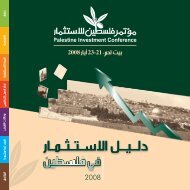

Business Plans - Palestine Investment Conference.

Business Plans - Palestine Investment Conference.

Business Plans - Palestine Investment Conference.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Inspiring<br />

<strong>Business</strong><br />

May 2010

The <strong>Palestine</strong> <strong>Investment</strong> <strong>Conference</strong> - Bethlehem 2010 will reflect a different<br />

face of <strong>Palestine</strong>. A <strong>Palestine</strong> that is, according to H.E. President Mahmoud<br />

Abbas, “A place where you can witness the veracity of the Palestinian people,<br />

their steadfastness, and persistence to stay and build a better future”, where all<br />

are invited “to witness firsthand the outstanding achievements of the Palestinian<br />

private sector at the industrial and investment levels and the Government’s<br />

progress in economic and administrative reforms”.<br />

This year’s conference provides a vivid testimony of the Palestinian government’s<br />

commitment to its vision and plan of nation building under the leadership of H.E.<br />

Prime Minister Dr. Salam Fayyad. All efforts will be geared towards building the<br />

institutional, social and economic infrastructure that will underpin a viable Palestinian<br />

State and enhance the ability of <strong>Palestine</strong>’s citizens to prosper in parity with other<br />

nation states. The Palestinian government, in partnership with the private sector,<br />

has thoroughly supported initiatives to promote trade and investment.<br />

Since <strong>Palestine</strong> <strong>Investment</strong> <strong>Conference</strong> - 2008, the momentum has been<br />

sustained through a series of high profile investment forums locally and<br />

internationally, such as the <strong>Palestine</strong> <strong>Business</strong> and <strong>Investment</strong> Forum, that<br />

took place in Washington DC, October 2008, The North Forum held in Nablus,<br />

November 2008, and finally, the London <strong>Business</strong> Forum on Trade and<br />

<strong>Investment</strong>, organized in December 2008.<br />

This book presents 123 projects that are business viable, in addition to operating<br />

businesses that are looking for expansion. These prospectuses tell the story<br />

of how Palestinian entrepreneurs have attracted investors, launched new<br />

ventures, and turned good ideas into real businesses despite all impediments,<br />

and will continue to do so, with the new prospectuses presented herein. The<br />

highlights include projects prospectuses from financial, infrastructure and real<br />

estate development, agribusiness, tourism, manufacturing, food and beverage,<br />

energy, and ICT sectors.<br />

Development of a sustainable, growing economy in <strong>Palestine</strong> is an objective<br />

shared by many. International donor institutions and other organizations promote<br />

trade and investment with <strong>Palestine</strong> and they fund projects that can be of real<br />

support to investors and trade partners. This book includes profiles of a few of<br />

these initiatives along with those of the <strong>Conference</strong> Partners and Sponsors and<br />

their new prospectuses.<br />

We hope that this book and the examples of successful businesses will inspire<br />

you; You too, can do business in <strong>Palestine</strong>.

Contents<br />

Manufacturing<br />

Aluminum Coating Plant..............................................................................................10<br />

Precious Metals Shaping Facility ................................................................................14<br />

Fleafel Textile Manufacturing ......................................................................................17<br />

Fabric Testing Laboratory (Startup)..............................................................................20<br />

Obaid Workshop Development....................................................................................24<br />

Manufacturing of Engine Parts ....................................................................................27<br />

Internal Epoxy Lining Mortar........................................................................................31<br />

Manufacturing of Iron Pipes ........................................................................................35<br />

Office Paper Envelopes Manufacturing.......................................................................39<br />

Al-Hamoda Packaging Line.........................................................................................42<br />

New Twine Rope Production Line................................................................................45<br />

Expansion of Saba Co. for Industrial <strong>Investment</strong> ........................................................49<br />

Al-Kassas Factory for Metal Profiles............................................................................53<br />

ZmZm Plastic Industries Co.........................................................................................57<br />

Stretch Factory.............................................................................................................61<br />

Shalhoub Chemical Industry - Plus Paint.....................................................................65<br />

Soap Factory Expansion..............................................................................................69<br />

Tissue Paper Manufacturing........................................................................................72<br />

Concrete Pipes and Manhole Factory..........................................................................75<br />

Iron Pipes Manufacturing.............................................................................................79<br />

Expansion of Paper Bags Production Line..................................................................83<br />

Galvanized Iron Production .........................................................................................86<br />

<strong>Palestine</strong> Aluminum Manufacturing..............................................................................89<br />

Furniture Factory..........................................................................................................92<br />

Mechanical, Electrical and Plumbing Services............................................................95<br />

Decorative Tiles and Bricks Manufacturing..................................................................99<br />

Commercial Refrigeration Equipment........................................................................103<br />

Raed Cosmetics Expansion.......................................................................................106<br />

Reinforcing Bars Manufacturing.................................................................................109<br />

Recycling Cooking Oil................................................................................................ 113

Natural Textile Manufacturing..................................................................................... 116<br />

Plastic Recycling Plant............................................................................................... 119<br />

Plastic Bags Recycling ..............................................................................................122<br />

Energy Saving Lamps................................................................................................125<br />

Hakoura Gold Chains Production..............................................................................128<br />

ICT<br />

Broadband and Modern IP Communication Service Company in <strong>Palestine</strong>..............132<br />

PALETS - <strong>Palestine</strong> Education Technologies Services..............................................137<br />

CoolNet – Internet Solutions Provider........................................................................140<br />

Mishwar......................................................................................................................143<br />

Virtual Visit.................................................................................................................146<br />

TechnoKit...................................................................................................................149<br />

“My Money” Free Accounting and Bookkeeping Portal..............................................152<br />

Courts.Net – A Case and Court Management System and e-Justice Portal..............155<br />

Online Virtual Mall......................................................................................................159<br />

Technology Educational Kits......................................................................................163<br />

Security and Surveillance Systems............................................................................167<br />

“Shobiddak”................................................................................................................171<br />

Mobile Search Service...............................................................................................175<br />

Agribusiness<br />

Al-Ard Palestinian Agri-Products Ltd. ........................................................................180<br />

Near East Industries and Trade Ltd. .........................................................................184<br />

New Production Line for Al-Naser Roasted Nuts.......................................................188<br />

Fruit and Vegetable Farm..........................................................................................192<br />

Expansion of Jabal Al Zaytoon Products & Markets..................................................195<br />

Abu Hasera Fishing Farm..........................................................................................198<br />

Hi-Tech Cultivating Farms..........................................................................................201<br />

Al Khozondar Salt Water Fishing Farm......................................................................205<br />

Sinokrot Agricultural Sector........................................................................................208<br />

Dairy Cattle Breeding ................................................................................................212<br />

Producing and Bottling Beverages ............................................................................215<br />

Cattle Farm................................................................................................................218<br />

Marine Fish Farm.......................................................................................................221<br />

Bottling Mineral Water................................................................................................224<br />

New Production Line and Packaging Machines.........................................................227

Tourism<br />

Bethlehem City Tour...................................................................................................232<br />

Olympic Swimming Pools..........................................................................................235<br />

Al Bashir Joy Land 2..................................................................................................238<br />

Developing and Expanding Al Yasmeen Hotel and Historical Compound ................241<br />

Hisham’s Palace Commercial and Tourism Compound.............................................244<br />

Expansion of Jerusalem Hotel in Jericho...................................................................247<br />

CGC Motel In The Ramallah Area.............................................................................250<br />

Furnished Buildings...................................................................................................253<br />

Days Inn Hotel...........................................................................................................256<br />

Bethlehem Tourism Center.........................................................................................259<br />

Murad Tourist Resort & Hotel.....................................................................................262<br />

Hayat Nablus.............................................................................................................265<br />

