Annual Report 2011 - PGS

Annual Report 2011 - PGS

Annual Report 2011 - PGS

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the consolidated financial statements<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

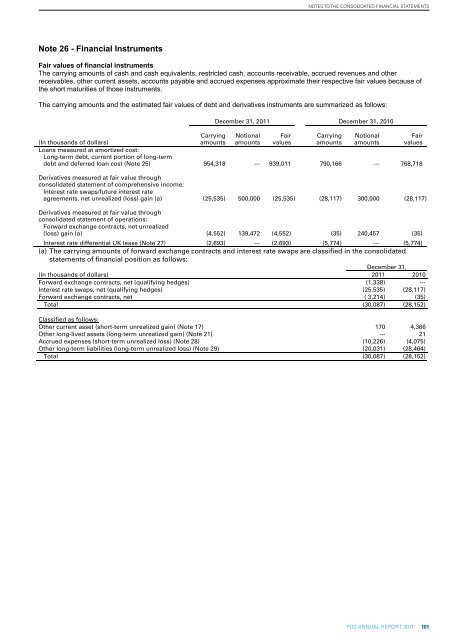

Note 26 - Financial Instruments<br />

Fair values of financial instruments<br />

The carrying amounts of cash and cash equivalents, restricted cash, accounts receivable, accrued revenues and other<br />

receivables, other current assets, accounts payable and accrued expenses approximate their respective fair values because of<br />

the short maturities of those instruments.<br />

The carrying amounts and the estimated fair values of debt and derivatives instruments are summarized as follows:<br />

Carrying<br />

amounts<br />

December 31, <strong>2011</strong> December 31, 2010<br />

Notional<br />

amounts<br />

Fair<br />

values<br />

Carrying<br />

amounts<br />

Notional<br />

amounts<br />

Fair<br />

values<br />

(In thousands of dollars)<br />

Loans measured at amortized cost:<br />

Long-term debt, current portion of long-term<br />

debt and deferred loan cost (Note 25) 954,318 --- 939,011 790,166 --- 768,718<br />

Derivatives measured at fair value through<br />

consolidated statement of comprehensive income:<br />

Interest rate swaps/future interest rate<br />

agreements, net unrealized (loss) gain (a) (25,535) 500,000 (25,535) (28,117) 300,000 (28,117)<br />

Derivatives measured at fair value through<br />

consolidated statement of operations:<br />

Forward exchange contracts, net unrealized<br />

(loss) gain (a) (4,552) 139,472 (4,552) (35) 240,457 (35)<br />

Interest rate differential UK lease (Note 27) (2,693) --- (2,693) (5,774) --- (5,774)<br />

(a) The carrying amounts of forward exchange contracts and interest rate swaps are classified in the consolidated<br />

statements of financial position as follows:<br />

December 31,<br />

(In thousands of dollars) <strong>2011</strong> 2010<br />

Forward exchange contracts, net (qualifying hedges) (1,338) ---<br />

Interest rate swaps, net (qualifying hedges) (25,535) (28,117)<br />

Forward exchange contracts, net ( 3,214) (35)<br />

Total (30,087) (28,152)<br />

Classified as follows:<br />

Other current asset (short-term unrealized gain) (Note 17) 170 4,366<br />

Other long-lived assets (long-term unrealized gain) (Note 21) --- 21<br />

Accrued expenses (short-term unrealized loss) (Note 28) (10,226) (4,075)<br />

Other long-term liabilities (long-term unrealized loss) (Note 29) (20,031) (28,464)<br />

Total (30,087) (28,152)<br />

<strong>PGS</strong> ANNUAL REPORT <strong>2011</strong> 30<br />

<strong>PGS</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong> 101