markets.<br />

Technology, talent and tolerance<br />

Political scientist Richard Florida<br />

explains cities’ keys to success.<br />

Generating profit ethically<br />

Transparency and fairness pay<br />

off for companies.<br />

<strong>Roland</strong> <strong>Berger</strong> Interview<br />

Trustworthy behavior opens new<br />

opportunities for growth.<br />

18<br />

24<br />

30<br />

33<br />

34<br />

Head of the class<br />

Six companies that show above<br />

average growth.<br />

Farewell to the “V-curve”<br />

Only a two-track strategy—<br />

increasing revenue and cutting<br />

costs—can ensure growth.<br />

How trust drives growth<br />

Companies that manage to build<br />

a corporate culture of trust will<br />

have an easier time entering<br />

new markets.<br />

Commentary: Seven surefire ways<br />

to run your company into the<br />

ground.<br />

“The time for indulgence is over“<br />

EU Commissioner Joaquín<br />

Almunia calls for more budget<br />

discipline in certain member<br />

states.<br />

50<br />

54<br />

56<br />

regulars<br />

3<br />

58<br />

Why Professor Porter is wrong<br />

Dealing with revolutionary<br />

innovations means conflict, but<br />

they can still be combined with<br />

established businesses.<br />

Good nose for business<br />

How celebrities are earning<br />

millions, well away from stage<br />

and screen.<br />

Completely underestimated<br />

Ten years after it was first<br />

unveiled, Short Message Service<br />

has developed into a multi-billion<br />

business.<br />

First views<br />

Service | Credits<br />

industry report<br />

Dossier<br />

The formula for growth<br />

How companies can overcome<br />

the limits to growth<br />

Beginning on p. 17<br />

38<br />

40<br />

44<br />

47<br />

48<br />

The shape of things to come<br />

Together in the fast lane<br />

Suppliers are taking over<br />

development tasks.<br />

El Dorado in Central Europe<br />

An increasing number of companies<br />

are outsourcing entire business<br />

processes to the new EU member<br />

states.<br />

“Competencies count”<br />

Wolfram Fischer of Hewlett-<br />

Packard recommends concentrating<br />

on a firm’s unique attributes.<br />

The shape of things to come<br />

think: act 5

p food for thought<br />

china – high-tech center<br />

High tech and electric lights<br />

China is developing into a leader in high technology on the back of massive state support.<br />

High levels of investment are aimed at creating globally important industry and research centers.<br />

In rural areas, by contrast, electric lighting is still seen as cutting-edge.<br />

To global leadership in 50 years<br />

From the 18th to the beginning of the 20th century, self-chosen isolation, conflicts with Asian neighbors and colonial powers, and a series of civil wars led to China’s technological and<br />

economic collapse. Beginning in 1949, four phases have shaped China’s return to global economic importance.<br />

Phase 1 Phase 2 Phase 3 Phase 4<br />

1949 – 1965<br />

Mao Zedong: Adoption of the Soviet scientific and<br />

technological model along with a centrally planned<br />

economy; in 1950, signing of the Chinese-Soviet<br />

treaty of friendship and mutual assistance.<br />

Source: Kathleen Walsh, “Foreign High-Tech R&D in China,” 2003<br />

1966 – 1976<br />

Mao’s Cultural Revolution,<br />

closure of universities,<br />

persecution of intellectuals<br />

and scientists.<br />

182,000<br />

patents were filed by Chinese state research<br />

institutes in 2003. That is roughly 30,000 more<br />

than in the states of the European Union.<br />

1977 – 1997<br />

Reforms under Deng Xiaoping; in 1979,<br />

US-China Science & Technology<br />

Agreement; import of science, technology<br />

and know-how from the US and Europe.<br />

1997 – present<br />

Concentration on high-tech<br />

industries; gradual turn away<br />

from economic model based<br />

solely on cheap production.<br />

Vast market for mobile telecommunications<br />

In just one year, roughly 71 million Chinese signed new contracts for mobile<br />

phones, more than double the population of Canada. A total of 315 million mobile<br />

phones make China the largest market in the world. <strong>Roland</strong> <strong>Berger</strong> Strategy<br />

Consultants predicts an additional 35 percent increase in the market in 2005.<br />

325<br />

315.1<br />

Backlog in the population<br />

Outside of China’s larger cities, light bulbs are still a sign of wealth and progress. The number<br />

of lamps and light fittings per households is rising throughout China. But for reasons of<br />

thrift, an average of only three are ever turned on.<br />

300<br />

275<br />

Number of new<br />

mobile phone<br />

contracts,<br />

in millions<br />

*Average number of light bulbs<br />

per household<br />

19<br />

250<br />

244.1<br />

6.5<br />

8.5<br />

225<br />

China<br />

1995*<br />

Source: Horizon Group, 2004<br />

China<br />

2003<br />

USA/Western Europe<br />

2003<br />

200<br />

Aug Sept Oct Nov Jan Feb Mar Apr May June July Aug<br />

2003 2004<br />

Source: National Bureau of Statistics of China, Ministry of Information Industry of China;<br />

“Outwardly Mobile in China,” <strong>Roland</strong> <strong>Berger</strong> Strategy Consultants<br />

6<br />

think: act

315 million chinese have mobile telephones food for thought f<br />

The dragon’s rapid growth<br />

China’s 9 percent GDP growth in 2003 makes it the fastest-growing large economy in the<br />

world. Driving the growth are IT, telecommunications and the auto industry.<br />

9.0<br />

6.5 6.4<br />

4.7<br />

3.1 3.0 2.0 1.1<br />

China Russia India USA UK Japan France Germany<br />

Source: OECD, National Bureau of Statistics of China<br />

Boom in the rust belt<br />

The People’s Republic of China invests roughly 300 billion RMB yuan<br />

(around 36 billion dollars) in public and private research facilities.<br />

Thanks to state financial support, new high-technology centers are<br />

emerging in the declining steel and petrochemical areas of the northeast.<br />

★★<br />

Xinjiang<br />

1.5/6.0<br />

★<br />

★<br />

Tibet<br />

0.1/38<br />

★★<br />

Shaanxi<br />

9.6/5.3<br />

★★<br />

Chongqing<br />

3.6/9.1<br />

★Beijing<br />

39.3/14.6<br />

★<br />

★Liaoning<br />

14.4/46.1<br />

★★<br />

Tianjin<br />

6.5/5.4<br />

★★<br />

★★<br />

★★ ★★<br />

Jiangsu<br />

27.2/21.2<br />

★★<br />

Heilongjiang<br />

5.04/9.6<br />

Sichuan<br />

13.2/17.2<br />

Shandong<br />

19.7/15.5<br />

★★<br />

Zhejinang<br />

13.7/22.7<br />

Shanghai<br />

25.3/13.9<br />

★<br />

★<br />

Spending in 2002<br />

in billions of RMB yuan (1 RMB yuan = 0.12 dollar)<br />

Spending growth since<br />

2001 as a percentage<br />

Source: National Bureau of Statistics of China, Statistical Bulletin on the Input of Science and Technology, October 2003<br />