Sultan Cable Car and Tourist Center.........................................................................269<br />

Ya Hala Project..........................................................................................................272<br />

Nablus Amusement Park (NAP).................................................................................275<br />

Qalqilya Health & Entertainment Center....................................................................279<br />

Recreational Resort...................................................................................................282<br />

JAR Recreational Parks ............................................................................................285<br />

Construction, Real Estate and Infrastructure<br />

Al Rawdah Subdivision..............................................................................................290<br />

Abu Dies UniversityDorms.........................................................................................293<br />

“The One” Executive Club..........................................................................................297<br />

Manufacturing of Construction Materials ..................................................................301<br />

Ready Mix Concrete Factory ...................................................................................305<br />

Al-Ghadeer Housing Neighborhood ..........................................................................309<br />

Rabeiyat Al Quds Neighborhood ...............................................................................313<br />

Al-Masayef Residential Project .................................................................................317<br />

Gaza Residential Towers ..........................................................................................321<br />

Al- Naqourah Housing Neighborhood .......................................................................325<br />

Switch Boards and Electrical Panels.........................................................................329<br />

Artificial Stone Manufacturing....................................................................................333<br />

Commercial Building In An Industrial Area.................................................................336<br />

Royal Villas, Royal Home, and Royal <strong>Business</strong> Center ............................................340<br />

Al Mashtal Chalets ....................................................................................................344<br />

PRICO House 2.........................................................................................................348<br />

Sinokrot Trade and Service Compound.....................................................................352

Fine Gravel Manufacturing.........................................................................................355<br />

Autoclaved Aerated Concrete (AAC).........................................................................358<br />

Qalqilya Commercial Center......................................................................................362<br />

Solid Waste Recycling - Nablus.................................................................................365<br />

Tertiary Waste Water Treatment Project – Jenin........................................................369<br />

Education<br />

Knowledge Village......................................................................................................374<br />

Kuhail Vocational Training Center..............................................................................377<br />

IMI’s Vocational Training Centre................................................................................381<br />

Technical Vocational Center for Mechanical Engineering..........................................385<br />

Stone & Marble<br />

Cultured Marble Manufacturing..................................................................................390<br />

Al-Zaeem Company for Marble and Stone................................................................394<br />

Expansion of Al-Dar Company for Marble and Stone................................................398<br />

Colored Artificial Stone...............................................................................................402<br />

Establishing a New Factory for Stone and Marble.....................................................405<br />

Antique Marble Manufacturing...................................................................................409<br />

Stone and Marble Manufacturing...............................................................................413<br />

Colored Stone & Marble Manufacturing.....................................................................416<br />

Raw Stone Cutting ....................................................................................................419<br />

Quarry and Stone & Marble Manufacturing...............................................................422<br />

Other Sectors<br />

Vehicles for Rental and Sale......................................................................................428<br />

Stylish Stained Glass.................................................................................................431<br />

Intravenous Infusion & Dialysis Facility .....................................................................434<br />

Handmade Crochet Work...........................................................................................437<br />

Russian Eye Center...................................................................................................441<br />

Ibn Sena Specialty Hospital in Jenin .........................................................................445

Manufacturing<br />

Sector

Aluminum Coating Plant 1<br />

Project Number:<br />

Project Name:<br />

Sponsor Company:<br />

Contact Details:<br />

PIC-2010-IO-001<br />

Aluminum Coating Plant<br />

Al-Yaseen Aluminum Company<br />

Mr. Yousef Mohammad Yaseen Ibraheem<br />

Kufor Sour, Qalqilya, <strong>Palestine</strong><br />

Tel: +970-9-2948444<br />

Total Cost of the Project: US$ 870,000<br />

<strong>Investment</strong> by Current Owners: US$ 305,000<br />

Required <strong>Investment</strong>:<br />

US$ 565,000 equity investment<br />

Project Description:<br />

Al-Yaseen Aluminum Co. (hereinafter: Al-Yaseen Co.) is seeking a partnership<br />

with a strategic investor/partner that can help in the establishment of a new plant<br />

for coating aluminum profiles. Al-Yaseen Co. already owns a plant that produces<br />

aluminum profiles, and due to the different colors demanded by customers, the<br />

company has to ship all its production to Israel for coating, which is considered<br />

expensive compared to the possibility of coating it in-house.<br />

The capacity of the new plant will exceed the internal needs of the owner, thus,<br />

Al-Yaseen Co. will offer the coating service to other producers in the region,<br />

who are currently doing the coating in Israel. Al-Yaseen Co. already developed<br />

a feasibility study of the project, and decided to go on with the project for cost<br />

saving reasons.<br />

Currently, there are two aluminum coating plants in the West Bank. Their aggregate<br />

capacity does not exceed 2,400 tons per year, which forces profile producers to<br />

coat their works in Israel. Al-Yaseen Co. will add another 1,200 tons of coating<br />

capacity to the Palestinian Market.<br />

Project Development Time Table:<br />

Expected number of months from finance availability<br />

Infrastructure Development<br />

2 months<br />

Building and Construction<br />

3 months<br />

Building and Construction Completion 8 months<br />

Furniture & Equipment Procurement 12 months<br />

Operations Start Up<br />

13 months<br />

10 Inspiring <strong>Business</strong>

Current Owners’ Profile:<br />

Al-Yaseen Aluminum Company is one of the leading aluminum factories in the Palestinian<br />

market. It was established 20 years ago, reflecting a long experience in producing and<br />

installing aluminum profiles on both the residential and industrial levels.<br />

The company is located nearby Qalqilya in the northern part of the West Bank, adjacent to<br />

the Israeli borders, which allowed the company to benefit from the moderate transportation<br />

cost. This is not the case anymore with the need of waiting by the Israeli borders across the<br />

Separation Wall, and all what it implies of additional backing and un-backing costs, which<br />

raised the urgent need for the company to have its own coating plant.<br />

Al-Yaseen company is known for its high quality products in terms of profiles, coats, various<br />

colours, and its installation. Introducing its own coating plant, shall not by any means reduce<br />

the quality of the final product, on the contrary, a higher finishing quality is expected as<br />

equivalent raw materials and technology to that of the Israelis’ is going to be utilized, besides<br />

the reduction of backing faults and malfunctions.<br />

Industry Highlights:<br />

The sector is served by an industry association which represents 40 major firms working<br />

in the industry. A rough figure of firms working in this industry is estimated at 120. The<br />

problem is how to define the working firms and how to recognize the working workshops.<br />

The average number of workers in the sector is estimated at 1000 workers.<br />

Sector diversification<br />

The sector is comprised of several diversified fields. These are: metal doors, aluminum<br />

profiles, iron and steel rods and drawing, welding and abrasive materials, nails and steel rods,<br />

metal furniture, scales, stone machinery, packaging machinery, lathing, agricultural machinery,<br />

municipal containers, kitchen wear, electric circuit boards and other specialized workshops.<br />

Quality as an advantage<br />

The quality is related to the application and use of the machines and tools produced. It is<br />

obvious that the majority of the products are either used for the industry or as complementary<br />

parts to other businesses. Hence, quality is an important matter. The PSI standards and<br />

specifications are valid only to some of these products, ISO certificates and fire preventing<br />

certificates have been acquired by some firms.<br />

There is a lack in fully equipped laboratories and testing, this can be overcome through<br />

close cooperation with academic institutions. Also, research and development can help<br />

choosing the proper composition of materials. Moreover, the culture of quality standards<br />

and specifications has to be widely spread in the sector.<br />

Technical position and capacity<br />

The total production capacity is barely reaching 40% of the sample companies. Technically<br />

speaking there is a big variation in the level of technology used in the sector ranging from<br />

low to high levels. The industry needs to be equipped with testing facilities and knowledge<br />

to cope with the technology and quality needs. Academic networking with the industry is<br />

vital to the development of this industry.<br />

Manufacturing Sector<br />

11

Marketing position<br />

Traditionally, the sector has experienced the export practices decades ago and still does.<br />

