2008 Annual Report - Queensland Police Service - Queensland ...

2008 Annual Report - Queensland Police Service - Queensland ...

2008 Annual Report - Queensland Police Service - Queensland ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

DEPARTMENT OF POLICE<br />

Department of <strong>Police</strong><br />

EPARTMENT OF NOTES POLICE DEPARTMENT TO AND OF FORMING POLICE PART OF THE FINANCIAL REPORT<br />

Notes to and forming part of the Financial <strong>Report</strong><br />

OTES TO AND FORMING For NOTES the year TO PART AND ended OF FORMING THE 30 June FINANCIAL <strong>2008</strong> PART OF REPORT THE FINANCIAL REPORT<br />

as at 30 June <strong>2008</strong><br />

or the year ended For 30 June the year <strong>2008</strong>ended 30 June <strong>2008</strong><br />

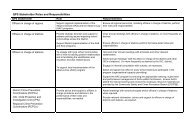

30. Financial Instruments<br />

0. Financial Instruments 30. Financial Instruments<br />

(a) Categorisation of Financial Instruments<br />

a) Categorisation of (a) Financial Categorisation Instruments of Financial Instruments<br />

The department has the following categories of financial assets and financial liabilities:<br />

he department has The the department following categories has the following of financial categories assets and of financial assets liabilities: and financial liabilities:<br />

<strong>2008</strong> 2007<br />

Category <strong>2008</strong> Note $'000 <strong>2008</strong> 2007<br />

$'000 2007<br />

ategory Category Note $'000 Note $'000 $'000<br />

$'000<br />

Financial Assets<br />

inancial Assets Cash Financial and Assets cash equivalents 14 135,687 118,676<br />

ash and cash equivalents Receivables Cash and cash equivalents 14 135,687 15 14 135,687 24,506 118,676<br />

118,676 21,200<br />

eceivables Receivables Total 15 24,506 15 160,193 24,506 21,200<br />

139,876 21,200<br />

otal Total 160,193 160,193 139,876<br />

139,876<br />

Financial Liabilities<br />

inancial Liabilities Financial Liabilities measured at amortised cost:<br />

inancial Liabilities measured Financial Liabilities at amortised measured Payables cost: at amortised cost:<br />

21 145,639 52,612<br />

Total Payables Payables 21 145,639 21 145,639 52,612<br />

52,612<br />

otal Total 145,639 145,639 52,612<br />

52,612<br />

(b) Credit Risk Exposure<br />

b) Credit Risk Exposure (b) Credit Risk Exposure<br />

The maximum exposure to credit risk at balance date in relation to each class of recognised financial assets is the gross<br />

he maximum exposure carrying The maximum to credit amount risk exposure of at those balance to assets credit date inclusive risk relation balance of any to each date provisions class in relation of for recognised impairment. to each class financial of recognised assets the financial gross assets is the gross<br />

arrying amount of those carrying assets amount inclusive of those of any assets provisions inclusive for of impairment. any provisions for impairment.<br />

The following table represents the department's maximum exposure to credit risk based on contractual amounts net of<br />

he following table any The represents allowances: following the table department's represents maximum the department's exposure maximum to credit risk exposure based to on credit contractual risk based amounts on contractual net of amounts net of<br />

ny allowances: any allowances:<br />

Maximum Exposure to Credit Risk <strong>2008</strong> 2007<br />

Category Maximum Exposure Maximum to Credit Risk Exposure to Credit Risk <strong>2008</strong> Note $'000 <strong>2008</strong> 2007<br />

$'000 2007<br />

ategory Category Note $'000 Note $'000 $'000<br />

$'000<br />

Financial Assets<br />

inancial Assets<br />

ash<br />

Cash Financial Assets<br />

Receivables Cash 14<br />

14<br />

135,687 15 14<br />

135,687<br />

135,687 24,506 118,676<br />

118,676<br />

118,676 21,200<br />

eceivables Receivables Total 15 24,506 15 160,193 24,506 21,200<br />

139,876 21,200<br />

otal Total 160,193 160,193 139,876<br />

139,876<br />

No collateral is held as security and no credit enhancements relate to financial assets held by the department.<br />

o collateral is held No as collateral security and is held no credit as security enhancements and no credit relate enhancements to financial assets relate held to financial by the department. assets held by the department.<br />

The department manages credit risk through the use of a credit management strategy. This strategy aims to reduce the<br />

he department manages exposure The department credit to credit risk manages through default the credit by use ensuring risk of a through credit that the management the department use of a credit strategy. invests management in This secure strategy assets strategy. aims and to This monitors reduce strategy the all aims funds to owed reduce on the a<br />

xposure to credit default timely exposure basis. by to ensuring credit Exposure default that to the credit by department ensuring risk is monitored that invests the department in on secure an ongoing assets invests and basis. in monitors secure assets all funds and owed monitors a all funds owed on a<br />

imely basis. Exposure timely to credit basis. risk Exposure is monitored credit on risk an is ongoing monitored basis. on an ongoing basis.<br />

No financial assets and financial liabilities have been offset and presented net in the Balance Sheet.<br />

o financial assets and No financial assets liabilities and have financial been liabilities offset and have presented been offset net in and the presented Balance Sheet. net in the Balance Sheet.<br />

The method for calculating any provisional impairment for risk is based on past experience, current and expected<br />

he method for calculating changes The method any in economic provisional for calculating conditions impairment any provisional and for changes risk impairment is based in client on credit for past risk experience, ratings. is based The on current main past factors and experience, expected affecting current the current and expected calculation<br />

hanges in economic for changes conditions provisions in economic and are changes disclosed conditions in below client and credit as changes loss ratings. events. client These main credit economic factors ratings. affecting and The geographic main the factors current changes affecting calculation form the part current of the calculation<br />

or provisions are disclosed department's for provisions below documented are as disclosed loss events. risk below These analysis as economic loss assessment events. and These in geographic conjunction economic changes with and geographic historic form part experience of changes the and form associated part of the industry data.<br />

epartment's documented department's risk analysis documented assessment risk analysis in conjunction assessment with in historic conjunction experience with and historic associated experience industry and associated data. industry data.<br />

The recognised impairment loss is $73,000 for the current year. This is an increase of $47,000 from 2007 and is due to<br />

he recognised impairment a The number recognised loss of loss $73,000 impairment events. for the loss current is $73,000 year. for This the is current an increase year. of This $47,000 is an increase from 2007 of $47,000 and is due from to 2007 and is due to<br />

number of loss events. a number of loss events.<br />

No financial assets have had their terms renegotiated so as to prevent them from being past due or impaired, and are<br />

o financial assets have stated No financial had at their assets carrying terms have renegotiated amounts had their as indicated. so terms as to renegotiated prevent them so as from to being prevent past them due from or impaired, being past and due are or impaired, and are<br />

tated at the carrying stated amounts at the as carrying indicated. amounts as indicated.<br />

Aging of past due but not impaired as well as impaired financial assets are disclosed in the following tables:<br />

ging of past due but Aging not of impaired past due as but well not as impaired as financial well as assets impaired are financial disclosed assets in the are following disclosed tables: in the following tables:<br />

Page 26<br />

Page 26<br />

Page 26<br />

118 With honour we serve<br />

Financial statements 2007-08