Download PDF 2008-2009 - Queen's University Belfast

Download PDF 2008-2009 - Queen's University Belfast

Download PDF 2008-2009 - Queen's University Belfast

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Consolidated Financial Statements<br />

<strong>2008</strong> - <strong>2009</strong>

Queen’s <strong>University</strong> <strong>Belfast</strong><br />

Consolidated Financial Statements <strong>2008</strong>-<strong>2009</strong><br />

Contents<br />

Page<br />

Operating and Financial Review<br />

(Honorary Treasurer’s Report) 2<br />

Corporate Governance 9<br />

Responsibilities of the Senate of the <strong>University</strong> 12<br />

Independent Auditors’ Report 13<br />

Statement of Principal Accounting Policies 15<br />

Consolidated Income and Expenditure Account 17<br />

Balance Sheets 18<br />

Consolidated Cash Flow Statement 20<br />

Consolidated Statement<br />

of Total Recognised Gains and Losses 21<br />

Notes to the Accounts 22<br />

Queen’s <strong>University</strong> <strong>Belfast</strong> Consolidated Financial Statements <strong>2008</strong> - 09<br />

1

Operating and Financial Review<br />

(Honorary Treasurer’s Report)<br />

Scope of the Financial Statements<br />

The financial statements presented to<br />

Senate comprise the results of all the<br />

<strong>University</strong>’s activities.<br />

In accordance with Financial Reporting<br />

Standard (FRS) 2 (amended), the<br />

consolidated financial statements of the<br />

<strong>University</strong> include all of its wholly owned<br />

subsidiaries, including QUBIS Ltd, Quhars<br />

Ltd and the <strong>University</strong> Book Shop Ltd. The<br />

financial statements also reflect the full<br />

adoption of FRS 17 (Retirement Benefits)<br />

and the Statement of Recommended<br />

Practice: Accounting for Further and<br />

Higher Education 2007 (SORP).<br />

Content of the Operating<br />

and Financial Review<br />

(Honorary Treasurer’s Report)<br />

The following review has been prepared<br />

in accordance with the Accounting<br />

Standards Board Reporting Statement,<br />

issued in January 2006, and as referred to<br />

within the SORP.<br />

Results for the Year<br />

A summary of the <strong>University</strong>’s<br />

Consolidated Income, Expenditure and<br />

Outturn for the year ended 31 July <strong>2009</strong><br />

is provided in the table below:<br />

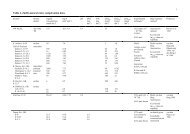

<strong>2008</strong>-09<br />

£’000<br />

2007-08<br />

£’000<br />

Income 288,937 258,440<br />

Expenditure 282,095 245,077<br />

Surplus<br />

for the year<br />

before taxation 6,842 13,363<br />

Share of joint<br />

venture’s deficit<br />

before taxation (23) (188)<br />

Taxation 2 -<br />

Surplus<br />

for the year 6,821 13,175<br />

Surplus for the<br />

year transferred<br />

to endowment<br />

funds (770) (607)<br />

Surplus for the<br />

year retained in<br />

general funds 6,051 12,568<br />

The <strong>University</strong>’s primary financial objective<br />

is to generate surpluses sufficient to<br />

sustain its ongoing activities and to<br />

maintain investment in the estate and<br />

associated infrastructure.<br />

The year under review has presented a<br />

significant challenge to the <strong>University</strong>,<br />

due to the deepening global economic<br />

recession. Strong financial stewardship has<br />

been exercised during this period, and,<br />

in the circumstances, the financial results<br />

of the <strong>University</strong> have been satisfactory.<br />

However, in view of the deteriorating<br />

pension situation, escalating pay costs<br />

and increasing pressure on future funding<br />

streams, there is an urgent need to secure<br />

cost savings, in order to ensure future<br />

sustainability. Against this background,<br />

and also in response to the outcome of<br />

the Research Assessment Exercise (RAE)<br />

<strong>2008</strong>, Senate approved in June <strong>2009</strong> the<br />

<strong>2009</strong> Academic and Financial Plan, further<br />

details of which are provided below. The<br />

first phase of the <strong>2009</strong> Plan, involved<br />

the implementation of a new severance<br />

and early retirement scheme, for which<br />

a provision, amounting to £9.9m,<br />

is included in the <strong>2008</strong>-09 financial<br />

statements.<br />

The resultant surplus of £6.1m,<br />

compared to £12.6m in 2007-08, has<br />

been earmarked within the <strong>University</strong> to<br />

replenish general reserves, to fund the<br />

<strong>University</strong>’s capital programme, including<br />

the financing of external loans, and to<br />

support full implementation of the <strong>2009</strong><br />

Academic and Financial Plan.<br />

In recent years, the level of surplus<br />

generated as a percentage of income, has<br />

been in line with the <strong>University</strong>’s target<br />

of 5%. However, as the table above<br />

demonstrates, this has reduced to 2.1% in<br />

<strong>2008</strong>-09, largely as a result of the costs of<br />

the implementation of the first phase of<br />

the <strong>2009</strong> Plan.<br />

Academic Plan 2006-11<br />

In June 2006, Senate approved the 2006-<br />

11 Academic Plan as the foundation<br />

stone of its five year Corporate Plan. The<br />

2006 Academic Plan is based on “Plan<br />

435i” which set targets for improving the<br />

undergraduate entry standards, increasing<br />

the proportion of postgraduate students<br />

and raising the proportion of externally<br />

derived income. These targets remain<br />

valid and, notwithstanding the more<br />

challenging economic conditions which<br />

now face the <strong>University</strong>, the academic<br />

planning process has continued to<br />

2 Queen’s <strong>University</strong> <strong>Belfast</strong> Consolidated Financial Statements <strong>2008</strong> - 09