Welding materials and abrasives were the main exports. The opportunity still exists for more<br />

exports in to countries. Metal doors, stone machinery and packaging machinery are some<br />

major examples. Locally, there is high competition with the Israeli and imported materials,<br />

mainly Chinese. PSI is not active in the regard of checking the quality of the imported<br />

materials. Local market needs carefully set regulations in order to maintain fair competition<br />

in the market.<br />

Financial position<br />

There are no precise figures indicating the total investment in the sector. But some references<br />

stated that the total amount of investments exceeds the figure of 100 million USD. According<br />

to the sample firms, 100% of them have the desire to invest in new machinery and 80% will<br />

invest in seeking new markets.<br />

Industry problems and needs:<br />

• This industrial sector’s needs are summarized in the following points:<br />

• Regulating the local market and achieving fair competition.<br />

• Design a package of promotional and technical assistance to open new markets<br />

for the industry and increase exports.<br />

• Equipping the industry with proper testing laboratory and linking it properly with the<br />

academic institutions.<br />

• Looking for alternatives of fuel consumption and decreasing power costs.<br />

• Industry’s wastes need to be properly recycled to maximize the outputs and to<br />

reduce impact to the environment.<br />

• Training and other administrative needs and modern management tools need to<br />

be devised.<br />

12 Inspiring <strong>Business</strong>

SWOT Analysis<br />

Internal Analysis<br />

Strengths<br />

Weaknesses<br />

• Long experience working with similar factories<br />

• Lack of large investments<br />

in Israel and <strong>Palestine</strong><br />

• Well developed and modern machines and<br />

equipment, as well as quality assurance<br />

procedures<br />

• Cost reduction for the company’s profile<br />

products, and products of surrounding<br />

aluminum plants<br />

• Availability of raw materials<br />

• Lower coating prices compared to the Israeli<br />

competitors<br />

External Analysis<br />

Opportunities<br />

Threats<br />

• High local demand for aluminum profiles for • Moderate competition from the other two<br />

new construction works<br />

local producers<br />

• Volatile raw materials prices<br />

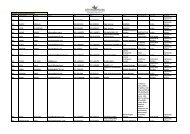

Financial Projections in US$ for the whole project<br />

(old and new investments)<br />

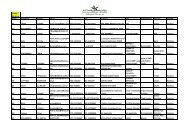

Indicators 2010 2011 2012 2013 2014 2015<br />

Income statement Accounts<br />

Revenues - 720,000 792,000 1,584,000 1,742,400 1,916,640<br />

Cost of Goods Sold - 219,000 229,950 460,898 507,042 557,804<br />

Operating Expenses - 254,100 256,725 263,277 276,441 290,263<br />

Taxes, interests and Depreciation - 105,035 113,799 196,974 211,838 228,286<br />

Net Income - 141,865 191,526 662,852 747,079 840,287<br />

Cash Flow Accounts<br />

Operating Cash Flow 0 208,865 237,476 927,149 1,044,292 1,174,370<br />

Financing Cash Flow 870,000 0 0 0 0 0<br />

Investing Cash Flow (870,000) 0 0 0 0 0<br />

Balance Sheet Accounts<br />

Total Assets 870,000 1,048,900 1,249,190 1,995,217 2,757,160 3,613,895<br />

Total Liabilities 0 37,035 45,799 128,974 143,838 160,286<br />

Total Equity 870,000 1,011,865 1,203,391 1,866,243 2,613,322 3,453,609<br />

Profitability Indicators<br />

Return on Assets - 13.53% 15.33% 33.22% 27.10% 23.25%<br />

Return on Equity - 14.02% 15.92% 35.52% 28.59% 24.33%<br />

Manufacturing Sector<br />

13

Precious Metals Shaping Facility 2<br />

Project Number:<br />

Project Name:<br />

Sponsor Company / Individual:<br />

Contact Details:<br />

Total Cost of the Project: US$ 150,000<br />

<strong>Investment</strong> by Current Owners: US$ 20,000<br />

Required <strong>Investment</strong>: US$ 130,000<br />

PIC-2010-IO-002<br />

Precious Metals Shaping Facility<br />

Mr. Bassam Khader Tarazi<br />

Mr. Bassam Khader Tarazi<br />

Gaza, <strong>Palestine</strong><br />

Tel: +970-8-2865007<br />

Mobile: +970-59-9487333<br />

Email: bassamt2010@hotmail.com<br />

Project Description:<br />

Mr. Tarazi is embarking on the establishment of a goldsmith facility to make a<br />

wide variety of necklaces, rings and bracelets. This production facility will use<br />

laser technology in addition to computerized systems to produce preciously highly<br />

finished pieces. The use of high-tech equipment will position the production facility<br />

at the forefront of local jewelry suppliers in the Gaza Strip and the West Bank<br />

when it becomes feasible.<br />

The proposed project will market its finished products to jewelry shops in addition<br />

to selling directly through its own jewelry shop. The key inputs for production will<br />

be gold and silver which will be purchased from suppliers in Gaza and Israel in<br />

addition to recycled older pieces available in the market. It is estimated that the<br />

facility would process 12 kg of gold per month in the first year of operations and<br />

eventually grow to reach 50 kg/month in the fifth year of operation.<br />

The project is trying to identify a strategic investor who is willing to invest<br />

US$130,000, the majority of which will be used for purchasing the necessary<br />

equipment. The initiative’s expected surplus of US$ 100,000 in each of the 3rd<br />

and 4th years of operation will be used to invest in a new building to house the<br />

production facility, with a total expected cost of US$ 240,000.<br />

Project Development Time Table:<br />

Legal Company Registration 3rd Quarter 2010<br />

Equipment Procurement and Facility Setup 4th Quarter 2010<br />

Operations Start Date 1st Quarter 2011<br />

14 Inspiring <strong>Business</strong>

Current Owners’ Profile:<br />

Mr. Bassam Tarazi is an expert in jewelry trading, having worked in the sector for 30<br />

years. Mr. Tarazi is a well known businessman who is a member of the Gaza chamber<br />

of commerce. Mr. Tarazi is a known businessman with extensive experience in the Gazan<br />

jewelry market.<br />

Industry Highlights:<br />

<strong>Palestine</strong>’s Jewellery sector has witnessed major growth since the establishment of the<br />

Palestinian National Authority. <strong>Investment</strong>s were undertaken in the establishment of many<br />

new workshops, particularly in Hebron to supply the local market with jewellery.<br />

The market is monitored by the Ministry of National Economy whose reports indicate an<br />

average of approximately 370 Kg of golden jewellery production per month.<br />

Gold and silver jewellery is deep rooted in Palestinian tradition, particularly for brides and<br />

accordingly the market is expected to continue its natural growth. Yet, the dramatic increase<br />

in gold price on the global market has had repercussions on the Palestinian market.<br />

Traditionally, brides are given certain amounts of gold as part of their marriage dowry, as<br />

gold prices have risen, grooms’ families have begun giving money as a dowry instead of<br />

gold.<br />

On the other hand however, gold is seeing a resurgence as a popular investment commodity.<br />

Due to recent price increase, investors have begun purchasing gold in the hopes that it will<br />

maintain its long-term value more consistently than currencies such as the US Dollar or the<br />

Jordanian Dinar.<br />

Manufacturing Sector<br />

15

SWOT Analysis<br />

Internal Analysis<br />

Strengths<br />

Weaknesses<br />

• First of its kind in Gaza<br />

• Requires expensive raw material<br />

• Utilization of hi-tech production machinery • Limited market<br />

• Short payback period<br />

• Extensive industry experience<br />

External Analysis<br />

Opportunities<br />

Threats<br />

• Future access to West Bank market and export • Current political and security conditions<br />

markets<br />

in Gaza<br />

• Developing products for the tourism sector • Inability to bring in raw materials<br />

