2008 Annual Report - Queensland Police Service - Queensland ...

2008 Annual Report - Queensland Police Service - Queensland ...

2008 Annual Report - Queensland Police Service - Queensland ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

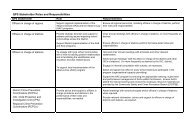

Travel 5,648 11,845<br />

Communications 27,393 23,819<br />

Accommodation and Public Utilities 10,703 10,345<br />

DEPARTMENT Resources Received OF POLICE Below Fair Value 19,096 15,419<br />

DEPARTMENT<br />

DEPARTMENT NOTES Contributions TO AND to<br />

OF<br />

OF FORMING national/state<br />

POLICE<br />

POLICE PART agencies OF THE FINANCIAL REPORT<br />

- 2,018<br />

NOTES<br />

NOTES For Training the year TO<br />

TO fees<br />

AND<br />

AND ended - courses/membership<br />

FORMING<br />

FORMING 30 June PART<br />

PART <strong>2008</strong> OF<br />

OF<br />

THE<br />

THE<br />

FINANCIAL<br />

FINANCIAL<br />

REPORT<br />

REPORT<br />

- 1,550<br />

For<br />

For Shared<br />

the<br />

the<br />

year<br />

year <strong>Service</strong><br />

ended<br />

ended Provider<br />

30<br />

30<br />

June<br />

June Charges<br />

<strong>2008</strong><br />

<strong>2008</strong><br />

17,684 16,308<br />

DEPARTMENT Equipment<br />

Department *Due to the Below abolition<br />

OF Asset POLICE<br />

of <strong>Police</strong> of Threshold the Cash Management levels Incentives Regime from 1 January 2007, 9,791the department no 6,838<br />

NOTES Operating<br />

Notes *Due<br />

*Due longer to<br />

to earns<br />

TO<br />

to the<br />

the Lease AND<br />

and abolition<br />

abolition interest<br />

FORMING Rentals<br />

forming on of<br />

of its the<br />

the and<br />

part surplus<br />

PART<br />

Cash<br />

Cash Rental<br />

of the Management<br />

Management OF<br />

funds of Premises THE<br />

Financial with<br />

FINANCIAL<br />

<strong>Queensland</strong> Incentives<br />

Incentives REPORT<br />

<strong>Report</strong> Regime<br />

Regime Treasury from<br />

from Corporation. 1<br />

January<br />

January 10,425<br />

2007,<br />

2007, The department the department<br />

department continues no<br />

no 7,856<br />

For Other<br />

as longer<br />

longer year ended 30 June <strong>2008</strong><br />

to earn at 30 earns<br />

earns interest June interest<br />

interest<br />

<strong>2008</strong> on deposits on<br />

on surplus<br />

surplus with other funds<br />

funds financial with<br />

with<br />

<strong>Queensland</strong><br />

<strong>Queensland</strong> institutions. Treasury<br />

Treasury<br />

Corporation.<br />

Corporation. 27,252<br />

The<br />

The<br />

department<br />

department<br />

continues<br />

continues 15,231<br />

Total<br />

to<br />

to<br />

earn<br />

earn<br />

interest<br />

interest<br />

on<br />

on<br />

deposits<br />

deposits<br />

with<br />

with<br />

other<br />

other<br />

financial<br />

financial<br />

institutions.<br />

institutions.<br />

255,712 217,228<br />

*Due<br />

6. Gain<br />

to<br />

on<br />

the<br />

Sale<br />

abolition<br />

of Property,<br />

of the<br />

Plant<br />

Cash Management<br />

and Equipment<br />

Incentives Regime from 1 January 2007, the department no<br />

longer<br />

6.<br />

6. Plant Gain<br />

Gain and<br />

earns<br />

on<br />

on equipment Sale<br />

Sale interest<br />

of<br />

of<br />

Property,<br />

Property, on its surplus<br />

Plant<br />

Plant<br />

and<br />

and funds<br />

Equipment<br />

Equipment with <strong>Queensland</strong> Treasury Corporation. The <strong>2008</strong> 1,371<br />

department continues<br />

1,003 2007<br />

Total<br />

to<br />

Plant<br />

Plant earn<br />

and<br />

and interest<br />

equipment<br />

equipment on deposits with other financial institutions.<br />

$'000 1,371 1,003<br />

$'000<br />

Total<br />

Total<br />

1,371<br />

1,371<br />

1,003<br />

1,003<br />

9. 6. Grants Gain on and Sale Contributions of Property, Plant and Equipment<br />