Operating and Financial Review<br />

(Honorary Treasurer’s Report)<br />

ensure that decisions are centred on their<br />

achievement.<br />

The Plan, which also includes enhanced<br />

research performance, and extended<br />

international connections and<br />

collaborations, will assist the <strong>University</strong> to<br />

develop world leading research centres<br />

and to offer a modernised, market –<br />

attuned education portfolio comparable<br />

with the best in the world. The Plan<br />

represents a total investment of £259m,<br />

of which some £189m will be on capital<br />

investment, to ensure that students<br />

and staff will be attracted to work and<br />

study in a safe, modern and high quality<br />

environment.<br />

Detailed arrangements are also in place<br />

to ensure that progress against the Plan is<br />

monitored, on an ongoing basis, by both<br />

the <strong>University</strong> Management Board and the<br />

Planning and Finance Committee.<br />

The <strong>University</strong> has adopted the CUC<br />

Performance Management Framework,<br />

incorporating 10 high level key<br />

performance indicators, and detailed<br />

reports on performance are prepared at<br />

Corporate, School and Academic Support<br />

Directorate level.<br />

Academic and Financial Plan <strong>2009</strong><br />

In response to the increasingly challenging<br />

economic conditions, the financial<br />

strategy for the <strong>University</strong> has recently<br />

been re-focused to encompass the<br />

following two directives:<br />

(i) Investment in <strong>2009</strong>-10 and future<br />

years will be funded through<br />

disinvestment;<br />

(ii) Greater selectivity in the deployment<br />

of resources will be a central theme<br />

of resource allocation.<br />

As outlined earlier in my report, the first<br />

phase of the Academic and Financial Plan<br />

<strong>2009</strong> has primarily focused on the need<br />

to reduce recurrent costs and re-position<br />

the <strong>University</strong> to address its objectives,<br />

as outlined in the Corporate Plan, in an<br />

increasingly competitive environment.<br />

This has involved four key components,<br />

namely:<br />

• the introduction of a partial<br />

moratorium on the recruitment and<br />

replacement of all posts;<br />

• the implementation of a new<br />

severance and early retirement<br />

scheme;<br />

• consideration of a series of School<br />

specific ‘major decisions’ which are<br />

aligned with strategic priorities; and<br />

• the re-prioritisation of current<br />

expenditure.<br />

Phase Two of the Plan, will seek to<br />

identify and secure levels of investment,<br />

in accordance with both the <strong>University</strong>’s<br />

Research Strategy and other institutional<br />

priorities. The underlying objective is<br />

for Queen’s to become a Global 100<br />

<strong>University</strong>. Such investment will be<br />

released on a selective basis in preparation<br />

for the Research Excellence Framework<br />

and will be fully aligned with the<br />

Institutional Research Strategy, and the<br />

undergraduate and postgraduate student<br />

number targets.<br />

Income<br />

Total income increased, in <strong>2008</strong>-09, by<br />

£30.5m or some 11.8% in cash terms.<br />

During the year, government grants<br />

increased by £12.1m, due to a number<br />

of factors, including the transfer of<br />

funding, amounting to £1.4m, from the<br />

Department of Agriculture and Rural<br />

Development to the Department for<br />

Employment and Learning (DEL). This<br />

funding, which related to the <strong>University</strong>’s<br />

Institute of Agri-Food and Land Use was<br />

subsequently consolidated within the<br />

recurrent grant funding for <strong>2008</strong>-09.<br />

In <strong>2008</strong>-09, the <strong>University</strong> was successful<br />

in securing funding from DEL of £9.5m,<br />

for a 3 year period, relating to the Cross<br />

Border Research and Development<br />

Funding - Strengthening the All Island<br />

Research Base. In addition, <strong>2008</strong>-09<br />

represented the fifth year of the approved<br />

expansion of the Medical School, resulting<br />

in the receipt of additional recurrent<br />

teaching grant funding.<br />

“Plan 435i” outlined above, includes a<br />

target to raise the proportion of income<br />

secured from non government sources<br />

(i.e. outside the block grant) by 5<br />

percentage points, after allowing for the<br />

increased income derived from tuition<br />

fees and full economic costing (fEC).<br />

Diversification of income can be achieved<br />

by, for example, increased income from<br />

external research grants and contracts,<br />

international students and knowledge<br />

transfer. The position across the past<br />

3 years, outlined below, demonstrates<br />

that the 5% increase has been achieved.<br />

However, going forward, this target will<br />

become particularly more challenging in<br />

view of increased competition for both<br />

research funding, and tuition fee income<br />

from international and postgraduate<br />

students. In addition, investment income<br />

has been adversely affected by the very<br />

low interest rates currently on offer.<br />

During the year the <strong>University</strong> has entered<br />

into a joint venture arrangement with<br />

INTO <strong>University</strong> Partnerships Limited<br />

(INTO), with the primary aim of increasing<br />

Queen’s <strong>University</strong> <strong>Belfast</strong> Consolidated Financial Statements <strong>2008</strong> - 09<br />

3

Operating and Financial Review<br />

(Honorary Treasurer’s Report)<br />

the number and range of international<br />

students studying at Queen’s <strong>University</strong><br />

<strong>Belfast</strong>. An INTO/Queen’s College will be<br />

established providing foundation courses<br />

which can lead to automatic enrolment on<br />

standard undergraduate and postgraduate<br />

programmes.<br />

During the period 2004-09 the <strong>University</strong><br />

has been successful in securing funding<br />

under SPUR 1 and SPUR 2, of £26m and<br />

£39m respectively. Further funding of<br />

£9.5m was secured in <strong>2009</strong> through the<br />

All Island Research collaboration initiative.<br />

The sustainability of the research activities<br />

initiated by these programmes remains a<br />

key challenge for the <strong>University</strong>.<br />

The third year of variable tuition fees,<br />

and the ongoing implementation of the<br />

Access Agreement with DEL, has resulted<br />

in tuition fee income from Home and EU<br />

students increasing by a further £5.9m<br />

(20%). Other increases are due to the<br />

growth in student numbers in planned<br />

areas (Social Work and Medicine) and, in<br />

the case of overseas fee income, higher<br />

fee rates payable. The need to maintain<br />

the quality of teaching and to enhance<br />

the student experience remains a priority<br />

within the <strong>University</strong> and, in this respect,<br />

a QAA Institutional Audit was undertaken<br />

in spring <strong>2009</strong>, with a very successful<br />

outcome having been achieved. Robust<br />

negotiations will continue with DEL to<br />

maximise the block grant for teaching and<br />

research, during the next comprehensive<br />

spending review period.<br />

The <strong>University</strong> continues to provide the<br />

majority of pre and post registration nurse<br />

training for the Department of Health,<br />

Social Services and Public Safety. During<br />

the year, income increased by £0.6m,<br />

due mainly to an increase in the unit of<br />

teaching resource for pre-registration<br />

students, and the impact of the four year<br />

direct entry Midwifery course.<br />

Income from research grants and contracts<br />

has increased by £8.1m to £59.3m. The<br />

<strong>2008</strong>-09 financial year was the third year<br />

of the implementation of the pricing of<br />

research grants on a fEC basis, following<br />

the review of the dual support system.<br />

Income from Research Councils and<br />

Charities increased by £1.2m from 2007-<br />

08, due to the ongoing implementation<br />

of fEC. The contribution to indirect<br />

costs increased by £2.5m, from £7.6m<br />

to £10.1m, representing a contribution<br />

rate of approximately 20%. The effective<br />

implementation of fEC has enabled<br />

the <strong>University</strong> to move towards a more<br />

sustainable research portfolio. However,<br />

it is also recognised that competition has<br />

increased, and the <strong>University</strong> will need to<br />

work harder to maintain the volume of<br />

research undertaken, as funders become<br />

more selective in awarding grants. Such<br />

an increase in competition, coupled<br />

with the current economic downturn,<br />

has resulted in the value and number of<br />

research awards decreasing in <strong>2008</strong>-09,<br />

and this is clearly a cause for concern.<br />

Other Operating Income has increased<br />

by £2.8m, due to additional other<br />

income being generated by Schools and<br />

Directorates, particularly from Patents and<br />

Licensing, Other Services Rendered and<br />

additional VAT recovered during the year.<br />

4 Queen’s <strong>University</strong> <strong>Belfast</strong> Consolidated Financial Statements <strong>2008</strong> - 09