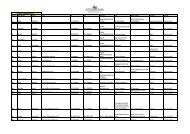

Financial Projections in US$<br />

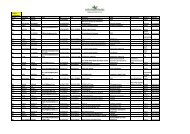

Indicators 2011-2010 2012 2013 2014 2015<br />

Income statement Accounts<br />

Revenues 432,000 600,000 720,000 756,000 793,800<br />

Expenses 168,800 236,500 285,000 299,650 315,033<br />

Gross Profit 255,200 355,500 427,000 448,350 470,768<br />

Depreciation 8,000 8,000 8,000 8,000 8,000<br />

Net Income 232,800 332,600 405,100 429,430 451,301<br />

Cash Flow Accounts<br />

Operating Cash Flow 200,800 381,133 400,767 340,897 376,192<br />

Investing Cash Flow (100,000) (120,000) (120,000) 0 0<br />

Financing Cash Flow 150,000 0 0 (100,000) (100,000)<br />

Balance Sheet Accounts<br />

Total Assets 328,500 541,300 777,233 1,084,000 1,415,096<br />

Total Liabilities 20,000 0 3,333 5,000 6,667<br />

Total Equity 308,500 541,300 773,900 1,079,000 1,408,430<br />

Profitability Indicators<br />

Return on Assets 48.25% 43.01% 42.79% 37.37% 30.35%<br />

Return on Equity 51.38% 43.01% 42.98% 37.54% 30.49%<br />

16 Inspiring <strong>Business</strong>

Fleafel Textile Manufacturing 3<br />

Project Number:<br />

Project Name:<br />

Sponsor Company:<br />

Contact Details:<br />

Total Cost of the Project: US$ 1,033,066<br />

<strong>Investment</strong> by Current Owners: US$ 516,533<br />

Required <strong>Investment</strong>: US$ 516,533<br />

PIC-2010-IO-003<br />

Fleafel Textile Manufacturing<br />

Fleafel Company for Trading and Home Textile<br />

Industry<br />

Eng. Amina Abu Safa<br />

Tel: +970-9-2675927<br />

Email:starabusafa@yahoo.com<br />

Website: www.fleafel.ps<br />

Project Description:<br />

The proposed project is a textile factory in Tulkarem to produce a wide range of<br />

home textiles from sheet sets, comforters, quilt covers and pillow cases to bed<br />

skirts, sofas skirts and curtains.<br />

Currently, the Fleafel Co. owns a specialized factory that produces textiles<br />

marketed in the local, Israeli and international markets.<br />

The company is seeking an investment partner to establish a new factory with the<br />

necessary equipment to enable it to produce high quality textile products, with a<br />

high production capacity in order to cover the identified market demands. Fleafel<br />

Co.’s main objective is to phase out the Israeli intermediaries and sell directly to<br />

Israeli and international markets. It is expected that the company will export 40%<br />

of its production to international markets and 45% to Israel.<br />

Project Development Time Table:<br />

Land<br />

Building Construction<br />

Equipment Order<br />

Equipment Procurement<br />

Completed<br />

2 months after funding<br />

Completed<br />

3 months after payment<br />

Current Owners’ Profile:<br />

Fleafel Company began operations in 1991 when Mr. Zeid Othman and Mr. Hasan Owkal<br />

opened a shop which sold textile industry accessories in Tulkarem. Later that year they<br />

Manufacturing Sector<br />

17

expanded their business by opening a small textile workshop. In 1995, Mr. Zaid Othman<br />

and Mr. Hasan Owkal established a new big factory under the name of Fleafel Company for<br />

Trading & Textile Industry with a total capital of 150,000 Jordanian Dinars.<br />

Fleafel Company is located on 3000 square meters of land in the village of Jarosheih near<br />

Tulkarem. The site is ideal because manpower, raw materials, and much of the client base<br />

are all located within relative proximity to the production site.<br />

Industry Highlights:<br />

The Palestinian industrial sector is categorized by its wide array of products and interrelated<br />

sub-sectors. The sector is severely hampered by the lack of consistent raw material availability<br />

due to stringent Israeli restrictions on imports. However, one major mitigating factor has been<br />

dedicated, hard working, and resilient nature of the local business community. The highly<br />

adaptable Palestinian private sector as a whole has been the driving force for the industry,<br />

allowing it to achieve some level of success despite the harsh economic environment<br />

created by the Israeli occupation.<br />

One of the main features of industrial sector has been its close connection to the Israeli<br />

economy. On one hand this is an unhealthy dynamic as it creates a certain reliance on<br />

Israeli economic ties, which are not forged on a level playing field. On the other hand, the<br />

industrial sector has undeniably reaped some benefits from Israeli business connections<br />

both locally and internationally.<br />

The sector is represented by the Palestinian Federation of Industries (PFI). The PFI<br />

advocates for better industrial policies and regulations while working on improving Palestinian<br />

industrial performance. The federation began its work in 1999 by representing six industrial<br />

associations. Today, the federation counts thirteen different industrial associations as<br />

members.<br />

Industry plays an important role in the economic and social well-being of Palestinian society.<br />

It employs about 13% of the total workforce and contributes 16% to the GDP. The rapid<br />

growth of industry was notable during the nineties; however political turmoil has since had<br />

an adverse impact on the industrial sector. The leather and shoe making industry as well as<br />

the garment and textile industry are examples of badly affected industries.<br />

18 Inspiring <strong>Business</strong>

SWOT Analysis<br />

Internal Analysis<br />

Strengths<br />

Weaknesses<br />

• Ideal location, especially for export to Israeli • Owner’s lack of financing to build new<br />

market<br />

factory<br />

• Extensive experience of management team<br />

• Company’s proven success in textile industry<br />

• Highly skilled labor force<br />

External Analysis<br />

Opportunities<br />

Threats<br />

• No competing manufacturing plant in the area • Ongoing political instability<br />

• Donor and government support for investments<br />

in Tulkarem<br />

• High demand for textile products in regional<br />

and international markets<br />

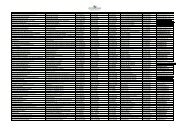

Financial Projections in US$<br />

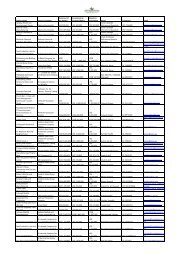

Indicators 2010 2011 2012 2013 2014<br />

Income statement Accounts<br />

Revenues 945,547 5,403,125 5,943,438 6,537,781 7,191,559<br />

Gross Profit 448,828 2,564,733 2,821,206 3,103,327 3,413,660<br />

Net Income 317,391 1,813,661 1,995,027 2,194,530 2,413,983<br />

Cash Flow Accounts<br />

Operating Cash Flow 349,130 1,995,027 2,194,530 2,413,983 2,655,381<br />

Investing Cash Flow (448,700) - - - -<br />

Financing Cash Flow 961,766 (453,415) (498,757) (548,632) (603,496)<br />

Balance Sheet Accounts<br />

Total Assets 1,279,157 2,639,403 4,135,673 5,781,570 7,592,058<br />

Total Liabilities - - - - -<br />

Total Equity 1,279,157 2,639,403 4,135,673 5,781,570 7,592,058<br />

Profitability Indicators<br />

Return on Assets 25% 69% 48% 38% 32%<br />

Return on Equity 25% 69% 48% 38% 32%<br />

Manufacturing Sector<br />

19

Fabric Testing Laboratory (Startup) 4<br />

Project Number:<br />

Project Name:<br />

Sponsor Company / Individual:<br />

Contact Details:<br />

Total Cost of the Project: US$ 230,000<br />

<strong>Investment</strong> by Current Owners: US$ 115,000<br />

Required <strong>Investment</strong>: US$ 115,000<br />

PIC-2010-IO-004<br />

Fabric Testing Laboratory<br />

Mr. Fouad Odeh<br />

Mr. Fouad Odeh<br />

Tel: +970-8-2866492<br />

Mobile: +970-59-9409721<br />

Email: fuadoda@hotmail.com<br />

Project Description:<br />

The opportunity is for an investor to take a 50% equity stake of a fabric and textile<br />

testing laboratory which will be established in Gaza.<br />

Due to the lack of such a testing facility, testing is done only in extreme necessities<br />

by sending samples to laboratories either in Jordan or Egypt. It is expected that<br />

the demand for the services of fabric and textile testing will increase with the<br />

presence of such facility in proximity to the customers and the time and costs<br />

associated with having different products tested.<br />

Main customers for the services will be:<br />

• Public sector institutions that purchase uniforms, such as the Ministry of<br />