★★<br />

Guangdong<br />

29.1/13.2<br />

think: act 7

p food for thought<br />

the dragon prepares to leap

the dragon prepares to leap<br />

food for thought f<br />

China goes Europe<br />

Chinese companies have been gearing up for their long march to<br />

the West for quite some time. Their joint ventures with established<br />

brand-name manufacturers and acquisitions of smaller companies<br />

make up for their weaknesses in service and marketing.<br />

:<br />

China is coming. Just ask any of the<br />

happy few with membership at Berlin’s<br />

China Club how close it has really got. The<br />

club has a bar, library and seven private<br />

dining rooms done up in a 1930s Shanghai<br />

Art Deco style with salmon-pink satin walls,<br />

luxuriously intricate 19th century Chinese<br />

art and oil paintings of post-Mao Red<br />

Guards. In the restaurant, head chef Tam<br />

Kok Kong prepares his signature dish—<br />

wasabi prawns.<br />

When she founded this exclusive club in the<br />

Adlon Hotel at Berlin’s Brandenburg Gate,<br />

Anne Maria Jagdfeld drew inspiration from<br />

the China Club in Hong Kong, of which she<br />

has been a member for many years. “I wanted<br />

to create a glamorous, cosmopolitan social<br />

club where members can network at the<br />

highest level,” says Jagdfeld, who also owns<br />

Quartier 206, a posh Berlin department<br />

THE FLOW OF FUNDS IS STILL<br />

HIGHLY IRREGULAR, BUT CHINA’S<br />

INVESTMENTS ARE RAPIDLY GROWING<br />

store. Much of that networking is conducted<br />

with businesspeople from China itself.<br />

The Chinese are coming as students,<br />

tourists, immigrants and investors. According<br />

to Professor Rolf D. Cremer, vice president<br />

of the International Business School<br />

in Shanghai, who has twenty years of professional<br />

experience in Asia, Chinese companies’<br />

global expansion is not just about<br />

their looking for new sales markets. It also<br />

has to do with China’s image of itself as a<br />

world leader. China does not see itself in the<br />

long term as the world’s mass production<br />

center, as merely contributing cheap labor<br />

to the manufacturing sector. Bessie Lee,<br />

CEO of the market research company<br />

Mindshare & Maxus China, confirms this:<br />

“By globalizing, Chinese companies improve<br />

their image.” (See sidebar.)<br />

In 2003, according to the OECD, only<br />

around $600 million in Chinese capital went<br />

abroad, while China itself drew direct investment<br />

to the tune of $53 billion. However,<br />

it can be assumed that in the future,<br />

“Chinese investments abroad will quickly<br />

increase past current levels.” That is the<br />

conclusion of a recent report prepared by<br />

the German embassy in Beijing.<br />

Where is the money going? “North America<br />

remains the developed market of choice,<br />

followed by Western Europe,” says Wei<br />

Zhou, a <strong>Roland</strong> <strong>Berger</strong> consultant in<br />

Shanghai and author of a study entitled<br />

“From Middle Kingdom to global market.”<br />

This study describes the expansion strategies<br />

of China’s top 50 corporate groups.<br />

Fifty-six percent of these companies are<br />

seeking new sales markets overseas because<br />

their internal dynamics are driving them to<br />

expand internationally. Companies that<br />

manufacture PCs, TVs or air conditioners<br />

are finding it necessary to increase their<br />

exports since domestic production capacities<br />

are exceeding local demand.<br />

Market entry seldom takes the form of a<br />

head-on assault. China’s groups “are on the<br />

lookout for segments that market leaders<br />

have already given up or that they are no<br />

„<br />

Why are Chinese companies expanding?<br />

That has a great deal to do with<br />

China’s perception of itself as a great<br />

nation. China compares its economic<br />

importance to that of countries like the US, Japan,<br />

Germany and Great Britain. By globalizing, Chinese<br />

companies are enhancing their prestige. The government<br />

is backing these companies and encouraging<br />

them to become active worldwide. China has a very<br />

different attitude toward competition than other<br />

Asian countries.<br />

Bessie Lee, CEO, Mindshare & Maxus China<br />

»<br />

Self-image counts<br />

Right now, it seems like the high-tech industries are<br />

most aggressive in expanding abroad. Examples<br />

include IT companies such as Lenovo and homeelectronics<br />

manufacturers such as Haier and TCL.<br />

These groups have highly developed products and<br />

abilities. I suspect that such high-end markets guarantee<br />

them a better return from a financial perspective<br />

as well as in terms of image and national prestige.<br />

Chinese companies are most interested in<br />

Europe and the United States simply because of the<br />

size of these markets.<br />

Looking into the future, consider this: Less than 20<br />

years after its markets opened up, already 6 percent<br />

of all Asia’s top 50 companies are<br />

Chinese, which is absolutely impressive.<br />

I expect this figure will double by<br />

2020, and possibly even triple.<br />

»<br />

think: act 9

p food for thought<br />

the dragon prepares to leap<br />

Victor Yuan, Chairman, Horizon Research<br />

»<br />

Using cost advantages<br />

Currently, Chinese companies are primarily<br />

manufacturing low-priced<br />

products for local markets. Their global<br />

partners are encouraging them to<br />

use their cost and price advantages to penetrate<br />

into international markets. This would also boost<br />

their domestic performance. Many Chinese consumers<br />

believe that an international company can<br />

make better products.<br />

In established markets, Chinese companies are<br />

presently pursuing a low-price, low-end strategy.<br />

However, they absolutely have the ability to undertake<br />

a medium-price strategy in developing markets.<br />

For example, it is much more profitable to<br />

develop a bicycle business in Afghanistan than in<br />

the US market.<br />

To date, Chinese companies have concentrated on<br />

the United States and Europe, but I believe they<br />

should focus more on developing markets. Many<br />

Chinese companies are concerned about social<br />

conditions in these types of countries, but some of<br />

them are starting to get interested in big, developing<br />

nations such as India and Brazil. Yet, from an<br />

overall perspective, the growth of Chinese companies<br />

will still be determined by China’s domestic<br />

market. The scale of their multinational<br />

operations is still smaller than the<br />

overseas operations of Taiwanese or<br />

Korean companies.<br />

»<br />

longer interested in because of insufficient<br />

profit margins and sales volumes,” write<br />

Ming Zeng and Peter Williamson, professors<br />

at the INSEAD Business School in Singapore,<br />

in the Harvard Business Review.<br />

Harro von Senger, a professor of Sinology at<br />

the University of Freiburg, Germany, agrees:<br />

“For Chinese companies, global expansion<br />

may initially only mean a partial expansion—into<br />

a foreign market in a specific<br />

region that is particularly well-suited for a<br />

Chinese product.”<br />

A good example of this is Haier. As the<br />

company, which today is the fourth-biggest<br />

manufacturer of refrigerators and washing<br />

machines in the world, expanded into the<br />

American market in 1994, it concentrated<br />

initially on the overlooked niche of small<br />

refrigerators for minibars and student lodgings.<br />

Soon Haier had reached a 50 percent<br />

share of the market.<br />

There are no challenges that Haier balks at.<br />

“We always follow the principle of cracking<br />

the toughest nut first,” says CEO Zhang<br />

Ruimin. And that is not always an easy task.<br />

For instance, Zhang characterizes German<br />

consumers as adamantly stuck on their<br />

national brands. To get around this, the<br />

company has since the mid-1980s been producing<br />

its refrigerators under license from<br />

the German manufacturer Liebherr—even<br />

winning a seal of approval by the German<br />

consumer association Stiftung Warentest.<br />

This award means so much to Ruimin that<br />

he has it on display in Haier’s headquarters<br />

in Qingdao, hanging between a dedication<br />

penned by Premier Wen Jiabao and the document<br />

produced by the American finance<br />

magazine Fortune describing the company<br />

leader as one of the 25 most powerful managers<br />

outside the United States.<br />

With its strategy, Haier is protected from<br />

the Achilles heel that Chinese companies<br />

traditionally possess: the lack of a strong<br />

brand name. “Chinese companies that want<br />

to expand globally need to build up a brand<br />

name,” says Thomas Eichelmann, a member<br />

of <strong>Roland</strong> <strong>Berger</strong> Strategy Consultants’ executive<br />