Operating and Financial Review<br />

(Honorary Treasurer’s Report)<br />

Income from endowments and interest<br />

receivable remained similar to last year.<br />

However, the 2007-08 total included a<br />

gift-aid payment of £1.1m made to the<br />

<strong>University</strong> by QUBIS Ltd, arising from<br />

the sale of Meridio Holdings, a spin out<br />

company from Kainos Ltd, which in turn<br />

was a spin out from the <strong>University</strong>’s<br />

Computer Science Department. Income<br />

from short-term investments has increased<br />

in <strong>2008</strong>-09 by £1.0m, due to higher levels<br />

of liquidity.<br />

While the <strong>University</strong> is currently carrying<br />

large cash reserves, a significant element<br />

of these funds is committed to support<br />

capital projects (see note 22). Problems<br />

in securing planning permission from<br />

the statutory authorities, for a number<br />

of major capital schemes, has resulted in<br />

delays in the capital programme.<br />

Expenditure<br />

Total expenditure increased by £37.0m,<br />

equivalent to some 15.1%. This includes<br />

an increase in staff costs of £9.6m, which<br />

is mainly accounted for by pay awards and<br />

other pay-related costs. In this respect,<br />

the <strong>University</strong> has honoured the final<br />

element of the three year pay award,<br />

with effect from 1 October <strong>2008</strong>, at the<br />

level of 5%, being the annual increase<br />

in the retail price index at September<br />

<strong>2008</strong>. This further increase in pay costs,<br />

together with the outcome of the<br />

triennial valuations of the Universities<br />

Superannuation Scheme (USS) and the<br />

Retirement Benefits Plan (RBP), will have<br />

a significant impact on future costs.<br />

Expenditure on pay over the last 3 years<br />

has increased by over 13%, including the<br />

impact of the triennial pay award, which<br />

amounted to 15.9%, and clearly, increases<br />

at this level are unsustainable in a period<br />

when income growth is likely to be more<br />

constrained.<br />

In accordance with the <strong>University</strong>’s Access<br />

Agreement with DEL, the <strong>University</strong><br />

implemented an Institutional Bursary<br />

Scheme in 2006-07, as part of its<br />

widening participation strategy. Additional<br />

related expenditure of £3.2m was incurred<br />

in <strong>2008</strong>-09, including £3.1m in respect of<br />

the Institutional Bursary Scheme. In total,<br />

over 43% of eligible students (3,876)<br />

received some level of bursary payment.<br />

Investment Performance<br />

The notes to the accounts set out full<br />

details of the Investment Funds of the<br />

<strong>University</strong>.<br />

The <strong>University</strong> Investment Fund is<br />

administered under the terms set out in<br />

the Queen’s <strong>University</strong> (Trust Scheme)<br />

Order (Northern Ireland) 1982 and<br />

includes monies donated and bequeathed<br />

to the <strong>University</strong> for a variety of purposes.<br />

The total income of the Investment Fund<br />

for the year ended 28 February <strong>2009</strong> was<br />

£2,025,173 compared with £1,943,167 in<br />

2007-08. After allowing for management<br />

expenses of £78,255 and a transfer from<br />

reserves of £21,626, the net income<br />

enabled a distribution to shareholders of<br />

34p per share, the same as the previous<br />

year. The Investment Fund recorded a<br />

decrease in value for the year of £0.04m<br />

from £42.55m to £42.51m. After allowing<br />

for the inclusion of new endowments of<br />

£2.2m, the overall decrease of £2.24m,<br />

or 5%, is attributable to losses on<br />

investments, due to a downturn in global<br />

markets. Since 31 July <strong>2009</strong>, markets have<br />

recovered and at 30 September <strong>2009</strong> the<br />

Investment Fund was valued at £46.18m,<br />

an increase of £3.67m, or 8%.<br />

The General Investment Fund is a passively<br />

managed, accumulated income fund.<br />

The value of the fund has decreased<br />

over the year from £14.4m to £13.6m,<br />

representing a decrease of £0.8m, in<br />

the year. After allowing for accumulated<br />

income of £0.5m, the total decrease<br />

for the year is £1.3m or 9%, and is<br />

attributable to losses on equity and fixed<br />

interest investments. Following further<br />

movements in investment values since<br />

the year end, on 30 September <strong>2009</strong> the<br />

fund was valued at £15m, representing an<br />

increase of £1.4m, or 10.3%.<br />

Treasury Management<br />

The <strong>University</strong> has a detailed treasury<br />

policy in place, which includes deposit<br />

limits with agreed financial institutions,<br />

for the investment of its cash deposits.<br />

The policy is regularly reviewed by the<br />

Investment Committee, to ensure that<br />

risk is minimised, and, during the current<br />

period of turbulence within the banking<br />

and financial sectors, it has proved to<br />

be particularly robust. The <strong>University</strong>’s<br />

levels of liquidity and cash reserves<br />

remain at high levels, although due to<br />

the lack of demand from the banking<br />

sector for funds, most institutions<br />

are offering very low rates on shortterm<br />

investments. As a consequence,<br />

alternative options to maximise income<br />

potential, whilst continuing to minimise<br />

risk to an acceptable level, are currently<br />

being explored, in conjunction with the<br />

Investment Committee.<br />

Queen’s <strong>University</strong> <strong>Belfast</strong> Consolidated Financial Statements <strong>2008</strong> - 09<br />