Interior and the Ministry of Health.<br />

• Public agencies regulating the market, including the Ministry of National<br />

Economy, Customs Authority and the Standards Institute.<br />

• Private sector companies engaged in the textile and clothes sector.<br />

The investment will be in equipping the laboratory, which will utilize 500 square<br />

meters of rented space in addition to recruitment and training industrial and<br />

chemical engineers. The chemicals used in the testing process will be imported<br />

from Egypt and Israel.<br />

The laboratory is expected to operate at 25% of its capacity in the first year with<br />

USD 24,000 of revenues, and to gradually reach 100% of the capacity in the 3rd<br />

year of operations generating USD 96,000 of revenues.<br />

20 Inspiring <strong>Business</strong>

Project Development Time Table:<br />

Construction of facility and Equipment Purchase 3rd Quarter 2010<br />

Recruiting and training Engineers 3rd Quarter 2010<br />

Operations Start Date 1st Quarter 2011<br />

Current Owners’ Profile:<br />

Mr. Fouad Odeh has a Bachelor of Science in electrical engineering with a Masters Degree<br />

in business administration. Mr. Odeh is an expert in the textile industry, currently a co-owner<br />

of Owda textile Company; as well as Mr. Odeh is an active business man and a member of<br />

the board of the Federation of Textile Industries.<br />

Mr. Odeh has previously served as the Chairman of the Federation of Textile Industries,<br />

board member of the General Union of Textile Industries and Treasurer of the <strong>Palestine</strong><br />

Trade Centre.<br />

Industry Highlights:<br />

Prior to the second intifada, there were more than 1700 firms operating in this sector in the<br />

West Bank alone. The figure now is hard to guess, according to the industry association`s<br />

estimates the number of working firms varies between 700 and 1000. Employment has<br />

dropped severely from 11000 permanent jobs to almost 5000 unsecured jobs. Women are<br />

the major work force in this sector. The sector is spread all over the West Bank and Gaza<br />

and represented by an industrial association.<br />

Sector diversification:<br />

The sector is composed mainly of textile, garment and clothing production, dying, wool<br />

wear, and other accessories. The main feature of this sector is of subcontracting nature.<br />

Quality as an advantage:<br />

The sector has witnessed some advancement in the past towards achieving high quality<br />

products. Some are up to the international standards. The accumulated experience of the<br />

sector, the abundant labor force, the ability to respond properly to the requests and needs<br />

of other producers and partners, and its keen understanding of manufacturing value chains<br />

in the industry contribute to the inherent advantages and opportunities of this sector.<br />

Technical position and capacity:<br />

The sector is now working at a capacity which is less than 35% of its normal production<br />

capacity. Many firms have been depended on the flextime, job sharing and reduced work<br />

days and work hours arrangements to maintain their labor force. The machinery is getting<br />

old and some are out of date. Intensive maintenance programs and machinery upgrading<br />

schemes are highly needed in this sector.<br />

Marketing position:<br />

It is obvious that an increased percentage of the sector operates on a subcontracting<br />

Manufacturing Sector<br />

21

asis and hence has no great problem in marketing products. The problem is hidden in<br />

getting more subcontracts and shifting to more autonomous state of manufacturing. Other<br />

producers are selling 70% of their sales in West Bank markets; the remaining is being sold<br />

outside the country, mainly to Israel. Some factories have exported to Jordan, others were<br />

successfully exporting to European markets and USA markets. Some entrepreneurs have<br />

capitalized on their personal relations and relatives in the export process. The export market<br />

was estimated at 15 million USD in 2000 and less than 10 million USD in 2001.<br />

Financial position:<br />

The sector produced a total of 126 million USD in the year 2000, which represented 15%<br />

of the gross industrial product. The sector considers the access of new markets as a first<br />

priority for financing, next to it is the upgrading and development of machinery. The need<br />

for investing in new machinery is not considered a priority for the sector at this stage. Prior<br />

to the second intifada, there were more than 1700 firms operating in this sector in the<br />

West Bank alone. The figure now is hard to guess, according to the industry association`s<br />

estimates the number of working firms varies between 700 and 1000. Employment has<br />

dropped severely from 11000 permanent jobs to almost 5000 unsecured jobs. Women<br />

are the major work force in this sector. The sector is spread all over the West Bank and<br />

represented by an industrial association.<br />

22 Inspiring <strong>Business</strong>

SWOT Analysis<br />

Internal Analysis<br />

Strengths<br />

Weaknesses<br />

• First of its kind in Gaza<br />

• Limited market<br />

• Short payback period of the project<br />

• Owner experience both as a business man and<br />

as a technical engineer<br />

External Analysis<br />

Opportunities<br />

Threats<br />

• Current political and security conditions<br />

• Future ability to serve the West Bank market<br />

in Gaza<br />

• Inability to bring in raw materials<br />

• Continued blockade on raw materials<br />

used in the garment and textile sectors<br />

Financial Projections in US$<br />

Indicators 2010 2011 2012 2013 2014<br />

Income statement Accounts<br />

Revenues 12,000 48,000 96,000 100,800 105,840<br />

Expenses 27,158 57,820 62,821 64,828 66,948<br />

Gross Profit 1,152 23,800 66,800 70,157 73,665<br />

Depreciation 4,050 8,100 8,100 8,100 8,100<br />

Net Income (19,208) (17,920) 25,079 27,872 30,792<br />

Cash Flow Accounts<br />

Operating Cash Flow (18,660) (10,285) 32,477 35,901 38,817<br />

Investing Cash Flow (162,000) 0 0 0 0<br />

Financing Cash Flow 230,000 0 (45,000) (45,000) (45,000)<br />

Balance Sheet Accounts<br />

Total Assets 210,942 192,956 173,117 155,998 141,799<br />

Total Liabilities 150 85 166 175 183<br />

Total Equity 210,792 192,872 172,951 155,823 141,615<br />

Profitability Indicators<br />

Return on Assets (9.11%) (9.29%) 14.49% 17.87% 21.72%<br />

Return on Equity (9.11%) (9.29%) 14.50% 17.89% 21.74%<br />

Manufacturing Sector<br />

23

Obaid Workshop Development 5<br />

Project Number:<br />

Project Name:<br />

Sponsor Company:<br />

Contact Details:<br />

Total Cost of the Project: US$ 440,860<br />

<strong>Investment</strong> by Current Owners: US$ 19,086<br />

Required <strong>Investment</strong>: US$ 421,774<br />

PIC-2010-IO-005<br />

Obaid Workshop Development<br />

Obaid Workshop<br />

Mr. Samer Obaid<br />

Salfit, West Bank, <strong>Palestine</strong><br />

Tel: +970-9-2519119<br />

Mobile: +970-59-8919112<br />

Email: s_obaid@yahoo.com<br />

Project Description:<br />

Obaid Workshop is seeking a partnership with a strategic/financing partner that<br />

can help in improving the quality of its workshop products and to expand the size<br />

and volume of its work. The workshop products and services portfolio includes<br />