committee. This is why they are<br />

increasingly seeking manufacturing opportunities<br />

in locations that stand for both high<br />

quality and premium products.<br />

“Over the next few years, we will see<br />

takeovers of very established brand names<br />

for which Chinese companies will be paying<br />

accordingly,” says Eichelmann. One particular<br />

reason for this trend has to do with the<br />

needs of the domestic market, since China’s<br />

emerging middle class favors internationally<br />

recognized brand-name products.<br />

CHINESE COMPANIES SUCCEED<br />

IN SEGMENTS THAT EMPHASIZE BOTH<br />

QUALITY AND LOW COST<br />

IT and consumer electronics are the principal<br />

focus for expanding Chinese companies.<br />

The strategy is simple: The expansion begins<br />

with partnerships or with the acquisition<br />

of brands that are already established<br />

in the target market. Production takes place<br />

either partially or completely in China,<br />

with marketing and sales conducted in the<br />

Western location.<br />

This is the path trodden by Lenovo, China’s<br />

biggest personal computer manufacturer.<br />

The Beijing Morning Post recently reported<br />

that Lenovo will take over US giant IBM’s<br />

production facility for notebooks and<br />

servers in Shenzhen. It’s a perfect springboard:<br />

Lenovo is teaming up with the chip<br />

manufacturer Intel and will supply the<br />

servers and computers for the 2006 Winter<br />

Olympics in Turin, Italy.<br />

Another expanding Chinese company is<br />

TCL. In 2002 the company, originally a huge<br />

cell phone manufacturer, took over Schneider,<br />

the insolvent TV and hi-fi manufacturer<br />

based in Bavaria, Germany, best known for<br />

its “Dual” record player. For two years TCL<br />

kept production in Germany alive; now it<br />

is divesting all but sales, marketing, and<br />

elements of research and development.<br />

10<br />

think: act

89.5 percent of all young chinese want to study abroad food for thought f<br />

“ For Chinese companies, global expansion may initially only<br />

mean a partial expansion into a specific foreign market.”<br />

Professor Harro von Senger<br />

TCL is engaged in a partnership strategy of<br />

global importance with the French group<br />

Thomson. Overnight the joint venture, of<br />

which TCL owns a 67 percent share, became<br />

the biggest manufacturer of consumer electronics<br />

in the world. It is aiming at producing—in<br />

Hong Kong—18 million color<br />

televisions and up to 4 million DVD players,<br />

with the technology originating in France.<br />

It is not only Western brands and Western<br />

technologies that China can build upon. The<br />

Old World’s big cities are vying to serve as<br />

bridgeheads for the future economic superpower.<br />

Hamburg (referred to in Chinese as<br />

Hanbao, “castle of the Chinese”) feels it<br />

stands a good chance of fulfilling this role,<br />

as it has already provided a branch location<br />

for 320 Chinese companies. “It is our stated<br />

objective to become Europe’s number one<br />

city in doing business with China,” says<br />

Reinhard Stuth, a councilor with the State<br />

Senate’s chancellery.<br />

The Senate has set up a Chinese-language<br />

wing at a city high school for the children of<br />

Hamburg’s 3,000 Chinese residents. And<br />

The Hochschule für Angewandte Wissenschaft,<br />

a university for applied science,<br />

has established an engineering college<br />

jointly with the University of Shanghai. The<br />

university clinic in Epperdorf plans to open<br />

an internationally significant institute for<br />

traditional Chinese medicine.<br />

CHINESE IMMIGRANTS MOVE<br />

AROUND EUROPE AS IF IT WERE A<br />

LARGE CHESSBOARD<br />

Hardly noticed by the public, some European<br />

cities such as Milan in Italy have even<br />

sprouted small Chinatowns. Chinese<br />

leatherworkers and silk-tie salesmen had already<br />

set up shop in the Via Paolo Sarpi district<br />

back in the 1930s. In fact, northern Italy<br />

has had an official Chinese trade and industry<br />

association since 1968. However, most of<br />

Italy’s 16,000-member Chinese community<br />

lives in Prato, a city near Florence built<br />

around the textile industry. Leather-processing<br />

plants in particular have drawn immigrants,<br />

many of them illegal, from Fujian<br />

and Zhejiang provinces. Yet as quickly as<br />

the Chinese community grows, it could also<br />

just as rapidly shrink if economic conditions<br />

were to become unfavorable, as they did in<br />

Prato, where more and more leather companies<br />

are closing.<br />

“Chinese immigrants consider Europe a<br />

kind of chessboard across which they can<br />

move about freely. As a result of their strong<br />

family ties and networks, they have start-up<br />

possibilities all over the continent,” says<br />

Professor Antonaella Ceccagno, head of<br />

Prato’s immigration center.<br />

While Chinese from the lower class try to<br />

make a go of it in leather manufacturing or<br />

in Asian restaurants, the middle class comes<br />

to Europe to study, especially since the<br />

drastic post-9/11 security measures have<br />

scared off enrollees in the United States.<br />

According to the national statistics office in<br />

Beijing, 89.5 percent of all young Chinese<br />

want to study abroad. In 2003, more than<br />

20,000 Chinese students were enrolled in<br />

German universities. And, looking at the <strong>issue</strong><br />

optimistically, it is possible that anyone<br />

who has studied at a European university<br />

may return as a vacationer. The numbers<br />

may back that projection. In 2003, 20.2 million<br />

people from China’s fast-growing middle<br />

and upper classes traveled abroad. Of<br />

them 300,000 went to France, Europe’s traditional<br />

travel destination.<br />

Chen Wang, head of the management board<br />

at Caissa Touristic AG, believes that the<br />

Chinese will constitute the fourth largest<br />

tourist group in the world by 2020. Many<br />

perceive the ever-growing stream of Chinese<br />

tourists, students and investors as a<br />

sign that the sleeping giant is awakening.<br />

“China’s broad impact on key indicators in<br />

all international spheres will be comparable<br />

to the global Americanization in the second<br />

half of the 20th century,” says Cremer.<br />

Chinese companies are<br />

pushing into Western<br />

markets because...<br />

p<br />

p<br />

p<br />

p<br />

p<br />

Chinese production of goods is greater than the<br />

purchasing power of Chinese consumers and<br />

their still comparatively low average income.<br />

China cannot absorb all its domestically<br />

produced goods.<br />

The principle “a bigger market is better for<br />

business” also applies to Chinese companies.<br />

Chinese companies can gain commercially<br />

useful business and other types of expertise by<br />

being internationally competitive.<br />

Global competition can help Chinese companies<br />

avoid both the hazard of becoming “inbred” and<br />

the associated inhibitors of development.<br />

Chinese companies earn foreign currency on the<br />

world market with which they can purchase<br />

expertise and technologies.<br />

(Source: Professor Harro von Senger)<br />

china’s direct investment abroad<br />

600 million dollars<br />

500<br />

400<br />

300<br />

200<br />

100<br />

90 97 98 99 00 01 02<br />

Since 1999, government-sponsored direct investment<br />

abroad has increased steadily.<br />

Source: OECD<br />

china’s globalized sectors<br />

16%<br />

8%<br />

16%<br />

20%<br />

40%<br />

Other<br />

Research & Development<br />

Sales/Marketing<br />

Production<br />

Purchasing<br />

As they expand, Chinese companies are using international<br />

partnerships to compensate for their weaknesses, primarily<br />

in sales and marketing.<br />

Source: <strong>Roland</strong> <strong>Berger</strong> Strategy Consultants<br />

