Fidelity VIP Index 500 Portfolio - Prudential

Fidelity VIP Index 500 Portfolio - Prudential

Fidelity VIP Index 500 Portfolio - Prudential

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

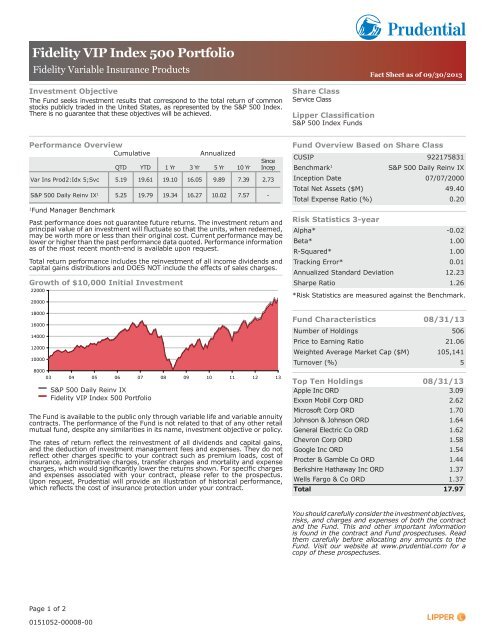

<strong>Fidelity</strong> <strong>VIP</strong> <strong>Index</strong> <strong>500</strong> <strong>Portfolio</strong><br />

<strong>Fidelity</strong> Variable Insurance Products<br />

Investment Objective<br />

The Fund seeks investment results that correspond to the total return of common<br />

stocks publicly traded in the United States, as represented by the S&P <strong>500</strong> <strong>Index</strong>.<br />

There is no guarantee that these objectives will be achieved.<br />

Fact Sheet as of 09/30/2013<br />

Share Class<br />

Service Class<br />

Lipper Classification<br />

S&P <strong>500</strong> <strong>Index</strong> Funds<br />

Performance Overview<br />

Cumulative<br />

Annualized<br />

QTD YTD 1 Yr 3 Yr 5 Yr 10 Yr<br />

Since<br />

Incep<br />

Var Ins Prod2:Idx 5;Svc 5.19 19.61 19.10 16.05 9.89 7.39 2.73<br />

S&P <strong>500</strong> Daily Reinv IX 1 5.25 19.79 19.34 16.27 10.02 7.57 -<br />

1<br />

Fund Manager Benchmark<br />

Past performance does not guarantee future returns. The investment return and<br />

principal value of an investment will fluctuate so that the units, when redeemed,<br />

may be worth more or less than their original cost. Current performance may be<br />

lower or higher than the past performance data quoted. Performance information<br />

as of the most recent month-end is available upon request.<br />

Total return performance includes the reinvestment of all income dividends and<br />

capital gains distributions and DOES NOT include the effects of sales charges.<br />

Growth of $10,000 Initial Investment<br />

22000<br />

20000<br />

18000<br />

16000<br />

14000<br />

12000<br />

10000<br />

8000<br />

03 04 05 06 07 08 09 10 11 12 13<br />

S&P <strong>500</strong> Daily Reinv IX<br />

<strong>Fidelity</strong> <strong>VIP</strong> <strong>Index</strong> <strong>500</strong> <strong>Portfolio</strong><br />

The Fund is available to the public only through variable life and variable annuity<br />

contracts. The performance of the Fund is not related to that of any other retail<br />

mutual fund, despite any similarities in its name, investment objective or policy.<br />

The rates of return reflect the reinvestment of all dividends and capital gains,<br />

and the deduction of investment management fees and expenses. They do not<br />

reflect other charges specific to your contract such as premium loads, cost of<br />

insurance, administrative charges, transfer charges and mortality and expense<br />

charges, which would significantly lower the returns shown. For specific charges<br />

and expenses associated with your contract, please refer to the prospectus.<br />

Upon request, <strong>Prudential</strong> will provide an illustration of historical performance,<br />

which reflects the cost of insurance protection under your contract.<br />

Fund Overview Based on Share Class<br />

CUSIP 922175831<br />

Benchmark 1<br />

S&P <strong>500</strong> Daily Reinv IX<br />

Inception Date 07/07/2000<br />

Total Net Assets ($M) 49.40<br />

Total Expense Ratio (%) 0.20<br />

Risk Statistics 3-year<br />

Alpha* -0.02<br />

Beta* 1.00<br />

R-Squared* 1.00<br />

Tracking Error* 0.01<br />

Annualized Standard Deviation 12.23<br />

Sharpe Ratio 1.26<br />

*Risk Statistics are measured against the Benchmark.<br />

Fund Characteristics 08/31/13<br />

Number of Holdings 506<br />

Price to Earning Ratio 21.06<br />

Weighted Average Market Cap ($M) 105,141<br />

Turnover (%) 5<br />

Top Ten Holdings 08/31/13<br />

Apple Inc ORD 3.09<br />

Exxon Mobil Corp ORD 2.62<br />

Microsoft Corp ORD 1.70<br />

Johnson & Johnson ORD 1.64<br />

General Electric Co ORD 1.62<br />

Chevron Corp ORD 1.58<br />

Google Inc ORD 1.54<br />

Procter & Gamble Co ORD 1.44<br />

Berkshire Hathaway Inc ORD 1.37<br />

Wells Fargo & Co ORD 1.37<br />

Total 17.97<br />

You should carefully consider the investment objectives,<br />

risks, and charges and expenses of both the contract<br />

and the Fund. This and other important information<br />

is found in the contract and Fund prospectuses. Read<br />

them carefully before allocating any amounts to the<br />

Fund. Visit our website at www.prudential.com for a<br />

copy of these prospectuses.<br />

Page 1 of 2<br />

0151052-00008-00

<strong>Fidelity</strong> <strong>VIP</strong> <strong>Index</strong> <strong>500</strong> <strong>Portfolio</strong><br />