<strong>2008</strong> 2007<br />

Grants Plant and – recurrent equipment 1,371 1,003<br />

$'000<br />

2,171<br />

<strong>2008</strong><br />

<strong>2008</strong> $'000 2007<br />

2007 638<br />

Subsidy Total payments<br />

$'000<br />

$'000 1,371 (5) 1,003<br />

$'000<br />

$'000-<br />

Total<br />

7. Employee Expenses<br />

2,166 638<br />

7.<br />

7.<br />

Employee<br />

Employee <strong>2008</strong> 2007<br />

Expenses<br />

Expenses<br />

10. Employee Depreciation Benefits and Amortisation<br />

$'000<br />

$'000<br />

Buildings<br />

Employee<br />

Employee Wages and Benefits<br />

Benefits salaries 884,014 26,730 804,360 25,126<br />

Plant 7. Employee Expenses<br />

Wages<br />

Wages Employer and<br />

and<br />

and superannuation Equipment<br />

salaries<br />

salaries contributions 884,014<br />

884,014 119,868 30,247<br />

804,360<br />

804,360 109,653 25,857<br />

Major<br />

Employer<br />

Employer Long service Plant<br />

superannuation<br />

superannuation and leave Equipment levy contributions<br />

contributions<br />

119,868<br />

119,868 15,581 110<br />

109,653<br />

109,653 14,232-<br />

Software Employee Benefits<br />

Long<br />

Long Voluntary service<br />

service Purchased Redundancy leave<br />

leave<br />

levy<br />

levyPayments 15,581<br />

15,581 - -<br />

14,232<br />

14,232 123 139<br />

Software Other<br />

Wages and salaries 884,014 804,360<br />

Voluntary<br />

Voluntary Employee Internally<br />

Redundancy<br />

Redundancy Benefits Generated<br />

Payments<br />

Payments 5,494 3,743 - 3,810 1,954 139<br />

139<br />

Employer superannuation contributions 119,868 109,653<br />

Other<br />

Other<br />

Employee<br />

Employee<br />

Benefits<br />

Benefits 62,580<br />

3,743<br />

3,743 54,916<br />

1,954<br />

1,954<br />

Employee<br />

Long service<br />

Related<br />

leave<br />

Expenses<br />

levy 15,581 14,232<br />

11. Voluntary Redundancy Payments - 139<br />

Employee<br />

Employee Payroll Impairment Tax* Related<br />

Related Losses Expenses<br />

Expenses<br />

48,261 44,204<br />

Bad Other Employee Benefits 3,743 1,954<br />

Payroll<br />

Payroll Workers Debts Tax*<br />

Tax* compensation premium * 14,527 48,261<br />

48,261 19 44,204<br />

44,204 18,174 26<br />

Impairment Workers<br />

Workers<br />

compensation<br />

compensation losses on trade premium<br />

premium receivables *<br />

14,527<br />

14,527 54 18,174<br />

18,174-<br />

Total<br />

Employee Related Expenses<br />

1,085,994 73 992,716 26<br />

Payroll Tax* 48,261 44,204<br />

Total<br />

Total<br />

1,085,994<br />

1,085,994<br />

992,716<br />

992,716<br />

12. Workers * Costs Revaluation of compensation workers' Decrement compensation premium * insurance and payroll tax are a consequence of 14,527 employing employees, 18,174 but<br />

Major are *<br />

Costs<br />

Costs not Plant counted of<br />

of<br />

workers'<br />

workers' and Equipment in employees' compensation<br />

compensation total insurance<br />

insurance remuneration and<br />

and<br />

payroll<br />

payroll package. tax<br />

tax They are<br />

are a are consequence<br />

consequence not employee of<br />

of 1,644 employing<br />

employing benefits, but employees,<br />

employees, rather 2,679 but<br />

but<br />

* Total are<br />

are employee Costs not<br />

not<br />

counted<br />

counted of related workers' in<br />

in expenses. employees'<br />

employees' compensation Employer total<br />

total insurance remuneration<br />

remuneration superannuation and payroll package.<br />

package. contributions tax They<br />

They are are<br />

are a consequence and not<br />

not the employee<br />

employee long 1,085,994 of service 1,644 benefits,<br />

benefits, employing leave but<br />

but levy employees, rather<br />

rather are 992,716 2,679 but are not<br />

counted<br />

employee<br />

employee regarded in as related<br />

related employees' expenses.<br />

expenses. benefits. total<br />

Employer<br />

Employer remuneration<br />

superannuation<br />

superannuation package. They<br />

contributions<br />

contributions are not employee<br />

and<br />

and<br />

the<br />

the<br />

long<br />

long benefits,<br />

service<br />

service but<br />

leave<br />

leave rather<br />

levy<br />

levy employee<br />

are<br />

are related<br />

expenses. * Costs of workers' compensation insurance and payroll tax are a consequence of employing employees, but<br />

