the RUSSIA oil & gas competitive intelligence report - Report Buyer

the RUSSIA oil & gas competitive intelligence report - Report Buyer

the RUSSIA oil & gas competitive intelligence report - Report Buyer

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Russia Oil and Gas Competitive Intelligence <strong>Report</strong> 2010<br />

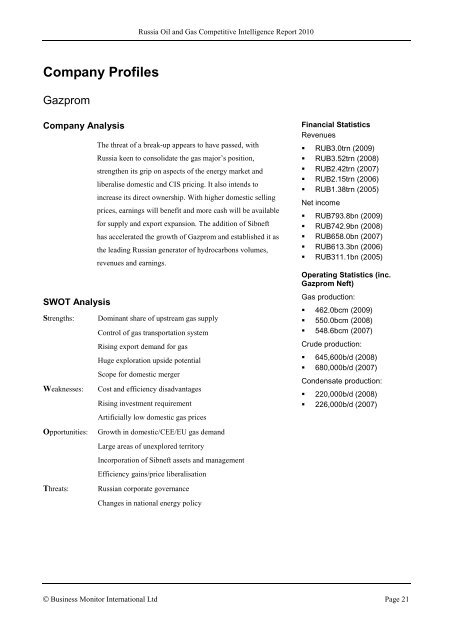

Company Profiles<br />

Gazprom<br />

Company Analysis<br />

SWOT Analysis<br />

The threat of a break-up appears to have passed, with<br />

Russia keen to consolidate <strong>the</strong> <strong>gas</strong> major’s position,<br />

streng<strong>the</strong>n its grip on aspects of <strong>the</strong> energy market and<br />

liberalise domestic and CIS pricing. It also intends to<br />

increase its direct ownership. With higher domestic selling<br />

prices, earnings will benefit and more cash will be available<br />

for supply and export expansion. The addition of Sibneft<br />

has accelerated <strong>the</strong> growth of Gazprom and established it as<br />

<strong>the</strong> leading Russian generator of hydrocarbons volumes,<br />

revenues and earnings.<br />

Strengths: Dominant share of upstream <strong>gas</strong> supply<br />

Control of <strong>gas</strong> transportation system<br />

Rising export demand for <strong>gas</strong><br />

Huge exploration upside potential<br />

Scope for domestic merger<br />

Weaknesses: Cost and efficiency disadvantages<br />

Rising investment requirement<br />

Artificially low domestic <strong>gas</strong> prices<br />

Financial Statistics<br />

Revenues<br />

• RUB3.0trn (2009)<br />

• RUB3.52trn (2008)<br />

• RUB2.42trn (2007)<br />

• RUB2.15trn (2006)<br />

• RUB1.38trn (2005)<br />

Net income<br />

• RUB793.8bn (2009)<br />

• RUB742.9bn (2008)<br />

• RUB658.0bn (2007)<br />

• RUB613.3bn (2006)<br />

• RUB311.1bn (2005)<br />

Operating Statistics (inc.<br />

Gazprom Neft)<br />

Gas production:<br />

• 462.0bcm (2009)<br />

• 550.0bcm (2008)<br />

• 548.6bcm (2007)<br />

Crude production:<br />

• 645,600b/d (2008)<br />

• 680,000b/d (2007)<br />

Condensate production:<br />

• 220,000b/d (2008)<br />

• 226,000b/d (2007)<br />

Opportunities:<br />

Threats:<br />

Growth in domestic/CEE/EU <strong>gas</strong> demand<br />

Large areas of unexplored territory<br />

Incorporation of Sibneft assets and management<br />

Efficiency gains/price liberalisation<br />

Russian corporate governance<br />

Changes in national energy policy<br />

© Business Monitor International Ltd Page 21