View sample - Report Buyer

View sample - Report Buyer

View sample - Report Buyer

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Executive Summary<br />

Introduction<br />

• Globally, the declining trend of the number of<br />

Wire-line subscriptions is anticipated to continue<br />

and reach a penetration rate of xx.x per cent<br />

with a total of x.x billion subscribers by the end<br />

of 2009.<br />

• The African continent has some of the world’s<br />

lowest penetration rates in wire-line<br />

communications.<br />

• There are xx countries, with a total population<br />

about xxx.x million, of which xx countries<br />

comprise sub-Saharan Africa with xxx.x million<br />

population.<br />

• While there were x,xxx million fixed telephone<br />

lines world wide in 2008, less than x.x per cent<br />

of these (xx.x million) were in Africa, thereby<br />

representing a tele-density of x.x per cent in<br />

2008.<br />

• Between 1998 and 2008, Africa added only x.x<br />

million fixed-telephone lines, which represent<br />

M514-63<br />

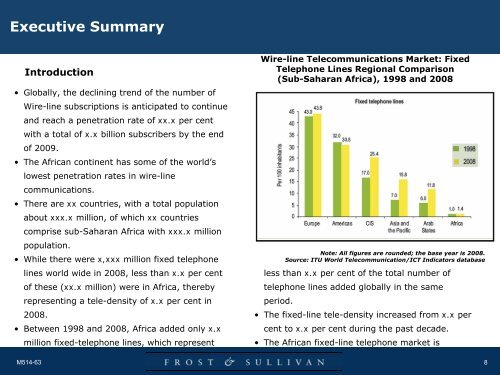

Wire-line Telecommunications Market: Fixed<br />

Telephone Lines Regional Comparison<br />

(Sub-Saharan Africa), 1998 and 2008<br />

Note: All figures are rounded; the base year is 2008.<br />

Source: ITU World Telecommunication/ICT Indicators database<br />

less than x.x per cent of the total number of<br />

telephone lines added globally in the same<br />

period.<br />

• The fixed-line tele-density increased from x.x per<br />

cent to x.x per cent during the past decade.<br />

• The African fixed-line telephone market is<br />

8

Executive Summary (Contd…)<br />

Introduction (Contd…)<br />

stagnating, and this is constraining fixed<br />

broadband growth.<br />

• The number of fixed broadband subscribers was<br />

xxx,xxx in 2008, thereby representing a<br />

penetration rate of x.x per cent in comparison<br />

with x.x million mobile broadband subscribers.<br />

• While the number of fixed-line Internet<br />

subscribers was x.x million, representing a<br />

penetration of x.x per cent in 2008 due to the<br />

low ownership (x.x per cent) of computers.<br />

• In sub-Saharan Africa, the number of fixed-line<br />

subscribers was x.x million, representing a teledensity<br />

of x.x per cent in 2008.<br />

• While the number of fixed Internet subscribers<br />

was xxx,xxx, representing a penetration rate of<br />

less than x.xx per cent in 2008.<br />

• Since the boom in Africa’s telecommunications<br />

market has taken place mainly in the mobile<br />

sector, the African wire-line operators could<br />

M514-63<br />

Wire-line Telecommunications Market: Fixed<br />

Broadband Region Comparison (Sub-Saharan Africa),<br />

2000-2008<br />

Note: All figures are rounded; the base year is 2008.<br />

Source: ITU World Telecommunication/ICT Indicators database.<br />

potentially become less attractive to investors.<br />

• Africa is lacking in investment-intensive infrastructure,<br />

such as fixed telephone lines and fixed broadband.<br />

• These indicators are low in comparison with the world<br />

average of xx.x per cent and xx.x per cent for the<br />

penetration of fixed telephone lines and Internet<br />

connection, respectively.<br />

9

Executive Summary (Contd…)<br />

Introduction (Contd…)<br />

Wire-line Market Development<br />

• Regulatory authorities also often favour<br />

incumbent fixed-line operators, who have<br />

problems to make profits, over new entrants,<br />

and this limits competition and private<br />

investment into fixed-line segment.<br />

• Traditional fixed-line telecommunications<br />

operators generate huge revenue streams, but<br />

are under pressure to expand network coverage,<br />

develop innovative data services and improve<br />

customer services.<br />

• The market participants used to be in the<br />

different tier of competition and/or part of value<br />

chain has started to offer similar lines of product.<br />

• For example, both cable and telecommunications<br />

operators offer fixed-line voice, broadband and<br />

video services.<br />

• Next Generation Network (NGN) is becoming the<br />

future technology of choice. This offers<br />

customers high-quality, converged and Internet<br />

Protocol (IP) -based services on one network.<br />

• In future, sub-Saharan Africa is expected to<br />

witness consolidation in its telecommunication<br />

sector as operators vie for the lower end of the<br />

market to help sustain robust growth.<br />

M514-63<br />

10

Executive Summary (Contd...)<br />

Introduction (Contd…)<br />

Wire-line Telecommunications Market: Undersea Cables Map (Sub-Saharan Africa), 2008<br />

Source: http://manypossibilities.net<br />

M514-63<br />

11

Executive Summary (Contd...)<br />

Introduction (Contd…)<br />

Undersea Cables<br />

• Several current and planned fibre projects will<br />

not only deliver high-capacity bandwidth to<br />

Africa, but also boost competition in the wire-line<br />

market and reduce costs of telecommunication.<br />

• However, expensive satellite services will<br />

continue to play a significant role in reaching<br />

Africa’s extensive rural and remote areas, where<br />

the majority of low-income group resides.<br />

• On the west coast, five submarine cable projects<br />

(Glo-1, WACS, MAIN One, ACE ,SAFE, SEA-ME-<br />

WE.3, and Atlantis-II) are under development.<br />

• Glo-1 has landed in the west coast in September<br />

2009 and WASC will land by the end of 2009.<br />

• MAIN One and ACE are expected to land in 2010<br />

and 2011, respectively.<br />

• On the east coast, the first fibre-optic submarine<br />

cable (SEACOM) went live in July 2009. Other<br />

three undersea cables (TEAMS, EASSy and<br />

Uhurunet) are expected to be operational along<br />

the east coast by the end of 2010.<br />

• These undersea cables will provide high-speed<br />

fibre optic connectivity at lower costs.<br />

• The whole sale tariffs of telecommunication<br />

services range between $x,xxx and $xx,xxx for<br />

SAT3 undersea cable and between $x,xxx and<br />

$x,xxx for satellite connection.<br />

• By the end of 2009, these tariffs will start<br />

declining to be within the range of $xxx and<br />

$x,xxx after Glo-1 undersea cable went live in<br />

the west coast, thereby representing an average<br />

cost reduction of xx.x per cent.<br />

• Besides better international networks, inland<br />

backbone terrestrial links will be needed and<br />

retail prices will have to come down once benefit<br />

of the wholesale price reduction is passed down<br />

to the end users.<br />

M514-63<br />

12

Executive Summary (Contd...)<br />

Introduction (Contd…)<br />

Undersea Cables (contd…)<br />

• In 2008, Africa as a whole had around xx Gbps<br />

of international bandwidth, and this corresponds<br />

to less than one-third of India’s total<br />

international connectivity.<br />

• On an average about xx.x percent of<br />

international broadband traffic volume are<br />

contributed by corporate users. The price of<br />

broadband services is likely to decline between<br />

xx and xx per cent.<br />

• Small and medium-sized enterprises (SMEs) may<br />

realise a cost reduction of xx per cent due to<br />

their relatively low usage of broadband services<br />

than corporate users, thereby increasing their<br />

ability to stay profitable.<br />

M514-63<br />

13