03<br />

think: act 11

p food for thought<br />

business trends<br />

Technology, talent and tolerance<br />

Star political scientist Richard Florida proposes a radical rethink of regional policies. His research<br />

suggests that creative minds only settle in diverse, metropolitan areas that foster uninhibited human<br />

interaction. This quality may become decisive for companies selecting their business locations.<br />

:<br />

Bestselling author Richard Florida loves<br />

to cause a stir. “A town without rock<br />

bands, gays and tattoo studios will experience<br />

decline sooner or later,” says Florida, a<br />

professor of economic development at<br />

George Mason University, located in Fairfax,<br />

Virginia. In saying this, he stands in marked<br />

opposition to most mayors and urban planners.<br />

They often dismiss people’s creative<br />

potential and focus merely on attracting<br />

companies with strong growth. In Florida’s<br />

view, this is a shortsighted strategy, as evidenced<br />

by the dramatic drop in importance<br />

of Pittsburgh, the “steel city.” The city’s<br />

decision-makers failed to complement its<br />

industrial past with an innovative infrastructure<br />

and lively culture. “The result<br />

is that the creative class there no longer<br />

feels inspired and is moving elsewhere,”<br />

says Florida.<br />

By “creative class” Florida means all the professional<br />

groups in which intelligence,<br />

inspiration and innovation are prerequisites<br />

for success. These include artists, media creatives<br />

and star chefs, as well as architects,<br />

scientists, attorneys and physicians. Florida<br />

places special emphasis on creative<br />

12<br />

think: act

30 percent of all workers in the united states are part of the creative class food for thought f<br />

“ Cities need to develop into appealing places for talented<br />

and creative people. They need to be tolerant, diverse and open.”<br />

Professor Richard Florida<br />

managers who abandon traditional thinking<br />

and continuously reinvent their businesses.<br />

“Besides being highly educated, these individuals<br />

are also united by a great willingness<br />

to move and are forever seeking new<br />

stimuli and inspiring work environments,”<br />

he says. Florida concludes that cities offering<br />

the best living environment for trendsetters<br />

can expect to have the highest level<br />

of prosperity. His reasoning: This group of<br />

individuals guarantees sustained growth<br />

with high added value.<br />

In his many talks, the political scientist has<br />

already referred to the fact that this trend<br />

transcends nations’ borders. That is a brief<br />

first taste of the theme of his next book,<br />

titled The Flight of the Creative Class, which<br />

IT TAKES THE RIGHT MIX OF<br />

MINORITIES TO DEVELOP A<br />

VIBRANT ENVIRONMENT<br />

will be published next spring. In it he discusses<br />

the migration of the US intelligentsia<br />

to more tolerant countries. In contrast to<br />

traditional thinkers, who point to errors in<br />

the system, Florida attributes this migration<br />

to the laws of the free market. His thesis is<br />

that global supply and demand also determine<br />

where creative people settle.<br />

It is therefore no longer enough, he says, to<br />

concentrate solely on good schools and safe<br />

streets. Instead, policy-makers should create<br />

the conditions for a lively urban milieu that<br />

assures a maximum degree of tolerance,<br />

diversity and openness. “That’s the only way<br />

to foster creativity and a fertile intellectual<br />

environment,” he says. Florida claims these<br />

two factors are the key drivers of economic<br />

growth. In other words, emerging, low-wage<br />

markets will not be the first to prosper;<br />

rather, benefits will flow to the regions best<br />

able to tap the creative potential of their<br />

inhabitants and draw talent from around<br />

the world. “Location now determines how<br />

people and job profiles match up, and it will<br />

become the central organizational unit of<br />

the creative age, replacing the company in<br />

that function,” he says.<br />

Florida’s vision of the cities and regions of<br />

the future is based on three pillars: technology,<br />

talent and tolerance. What is important<br />

is a distinctive lifestyle that delivers a rich<br />

cultural existence, best supported by high<br />

investment and the influx of people operating<br />

outside the mainstream.<br />

“In our focus groups we’re always hearing<br />

that people want to move to a place where<br />

they can simply be themselves,” reports<br />

Florida from his consulting experience.<br />

“That’s something particularly important for<br />

inspired, entrepreneurial people.”<br />

Based on these insights, he has drawn up a<br />

map of creative cities in the United States.<br />

The following characteristics were quantified<br />

and compared with one another: the<br />

number of inhabitants belonging to the<br />

creative class, the number of homosexuals,<br />

the economic power of high-tech industries,<br />

and the number of patent applications per<br />

capita. The findings: Apart from some<br />

smaller cities in the Rocky Mountains that<br />

can be counted as creative locations, the<br />

phenomenon is primarily connected with<br />

large cities. Vibrant, inspiring environments<br />

emerge where there is a large concentration<br />

of people who together constitute an<br />

enthralling mix of minorities. Other key factors<br />

are cultural attractions and universities,<br />

RICHARD FLORIDA, 47, was a professor of<br />

economic development at Carnegie Mellon<br />

University in the former steel town of Pittsburgh,<br />

Pennsylvania before moving to George Mason<br />

University in Fairfax, Virginia, in the summer of<br />

2004. Next spring Florida will publish The Flight<br />

of the Creative Class, in which he examines the<br />

worldwide competition for creative talent<br />

between cities and regions. Florida studied at<br />

Rutgers College and earned his PhD at Columbia<br />

University. In addition to his academic career, he<br />

heads two companies that he founded: the communications<br />

company Creativity Group and the<br />

consulting firm Catalytix.<br />

described by Florida as “creativity hubs.”<br />

At the top of the list are West Coast metropolitan<br />

areas such as Seattle, Portland, San<br />

Francisco, and the latter’s neighbor, Silicon<br />

Valley. Ambitious cities such as Minneapolis<br />

and Austin, which first developed a lively<br />

subculture and then began to prosper, also<br />

rank highly. In stark contrast to these are<br />

cities of the Old South such as Memphis and<br />

New Orleans. According to Florida’s criteria,<br />

these are the least creative.<br />

THE UNITED STATES COULD FORFEIT ITS<br />

POSITION AS A LEADING POWER<br />

IN THE CREATIVE SECTOR<br />

Florida rates European cities such as<br />

Dublin, Amsterdam, London and Munich<br />

very highly. They have managed, he argues,<br />

to become clusters for talent and technology.<br />

In these innovative regions live creative<br />

people attracted both by the high degree of<br />

tolerance and by local acceptance of innovative<br />

elites from in-country and abroad. The<br />

pay-offs of such modern life-styles take<br />

years to materialize.<br />

However, success is in the offing thanks to<br />

the energies that are releasing inspiration<br />

and wellbeing. Consider Berlin. “The city is<br />

a creative center with plenty of room for a<br />

tremendously diverse group of people willing<br />

to take risks,” says Florida. Still, the<br />

German capital is seeing competition from<br />

further north. Florida’s Creativity Group<br />

recently expanded its analysis to 14<br />

European countries. The figures suggest<br />

that the epicenter of competition with the<br />

United States is moving from traditional<br />

strongholds such as Great Britain, Germany<br />

and France to Ireland and Scandinavia,<br />

where the creative class has been growing at<br />

a peak annual rate of 7 percent since 1995. In<br />

terms of creativity, Sweden has already overtaken<br />

the United States. And if America fails<br />

to pay attention, Florida concludes, it could<br />

forfeit its position as a leading power in the<br />

creative sector.<br />

think: act 13

p food for thought<br />

ethics and management

the profit-revenue ratio is 18 percent higher at ethically managed companies<br />

food for thought f<br />

Generating profit ethically<br />

Companies that link management and ethics generate greater profits in the long run, according to<br />

findings from US government adviser, David Steiner. He is convinced that Europe is currently poised<br />

to take a leading role in developing a comprehensive model for ethical standards.<br />