Aluminum products, iron products, maintenance and painting, as well as wholesale<br />

of iron products. The workshop mainly targets the Salfit market, nonetheless it<br />

supplies a diversified base of customers in Nablus, Ramallah, Jericho in addition<br />

to other cities.<br />

Project Development Time Table:<br />

Equipment Order<br />

Receiving the Equipment<br />

First month of funding<br />

3 months after ordering<br />

Current Owners’ Profile:<br />

Obaid Workshop was established in 2008 by Samer and Osama Obaid, and is considered<br />

one of the largest workshops in Salfit. Due to the respected quality and punctual delivery of<br />

its services to its customer, Obaid’s workshop was able to expand its coverage to the north<br />

and the middle of the West Bank.<br />

Industry Highlights:<br />

The Palestinian industrial sector is categorized by its wide variety of products and interrelated<br />

sub sector branches. The sector lacks severely the adequate continuously available raw<br />

materials for the sustainability of the sector. But it has a great advantage of the dedicated hard<br />

24 Inspiring <strong>Business</strong>

working and resilient business community. The business community, as a driving force for<br />

the industry, was able to achieve several successes during difficult uncertain conditions.<br />

One of the main features of industry was its connectivity to the Israeli economy. On one<br />

side this is a fatal threat to industry because its success is subject to the Israeli priorities,<br />

not the Palestinian priorities, and it is a known fact that most of these priorities are not<br />

business related and highly politicized. On the other hand, industry has benefited from<br />

Israeli business connections elsewhere in the world.<br />

The sector is represented by the Palestinian Federation of Industries (PFI). The PFI advocates<br />

for better industrial policies and regulations and works on developing and upgrading<br />

industrial performance. The federation started its work in 1999 with a representation of six<br />

industrial associations. Today, thirteen different industrial associations are members of the<br />

federation.<br />

Industry is playing an important role in the economic and social well being of the Palestinian<br />

society. It employs about 13% of the total workforce and it contributes 16% to the GDP.<br />

Exports were (and still are) a good economic ambassador for the entire Palestinian cause.<br />

The rapid growth of industry was notable during the nineties, the political uncertainty and<br />

turbulences have affected the industrial sector negatively.<br />

A slight shift was noticed in the structuring of industry that is related to both political changes<br />

and international economic changes and globalization sequences. The leather and shoe<br />

making industry and the garment and textile industry are examples of badly affected<br />

industries. Contrary to that, Pharmaceutical industries and marble and stone industries<br />

were good examples of positive change.<br />

Manufacturing Sector<br />

25

SWOT Analysis<br />

Internal Analysis<br />

Strengths<br />

Weaknesses<br />

• The long experience of the owners in the • Lack of additional financial resources<br />

industry<br />

from the current owner<br />

• Quality and on-time delivery of the products by<br />

the company<br />

• The workshop classified by the Ministry of<br />

Local Government as level 2 workshop and<br />

will be upgraded to level 1 when the project is<br />

completed<br />

External Analysis<br />

Opportunities<br />

Threats<br />

• Ability to expand the company market share<br />

and geographical coverage<br />

• Political instability<br />

Financial Projections in US$<br />

Indicators 2010 2011 2012 2013 2014<br />

Income statement Accounts<br />

Revenues 241,935 282,258 349,462 376,344 413,978<br />

Gross Profit 143,817 134,409 182,796 215,054 236,559<br />

Net Income 87,061 43,929 76,548 96,871 111,548<br />

Cash Flow Accounts<br />

Operating Cash Flow 106,142 101,309 135,957 156,280 170,957<br />

Investing Cash Flow (493,280) (53,763) (6,720)<br />

Financing Cash Flow 493,280 (5,376) (42,306) (52,468) (59,806)<br />

Balance Sheet Accounts<br />

Total Assets 695,932 734,485 768,727 813,130 864,872<br />

Total Liabilities 22,849 17,473 13,441 9,409 5,376<br />

Total Equity 673,083 717,012 755,286 803,721 859,495<br />

Profitability Indicators<br />

Return on Assets 13% 6% 10% 12% 13%<br />

Return on Equity 13% 6% 10% 12% 13%<br />

26 Inspiring <strong>Business</strong>

Manufacturing of Engine Parts 6<br />

Project Number:<br />

Project Name:<br />

Sponsor Company:<br />

Contact Details:<br />

Total Cost of the Project: US$ 1,068,022<br />

<strong>Investment</strong> by Current Owners: US$ 710,852<br />

Required <strong>Investment</strong>: US$ 357,170<br />

PIC-2010-IO-006<br />

Manufacturing of Engine Parts<br />

IMI Equipment Co.<br />

Mr. Imad Al-Aref<br />

Ramallah, <strong>Palestine</strong><br />

Tel: +970-2-2961678<br />

Fax: +970-2-977460<br />

Email: ceo@imi-equipment.ps<br />

Website: www.imi-equipment.ps<br />

Project Description:<br />

IMI Equipment Co. is seeking an investment partner to assist in establishing an<br />

assembly line for manufacturing engine parts. These parts will include alternators,<br />

radiators, control panels, canopies, fuel tanks, metal bases and any additional<br />

parts used in an engine. Their technical specifications will be from 10KVA up to<br />

500 KVA in both standby and prime applications.<br />

Two years ago, IMI Equipment Co. began to import ready-made generators from<br />

Turkey, however the management team now believes it would be more costefficient<br />

to manufacture the necessary parts locally. Hence the initiative to develop<br />

an assembly line for generator and engine parts was born.<br />

IMI Equipment Co. is number one in the Palestinian market in terms of local<br />

generator assembly, and currently exports to Israel, Jordan, Iraq, Saudi Arabia, and<br />

the U.A.E. IMI is in the process of expanding its service to export markets; part of<br />

which has involved a focused effort on product quality enhancement in line with the<br />

Palestinian standards. IMI has an office in Jordan which is exclusively dedicated<br />

to supporting the company’s export operation. Company management anticipates<br />

a sales breakdown along the following lines: 72% local market, 8% Israeli market<br />

at 8% and the rest of the export market at 20%. It is expected that the company’s<br />

revenues will surpass US$1 million in 2013, of which $300,000 will be net income.<br />

IMI Equipment Co. faces no local competition for parts manufacturing aside<br />

from those imported from China, Turkey and Europe upon which the Palestinian<br />

market currently relies. By manufacturing these parts IMI first and foremost will be<br />

providing Palestinian companies with a more cost-effective alternative not subject<br />

to shipping and customs cost, while at the same time contributing significantly to<br />

Palestinian manufacturing capacity.<br />

Manufacturing Sector<br />

27

Project Development Time Table:<br />

Operations Start Date<br />

Expected number of months from finance availability<br />

3 months<br />

Current Owners’ Profile:<br />

IMI Equipment is an international trading company with offices in <strong>Palestine</strong>, Jordan and<br />

Kuwait. IMI’s main focus is on heavy machinery, equipment supply and project implementation.<br />

IMI’s team of young professionals constantly strives to provide high quality products and<br />

excellent service to clients; which has earned the company a strong reputation both in<br />

<strong>Palestine</strong> and in the wider region. Excellent after-sales service in particular has helped<br />

distinguish IMI from the competition. An emphasis on training has been critical in achieving<br />

this, as it has ensured employees keep abreast of all the latest technological developments<br />

in the field of industrial manufacturing.<br />

IMI Equipment Co. recently added compactors and solid waste stationary units to its product<br />

portfolio, as part of its ongoing efforts to diversify its services to sectors such as water,<br />

electricity, concrete and infrastructure.<br />

In addition to representing its own brand, IMI Equipment Co. is also the exclusive regional<br />

agent for several leading international companies, including: Hidromek and Cukorova<br />