The regarded<br />

regarded decrement as<br />

as Employer<br />

employee<br />

employee for aircraft,<br />

superannuation<br />

benefits.<br />

benefits. not being a<br />

contributions<br />

reversal of a<br />

and<br />

previous<br />

the long<br />

revaluation<br />

service leave<br />

increment<br />

levy<br />

in<br />

are<br />

respect<br />

regarded<br />

of the<br />

as employee<br />

same<br />

benefits.<br />

are not counted in employees' total remuneration package. They are not employee benefits, but rather<br />

class Number of assets, of Employees has been recognised as an expense in the Income Statement.<br />

employee related expenses. Employer superannuation contributions and the long service leave levy are<br />

Number<br />

Number The number of<br />

of<br />

Employees<br />

Employees of employees includes both full-time employees and part-time employees measured on a fulltime<br />

Other number<br />

13.<br />

regarded as employee benefits.<br />

The<br />

The number equivalent Expenses of<br />

of<br />

employees<br />

employees basis. includes<br />

includes<br />

both<br />

both<br />

full-time<br />

full-time<br />

employees<br />

employees<br />

and<br />

and<br />

part-time<br />

part-time<br />

employees<br />

employees<br />

measured<br />

measured<br />

on<br />

on a<br />

fulltime<br />

fulltime<br />

on equivalent<br />

Loss equivalent disposal basis.<br />

basis. of non current assets 4,532 2,177<br />

Number of Employees<br />

External Number audit of Employees: fees* 13,570 186 13,177 187<br />

Insurance<br />

The number of employees includes both full-time employees and part-time employees measured on a fulltime<br />

equivalent Remuneration<br />

Other basis.<br />

100 3,510<br />

Number<br />

Number<br />

of<br />

of premiums Employees:<br />

Employees: QGIF 13,570<br />

13,570 2,936 13,177<br />

13,177 1,844<br />

Insurance Executive<br />

Ex-gratia Executive<br />

Executive The number payments Remuneration<br />

Remuneration of senior executives who received or were due to<br />

322 87<br />

Property The<br />

Number The receive number<br />

number total of<br />

Plant<br />

Employees:<br />

of<br />

of remuneration and senior<br />

senior Equipment executives<br />

executives of $100,000 Write who<br />

who off received<br />

received or more: or<br />

or<br />

were<br />

were<br />

due<br />

due<br />

to<br />

to<br />

13,570- 13,177 1,199<br />

Inventory receive<br />

receive<br />

total<br />

total Write remuneration<br />

remuneration off of<br />

of<br />

$100,000<br />

$100,000<br />

or<br />

or<br />

more:<br />

more:<br />

26 26<br />

Losses<br />

Executive $100,000 of to Public<br />

Remuneration $119,999 Monies 17 1 123-<br />

The number of senior executives who received or were due to<br />

Gifts $100,000<br />

$100,000 $120,000 to $119,999<br />

$119,999 $139,999 3 1 52<br />

-<br />

Legal<br />

receive total remuneration of $100,000 or more:<br />

$120,000<br />

$120,000 $140,000 Fees to and $139,999<br />

$139,999 $159,999 compensation claimable from QGIF 3- 618<br />

23<br />

Spouse $140,000<br />

$140,000 $160,000 Payments to $159,999<br />

$159,999 $179,999 37 - 182<br />

39<br />

Other<br />

$100,000 $119,999<br />

$160,000<br />

$160,000 $180,000 to $179,999<br />

$179,999 $199,999 (100)<br />

1 -<br />

7 1,409 10<br />

9<br />

Total<br />

$120,000 $139,999<br />

$180,000<br />

$180,000 $200,000 to $199,999<br />

$199,999 $219,999 8,020<br />

3 2<br />

71 11,367 10<br />

10-<br />

$140,000 $159,999<br />

$200,000<br />

$200,000 $220,000 to $219,999<br />

$219,999 $239,999 3 3<br />

1 -<br />

$160,000 $179,999<br />

$220,000 $239,999<br />

7 9<br />

*<br />

$220,000 $240,000 Total external to $239,999 $259,999 audit fees relating to the 2007-08 financial year are estimated to be $201,000 1- (2007: 2<br />