5

Operating and Financial Review<br />

(Honorary Treasurer’s Report)<br />

Capital and Long Term Maintenance<br />

The <strong>University</strong> has approved a revised<br />

Estates Strategy covering the period 2007-<br />

17, which is based on the need to ensure<br />

financial and environmental sustainability.<br />

This strategy continues to focus on<br />

the efficient and effective use of space<br />

and the provision of accommodation<br />

which will enhance the quality of<br />

learning, teaching and research and the<br />

environment for students and staff. The<br />

level of investment, recommended by the<br />

Higher Education Funding Council for<br />

England (HEFCE), is 4.5% of Insurable<br />

Replacement Value invested in the capital<br />

development of an institution’s non<br />

residential estate. Notwithstanding the<br />

difficulties in securing planning permission<br />

for some major capital projects, the level<br />

of investment has been maintained in or<br />

around the target of 5% of the insurable<br />

replacement value of the estate.<br />

There has been significant investment in<br />

the physical estate during <strong>2008</strong>-09 with<br />

some £30.4m of expenditure having<br />

been incurred on buildings and assets in<br />

the course of construction. A number of<br />

specific projects have been taken forward<br />

as part of the <strong>University</strong>’s capital and longterm<br />

maintenance plan. These projects<br />

form part of a total investment plan of<br />

approximately £200m, and include:<br />

• ongoing refurbishment of student<br />

accommodation;<br />

• ongoing refurbishment work in<br />

respect of Health and Safety within<br />

the <strong>University</strong>’s campus;<br />

• expenditure on the Research Capital<br />

Investment Fund (RCIF) and Learning<br />

and Teaching Capital. This includes<br />

development of the Whitla Medical<br />

and David Keir Buildings and the<br />

Cardiovascular Research Centre at the<br />

Royal Victoria Hospital site, together<br />

with work to develop the <strong>University</strong>’s<br />

ICT and Teaching Infrastructure;<br />

• Health Sciences refurbishment,<br />

including the provision of further<br />

research accommodation, and to<br />

facilitate the expansion of the medical<br />

school;<br />

• extension of the Physical Education<br />

Centre;<br />

• development of sports facilities at<br />

Upper Malone;<br />

• completion of the construction of the<br />

New Library; and<br />

• creation of an Executive Education<br />

Centre at Riddel Hall.<br />

Conventional funding, primarily from<br />

government, has continued to be<br />

supplemented by additional significant<br />

private contributions from benefactors,<br />

provided through the Queen’s <strong>University</strong><br />

of <strong>Belfast</strong> Foundation. The Foundation’s<br />

principal activity is to advance the<br />

strategic goals and objectives of the<br />

<strong>University</strong>, under the direction of an<br />

independent Foundation Board. During<br />

the year, the level of the Foundation’s<br />

fundraising was substantial, with some<br />

£9.2m being disbursed to the <strong>University</strong>.<br />

This includes £2.5m in relation to the New<br />

Library, £2.7m on various research projects<br />

under the Sharing Education Programme<br />

and £1.5m on Vision Sciences at Queen’s.<br />

Work on Campaign 2, to be known as<br />

Campaign 100, and which will centre on<br />

major research initiatives, is ongoing.<br />

It is also vitally important that government<br />

capital funding is maintained, at least at<br />

current levels, if the level of investment<br />

necessary to remain competitive with<br />

other Russell Group universities is to be<br />

achieved.<br />

Balance Sheet<br />

The <strong>University</strong> has continued to account<br />

for the RBP in accordance with the<br />

requirements of FRS 17. This has involved,<br />

inter alia, accounting for the scheme<br />

deficit of £36.1m (<strong>2008</strong>: £29.9m)<br />

within general reserves. A fall in asset<br />

values in the year to 31 July <strong>2009</strong> was<br />

compounded by an increase in liabilities<br />

the net result being a further increase in<br />

the deficit.<br />

As at the Balance Sheet date of 31 July<br />

<strong>2009</strong>, total consolidated net assets of<br />

the <strong>University</strong> had increased to £321.1m,<br />

compared to £302.9m at 31 July <strong>2008</strong>.<br />

This has largely been matched by an<br />

increase in deferred capital grants of<br />

£20.7m offset by a decrease in general<br />

reserves of £2.7m. Net liquidity improved<br />

during the year. The annualised servicing<br />

cost of external debt of 1.8% remains<br />

well below the 4% limit set in the<br />

<strong>University</strong>’s Financial Memorandum.<br />

The <strong>University</strong> continues to effectively<br />

manage its working capital and the<br />

current asset ratio has been maintained<br />

at an acceptable level, as outlined in the<br />

table on page 7.<br />

Future Developments<br />

The introduction of deferred variable<br />

tuition fees in 2006-07 has enabled<br />

Queen’s to gain access to levels of<br />

additional income similar to institutions<br />

in the rest of the UK and hence remain<br />

competitive and continue to deliver<br />

world class education and research. In<br />

this respect, both the Westminster and<br />

6 Queen’s <strong>University</strong> <strong>Belfast</strong> Consolidated Financial Statements <strong>2008</strong> - 09

Operating and Financial Review<br />

(Honorary Treasurer’s Report)<br />

levels of investment. Pay settlements<br />

in future years must be moderated<br />

and payroll costs controlled, ensuring<br />

improved levels of performance and<br />

productivity.<br />

devolved governments are committed<br />

to reviewing the Variable Fees policy in<br />

<strong>2009</strong>-10. The outcome of this review<br />

will determine the <strong>University</strong>’s ability<br />

to maintain levels of investment and<br />

develop its competitive position, going<br />

forward. As part of the Access Agreement<br />

the <strong>University</strong> has introduced ongoing<br />

monitoring arrangements which inter<br />

alia, assess the overall impact of variable<br />

fees on the <strong>University</strong>’s student profile,<br />

and assess the effectiveness of the<br />

institutional bursary scheme and the<br />

associated outreach measures detailed in<br />

the Agreement.<br />

The <strong>University</strong> has consolidated its<br />

position as a major research institution,<br />

following the outcome of the RAE. A<br />

revised Research Strategy has been<br />

developed, in preparation for the new<br />

Research Excellence Framework. The<br />

delivery of this Strategy, supplemented by<br />

the implementation of the second phase<br />

of the <strong>2009</strong> Academic and Financial Plan,<br />

should have a significant, favourable<br />

impact on the <strong>University</strong>’s future position,<br />

relative to its peers in the Russell Group.<br />

Discussions are ongoing with Stranmillis<br />

<strong>University</strong> College with a view to<br />

merging. Such a merger will require<br />

Assembly approval and for this reason,<br />

is unlikely to take effect until 2010-11,<br />

at the earliest. Both the College and the<br />

<strong>University</strong> are committed to the merger,<br />

and recognise that the Stranmillis School<br />

of Education can not only be financially<br />

sustainable, but also can create a world<br />

class centre providing training for teachers<br />

throughout the full range of requirements,<br />

underpinned by a strong research base.<br />

Following the recommendations<br />

contained within the Better Regulation<br />

Task Force report, the <strong>University</strong> remains<br />

committed to the need to reduce the<br />

burden of bureaucracy, while remaining<br />

fully accountable to its key stakeholders.<br />

The regulatory framework within Northern<br />

Ireland remains particularly onerous<br />

and, in this respect, the <strong>University</strong> will<br />

continue to lobby the key stakeholders in<br />

an attempt to effect rationalisation and<br />

change. On a more positive note, a HEFCE<br />

Audit Assurance review was undertaken<br />

in <strong>2008</strong>-09, with a very satisfactory<br />

outcome, in which the <strong>University</strong> was<br />

recognised as a sector leader, in terms<br />

of corporate governance and financial<br />

control.<br />

A key issue for the <strong>University</strong> involves<br />

the potential impact of the Northern<br />

Ireland Charities Act <strong>2008</strong> on the<br />

<strong>University</strong>’s future reporting, regulatory<br />

and governance arrangements. We are<br />

currently liaising closely with the Charity<br />

Commission for Northern Ireland and DEL,<br />

with a view to developing and agreeing<br />

a workable solution for the universities<br />

within Northern Ireland.<br />

As stated above, the projected increases<br />

in pay and pension costs, in <strong>2009</strong>-10, will<br />

significantly impact on the <strong>University</strong>’s<br />

ability to continue to generate surpluses at<br />

the levels necessary to maintain adequate<br />

Of particular concern to the <strong>University</strong><br />

is the financial health of the Universities<br />

Superannuation Scheme, a mutual scheme<br />

for the majority of the HE sector, and in<br />

particular, the size of the funding deficit.<br />

The conservative ongoing valuation as<br />

at 31 March <strong>2008</strong> reported a deficit of<br />

£11.8bn which, as at 31 March <strong>2009</strong>,<br />

due largely to a substantial fall in scheme<br />

assets, increased to £19.7bn. The FRS<br />

17 figures (which use higher corporate<br />

bond yields rather than gilt yields, thereby<br />

reducing liabilities) projected a deficit<br />

of £3.2bn, as at 31 March <strong>2009</strong>. Both<br />

measures will have recovered to some<br />

extent since that low point, in line with<br />

increases in asset values. Some immediate<br />

steps have been taken to address this<br />

issue, going forward, including the<br />

increase in employer contributions from<br />

14% to 16% from 1 October <strong>2009</strong>.<br />

However, more fundamental and radical<br />

changes will be required, in order to<br />

ensure future financial sustainability of the<br />

Scheme.<br />

The role that universities can, and should<br />

play in the development of their regional<br />

economies is now well accepted and<br />

was endorsed in the Programme for<br />

Government in Northern Ireland. This is<br />

particularly important in a region such as<br />

Northern Ireland where the contribution<br />

of Queen’s to the maintenance and<br />

development of a world class portfolio<br />

of research and teaching is vital. The<br />

<strong>University</strong> will also continue to play a key<br />

role in the generation of new companies<br />

through knowledge transfer and the<br />

commercialisation of research. In this<br />

regard the contribution of QUBIS Ltd over<br />

the last 20 years is well recognised and<br />

this activity will continue.<br />

In recent years, Government has placed<br />

increased emphasis on the role of<br />

universities as drivers of economic growth<br />

at regional and national level. In this<br />

respect, the <strong>University</strong> has implemented a<br />

revised Knowledge Exploitation Strategy<br />

and established a Knowledge Exploitation<br />

Unit. Funding has been made available<br />

Queen’s <strong>University</strong> <strong>Belfast</strong> Consolidated Financial Statements <strong>2008</strong> - 09<br />