(Turkey), Landini (Italy), Manitou (France), Nasser Group (Jordan), Bomag (Germany),<br />

Cemen Tech (USA), and Dressta (Poland). These relationships bring much value to IMI<br />

in terms of credibility and exposure to international best practices. IMI management is<br />

committed to pursuing their vision to become the premier supplier of heavy machinery in<br />

<strong>Palestine</strong>, while continuing to build its brand equity and regional market share.<br />

Industry Highlights:<br />

The metal industry is served by an association which represents 40 major firms working<br />

in the sector. A rough estimate of the number of firms working in this industry is 120. The<br />

average number of workers in the sector is estimated to be 1000.<br />

Sector diversification<br />

The sector is comprised of the following diversified fields: metal doors, aluminum profiles,<br />

iron and steel rods, welding and abrasive materials, nails and steel rods, metal furniture,<br />

scales, stone machinery, packaging machinery, lathing, agricultural machinery, municipal<br />

containers, kitchen wear, electric circuit boards and other specialized workshops.<br />

Quality as an advantage<br />

Product quality in this sector is usually measured in terms of life-span. The majority of the<br />

products are either used in support of the industry itself, or as complementary parts to<br />

other businesses. Given how much other working parts in any construction or industrial<br />

process rely on their metal counterparts, quality is extremely important. PSI standards and<br />

specifications are valid only for some of these products; ISO certificates and fire prevention<br />

certificates have been acquired by some but not all of the firms in the sector.<br />

28 Inspiring <strong>Business</strong>

Technical position and capacity<br />

The total production capacity barely reaches 40% among the sampled companies.<br />

Technically speaking there is a significant variation in the level of technology used in the<br />

sector. The industry needs to be equipped with testing facilities and know-how to cope with<br />

increasing technological and quality-related specifications. Academic networking with the<br />

industry is also vital to the development of this industry.<br />

Marketing position<br />

The metal sector has been involved in the export market for decades, and continues to be<br />

despite the heavy restrictions on movement imposed by Israeli authorities. Welding materials<br />

and abrasives have traditionally been the main exports. However, the opportunity exists for<br />

moving into new export markets with a wider variety of metal products, such as metal doors,<br />

stone machinery and packaging machinery. Locally, there is strong competition from Israeli<br />

and imported materials, mainly Chinese. Unfortunately, PSI is not active with regards to<br />

verifying the quality of imported materials. It would be beneficial to set strict regulations with<br />

regards to competing imports in order to maintain fair competition in the market.<br />

Financial position<br />

There are no precise figures indicating the total level of investment in the sector. However<br />

some industry experts have stated that the total amount of investments exceeds US$ 100<br />

million. According to the sample firms, 100% of them would like to invest in new machinery<br />

and 80% will invest in seeking new markets.<br />

Industry problems and needs<br />

This industrial sector’s most pressing needs can be summarized by the following points:<br />

• Increasing industry regulations in order to promote fair competition;<br />

• Designing a package of promotional and technical assistance to assist in opening<br />

new export markets;<br />

• Equipping the industry with proper testing facilities and linking companies properly<br />

with relevant academic institutions;<br />

• Investing in development of alternatives energy sources and to decrease powerrelated<br />

costs;<br />

• Encouraging more environmentally-friendly practices such as industrial waste<br />

recycling.<br />

Manufacturing Sector<br />

29

SWOT Analysis<br />

Internal Analysis<br />

Strengths<br />

Weaknesses<br />

• Experienced and well established in the • Lacks sufficient capital to complete all<br />

industry<br />

phases of building the new assembly line<br />

• Raw materials are widely available<br />

• Provides a locally-produced, lower priced<br />

alternative to Palestinian and Middle Eastern<br />

companies currently relying on imports<br />

External Analysis<br />

Opportunities<br />

Threats<br />

• Strong growth in demand for these products<br />

• Political instability<br />

locally and regionally<br />

• Increased regional export market share • Existence of strong foreign competition<br />

• No regulatory restrictions on importing<br />

necessary equipment<br />

Financial Projections in US$ for the whole project<br />

(old and new investments)<br />

Indicators 2010 2011 2012 2013 2014<br />

Income statement Accounts<br />

Revenues 456,000 641,000 800,000 1,075,000 1,128,750<br />

Gross Profit 120,000 351,000 505,000 565,000 593,250<br />

Net Income 23,788 244,582 395,118 450,108 478,264<br />

Cash Flow Accounts<br />

Operating Cash Flow 56,000 272,900 419,300 469,900 493,395<br />

Investing Cash Flow 0 0 0 0 0<br />

Financing Cash Flow 294,022 (82,861) (82,861) (82,861) (82,861)<br />

Balance Sheet Accounts<br />

Total Assets 1,028,661 1,206,200 1,530,139 1,904,677 2,302,711<br />

Total Liabilities 294,022 226,978 155,799 80,230 0<br />

Total Equity 734,640 979,222 1,374,340 1,824,447 2,302,711<br />

Profitability Indicators<br />

Return on Assets 2.31% 20.28% 25.82% 23.63% 20.77%<br />

Return on Equity 3.24% 24.98% 28.75% 24.67% 20.77%<br />

30 Inspiring <strong>Business</strong>

Internal Epoxy Lining Mortar 7<br />

Project Number:<br />

Project Name:<br />

Sponsor Company:<br />

Contact Details:<br />

Total Cost of the Project: US $ 4,310,000<br />

<strong>Investment</strong> by Current Owners: US $ 3,560,000<br />

Required <strong>Investment</strong>: US $ 750,000<br />

PIC-2010-IO-007<br />

Internal Epoxy Lining Mortar<br />

Future Iron Pipes<br />

Mr. Ahmad K. Naser<br />

Hebron Main Road<br />

Dura, Hebron, <strong>Palestine</strong><br />

Tel: +970-2-2286808<br />

Email: ahmad@a-brothers.com<br />

Project Description:<br />

This is an opportunity to financially assist in the establishment of an additional<br />

production line that will produce internal epoxy lining mortar for the steel pipes<br />

with the diameters 1”, 2”, 3”, 4”, 6”, 8”, 10”, 12”, and 16”.<br />

The company currently manufactures steel pipes with external 3LPE anti corrosion<br />

coating, and internal cement mortar lining.<br />

Future Iron Pipes currently targets the Palestinian market, Jordan, and other<br />

Middle Eastern countries. The additional products the company is seeking to<br />

manufacture will expand their exporting market to construction companies in the<br />

building sector in countries such as Turkey, Europe and Asia. Additionally, the<br />

new pipes with internal epoxy mortar lining will allow the company to focus on<br />

the public sector since the pipes will have the ability to be used for water, gas<br />

and oil lines, which will ultimately assist in the development and organization of<br />

<strong>Palestine</strong>’s infrastructure.<br />

Due to the expansion of the building sector and the increasingly high demand<br />

for infrastructure, the company has the opportunity to be the sole provider to the<br />

Palestinian market. There is a very high demand for these steel pipes. Future Iron<br />

Pipes faces no local Palestinian competition whatsoever, although there are two<br />

Israeli manufacturers in which the Palestinian market exclusively rely on.<br />

Future Iron Pipes aims at distributing their products through wholesale companies<br />

and agents in the building sector. The company will also export their products<br />

internationally, guaranteeing the best price, highest quality and compliance with<br />

international standards since their running cost will be a lot cheaper.<br />

Manufacturing Sector<br />

31

Project Development Time Table:<br />

Expected number of months from finance availability<br />

Establishment of new production line 12<br />

Current Owners’ Profile:<br />

Future Iron Pipes (FIP) was founded in 2009 using the latest computerized technologies; it<br />

is the first privately owned large scale manufacturer of coated steel pipes. It has a diversified<br />

customer base and actively participates in the global coating and lining industry.<br />