-<br />

$180,000 $199,999<br />

$240,000 $259,999<br />

7 10<br />

$155,000). $260,000 $240,000 to There $279,999 $259,999<br />

are no non-audit services included in this amount.<br />

1 - 2-<br />

$200,000 $219,999<br />

$260,000<br />

$260,000 $320,000 to $279,999<br />

$279,999 $339,999 1- 1<br />

-<br />

$220,000<br />

$360,000 $239,999<br />

$320,000<br />

$320,000 to $379,999 $339,999<br />

$339,999 1 - 1-<br />

$240,000 $259,999<br />

$360,000<br />

$360,000 Total to<br />

to<br />

$379,999<br />

$379,999 25<br />

- 2<br />

1 27<br />

-<br />

$260,000<br />

Total<br />

Total to $279,999 1 -<br />

25<br />

25<br />

27<br />

27<br />

$320,000 to $339,999<br />

The total remuneration of executives shown above** ($'000)<br />

- 1<br />

4,587 4,918<br />

$360,000 to $379,999 1 -<br />

The<br />

The<br />

total<br />

total<br />

remuneration<br />

remuneration<br />

of<br />

of<br />

executives<br />

executives<br />

shown<br />

shown<br />

above**<br />

above**<br />

($'000)<br />

($'000)<br />

4,587<br />

4,587<br />

4,918<br />

4,918<br />

** Total The amount calculated as executive remuneration in these financial statements includes 25 the direct 27<br />

** remuneration **<br />

The The<br />

amount amount received, calculated<br />

calculated as as well as executive<br />

executive as items remuneration<br />

remuneration not directly Page received in<br />

in<br />

in these<br />

these 19by financial<br />

financial senior statements executives, statements includes such includes as the the movement direct<br />

direct<br />

direct remuneration in<br />

received, remuneration<br />

remuneration leave The total accruals, remuneration as well received,<br />

received, fringe as items benefits as<br />

as of executives well<br />

well not tax directly as<br />

as paid items<br />

items shown on received not<br />

not motor directly<br />

directly above** by vehicles senior received<br />

received ($'000) and executives, by<br />

by employer senior<br />

senior such executives,<br />

executives, superannuation as the 4,587 such<br />

such movement as<br />

as contributions. the<br />

the in movement<br />

movement leave This accruals, 4,918 in<br />

in fringe<br />

benefits leave<br />

leave amount accruals,<br />

accruals, will tax therefore paid fringe<br />

fringe on motor benefits<br />

benefits differ vehicles from tax<br />

tax advertised paid<br />

paid and on<br />

on employer motor<br />

motor executive vehicles<br />

vehicles superannuation remuneration and<br />

and<br />

employer<br />

employer contributions. packages superannuation<br />

superannuation which This do amount not contributions.<br />

contributions. include will therefore This<br />

This latter differ from<br />

advertised<br />

** The amount calculated as executive remuneration in these financial statements includes the direct<br />

amount<br />

amount items. will<br />

will executive therefore<br />

therefore remuneration differ<br />

differ<br />

from<br />

from<br />

advertised<br />

advertised packages executive<br />

executive which do remuneration<br />

remuneration not include the packages<br />

packages latter which<br />

which items. do<br />

do<br />

not<br />

not<br />

include<br />

include<br />

the<br />

the<br />

latter<br />

latter<br />

remuneration received, as well as items not directly received by senior executives, such as the movement in<br />

items.<br />

items.<br />

leave<br />

The total<br />

accruals,<br />

separation<br />

fringe<br />

and<br />

benefits<br />

redundancy/termination<br />

tax paid on motor vehicles<br />

benefit payments<br />

and employer superannuation contributions. This<br />

amount will therefore differ from advertised executive remuneration packages which do not include the latter<br />

The<br />

The during total<br />

total the separation<br />

separation year to executives and<br />

and<br />

redundancy/termination<br />

redundancy/termination shown above ($'000) benefit<br />

benefit<br />

payments<br />

payments<br />

- 135<br />

items.<br />

during<br />

during<br />

the<br />

the<br />

year<br />

year<br />

to<br />

to<br />

executives<br />

executives<br />

shown<br />

shown<br />

above<br />

above<br />

($'000)<br />

($'000)<br />

- 135<br />

135<br />

The total separation and redundancy/termination benefit payments<br />

during the year to executives shown above ($'000)<br />

- 135<br />

Page 18<br />

Page 18<br />

Page 18<br />

Financial statements 2007-08<br />

With honour we serve 109