:<br />

When David Steiner wants to explain<br />

how transparency is created, his job at<br />

British merchant bank SG Warburg comes<br />

to mind: “It was the first bank to open all<br />

incoming mail centrally and make it available<br />

to all employees in an abbreviated<br />

form.” This rigorous transparency model<br />

left its mark on the American ethicist. “I<br />

learned my first lesson in business ethics at<br />

SG Warburg,” he says.<br />

These days, the Institute for Corporate Cultural<br />

Affairs (ICCA) in Frankfurt, Germany<br />

is profiting from Steiner’s experience. Its job<br />

is to encourage companies to think about<br />

social and environmental <strong>issue</strong>s. The need<br />

for them to do so is pressing: As the influence<br />

of state and religion on society wanes, companies<br />

are being called on to fill the gap.<br />

But instead of chiding companies, the ICCA<br />

plays up the benefits of good corporate citizenship.<br />

“We can prove that compliance<br />

with ethical standards has a positive impact<br />

on performance,” says Steiner.<br />

For example, the Dow Jones Sustainability<br />

Indexes (DJSI), which list sustainably operated<br />

companies, beat the MSCI World Index<br />

by 42 points between December 1993 and<br />

September 2004. Likewise, the powerful US<br />

pension fund CalPERS invested $700 million<br />

in companies committed to protecting the<br />

environment and posted gains for its efforts.<br />

In September, the ICCA met with experts<br />

and executives like Rolf-Ernst Breuer, former<br />

chairman of Germany’s Deutsche Bank,<br />

and Richard Edelman, CEO of Edelman<br />

Public Relations Worldwide, to talk about<br />

the corporate code of conduct. “The first<br />

companies are expected to sign up to the<br />

code of conduct as early as 2005,” he says.<br />

The ICCA is also developing an “Ethics Standard<br />

of Excellence” to define the highest<br />

possible level of social responsibility for<br />

international companies, with a role that<br />

extends beyond their usual areas of operation.<br />

Says Steiner: “This is a process in<br />

which Europe, with the help of the ICCA,<br />

can take a leading role.” The ICCA wants to<br />

serve as a think tank in this context and<br />

channel the ethical efforts of corporate<br />

groups. It also wants to create an award for<br />

ethical corporate governance.<br />

Of course, senior managers may be hesitant<br />

to introduce moral and social standards out<br />

of fear of diluting shareholder value. Steiner<br />

reassures them: “The interests of shareholders<br />

are a priority for us as well. But we want<br />

to prove that companies can both satisfy<br />

DAVID M. STEINER is a professor at Boston<br />

University and department chairman of the School<br />

of Education. On behalf of the Institute for Corporate<br />

Cultural Affairs (ICCA), he is studying <strong>issue</strong>s<br />

relating to ethical corporate leadership and social<br />

responsibility. Steiner, who studied philosophy and<br />

ethics in Oxford, England, and earned his Ph.D. at<br />

Harvard University, is a recognized expert in the<br />

fields of ethics and education. He has been serving<br />

as director of the National Endowment for the Arts<br />

in Washington, DC since June 2004. This government<br />

organization’s purpose is to strengthen the<br />

role of the arts in culture and education.<br />

shareholder expectations and serve the<br />

community at the same time.”<br />

Steiner’s argument is backed by Simone<br />

Webley and Elise More. Working for the Institute<br />

of Business Ethics, in Britain, these<br />

two researchers have discovered that ethically<br />

managed companies generate 18 percent<br />

higher profits than their competitors.<br />

Moreover, these companies present a less<br />

volatile price-to-earnings ratio and are able<br />

to increase their return on capital employed<br />

(ROCE) by approximately 50 percent, while<br />

LACK OF TRANSPARENCY AND<br />

ETHICAL AMBIVALENCE CAN<br />

BE VERY COSTLY<br />

this value actually fell for companies without<br />

a code of conduct.<br />

The equation also works the other way<br />

around, because those who take an active<br />

approach to acknowledging and tackling<br />

mistakes generally suffer no loss in sales.<br />

“Lack of transparency and ethical ambivalence<br />

are more expensive than simply<br />

telling the truth,” says Steiner. The biggest<br />

obstacle to introducing new standards is the<br />

gap between short- and long-term expectations.<br />

Says Steiner, “It’s true that ethical<br />

management involves considerable costs up<br />

front, but these more than balance out in<br />

the long run.”<br />

The code of conduct currently being discussed<br />

by the ICCA forbids fraud and discrimination,<br />

promotes transparency and<br />

cultural diversity, and requires companies<br />

think: act 15

p food for thought<br />

ethics and management<br />

to contribute to their communities and uphold<br />

human rights. The Ethics Standard of<br />

Excellence is intended to ensure that all<br />

employees are provided with comprehensive<br />

training and health care coverage, as<br />

well as a humane work environment, fair<br />

compensation and environmentally sound<br />

operations. “The ICCA wants to express<br />

these principles in terms of balance-sheet<br />

items to show companies the impact of<br />

their behavior,” says Steiner, who since<br />

June has also been advising the United<br />

States government on cultural and ethical<br />

matters. The professor recommends that<br />

companies create an ethics board to introduce<br />

the code of conduct in order to ensure<br />

that employees are qualified and in compliance<br />

with standards.<br />

“Credibility and growth”<br />

<strong>Roland</strong> <strong>Berger</strong>, founder and chairman of the supervisory board of <strong>Roland</strong> <strong>Berger</strong> Strategy<br />

Consultants, believes that ethical behavior is absolutely essential for companies today.<br />

His advice: The more credible a company’s actions are, the greater its growth opportunities.<br />

THINK: ACT Mr. <strong>Berger</strong>, when it comes to<br />

corporate decision-making, is it possible<br />

to act in a consistently ethical manner, or<br />

does that conflict with the profitability<br />

principle?<br />

ROLAND BERGER One can act ethically, and<br />

one must do so. Companies today are closely<br />

<strong>Roland</strong> <strong>Berger</strong>, consulting company founder<br />

scrutinized in terms of what they do, how<br />

they do it—and often also where they do it.<br />

Issues that relate to subjects such as quality,<br />

product safety, employee relations, corporate<br />

commitment and environmental considerations—anywhere<br />

in the world, as it happens<br />

—are openly discussed and analyzed without<br />

individual companies really having any influence<br />

over the respective evaluation criteria.<br />

The more a company displays ethics and<br />

credibility, the greater its opportunities for<br />

growth are.<br />

So are ethics indispensable?<br />

Absolutely! If customers or employees are not<br />

happy with what they find at a company,<br />

they may very well vote with their feet. Those<br />

consequences will be quickly reflected in the<br />

company’s performance on the stock market.<br />

That’s tremendous leverage.<br />

In your opinion, what are the pillars<br />

of corporate ethics?<br />

First of all, a company needs a set of values<br />

that it stands for and advocates. However,<br />

most corporate visions and mission statements<br />

are market- and not value-related.<br />

Second, it needs a clear statement on how it<br />

plans to achieve its objectives. This statement<br />

will also determine which procedures it will<br />

pursue or exclude. Third, there must be principles<br />

in place that govern internal processes<br />

and their interactions. Fourth, you need<br />

clearly delineated responsibilities. Rules and<br />

individual obligations should be monitored.<br />

Companies often lack this culture of responsibility—meaning<br />

you don’t have to look far to<br />

see why there is a lack of credibility.<br />

Management’s reputation is affected by a<br />

few, highly visible cases. Can ethical management<br />

remedy this type of situation?<br />

In many countries, there have been some very<br />

clear cases of management failure that, in the<br />

public eye, have been more influential than<br />

the proper ethical behavior displayed by the<br />

vast majority of companies out there. It takes<br />

consistently unimpeachable behavior as well<br />

as openness and communication to survive<br />

this type of situation. Ethics is not just about<br />

having values, it’s also about conveying<br />

them, both within the company and to the<br />

public. That way, should a company find<br />

itself dealing with a crisis, it will have a<br />

credible base from which it can believably<br />

defend its actions.<br />

16<br />

think: act

Dossier #01<br />

THE FORMULA<br />

FOR GROWTH<br />

COMPANIES THAT AIM FOR LONG-TERM SUCCESS<br />

MUST BE ABLE TO DO MANY THINGS SIMULTANEOUSLY:<br />

INNOVATE, EXPAND, RESTRUCTURE, MOTIVATE<br />

AND, NOT LEAST, INSPIRE TRUST.