7

Operating and Financial Review<br />

(Honorary Treasurer’s Report)<br />

from Round 2 of the Higher Education<br />

Innovation Fund (HEIF), amounting to<br />

£1.5m per annum for the three years<br />

ending 31 July 2010, and this will assist<br />

the <strong>University</strong> in extending its impact<br />

within the regional economy. This funding<br />

will need to be supplemented from other<br />

sources, if the commercial potential of the<br />

high quality research undertaken within<br />

the <strong>University</strong> is to be fully exploited.<br />

I am delighted to report that the<br />

<strong>University</strong> has recently, in October<br />

<strong>2009</strong>, been named as the Times Higher<br />

Education Entrepreneurial <strong>University</strong> of<br />

the year. This demonstrates excellence in<br />

relation to ‘strong leadership engagement<br />

with students in a diversity of learning<br />

opportunities and a clear tangible<br />

impact on staff, business and the local<br />

community’.<br />

Conclusion<br />

In conclusion, I am pleased to confirm<br />

that the financial outturn for the year<br />

under review has been satisfactory and<br />

gives further assurance as to the strong<br />

managerial and financial framework<br />

which is in place. The necessary<br />

investment in the <strong>University</strong>’s academic<br />

strategy and infrastructure has been<br />

maintained.<br />

These achievements are due to the<br />

commitment and hard work of all staff,<br />

both academic and academic support,<br />

and their contribution is highly valued.<br />

I would, in particular, like to thank the<br />

staff of the Finance Department, for the<br />

efficient and effective manner with which<br />

the <strong>University</strong>’s financial affairs continue<br />

to be managed.<br />

The <strong>University</strong> has made significant<br />

progress in recent years, both in terms<br />

of its research and teaching quality,<br />

and the drive to ensure the delivery<br />

of world class research and education<br />

portfolios will continue as the Corporate<br />

Plan is implemented. Queen’s will also<br />

continue to play a significant role under<br />

the leadership of the Vice-Chancellor,<br />

Professor Peter Gregson, in research,<br />

education and economic development<br />

within the region of Northern Ireland and<br />

beyond and current strategies will help<br />

promote the <strong>University</strong> towards being<br />

among the top 100 global universities.<br />

Full implementation of the Corporate Plan<br />

will greatly enhance strategic planning,<br />

governance, management and the quality<br />

of decision making and accountability<br />

over the next ten years. In this way the<br />

financial success of the <strong>University</strong> can be<br />

secured with current and future activities<br />

being sustained despite difficult economic<br />

conditions.<br />

8 Queen’s <strong>University</strong> <strong>Belfast</strong> Consolidated Financial Statements <strong>2008</strong> - 09

Corporate Governance<br />

The following statement is<br />

given to assist readers of the<br />

financial statements to obtain an<br />

understanding of the Governance<br />

procedures applied by the Senate of<br />

the <strong>University</strong>.<br />

The <strong>University</strong> is an autonomous body<br />

established under the Irish Universities<br />

Act 1908. In common with all public<br />

bodies it operates within a strong<br />

framework of regulation. Not only does<br />

the <strong>University</strong> comply with all mandatory<br />

requirements but it also strives to operate<br />

that guidance which represents best<br />

practice. The <strong>University</strong> has adopted the<br />

Guide for Members of Governing Bodies<br />

of Universities and Colleges in England,<br />

Wales and Northern Ireland published in<br />

June 1995 by the Committee of <strong>University</strong><br />

Chairs, and revised, most recently, in<br />

March <strong>2009</strong>. The Guide sets out current<br />

best practice for the corporate governance<br />

of higher education institutions. The<br />

<strong>University</strong> already fully complies with the<br />

key recommendations made in the Guide.<br />

Summary of the <strong>University</strong>’s Structure<br />

of Corporate Governance<br />

The <strong>University</strong>’s Senate comprises lay and<br />

academic persons appointed under the<br />

Statutes of the <strong>University</strong>, the majority of<br />

whom are non-executive. The role of the<br />

Chairman of Senate is separate from the<br />

role of the <strong>University</strong>’s Vice-Chancellor<br />

as Chief Executive. Senate is responsible<br />

for the ongoing strategic direction of the<br />

<strong>University</strong> whilst the Executive Officers<br />

are responsible for the operational<br />

management of the institution. Senate<br />

approves all major developments and<br />

receives regular reports on the day to<br />

day activities of the <strong>University</strong> and its<br />

subsidiary companies. Senate meets at<br />

least four times a year and is supported by<br />

several committees, including a Planning<br />

and Finance Committee, a Membership<br />

Committee, a Remuneration Committee<br />

and an Audit Committee. All of these<br />

committees are formally constituted with<br />

Terms of Reference and are comprised<br />

mainly of lay members of Senate.<br />

The Planning and Finance Committee<br />

supervises, inter alia, all matters relating to<br />

the finance and accounts of the <strong>University</strong>,<br />

the investment of its funds, the receipt of<br />

its income and the expenditure thereof,<br />

and the management of trust funds.<br />

The Committee also advises Senate on<br />

the raising and financing of loans. It is<br />

the duty of the Planning and Finance<br />

Committee to present a report to each<br />

meeting of Senate.<br />

The Membership Committee seeks out<br />

and recommends new lay co-opted<br />

members to the Senate.<br />

The Remuneration Committee reviews<br />

and determines the salaries and conditions<br />

of service of the senior officers of the<br />

<strong>University</strong> annually, including the Vice-<br />

Chancellor.<br />

The membership of the Audit Committee<br />

consists of four independent nonexecutive<br />

members of Senate, namely Mr<br />

E Bell (Chair), Ms R Connolly, Dr B Hanna,<br />

Mr D Licence and one co-optee, Mrs A<br />

Henderson. During the year, Miss A Paisley<br />

also served as Chair of the Committee,<br />

until her resignation from Senate in<br />

December <strong>2008</strong>. The terms of reference<br />

are as outlined below:<br />

(a) To advise Senate on the appointment<br />

of the external auditors, the audit<br />

fee, the provision of any non-audit<br />

services by the external auditors,<br />

and any questions of resignation or<br />

dismissal of the external auditors.<br />

(b) To discuss with the external auditors,<br />

before the audit begins, the nature<br />

and scope of the audit.<br />

(c) To discuss with the external auditors<br />

problems and reservations arising<br />

from the interim and final audits,<br />

including review of the management<br />

letter, incorporating management<br />

responses, and any other matters the<br />

external auditors may wish to discuss<br />

(in the absence of management<br />

where necessary).<br />

(d) To consider and advise Senate on<br />

the appointment and terms of<br />

engagement of the internal audit<br />

service, the audit fee, the provision of<br />

any non-audit services by the internal<br />

auditors, and any questions of<br />

resignation or dismissal of the internal<br />

auditors.<br />

(e) To review the internal auditors’<br />

audit risk assessment, strategy and<br />

programme; consider major findings<br />

of internal audit investigations and<br />

management’s response and promote<br />

co-ordination between the internal<br />

and external auditors. The Committee<br />

will ensure that the resources made<br />

available for internal audit are<br />

sufficient to meet the institution’s<br />

needs (or make a recommendation to<br />

Senate, as appropriate).<br />

(f) To keep under review the<br />

effectiveness of the <strong>University</strong>’s<br />

risk management, control and<br />

governance arrangements and, in<br />

particular, to review the external<br />

auditors’ management letter, the<br />

internal auditors’ annual report,<br />

and management responses.<br />

The Committee shall make<br />

recommendations to relevant<br />

committees, or to the Vice-<br />

Chancellor, to ensure that measures<br />

are taken to deal effectively with<br />

matters raised in audit reports.<br />

(g) To monitor the implementation<br />

of agreed audit-based<br />

recommendations, through the<br />

Internal Audit Recommendation<br />

Schedule.<br />

(h) To ensure that all significant losses<br />

have been properly investigated and<br />

that the internal and external auditors<br />

and, where appropriate, the HEFCE<br />

accounting officer and DEL, have<br />

been informed.<br />

(i) To oversee the institution’s policy on<br />

fraud irregularity, including being<br />

notified of any action taken under<br />

that policy.<br />

(j) To provide ongoing assurance to<br />

Senate, in respect of the management<br />

and quality assurance of data.<br />

(k) To satisfy itself that satisfactory<br />

arrangements are in place to promote<br />

economy, efficiency and effectiveness.<br />

(l) To receive any relevant report from<br />

the Northern Ireland Audit Office, the<br />

National Audit Office, HEFCE or any<br />

other body which fulfils a recognised<br />

audit function in respect of the<br />

<strong>University</strong> or related institutions,<br />

funded in full or part from public<br />

funds.<br />

(m) To monitor annually the performance<br />

and effectiveness of the external<br />

and internal auditors, including any<br />

matters affecting their objectivity, and<br />

make recommendations to Senate<br />

Queen’s <strong>University</strong> <strong>Belfast</strong> Consolidated Financial Statements <strong>2008</strong> - 09<br />

