Multiple benefits of renovation in buildings - PU Europe

Multiple benefits of renovation in buildings - PU Europe

Multiple benefits of renovation in buildings - PU Europe

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Multiple</strong> <strong>benefits</strong> <strong>of</strong> <strong>in</strong>vest<strong>in</strong>g <strong>in</strong> energy<br />

efficient <strong>renovation</strong> <strong>of</strong> build<strong>in</strong>gs<br />

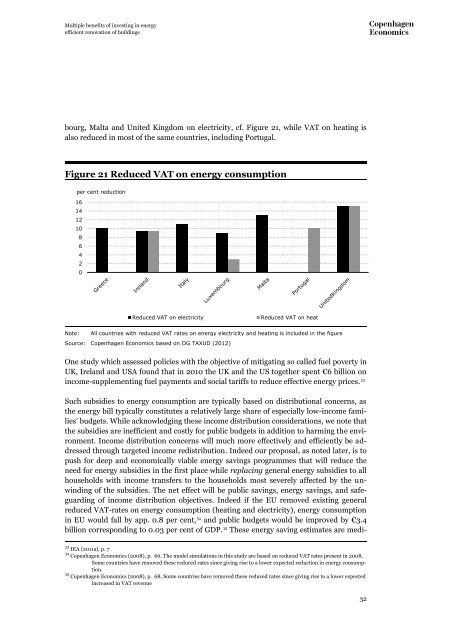

bourg, Malta and United K<strong>in</strong>gdom on electricity, cf. Figure 21, while VAT on heat<strong>in</strong>g is<br />

also reduced <strong>in</strong> most <strong>of</strong> the same countries, <strong>in</strong>clud<strong>in</strong>g Portugal.<br />

Figure 21 Reduced VAT on energy consumption<br />

per cent reduction<br />

16<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

Reduced VAT on electricity<br />

Reduced VAT on heat<br />

Note:<br />

All countries with reduced VAT rates on energy electricity and heat<strong>in</strong>g is <strong>in</strong>cluded <strong>in</strong> the figure<br />

Source: Copenhagen Economics based on DG TAXUD (2012)<br />

One study which assessed policies with the objective <strong>of</strong> mitigat<strong>in</strong>g so called fuel poverty <strong>in</strong><br />

UK, Ireland and USA found that <strong>in</strong> 2010 the UK and the US together spent €6 billion on<br />

<strong>in</strong>come-supplement<strong>in</strong>g fuel payments and social tariffs to reduce effective energy prices. 33<br />

Such subsidies to energy consumption are typically based on distributional concerns, as<br />

the energy bill typically constitutes a relatively large share <strong>of</strong> especially low-<strong>in</strong>come families’<br />

budgets. While acknowledg<strong>in</strong>g these <strong>in</strong>come distribution considerations, we note that<br />

the subsidies are <strong>in</strong>efficient and costly for public budgets <strong>in</strong> addition to harm<strong>in</strong>g the environment.<br />

Income distribution concerns will much more effectively and efficiently be addressed<br />

through targeted <strong>in</strong>come redistribution. Indeed our proposal, as noted later, is to<br />

push for deep and economically viable energy sav<strong>in</strong>gs programmes that will reduce the<br />

need for energy subsidies <strong>in</strong> the first place while replac<strong>in</strong>g general energy subsidies to all<br />

households with <strong>in</strong>come transfers to the households most severely affected by the unw<strong>in</strong>d<strong>in</strong>g<br />

<strong>of</strong> the subsidies. The net effect will be public sav<strong>in</strong>gs, energy sav<strong>in</strong>gs, and safeguard<strong>in</strong>g<br />

<strong>of</strong> <strong>in</strong>come distribution objectives. Indeed if the EU removed exist<strong>in</strong>g general<br />

reduced VAT-rates on energy consumption (heat<strong>in</strong>g and electricity), energy consumption<br />

<strong>in</strong> EU would fall by app. 0.8 per cent, 34 and public budgets would be improved by €3.4<br />

billion correspond<strong>in</strong>g to 0.03 per cent <strong>of</strong> GDP. 35 These energy sav<strong>in</strong>g estimates are medi-<br />

33 IEA (2011a), p. 7<br />

34 Copenhagen Economics (2008), p. 66. The model simulations <strong>in</strong> this study are based on reduced VAT rates present <strong>in</strong> 2008.<br />

Some countries have removed these reduced rates s<strong>in</strong>ce giv<strong>in</strong>g rise to a lower expected reduction <strong>in</strong> energy consumption.<br />

35 Copenhagen Economics (2008), p. 68. Some countries have removed these reduced rates s<strong>in</strong>ce giv<strong>in</strong>g rise to a lower expected<br />

<strong>in</strong>creased <strong>in</strong> VAT revenue<br />

32