DOSSIER #01 The formula for growth<br />

[Hennes & Mauritz]<br />

40%<br />

FASHION FROM MORE THAN 1000 STORES<br />

more shops were opened by Hennes & Mauritz<br />

between 2001 and 2003. In the summer of 2004, the<br />

1000th was opened in Boulogne-sur-Mer, France;<br />

another 65 around the globe were planned for the<br />

fourth quarter. The strategy of boosting sales space<br />

has paid off for the world’s largest fashion chain: From<br />

2001 to 2003, the Swedish company’s profits (EBITA)<br />

grew an average of 29.76 percent annually.<br />

10-year<br />

Source: <strong>Roland</strong> <strong>Berger</strong> Strategy Consultants; H&M Annual Report 2003, Chart: Wallstreet Online<br />

STOCK CHART<br />

H&M / DOW JONES<br />

25000%<br />

20000%<br />

15000%<br />

10000%<br />

5000%<br />

0%<br />

1995 96 97 98 99 00 01 02 03 04<br />

comparison against the Dow Jones Index<br />

18<br />

think: act

The formula for growth DOSSIER #01<br />

[Canon]<br />

1992<br />

LEADING PATENT FACTORY<br />

STOCK CHART<br />

Canon / DOW JONES<br />

American patents were awarded to Canon in 2003,<br />

450%<br />

ranking the firm second among the top five research<br />

350%<br />

companies in the United States. International<br />

research facilities are part of the photo and office<br />

250%<br />

equipment maker’s growth strategy. Seventy-three<br />

150%<br />

percent of Canon’s sales come from outside of<br />

0%<br />

Japan. Average annual growth in profits (EBITA)<br />

1995 96 97 98 99 00 01 02 03 04<br />

between 1993 and 2003 was 11.87 percent.<br />

10-year comparison against the Dow Jones Index<br />

Source: <strong>Roland</strong> <strong>Berger</strong> Strategy Consultants; Canon Factbook 2004/2005, Chart: Wallstreet Online<br />

think: act 19

DOSSIER #01 The formula for growth<br />

[Home Depot]<br />

54.7<br />

CONTINUOUS MODERNIZATION<br />

dollars were spent by the average Home Depot<br />

customer in the second quarter of 2004. That is the<br />

highest second-quarter number ever for the world’s<br />

largest home improvement chain. Home Depot<br />

constantly invests in modernizing its stores and in<br />

training its employees. Over the last 10 years, the<br />

company has produced average annual profit growth<br />

of 24.99 percent (EBITA, 1993–2003).<br />

STOCK CHART<br />

Home Depot / DOW JONES<br />

1995 96 97 98 99 00 01 02 03 04<br />

10-year comparison against the Dow Jones Index<br />

800%<br />

600%<br />

400%<br />

200%<br />

0%<br />

Source: <strong>Roland</strong> <strong>Berger</strong> Strategy Consultants; Chart: Wallstreet Online<br />

20 think: act

The formula for growth DOSSIER #01<br />

[Continental]<br />

30%<br />

UNTOUCHED BY THE SECTOR’S PROBLEMS<br />

STOCK CHART<br />

Continental / DOW JONES<br />

increase was shown by Continental’s stock price from<br />

500%<br />

January to November 2004. The automotive supplier and<br />

400%<br />

tire manufacturer has been growing faster than the sector<br />

300%<br />

as a whole. The strategic foundation for this growth was<br />

200%<br />

provided by the tire replacement business, which<br />

100%<br />

decoupled Continental from new car sales, by consistent<br />

0%<br />

relocation of production to low-cost locales and by the<br />

1995 96 97 98 99 00 01 02 03 04<br />

company’s overall balanced product portfolio.<br />

10-year comparison against the Dow Jones Index<br />

Source: <strong>Roland</strong> <strong>Berger</strong> Strategy Consultants; Chart: Wallstreet Online<br />

think: act 21

DOSSIER #01 The formula for growth<br />

[Microsoft]<br />

65<br />

SUCCESS FROM MONOPOLY AND MARKETING<br />

billion dollars (rounded) were held in cash reserves by Microsoft at the<br />

end of November 2004. In recent years, the world’s largest software<br />

company has seldom been the first to take advantage of new technologies<br />

to open up a market, such as the Internet or new standard business<br />

software. Nevertheless, strong marketing and a dominant<br />

position in PC operating systems brought the company annual<br />

average profit growth (EBITA) of 26.18 percent in the years between<br />

1993 and 2003.<br />

10-year<br />

Sources: <strong>Roland</strong> <strong>Berger</strong> Strategy Consultants, Barron’s; Chart: Wallstreet Online<br />

STOCK CHART<br />

Microsoft / DOW JONES<br />

2000%<br />

1500%<br />

1000%<br />

500%<br />

0%<br />

1995 96 97 98 99 00 01 02 03 04<br />

comparison against the Dow Jones Index<br />

22<br />

think: act

The formula for growth DOSSIER #01<br />

[Porsche]<br />

82%<br />

LEAVING THE ECONOMY BEHIND<br />

STOCK CHART<br />

Porsche / DOW JONES<br />

was Porsche’s average annual level of profit growth<br />

2000%<br />

(EBITA) from 1994 to 2003. The Stuttgart, Germanybased<br />

sports car maker bucked the sector’s downward<br />

1500%<br />

slide with a combination of a strong brand, technical<br />

1000%<br />

excellence and a nose for trends. The Cayenne SUV came<br />

500%<br />

at the right time, helping the company top its goals in<br />

0%<br />

the 2003/04 business year. Porsche sold 39,913 of the<br />

1995 96 97 98 99 00 01 02 03 04<br />

luxury SUVs, beating its target of 30,000.<br />

10-year comparison against the Dow Jones Index<br />

Source: <strong>Roland</strong> <strong>Berger</strong> Strategy Consultants; Chart: Wallstreet Online<br />