9

Corporate Governance<br />

concerning their re-appointment,<br />

where appropriate.<br />

(n) To consider the draft annual financial<br />

statements, in the presence of the<br />

external auditors, ensuring that<br />

sufficient consideration has been<br />

given to all relevant matters, that<br />

there is compliance with relevant<br />

legislation, HEFCE accounts directions,<br />

and accounting standards, and that<br />

there are no major disagreements<br />

between the external auditors and<br />

the Planning and Finance Committee<br />

and/or the Director of Finance over<br />

accounting policies.<br />

(o) In the event of the merger or<br />

dissolution of the institution, to<br />

ensure that the necessary actions are<br />

completed, including arranging for a<br />

final set of financial statements to be<br />

completed and signed.<br />

(p) To report on a regular basis to Senate<br />

and to compile an annual report<br />

which, following consideration by<br />

Senate, will be sent to DEL and the<br />

HEFCE Assurance Service - this annual<br />

report shall include an opinion on<br />

the adequacy and effectiveness of<br />

the <strong>University</strong>’s arrangements for<br />

risk management, internal control,<br />

governance and value for money.<br />

(q) The Committee is authorised by<br />

Senate to obtain outside legal or<br />

other independent professional advice<br />

and to secure the attendance of nonmembers<br />

with relevant experience<br />

and expertise if it considers this<br />

necessary, normally in consultation<br />

with the Registrar and Chief<br />

Operating Officer and/or the Chair of<br />

Senate.<br />

The <strong>University</strong> has implemented a<br />

process for identifying, assessing and<br />

managing the <strong>University</strong>’s significant<br />

risks in line with HEFCE Accounts<br />

Direction, which in turn is based on the<br />

Combined Code applied as appropriate<br />

to Higher Education. The <strong>University</strong> has<br />

also adopted the Governance Code of<br />

Practice contained in the Committee<br />

of <strong>University</strong> Chairs guidance issued in<br />

March <strong>2009</strong> (‘Guide for Members of<br />

Higher Education Governing Bodies in<br />

the UK’). A Risk Management Committee<br />

has been established, and the process of<br />

embedding risk management at School/<br />

Directorate level in both the planning<br />

processes and operational arrangements<br />

of the <strong>University</strong> is well developed. This<br />

process is regularly reviewed by the Audit<br />

Committee on behalf of Senate to ensure<br />

that a sound system of internal control<br />

covering all risks is in place.<br />

Statement on Internal Control<br />

As the governing body of Queen’s<br />

<strong>University</strong> <strong>Belfast</strong>, we have responsibility<br />

for maintaining a sound system of internal<br />

control that supports the achievement<br />

of the <strong>University</strong>’s policies, aims and<br />

objectives, while safeguarding the public<br />

and other funds and assets for which we<br />

are responsible. This responsibility has<br />

been assigned to Senate in accordance<br />

with the <strong>University</strong>’s Charter and Statutes<br />

and the Financial Memorandum with DEL.<br />

The system of internal control is designed<br />

to manage rather than eliminate the risk<br />

of failure to achieve policies, aims and<br />

objectives. To that extent it can, therefore,<br />

only provide reasonable and not absolute<br />

assurance of effectiveness.<br />

The system of internal control is based on<br />

an ongoing process designed to identify<br />

the principal risks to the achievement of<br />

policies, aims and objectives, to evaluate<br />

the nature and extent of those risks and<br />

to manage them efficiently, effectively<br />

and economically. This process has been<br />

in place for the year ended 31 July <strong>2009</strong><br />

and up to the date of approval of the<br />

financial statements, and accords in full<br />

with HEFCE guidance.<br />

As the governing body, we have<br />

responsibility for reviewing the<br />

effectiveness of the system of internal<br />

control. The following processes have<br />

been established:<br />

(a) We meet at regular intervals (at least<br />

four times a year) to consider the<br />

strategies and plans of the <strong>University</strong>.<br />

(b) We receive regular reports from the<br />

Chairman of the Audit Committee<br />

concerning internal control, and<br />

we require regular reports from<br />

managers on the steps they are<br />

taking to manage risk in their areas<br />

of responsibility, including progress<br />

reports on key projects.<br />

(c) We have established a Risk<br />

Management Committee to oversee<br />

risk management.<br />

(d) The Audit Committee receives regular<br />

reports from the internal auditors<br />

which include their independent<br />

opinion on the adequacy and<br />

effectiveness of the <strong>University</strong>’s<br />

system of internal control, together<br />

with recommendations for<br />

improvement.<br />

(e) Programmes of facilitated workshops<br />

have been held in both Schools<br />

and Directorates to identify new<br />

and emerging risks and to ensure<br />

the adequacy of counter measures.<br />

Schools and Directorates are<br />

responsible for identifying, evaluating<br />

and managing their significant risks.<br />

(f) A programme of risk awareness<br />

training is ongoing and risk<br />

management is integrated within<br />

the <strong>University</strong>’s business planning<br />

process.<br />

(g) A system of key performance and risk<br />

indicators has been developed.<br />

(h) A robust risk prioritisation<br />

methodology based on risk ranking<br />

and cost-benefit analysis has been<br />

established.<br />

(i) A corporate risk register is maintained<br />

and regularly reviewed and<br />

updated with responsibility for the<br />

management of each risk embedded<br />

within the management structure of<br />

the <strong>University</strong>.<br />

(j) All information used for both<br />

operational and financial reporting<br />

purposes is captured and processed<br />

accurately and to an appropriate<br />

quality standard, particularly where it<br />

is used by third parties or relied on by<br />

other parts of government.<br />

(k) Reports are received from budget<br />

holders, department heads and<br />

project managers on internal control<br />

activities.<br />

10 Queen’s <strong>University</strong> <strong>Belfast</strong> Consolidated Financial Statements <strong>2008</strong> - 09

Corporate Governance<br />

Our review of the effectiveness of the<br />

system of internal control is undertaken<br />

on an annual basis with reference to the<br />

HEFCE guidance on risk management.<br />

It is our view that the <strong>University</strong> has an<br />

effective Risk Management process in<br />

place and that the Corporate Risk Register<br />

is being managed on an active basis with<br />

specific action plans in place to address<br />

all risks. This view is informed by the<br />

work of the <strong>University</strong>’s internal auditors<br />

who operate to standards defined in the<br />

Accountability and Audit: HEFCE Code of<br />

Practice.<br />

Our review of the effectiveness of the<br />

system of internal control is also informed<br />

by the work of the Senior Officers within<br />

the <strong>University</strong>, who have responsibility<br />

for the development and maintenance of<br />

the internal control framework, and by<br />

comments made by the external auditors<br />

in their management letter and other<br />

reports.<br />

As a result of our overall review of the<br />

effectiveness of the system of internal<br />

control, including Risk Management,<br />

we are content that no significant<br />

weaknesses have been identified. This<br />

has been confirmed by the assurance<br />

given to <strong>University</strong>’s Accounting Officer<br />

by the internal auditors in their Annual<br />

Statement of Assurance.<br />

Queen’s <strong>University</strong> <strong>Belfast</strong> Consolidated Financial Statements <strong>2008</strong> - 09<br />

