Multiple benefits of renovation in buildings - PU Europe

Multiple benefits of renovation in buildings - PU Europe

Multiple benefits of renovation in buildings - PU Europe

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Multiple</strong> <strong>benefits</strong> <strong>of</strong> <strong>in</strong>vest<strong>in</strong>g <strong>in</strong> energy<br />

efficient <strong>renovation</strong> <strong>of</strong> build<strong>in</strong>gs<br />

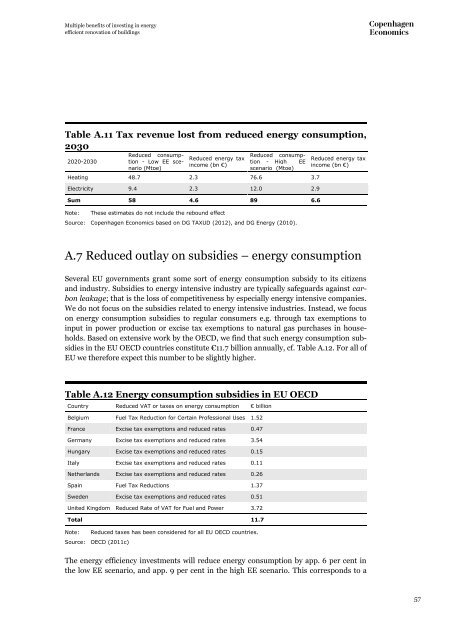

Table A.11 Tax revenue lost from reduced energy consumption,<br />

2030<br />

2020-2030<br />

Reduced consumption<br />

- Low EE scenario<br />

(Mtoe)<br />

Reduced energy tax<br />

<strong>in</strong>come (bn €)<br />

Reduced consumption<br />

- High EE<br />

scenario (Mtoe)<br />

Heat<strong>in</strong>g 48.7 2.3 76.6 3.7<br />

Electricity 9.4 2.3 12.0 2.9<br />

Sum 58 4.6 89 6.6<br />

Note:<br />

These estimates do not <strong>in</strong>clude the rebound effect<br />

Source: Copenhagen Economics based on DG TAXUD (2012), and DG Energy (2010).<br />

Reduced energy tax<br />

<strong>in</strong>come (bn €)<br />

A.7 Reduced outlay on subsidies – energy consumption<br />

Several EU governments grant some sort <strong>of</strong> energy consumption subsidy to its citizens<br />

and <strong>in</strong>dustry. Subsidies to energy <strong>in</strong>tensive <strong>in</strong>dustry are typically safeguards aga<strong>in</strong>st carbon<br />

leakage; that is the loss <strong>of</strong> competitiveness by especially energy <strong>in</strong>tensive companies.<br />

We do not focus on the subsidies related to energy <strong>in</strong>tensive <strong>in</strong>dustries. Instead, we focus<br />

on energy consumption subsidies to regular consumers e.g. through tax exemptions to<br />

<strong>in</strong>put <strong>in</strong> power production or excise tax exemptions to natural gas purchases <strong>in</strong> households.<br />

Based on extensive work by the OECD, we f<strong>in</strong>d that such energy consumption subsidies<br />

<strong>in</strong> the EU OECD countries constitute €11.7 billion annually, cf. Table A.12. For all <strong>of</strong><br />

EU we therefore expect this number to be slightly higher.<br />

Table A.12 Energy consumption subsidies <strong>in</strong> EU OECD<br />

Country Reduced VAT or taxes on energy consumption € billion<br />

Belgium Fuel Tax Reduction for Certa<strong>in</strong> Pr<strong>of</strong>essional Uses 1.52<br />

France Excise tax exemptions and reduced rates 0.47<br />

Germany Excise tax exemptions and reduced rates 3.54<br />

Hungary Excise tax exemptions and reduced rates 0.15<br />

Italy Excise tax exemptions and reduced rates 0.11<br />

Netherlands Excise tax exemptions and reduced rates 0.26<br />

Spa<strong>in</strong> Fuel Tax Reductions 1.37<br />

Sweden Excise tax exemptions and reduced rates 0.51<br />

United K<strong>in</strong>gdom Reduced Rate <strong>of</strong> VAT for Fuel and Power 3.72<br />

Total 11.7<br />

Note: Reduced taxes has been considered for all EU OECD countries.<br />

Source: OECD (2011c)<br />

The energy efficiency <strong>in</strong>vestments will reduce energy consumption by app. 6 per cent <strong>in</strong><br />

the low EE scenario, and app. 9 per cent <strong>in</strong> the high EE scenario. This corresponds to a<br />

57