think: act 23

DOSSIER #01 The formula for growth<br />

nSANOFI-AVENTIS<br />

The merger with Aventis in 2004 made<br />

Sanofi-Synthélabo the third largest<br />

pharmaceutical group in the world and<br />

the market leader in Europe.<br />

33% In the<br />

year 2003 alone,<br />

Sanofi boosted US<br />

sales by one-third.<br />

SOURCE: SANOFI-SYNTHÉLABO ANNUAL REPORT<br />

»We want to grow in<br />

the generic-drug<br />

business—possibly<br />

through making<br />

acquisitions.«<br />

JEAN-FRANÇOIS DEHECQ, CEO, SANOFI-AVENTIS<br />

OPERATING PROFITS (in $ billion)<br />

1.417<br />

1.817<br />

CAGR: 33 %<br />

2.335<br />

3.321<br />

2000 2001 2002 2003<br />

Between 2000 and 2003, Sanofi-<br />

Synthélabo increased its midyear<br />

operating result (CAGR—compound<br />

annual growth rate) by 33 percent,<br />

a figure achieved by a series of salesand-margin-strengthening<br />

bestsellers<br />

that the group developed in-house.<br />

Farewell to the »V-curve«<br />

GROWTH OR RESTRUCTURING? FOR TOP INTERNATIONAL COMPANIES, THIS IS NO LONGER<br />

AN EITHER-OR QUESTION. SUSTAINED SUCCESS REQUIRES A TWO-PRONGED STRATEGY, ONE THAT<br />

BOOSTS SALES WHILE SIGNIFICANTLY REDUCING COSTS AT THE SAME TIME.<br />

s<br />

SPEED IS WHAT DETERMINES the success of Canon,<br />

the Japanese manufacturer of business machines and<br />

cameras—at least when it comes to printer or copier<br />

output, or to the shutter speeds of digital cameras.<br />

However, at his upper-management meetings at 8<br />

o’clock every morning, company president and CEO<br />

Fujio Mitarai likes to slow things down. Half an hour<br />

before official office hours, the Canon directors meet for<br />

their daily session on the 17th floor of the Tokyo head<br />

office, located on the banks of the Tama River. Over cups<br />

of green tea, they talk about current <strong>issue</strong>s not always<br />

related to the world of big business. Mitarai says of his<br />

seemingly outmoded leadership style, one that cultivates<br />

easy conviviality and informal contacts, “Management<br />

works only through communication. If you neglect<br />

it, you can run the danger of losing touch with reality.”<br />

AS AFFABLE AS MITARAI may appear in the tightestknit<br />

of management circles, he shows himself to be all<br />

the more unrelenting when he deals with the task<br />

at hand. “The most important thing at Canon is profitability,”<br />

is the 69 year-old’s credo. Accordingly, Mitarai<br />

did not shy away from an iron-fisted management style<br />

when he took up his present position in 1995. Within<br />

five years, the new boss let go of the company’s seven<br />

biggest money-losers, including the typewriter, personal<br />

computer and LCD monitor businesses. “If a corporate<br />

group wants to achieve stable growth, it has to carefully<br />

select the business branches that are potentially<br />

profitable, and focus all resources on those,” explains<br />

Mitarai. Nevertheless his strategy was not limited to the<br />

streamlining process. At the same time, he restructured<br />

manufacturing processes and relieved overwhelmed<br />

production assembly lines by making groups<br />

responsible for their own work, an approach known<br />

around Canon as “cell manufacturing.” The restructuring<br />

not only increased employee motivation, it also<br />

reduced operating costs by one-third. The result is that<br />

fewer people now deliver a higher output, and they do<br />

so with a lower rate of error.<br />

THE RESULTS SPEAK for themselves. Over the past<br />

decade Canon was among the companies around the<br />

globe with the strongest growth in value. Between<br />

1993 and 2003, the manufacturer of optoelectronic<br />

devices and office equipment increased its earnings<br />

before interest, taxes and amortizations (EBITA) by an<br />

average of almost 12 percent annually. The secret of<br />

this success is the company’s unconventional mixture<br />

of goal orientation with a trust-based culture. For years<br />

Mitarai traveled from one location to the next to explain<br />

to employees the importance of entrepreneurial thinking<br />

and acting at all levels of the company’s hierarchy.<br />

These appeals would not have availed, however, had it<br />

not been for an aspect of Canon’s corporate culture<br />

called “kyosei.” This term roughly translates as “living<br />

and working together for the common good.” The concept<br />

also includes the company’s social obligations<br />

and lifelong employment relationships, as well as the<br />

personal commitment and continuous training of individual<br />

employees. With this approach, Canon is achieving<br />

what would have been considered unthinkable five<br />

years ago: Pursuing the dreams of growth, without losing<br />

sight of a strict earnings-oriented attitude. Mitarai<br />

intends to continue in this direction. For 2005, the<br />

head of Canon has assigned his people the objective of<br />

achieving or defending market leadership in all core<br />

business areas, and to continue unflinchingly along<br />

the course of reducing costs.<br />

FEW GROUPS HAVE BEEN ABLE to master the art of<br />

combining steady growth with high profitability.<br />

According to an analysis conducted by <strong>Roland</strong> <strong>Berger</strong><br />

Strategy Consultants, only one-quarter of the 1,700<br />

largest companies in Asia, Europe and North America<br />

were able to increase their profits more than their sales<br />

24<br />

think: act

The formula for growth DOSSIER #01<br />

between 1991 and 2003. These “profitable growers”<br />

(see diagrams beginning p.18) have achieved the business<br />

equivalent of squaring the circle. They exploit<br />

economies of scale and scope without having to cope<br />

with the disadvantages that often threaten large organizations.<br />

Among these disadvantages are:<br />

p At the administrative level: complexity and the<br />

creation of hierarchies;<br />

p At the technical level: incompatible processes,<br />

systems and structures;<br />

p At the cultural level: disintegration tendencies.<br />

To complicate matters, the era of global competition<br />

does not allow any time for consolidation periods anymore.<br />

“The game has changed: The classic V-curve—<br />

first trimming down, then growing—is outdated,” warns<br />

Burkhard Schwenker, CEO of <strong>Roland</strong> <strong>Berger</strong> Strategy<br />

Consultants. Schwenker says that some formulas have<br />

proven successful in avoiding the risk of growth and<br />

link-up disadvantages. This includes decentralization of<br />

rapidly grown organizations as well as creating clearly<br />

defined areas of responsibility and flat hierarchies.<br />

Also, Schwenker considers a modular and flexible infrastructure<br />

in equipment and IT a key factor so businesses<br />

can quickly react to changed conditions. Finally, the<br />

employees in all areas must be encouraged to be<br />

proactively committed to the company.<br />

COMPANIES HAVE NO CHOICE other than to grow<br />

because margins shrink in saturated markets and, if revenues<br />

remain constant, profits shrink along as well.<br />

Thus, increased earnings require growth in sales. It is a<br />

situation that forces a company’s hand but also opens<br />

up new opportunities. For profitable growth produces its<br />

own momentum, continuously generating new growth.<br />

The generation of free cash flow is a prerequisite. “Such a<br />

flow is created when a corporate group intelligently<br />

improves its cost base and establishes competitive<br />

structures without damaging its core,” write the authors<br />

of a study titled “Finding the formula for growth,” by<br />

<strong>Roland</strong> <strong>Berger</strong> Strategy Consultants. Funds released can<br />