11

Responsibilities of the<br />

Senate of the <strong>University</strong><br />

In accordance with the <strong>University</strong>’s Charter<br />

and Statutes the Senate, as the governing<br />

body, is responsible for the oversight of<br />

the management and administration of<br />

the <strong>University</strong>’s affairs, including ensuring<br />

an effective system of internal control, and<br />

is required to present audited financial<br />

statements for each financial year.<br />

The Senate is of the view that there<br />

is an ongoing process for identifying,<br />

evaluating and managing the <strong>University</strong>’s<br />

significant risks. This process has been in<br />

place for the year ended 31 July <strong>2009</strong> and<br />

up to the date of approval of the financial<br />

statements, is regularly reviewed by the<br />

Senate and accords with the Combined<br />

Code as deemed appropriate for Higher<br />

Education.<br />

The Senate is responsible for keeping<br />

proper accounting records which<br />

disclose with reasonable accuracy at<br />

any time the financial position of the<br />

<strong>University</strong> and enable it to ensure that<br />

the financial statements are prepared<br />

in accordance with the <strong>University</strong>’s<br />

Charter and Statutes, the Statement of<br />

Recommended Practice: Accounting for<br />

Further and Higher Education and other<br />

relevant accounting standards. In addition,<br />

within the terms and conditions of the<br />

Financial Memorandum between DEL<br />

and the <strong>University</strong>, the Senate, through<br />

its designated office holder, is required<br />

to prepare financial statements for each<br />

financial year which give a true and fair<br />

view of the state of the affairs of the<br />

<strong>University</strong> and of the surplus or deficit and<br />

cash flows for that year.<br />

In causing the financial statements to be<br />

prepared, the Senate has ensured that:<br />

--<br />

Suitable accounting policies are<br />

selected and applied consistently;<br />

--<br />

Judgements and estimates are made<br />

that are reasonable and prudent;<br />

--<br />

Applicable accounting standards<br />

have been followed, subject to any<br />

material departures being disclosed<br />

and explained in the financial<br />

statements; and<br />

--<br />

The financial statements are prepared<br />

on the going concern basis unless it<br />

is inappropriate to presume that the<br />

<strong>University</strong> will continue in operation.<br />

The Senate has taken reasonable steps to:<br />

--<br />

Ensure that funds from DEL are used<br />

only for the purposes for which they<br />

have been given and in accordance<br />

with the Financial Memorandum<br />

with the Department and any other<br />

conditions which the Department<br />

may from time to time prescribe;<br />

--<br />

Ensure that there are appropriate<br />

financial and management controls in<br />

place to safeguard public funds and<br />

funds from other sources;<br />

--<br />

Safeguard the assets of the <strong>University</strong><br />

and prevent and detect fraud; and<br />

--<br />

Secure the economical, efficient<br />

and effective management of<br />

the <strong>University</strong>’s resources and<br />

expenditure.<br />

The key elements of the <strong>University</strong>’s<br />

system of internal control, which is<br />

designed to discharge the responsibilities<br />

set out above, include the following:<br />

--<br />

Clear definitions of the responsibilities<br />

of, and authority delegated to,<br />

resource managers;<br />

--<br />

A medium and short-term planning<br />

process, supplemented by detailed<br />

annual income, expenditure and<br />

capital budgets;<br />

--<br />

Monthly reviews of financial results<br />

involving variance reporting and<br />

updates of forecast outturns;<br />

--<br />

Clearly defined and formalised<br />

requirements for approval and<br />

control of expenditure, with decisions<br />

involving material capital or revenue<br />

expenditure being subject to formal<br />

detailed approval;<br />

--<br />

A professional internal audit service<br />

whose annual programme is<br />

approved by Senate; and<br />

--<br />

A system of risk management<br />

including the clarification, assessment<br />

and management of key risks.<br />

The Audit Committee, on behalf of<br />

Senate, monitors the effectiveness of the<br />

<strong>University</strong>’s system of internal control.<br />

Any system of internal control can,<br />

however, only provide reasonable, but not<br />

absolute, assurance against material loss<br />

or misstatement.<br />

12 Queen’s <strong>University</strong> <strong>Belfast</strong> Consolidated Financial Statements <strong>2008</strong> - 09

Independent Auditors’ Report<br />

To the Senate of Queen’s <strong>University</strong> <strong>Belfast</strong><br />

