The Pfandbrief 2011 | 2012

The Pfandbrief 2011 | 2012

The Pfandbrief 2011 | 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

cue fund, first and second economic stimulus packages). Via direct (e.g. infrastructure investment)<br />

and indirect (e.g. avoidance of capital bottlenecks by giving support to banks) transmission<br />

channels, this reduces on a lasting basis the danger that property investments might lose<br />

their value – as the following examination of changes in market values shows.<br />

Stable Performance<br />

Back in the days when investment decisions focused mainly on earnings potential, the stable<br />

performance of German commercial properties was considered a shortcoming. This view<br />

has now been relativized given the return to greater risk awareness which downturns usually<br />

produce.<br />

<strong>The</strong> importance of the German property market as a safe investment haven had already<br />

been demonstrated most impressively during earlier recessions.<br />

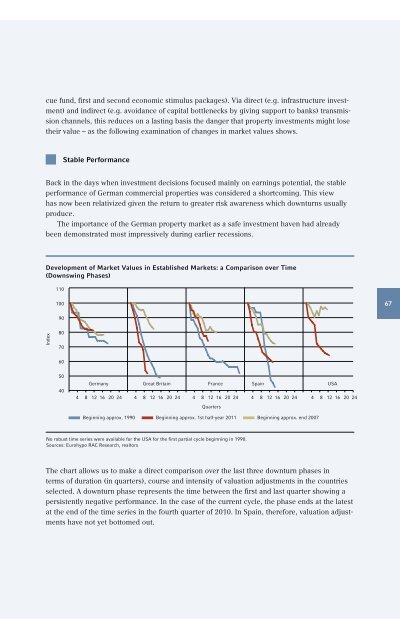

Development of Market Values in Established Markets: a Comparison over Time<br />

(Downswing Phases)<br />

110<br />

100<br />

67<br />

90<br />

Index<br />

80<br />

70<br />

60<br />

50<br />

40<br />

Germany Great Britain France Spain<br />

USA<br />

4 8 12 16 20 24<br />

4 8 12 16 20 24 4 8 12 16 20 24 4 8 12 16 20 24 4 8 12 16 20 24<br />

Quarters<br />

Beginning approx. 1990 Beginning approx. 1st half-year <strong>2011</strong> Beginning approx. end 2007<br />

No robust time series were available for the USA for the first partial cycle beginning in 1990.<br />

Sources: Eurohypo RAC Research, realtors<br />

<strong>The</strong> chart allows us to make a direct comparison over the last three downturn phases in<br />

terms of duration (in quarters), course and intensity of valuation adjustments in the countries<br />

selected. A downturn phase represents the time between the first and last quarter showing a<br />

persistently negative performance. In the case of the current cycle, the phase ends at the latest<br />

at the end of the time series in the fourth quarter of 2010. In Spain, therefore, valuation adjustments<br />

have not yet bottomed out.