flow into the expansion of business activities. This creates<br />

new scale advantages, which, to close the circle, lead to<br />

exceptional operating performance and new cash flows.<br />

SO HOW IS IT FEASIBLE to initiate that kind of a<br />

growth algorithm? Companies wanting to increase their<br />

value continuously according to this formula need to<br />

make a series of simultaneous adjustments. Besides an<br />

ability to grow, the willingness to do so is also fundamental.<br />

Companies capable of growth are those that<br />

have sufficient liquidity as well as suitable products and<br />

structures with which to set out along and successfully<br />

manage an expansion-oriented course. The willingness<br />

to grow brings softer factors into play, such as attitudes,<br />

corporate culture, acceptance of change and a<br />

desire to innovate—or, in other words, trust and confidence<br />

in one’s own capabilities. Put this way, growth<br />

becomes a management function.<br />

BOTH PREREQUISITES, the capability and the willingness<br />

to grow, are exhibited by Nestlé. With 250,000<br />

employees and $74 billion in sales, the world’s largest<br />

food company is fully focused on new markets. It’s an<br />

absolute necessity for Nestlé since the core business is<br />

increasingly coming up against growth ceilings. While<br />

the Swiss company still earns 90 percent of its revenue<br />

from foodstuffs and water, profit margins are stagnating—not<br />

least because of the collective purchasing<br />

power of discount stores. “It was clear that items like<br />

tomato sauce and noodles would not produce any new<br />

value in the long term,” says Nestlé CEO Peter Brabeck-<br />

Letmathe about the interim result of the company’s<br />

strategic reorientation. “I had to identify business sectors<br />

that could create new growth.” The small but highend<br />

pharmaceutical products unit was significantly<br />

expanded, for example. With an EBIT margin of more<br />

than 30 percent, the business unit has outstanding<br />

earning power. It is supported primarily by the US subsidiary<br />

Alcon, purchased in 1977, that specializes in contact<br />

lens care and eye medication.<br />

NESTLÉ IS PINNING even higher hopes on the nutrition-based<br />

business sector that is developing healthenhancing<br />

foodstuffs. One prototype is the LC1 yogurt<br />

that is designed to strengthen the immune system.<br />

Consumers knowledgeable about nutrition are willing to<br />

pay up to 40 percent more for such products. It should<br />

think: act 25

DOSSIER #01 The formula for growth<br />

nSYMANTEC<br />

The US manufacturer of security software<br />

is the global market leader and manages<br />

its sales via excellent relations with over<br />

600 international corporate groups.<br />

32.5%<br />

Symantec increased<br />

its profit margin from<br />

20.3 to 32.5 percent.<br />

SOURCE: SPEAR SECURITY INDUSTRY ANALYST NEWS<br />

»We intend to achieve<br />

massive growth by<br />

visibly outperforming<br />

the market.«<br />

JOHN W. THOMPSON,<br />

CEO, SYMANTEC<br />

OPERATING PROFITS (in $ million)<br />

136<br />

32<br />

CAGR: 58 %<br />

357<br />

532<br />

2000 2001 2002 2003<br />

Symantec handled the 2001 slump<br />

well. Despite the setback of 2000 to<br />

2003, its midyear operating (CAGR)<br />

results increased by 58 percent. The<br />

reason: continuous acquisitions and a<br />

consistent brand-name strategy.<br />

be noted, however, that five years of intensive research<br />

went into the designer food. It is therefore not surprising<br />

that Nestlé is looking for strong joint-venture partners<br />

to help shoulder the load. Jointly with the French<br />

cosmetics group L’Oréal, in which Nestlé holds a 26.4<br />

percent stake, it is developing beauty tablets that slow<br />

down the visible effect of aging on skin, hair and nails.<br />

The financing for such research projects comes from<br />

the “Life Ventures” risk capital fund.<br />

IN ADDITION, Brabeck-Letmathe is counting on<br />

specific purchases to reap increasing economies of<br />

scale and scope in the core businesses. In June 2003<br />

Nestlé acquired Dreyer’s, the second largest US ice<br />

cream producer, for $2.8 billion. Just a short time earlier,<br />

Nestlé had purchased the German company Schöller<br />

Group and the Swiss ice cream brand Mövenpick. For<br />

Brabeck-Letmathe, who very early in his career delivered<br />

ice cream by truck, expansion is by no means an<br />

end in itself. “We’re not looking to be the largest company,<br />

rather the most competitive one.” His personal<br />

motto expresses the desire both to grow and to improve<br />

margins. “The art of good management consists of<br />

achieving both simultaneously,” emphasizes the Nestlé<br />

CEO. Keeping these in balance sometimes also necessitates<br />

that Brabeck-Letmathe repeatedly divest parts of<br />

the company. Although 29 new plants were opened in<br />

2003 alone, 26 existing ones were also sold or closed,<br />

always with the overall objective of optimizing the<br />

group’s portfolio in a value-oriented manner.<br />

THE FACT THAT THE GROWTH curve looks different<br />

for various sectors also holds true for different regions,<br />

as exemplified by the electronics giant Siemens. While<br />

the figures for Germany’s domestic market in the<br />

slumping sectors of communications and transportation<br />

systems point to consolidation, Siemens is on an<br />

expansion course in the United States with its “Siemens<br />

One” program. The growth strategy was conceived by<br />

the designated chairman of the board, Klaus Kleinfeld,<br />

who headed the company’s US operations and will<br />

replace Heinrich v. Pierer as chairman in January 2005.<br />

Kleinfeld’s successor, George Nolen, now can reap the<br />

fruitful outcome of this endeavor. By 2006, he is<br />

expecting additional business of at least €2 billion<br />

from established accounts alone. His cross-selling<br />

strategy aims to provide large-scale customers such as<br />

hospitals, sports arenas and rail companies with complete,<br />

one-stop infrastructure solutions. Siemens just<br />

received a contract worth up to $1.37 billion to install<br />

high-tech explosives-detection systems at all commercial<br />

airports in the United States. “We won the bid<br />

because we have the necessary experience in airport<br />

logistics, building security, baggage handling and X-ray<br />

scanning,” emphasizes Nolen.<br />

THE COMPANY ALSO has an advantage in that<br />

Siemens is increasingly perceived as a domestic entity<br />

in the United States. After all, the company employs<br />

70,000 people there, almost all of them Americans.<br />

Siemens is pursuing its decentralization strategy also<br />

for another reason. In a monolithic organization, mental<br />

barriers and cultural differences can end up inhibiting<br />

growth. “In the past, we did not always understand the<br />

needs of our customers,” notes Nolen. In order to minimize<br />

such conflicts, Siemens depends almost exclusively<br />

on “locals” in all countries, who usually better<br />

understand the regional market and its particular customer<br />

requirements. For v. Pierer, Siemens is, as a<br />

result, “a German company in Germany, a US company<br />

in the US and a Chinese company in China.”<br />

THE SIGNIFICANCE OF “soft” growth factors, especially<br />

during periods of change situations, can hardly be<br />

overestimated. Subcultures often crop up, especially<br />

after mergers and larger-scale organizational change<br />

projects. These can influence employees more than the<br />

actual corporate culture, and can cause divisions to<br />

insulate themselves from one another or even prevent<br />

their integration after a merger. Open communications,<br />

a willingness to discuss matters and corporate management’s<br />

competence to make decisions with the<br />

employees’ backing prevent this type of drift. Successful<br />

growth companies find their identities less in their<br />

products, but in their group-wide set of values. Even if<br />

the wording is similar in many companies, the important<br />

thing is that values are openly agreed upon and<br />

actually put into practice on a daily level. Siemens CEO<br />

v. Pierer considers the integrity of both its business<br />

policies and its responsible employees the core value of<br />

the company. From this he derives principles such as<br />

decency, honesty, sincerity, openness and tolerance.<br />

26<br />

think: act

The formula for growth DOSSIER #01<br />

According to v. Pierer, this type of code of conduct creates<br />

trust and a sense of confidence among both<br />

employees and customers.<br />

TRUST-BUILDING MEASURES designed to reinforce<br />

its own identity are also used by Tchibo Holding, based<br />

in Hamburg, Germany. Founded as a coffee roaster in<br />

1949, the retailer’s everyday goods and services division<br />

has experienced double-digit growth in the last<br />

four years. This division is currently responsible for 60<br />

percent of sales and 95 percent of earnings. This<br />

change could be seen as a cultural revolution that<br />

ended up presenting fundamental questions about the<br />

company’s purpose. Nonfood board member Stefan<br />