We have audited the group financial<br />

statements (‘the financial statements’) of<br />

Queen’s <strong>University</strong>, <strong>Belfast</strong> for the year<br />

ended 31 July <strong>2009</strong> which comprise the<br />

Consolidated Income and Expenditure<br />

Account, the Consolidated and <strong>University</strong><br />

Balance Sheets, the Consolidated Cash<br />

Flow Statement, the Statement of Group<br />

Total Recognised Gains and Losses and the<br />

related notes. These financial statements<br />

have been prepared under the accounting<br />

policies set out therein.<br />

Respective responsibilities of the<br />

Senate and auditors<br />

The Senate’s responsibilities for preparing<br />

the financial statements in accordance<br />

with the Accounts Direction issued by<br />

the Higher Education Funding Council<br />

for England (HEFCE), the Statement of<br />

Recommended Practice – Accounting for<br />

Further and Higher Education, applicable<br />

United Kingdom law and Accounting<br />

Standards (United Kingdom Generally<br />

Accepted Accounting Practice), are set out<br />

in the Statement of Responsibilities of the<br />

Senate of the <strong>University</strong>.<br />

Our responsibility is to audit the financial<br />

statements in accordance with relevant<br />

legal and regulatory requirements, and<br />

International Standards on Auditing<br />

(UK and Ireland). This report, including<br />

the opinion, has been prepared for and<br />

only for the Senate of the <strong>University</strong>,<br />

in accordance with the Charter and<br />

Statutes of the <strong>University</strong>. We do not,<br />

in giving this opinion, accept or assume<br />

responsibility for any other purpose or to<br />

any other person to whom this report is<br />

shown or into whose hands it may come,<br />

save where expressly agreed by our prior<br />

consent in writing.<br />

We report to you our opinion as to<br />

whether the financial statements give<br />

a true and fair view and are properly<br />

prepared in accordance with the<br />

Statement of Recommended Practice<br />

- Accounting for Further and Higher<br />

Education.<br />

We report to you whether in our opinion,<br />

income from funding bodies, grants<br />

and income for specific purposes and<br />

from other restricted funds administered<br />

by the <strong>University</strong>, have been properly<br />

applied in all material respects for the<br />

purposes for which they were received,<br />

and whether income has been applied in<br />

all material respects in accordance with<br />

the <strong>University</strong>’s Charter and Statutes and<br />

where appropriate with the Financial<br />

Memorandum with the Department for<br />

Employment and Learning.<br />

We also report to you whether, in our<br />

opinion, the information given in the<br />

Honorary Treasurer’s report is consistent<br />

with those financial statements. In<br />

addition we report to you if, in our<br />

opinion, the <strong>University</strong> has not kept<br />

adequate accounting records, if financial<br />

statements are not in agreement with<br />

the accounting records or if we have<br />

not received all the information and<br />

explanations we require for our audit.<br />

We read the other information contained<br />

in the Honorary Treasurer’s report and<br />

consider the implications for our report<br />

if we become aware of any apparent<br />

misstatements or material inconsistencies<br />

with the financial statements. This other<br />

information comprises only the Operating<br />

and Financial Review and the Corporate<br />

Governance statement.<br />

We also review the statement on internal<br />

control, included as part of the Corporate<br />

Governance statement, and comment<br />

if the statement is inconsistent with<br />

our knowledge of the <strong>University</strong> and<br />

group. We are not required to consider<br />

whether the statement on internal control<br />

covers all risks and controls, or to form<br />

an opinion on the effectiveness of the<br />

group’s corporate governance procedures<br />

or its risk and control procedures. We<br />

consider the implications for our report<br />

if we become aware of any apparent<br />

misstatements or material inconsistencies<br />

with the financial statements. Our<br />

responsibilities do not extend to any other<br />

information.<br />

The maintenance and integrity of the<br />

Queen’s <strong>University</strong> of <strong>Belfast</strong>’s website<br />

is the responsibility of Senate; the work<br />

carried out by the auditors does not<br />

involve consideration of these matters<br />

and, accordingly, the auditors accept no<br />

responsibility for any changes that may<br />

have occurred to the financial statements<br />

since they were initially presented on the<br />

website.<br />

Basis of audit opinion<br />

We conducted our audit in accordance<br />

with International Standards on Auditing<br />

(UK and Ireland) issued by the Auditing<br />

Practices Board and with the HEFCE<br />

Accountability and Audit Code of Practice<br />

contained in the Financial Memorandum.<br />

An audit includes examination, on a test<br />

basis, of evidence relevant to the amounts<br />

and disclosures in the financial statements.<br />

It also includes an assessment of the<br />

significant estimates and judgements<br />

made by the Senate in the preparation of<br />

the financial statements, and of whether<br />

the accounting policies are appropriate<br />

to the group’s circumstances, consistently<br />

applied and adequately disclosed.<br />

We planned and performed our audit<br />

so as to obtain all the information and<br />

explanations which we considered<br />

necessary in order to provide us with<br />

sufficient evidence to give reasonable<br />

assurance that the financial statements<br />

are free from material misstatement,<br />

whether caused by fraud or other<br />

irregularity or error. In forming our opinion<br />

we also evaluated the overall adequacy<br />

of the presentation of information in the<br />

financial statements.<br />

Queen’s <strong>University</strong> <strong>Belfast</strong> Consolidated Financial Statements <strong>2008</strong> - 09<br />

13

Independent Auditors’ Report<br />

To the Senate of Queen’s <strong>University</strong> <strong>Belfast</strong><br />

Opinion<br />

In our opinion:<br />

• the financial statements give a true<br />

and fair view of the state of affairs of<br />

the <strong>University</strong> and the group at<br />

31 July <strong>2009</strong>, and of the group’s<br />

income and expenditure, recognised<br />

gains and losses and cash flows for<br />

the year then ended;<br />

• the financial statements have been<br />

properly prepared in accordance with<br />

the Statement of Recommended<br />

Practice - Accounting for Further<br />

and Higher Education, and United<br />

Kingdom Generally Accepted<br />

Accounting Practice;<br />

• in all material respects, income from<br />

the Department for Employment<br />

and Learning, grants and income<br />

for specific purposes and from other<br />

restricted funds administered by the<br />

<strong>University</strong> have been applied only for<br />

the purposes for which they were<br />

received; and<br />

• in all material respects, income has<br />

been applied in accordance with the<br />

<strong>University</strong>’s Charter and Statutes and<br />

where appropriate in accordance with<br />

the Financial Memorandum with the<br />

Department for Employment and<br />

Learning.<br />

PricewaterhouseCoopers LLP<br />

Chartered Accountants and<br />

Registered Auditors<br />

<strong>Belfast</strong><br />

24 November <strong>2009</strong><br />

14 Queen’s <strong>University</strong> <strong>Belfast</strong> Consolidated Financial Statements <strong>2008</strong> - 09

Statement of<br />

Principal Accounting Policies<br />

1. Basis of Preparation<br />

The financial statements have been<br />

prepared under the historical cost<br />

convention, as modified by the<br />

revaluation of Endowment and<br />

Fixed Asset Investments, and in<br />

accordance with both the Statement<br />

of Recommended Practice (SORP):<br />

Accounting for Further and Higher<br />

Education 2007 and applicable<br />

Accounting Standards.<br />

2. Consolidation<br />

In accordance with Financial<br />

Reporting Standard (FRS) 2<br />

(amended), the consolidated financial<br />

statements of the <strong>University</strong> include<br />

its wholly owned subsidiaries, QUBIS<br />

Ltd, Quhars Ltd and the <strong>University</strong><br />

Book Shop Ltd.<br />

The results of its associated<br />

undertaking, <strong>University</strong> Challenge<br />

Fund (NI) Ltd have also been included,<br />

based on the share of the operating<br />

deficit and net assets. Details are<br />

presented in Note 12. In accordance<br />

with FRS 9, Associates, Joint Ventures<br />

and other Joint Arrangements, a<br />

proforma income and expenditure<br />

account and net assets statement,<br />

incorporating the <strong>University</strong>’s material<br />

interest in its associated undertaking,<br />

Kainos Software Limited, is presented<br />

at Note 12, together with summary<br />

details of the financial statements of<br />

the unconsolidated subsidiaries.<br />

3. Recognition of Income<br />

Government grants are accounted for<br />

in the period to which they relate.<br />

Fee income is stated gross and<br />

credited to the income and<br />

expenditure account over the period<br />

in which the students are studying.<br />

Bursaries and scholarships are<br />

accounted for gross, as expenditure,<br />

and not deducted from income.<br />

Recurrent income from research<br />

and other grants and contracts is<br />

accounted for on an accruals basis<br />

and included to the extent of the<br />

completion of the contract or service<br />

concerned; any payments received<br />

in advance of such performance are<br />

recognised on the balance sheet as<br />

liabilities.<br />

Grants received in respect of the<br />

acquisition or construction of fixed<br />

assets are treated as deferred capital<br />

grants. Such grants are credited to<br />

deferred capital grants and an annual<br />

transfer made to the income and<br />

expenditure account over the useful<br />

economic life of the asset, at the<br />

same rate as the depreciation charge<br />

on the asset for which the grant was<br />

awarded.<br />

Endowment and investment income<br />

is credited to the income and<br />

expenditure account on a receivable<br />

basis. Income from restricted<br />

endowments not expended, is<br />

transferred from the income and<br />

expenditure account to restricted<br />

endowments.<br />

Any increase or decrease in value<br />

arising from revaluation of fixed<br />

assets is carried to the revaluation<br />

reserve via the statement of<br />

recognised gains and losses.<br />

Increases or decreases arising on the<br />

revaluation or disposal of endowment<br />

assets are added to, or subtracted<br />

from, the funds concerned and<br />

accounted for through the balance<br />

sheet and reported in the statement<br />

of total recognised gains and losses.<br />

4. Pension Schemes<br />

The two principal pension schemes<br />

for the <strong>University</strong>’s staff are the<br />

Universities Superannuation Scheme<br />

(USS) and the Retirements Benefits<br />

Plan of Queen’s <strong>University</strong> <strong>Belfast</strong><br />

(RBP).<br />

It is not possible to separately<br />

identify the <strong>University</strong>’s share of the<br />

underlying assets and liabilities of<br />

the USS, and hence contributions<br />

are accounted for as if it were a<br />

defined contribution scheme, and<br />

contributions to this scheme are<br />

included as expenditure in the period<br />

in which they are payable.<br />

The schemes are defined benefit<br />

schemes which are externally funded<br />

and contracted out of the state<br />

Pension Scheme. The Funds are<br />

valued every three years by actuaries<br />

using the projected unit method, the<br />

rates of contribution payable being<br />

determined by the trustees on the<br />

advice of the actuaries. Pension costs<br />

are assessed on the basis of the latest<br />

actuarial valuations of the schemes<br />

and are accounted for on the basis<br />

of charging the cost of providing<br />

pensions over the period during<br />

which the <strong>University</strong> benefits from<br />

the employees’ services. Variations<br />

from regular cost are spread over the<br />

expected average remaining working<br />

lifetime of members of the schemes,<br />

after making allowances for future<br />

withdrawals.<br />

The difference between the fair value<br />

of the assets held in the <strong>University</strong>’s<br />

defined benefit pension scheme<br />

(RBP) and the scheme’s liabilities,<br />

measured on an actuarial basis<br />

using the projected unit method, is<br />