<strong>Fidelity</strong> Variable Insurance Products<br />

Sector Allocation 08/31/13<br />

1 Financials 17.07<br />

9 10<br />

8<br />

1<br />

7<br />

6<br />

2<br />

5<br />

3<br />

4<br />

2 Technology 15.12<br />

3 Consumer Services 12.80<br />

4 Health Care 12.06<br />

5 Industrials 11.47<br />

6 Consumer Goods 10.57<br />

7 Oil & Gas 10.24<br />

8 Utilities 3.31<br />

9 Basic Materials 2.76<br />

10 Telecommunications 2.45<br />

Managed By<br />

ADVISOR<br />

<strong>Fidelity</strong> Management & Research Company<br />

SUB-ADVISOR(S)<br />

Geode Capital Management, LLC<br />

FMR Co., Inc. (FMRC)<br />

Asset Allocation 08/31/13<br />

Equity<br />

98.19<br />

Other<br />

Cash<br />

Fixed Income<br />

1.01<br />

0.74<br />

0.06<br />

0 25 50 75 100 125<br />

% of Investments<br />

Top Holdings, Asset Allocation, Quality Analysis &<br />

Sector Weightings<br />

Data is based on information collected from the investment<br />

company, is updated as of the date shown in the section’s title, and<br />

will vary over time. Asset Allocation may equal less than or greater<br />

than 100% due to hedged funds or leveraged cash positions by the<br />

Fund. Holdings and allocations are subject to change.<br />

Risk Measures<br />

Alpha - Measures a manager’s contribution to performance due to<br />

security selection or market timing relative to the index.<br />

Beta – Measures a portfolio’s sensitivity to market movements in<br />

the index.<br />

R-Squared - A measure that indicates the extent to which fluctuations<br />

in portfolio returns are correlated with those of the index.<br />

Standard Deviation – A measure of risk that gauges the variability<br />

of actual returns from the expected values and the dispersion of<br />

these variations over time.<br />

Sharpe Ratio – A measure that uses standard deviation and excess<br />

return to determine reward per unit of risk.<br />

Tracking Error – A divergence between the price behavior of a<br />

position or portfolio and the price behavior of a benchmark.<br />

Indices<br />

The S&P <strong>500</strong> <strong>Index</strong> is widely regarded as the best single gauge<br />

of the U.S. equities market, this world-renowned index includes<br />

a representative sample of <strong>500</strong> leading companies in leading<br />

industries of the U.S. economy. Although the S&P <strong>500</strong> focuses on<br />

the Large-Cap segment of the market, with over 80% coverage<br />

of U.S. equities, it is also an ideal proxy for the total market.<br />

The value of the index includes reinvestment of all dividends. An<br />

investor cannot invest directly in an index.<br />

S&P <strong>500</strong> Funds<br />

The S&P <strong>500</strong> <strong>Index</strong> Fund is an unmanaged index of <strong>500</strong> Large-Cap<br />

U.S. stocks that is generally considered to be representative of U.S.<br />

stock market activity. The S&P <strong>500</strong> <strong>Index</strong> is not available for direct<br />

investment and its returns do not reflect the fees and expenses<br />

that have been deducted from the fund’s return.<br />

Group variable life insurance products are issued by The <strong>Prudential</strong> Insurance Company of America (“<strong>Prudential</strong>”) and distributed through<br />

<strong>Prudential</strong> Investment Management Services LLC (“PIMS”). The <strong>Prudential</strong> Insurance Company of America is located at 751 Broad Street,<br />

Newark, NJ 07102 and PIMS is located at Three Gateway Center, 14th Floor, Newark, NJ 07102. Both are <strong>Prudential</strong> Financial companies<br />

and each is solely responsible for its financial and contractual obligations.<br />

©2013 <strong>Prudential</strong> Financial, Inc. and its related entities. <strong>Prudential</strong>, the <strong>Prudential</strong> logo and the Rock symbol are service marks of<br />

<strong>Prudential</strong> Financial, Inc. and its related entities, registered in many jurisdictions worldwide.<br />

<strong>Prudential</strong> and <strong>Fidelity</strong> Investments are not affiliated.<br />

Fund data provided by Lipper. © 2013 Thomson Reuters. All rights reserved. Any copying, republication or redistribution of Lipper content<br />

is expressly prohibited without the prior written consent of Lipper. The information contained herein is not represented or warranted to be<br />

accurate, complete, or timely. Past performance is no guarantee of future performance.<br />

Page 2 of 2