FIP’s policy is to provide the customer with optimum quality and workmanship within their<br />

requested delivery schedule. The experienced workforce is dedicated to providing the<br />

highest quality product and customer service.<br />

Fully prepared to meet the demands generated by the expansion of water distribution<br />

systems, natural gas, oil pipelines and related projects, Future Iron Pipes supplies external<br />

anti-corrosive, 3 layered PE/PP coating according to the international and Palestinian<br />

standards, and internal cement mortar lining for pipes.<br />

Industry Highlights:<br />

The metal industry is served by an industry association which represents 40 major firms<br />

working in the industry. A rough figure of firms working in this industry is estimated at 120.<br />

The problem is how to define the working firms and how to recognize the working workshops.<br />

The average number of workers in the sector is estimated at 1000 workers.<br />

Sector diversification<br />

The sector is comprised of several diversified fields. These are: metal doors, aluminum<br />

profiles, iron and steel rods and drawing, welding and abrasive materials, nails and steel<br />

rods, metal furniture, scales, stone machinery, packaging machinery, lathing, agricultural<br />

machinery, municipal containers, kitchen wear, electric circuit boards and other specialized<br />

workshops.<br />

Quality as an advantage<br />

The quality is related to the application and use of the machines and tools produced. It is<br />

obvious that the majority of the products are either used for the industry or as complementary<br />

parts to other businesses. Hence, quality is an important matter. The PSI standards and<br />

specifications are valid only to some of these products; ISO certificates and fire preventing<br />

certificates have been acquired by some firms.<br />

There is a lack in fully equipped laboratories and testing, this can be overcome through<br />

close cooperation with academic institutions. Also, research and development can help<br />

choosing the proper composition of materials. Moreover, the culture of quality standards<br />

and specifications has to be widely spread in the sector.<br />

32 Inspiring <strong>Business</strong>

Technical position and capacity<br />

The total production capacity is barely reaching 40% of the sample companies. Technically<br />

speaking there is a big variation in the level of technology used in the sector ranging from<br />

low to high levels. The industry needs to be equipped with testing facilities and knowledge<br />

to cope with the technology and quality needs. Academic networking with the industry is<br />

vital to the development of this industry.<br />

Marketing position<br />

Traditionally, the sector has experienced the export practices decades ago and still does.<br />

Welding materials and abrasives were the main exports. The opportunity still exists for more<br />

exports in to countries. Metal doors, stone machinery and packaging machinery are some<br />

major examples. Locally, there is high competition with the Israeli and imported materials,<br />

mainly Chinese. PSI is not active in the regard of checking the quality of the imported<br />

materials. Local market needs carefully set regulations in order to maintain fair competition<br />

in the market.<br />

Financial position<br />

There are no precise figures indicating the total investment in the sector. But some references<br />

stated that the total amount of investments exceeds the figure of 100 million USD. According<br />

to the sample firms, 100% of them have the desire to invest in new machinery and 80% will<br />

invest in seeking new markets.<br />

Manufacturing Sector<br />

33

SWOT Analysis<br />

Internal Analysis<br />

Strengths<br />

Weaknesses<br />

• Lack of financial resources to complete<br />

• Sole provider of the Palestinian market<br />

all phases of the project<br />

• New product will assist <strong>Palestine</strong>’s Public<br />

sector since the pipes may now be used for oil,<br />

gas and water lines<br />

External Analysis<br />

Opportunities<br />

Threats<br />

• To expand their exporting market to more<br />

• Political instability<br />

international markets<br />

• There are no apparent restrictions on importing<br />

the needed type of equipment<br />

Financial Projections in US$<br />

Indicators 2010-2011 2012 2013 2014 2015<br />

Income statement Accounts<br />

Revenues 400,000 550,000 600,000 630,000 661,500<br />

Gross Profit 320,000 467,000 516,000 541,800 568,890<br />

Net Income 110,000 258,400 308,200 332,960 358,958<br />

Cash Flow Accounts<br />

Operating Cash Flow 297,000 445,000 495,200 519,960 545,958<br />

Investing Cash Flow (900,000) 0 0 0 0<br />

Financing Cash Flow 900,000 0 (250,000) (300,000) (330,000)<br />

Balance Sheet Accounts<br />

Total Assets 4,610,000 4,618,400 4,626,600 4,629,5604 4,638,518<br />

Total Liabilities 190,000 190,000 190,000 190,000 190,000<br />

Total Equity 4,420,000 4,428,400 4,436,600 4,439,560 4,448,518<br />

Profitability Indicators<br />

Return on Assets 2.39% 5.60% 6.66% 7.19% 7.74%<br />

Return on Equity 2.49% 5.84% 6.95% 7.50% 8.07%<br />

34 Inspiring <strong>Business</strong>

Manufacturing of Iron Pipes 8<br />

Project Number:<br />

Project Name:<br />

Sponsor Company:<br />

Contact Details:<br />

Total Cost of the Project: US $7,800,000<br />

<strong>Investment</strong> by Current Owners: US $1,500,000<br />

Required <strong>Investment</strong>: US $6,300,000<br />

PIC-2010-IO-008<br />

Manufacturing of Iron Pipes<br />

Future Iron Pipes<br />

Mr. Ahmad K. Naser<br />

Future Iron Pipes<br />

Hebron Main Road<br />

Dura, Hebron<br />

Tel: +970-2-2286808<br />

Email: ahmad@a-brothers.com<br />

Project Description:<br />

Future Iron Pipes (FIP) is seeking a financing partner to assist in the establishment<br />

of a company that will manufacture the following products: steel pipes with<br />

diameters 3”,4”,5”,6”,8”, as well as rectangular sections sized 20x20, 20x15,<br />

60x60, 80x40,30x30, 40x20, 80x80, and 120x40.<br />

FIP currently produces coating and lining for steel pipes, while now they wish<br />

to venture into manufacturing steel pipes themselves rather than continuing to<br />

outsource them exclusively from the only 3 Israeli suppliers in the region. By<br />

manufacturing these steel pipes in-house, FIP will significantly cut its shipping<br />

and time-related costs while decreasing the company’s overhead. It will enable<br />

the company to produce their own high-quality pipes and expedite their existing<br />

coating process in a much more cost-efficient and timely manner.<br />

FIP will be the only company in the <strong>Palestine</strong> to manufacture these steel pipes; it will<br />

also seek to increase their exports as there is a high demand for such pipes worldwide.<br />

The Palestinian market alone consumes thousands of tons of steel piping annually.<br />

Even Israeli manufacturers are importing from Turkey to satisfy their own domestic<br />

market demand, as their production capacity can’t keep up. This is due to a boom in<br />

real estate development and construction, which constantly require steel piping.<br />

Establishing the first steel piping manufacturing plant of its kind will truly assist<br />

in the overall development of Palestinian economy, as it helps it become more<br />

self-reliant for all aspects of the construction phase, of which building materials<br />

are a crucial component. The Palestinian public sector will rely exclusively on FIP<br />

for the steel pipes and their coating process, since these pipes are used for water,<br />

gas and oil lines.<br />

Manufacturing Sector<br />

35

Project Development Time Table:<br />

Expected number of months from finance availability<br />

Establishment of Company 12<br />

Current Owners’ Profile:<br />

Future Iron Pipes (FIP) was founded in 2009 using the latest technology as the first privatelyowned<br />

large scale manufacturer of coated steel pipes. It has since come to play a prominent<br />

role in the marketplace and actively participates in the global coating and lining industry.<br />