2010 - Public Relations Society of America

2010 - Public Relations Society of America

2010 - Public Relations Society of America

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

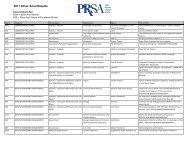

Table 1<br />

Impact <strong>of</strong> Corporate Reputation on Purchase and Investment Decisions as Affected by Income<br />

Response mean for income levels<br />

Survey<br />

question < $20k<br />

$20k-<br />

$39,000<br />

$40k-<br />

$59,999<br />

$60k-<br />

$79,999<br />

$80k-<br />

$99,999<br />

$100k-<br />

149,999 $150k+<br />

Decision to<br />

purchase<br />

2.24 2.47 2.73 2.63 2.63 2.68 2.61<br />

Decision to<br />

invest<br />

3.00 2.77 2.65 2.43 2.56 2.34 2.56<br />

Note. N=691 for purchase question, 689 for investment question.<br />

As with income level, age category does not appear to reveal significant variation. Table<br />

2 depicts responses segmented by age. Mean responses for each age category rest between<br />

“occasionally” and “frequently,” as they did by income level. Cumulative means for all age<br />

categories were 2.61 for purchase decisions (sd = 1.24) and 2.59 for investment decisions (sd =<br />

1.74). Again responses by age were compared using a one-way ANOVA. No significant<br />

difference was found for intent to purchase (F(4, 828) = 1.369, p = .243) or for intent to invest<br />

(F(4, 827) = 1.232, p = .169). Tukey’s HSD post-hoc test revealed no significant differences<br />

across the entire range <strong>of</strong> comparisons by age segment.<br />

Table 2<br />

Impact <strong>of</strong> Corporate Reputation on Purchase and Investment Decisions as Affected by Age<br />

Response mean for age segments<br />

Survey<br />

question 18-34 35-44 45-54 55-64 65+<br />

Decision to<br />

purchase<br />

2.65 2.60 2.65 2.72 2.39<br />

Decision to<br />

invest<br />

2.42 2.44 2.79 2.61 2.72<br />

Note. N=833 for purchase question, 832 for investment question.<br />

Continuing the pattern <strong>of</strong> examining demographically segmented respondent groups,<br />

level <strong>of</strong> education also fails to produce significant differences for purchase decisions, but<br />

education level does appear to matter in regard to investment decisions. Table 3 shows that<br />

regardless <strong>of</strong> education level, mean response levels again fall between “occasionally” and<br />

“frequently” for goods and services purchase decisions. For investment decisions, though,<br />

respondents with only a high school diploma or less education appear to be affected less by a<br />

company’s reputation, reporting means between “occasionally” and “rarely” to describe<br />

reputation’s impact on their investment calculations. Cumulative means for all education levels<br />

were 2.60 for purchase decisions (sd = 1.24) and 2.59 for investment decisions (sd = 1.74).<br />

When responses by education level were compared using a one-way ANOVA, no significant<br />

difference was found for intent to purchase (F(4, 832) = 1.861, p = .115), and Tukey’s HSD<br />

post-hoc test confirms that this is true for all cross-comparisons among education levels.<br />

Differences are significant, however, for intent to invest (F(4, 831) = 5.381, p = .000). To<br />

determine specific comparisons among education level segments, Tukey’s HSD post-hoc test<br />

60