Annual Report 2011 - PGS

Annual Report 2011 - PGS

Annual Report 2011 - PGS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the consolidated financial statements<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

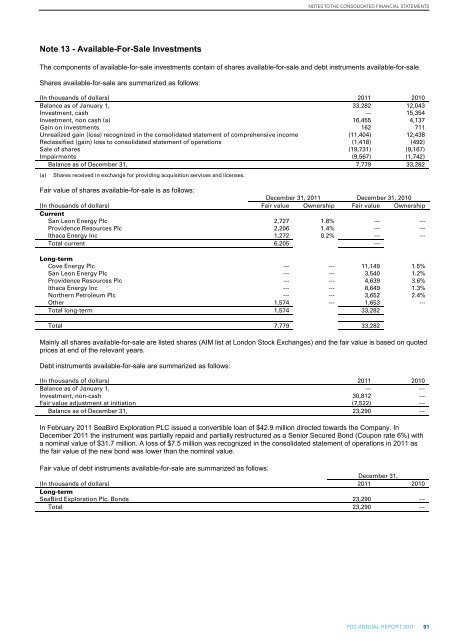

Note 13 - Available-For-Sale Investments<br />

The components of available-for-sale investments contain of shares available-for-sale and debt instruments available-for-sale.<br />

Shares available-for-sale are summarized as follows:<br />

(In thousands of dollars) <strong>2011</strong> 2010<br />

Balance as of January 1, 33,282 12,043<br />

Investment, cash --- 15,354<br />

Investment, non cash (a) 16,455 4,137<br />

Gain on investments 162 711<br />

Unrealized gain (loss) recognized in the consolidated statement of comprehensive income (11,404) 12,438<br />

Reclassified (gain) loss to consolidated statement of operations (1,418) (492)<br />

Sale of shares (19,731) (9,167)<br />

Impairments (9,567) (1,742)<br />

Balance as of December 31, 7,779 33,282<br />

(a)<br />

Shares received in exchange for providing acquisition services and licenses.<br />

Fair value of shares available-for-sale is as follows:<br />

December 31, <strong>2011</strong> December 31, 2010<br />

(In thousands of dollars) Fair value Ownership Fair value Ownership<br />

Current<br />

San Leon Energy Plc 2,727 1.8% --- ---<br />

Providence Resources Plc 2,206 1.4% --- ---<br />

Ithaca Energy Inc 1,272 0.2% --- ---<br />

Total current 6,205 ---<br />

Long-term<br />

Cove Energy Plc --- --- 11,149 1.5%<br />

San Leon Energy Plc --- --- 3,540 1.2%<br />

Providence Resources Plc --- --- 4,639 3.6%<br />

Ithaca Energy Inc --- --- 8,649 1.3%<br />

Northern Petroleum Plc --- --- 3,652 2.4%<br />

Other 1,574 --- 1,653 ---<br />

Total long-term 1,574 33,282<br />

Total 7,779 33,282<br />

Mainly all shares available-for-sale are listed shares (AIM list at London Stock Exchanges) and the fair value is based on quoted<br />

prices at end of the relevant years.<br />

Debt instruments available-for-sale are summarized as follows:<br />

(In thousands of dollars) <strong>2011</strong> 2010<br />

Balance as of January 1, --- ---<br />

Investment, non-cash 30,812 ---<br />

Fair value adjustment at initiation (7,522) ---<br />

Balance as of December 31, 23,290 ---<br />

In February <strong>2011</strong> SeaBird Exploration PLC issued a convertible loan of $42.9 million directed towards the Company. In<br />

December <strong>2011</strong> the instrument was partially repaid and partially restructured as a Senior Secured Bond (Coupon rate 6%) with<br />

a nominal value of $31.7 million. A loss of $7.5 million was recognized in the consolidated statement of operations in <strong>2011</strong> as<br />

the fair value of the new bond was lower than the nominal value.<br />

Fair value of debt instruments available-for-sale are summarized as follows:<br />

December 31,<br />

(In thousands of dollars) <strong>2011</strong> 2010<br />

Long-term<br />

SeaBird Exploration Plc. Bonds 23,290 ---<br />

Total 23,290 ---<br />

<strong>PGS</strong> ANNUAL REPORT <strong>2011</strong> 20<br />

<strong>PGS</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong> 91