The Pfandbrief 2011 | 2012

The Pfandbrief 2011 | 2012

The Pfandbrief 2011 | 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Pfandbrief</strong>e in Securities Indices – Current Trends and Applications<br />

Morningstar<br />

<strong>The</strong> Morningstar European Covered Bond Index is based on UCITS 22(4). In addition, Morningstar<br />

sets the following criteria:<br />

Minimum volume of EUR 1 billion<br />

Minimum remaining time to maturity of one year<br />

However, the index definition shows certain inconsistencies, in that UCITS 22(4) is established<br />

as a criterion while the criterion of a bank-issued bond is softened. <strong>The</strong> criteria are satisfied if<br />

investors can hold the bank acting in the background liable “in some other way”. This includes<br />

the possibility of using as issuer a securitisation vehicle that is guaranteed by a bank.<br />

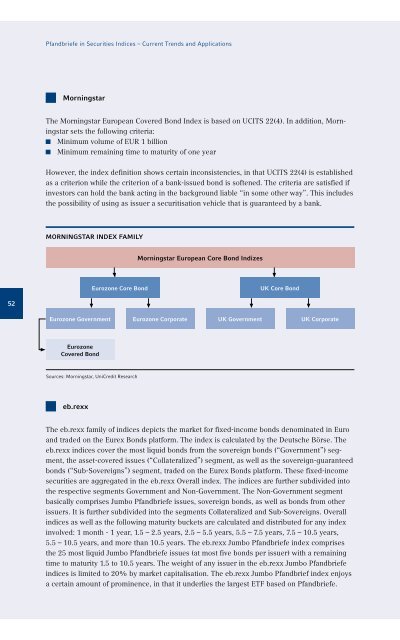

MORNINGSTAR INDEX FAMILY<br />

Morningstar European Core Bond Indizes<br />

Eurozone Core Bond<br />

UK Core Bond<br />

52<br />

Eurozone Government<br />

Eurozone Corporate<br />

UK Government<br />

UK Corporate<br />

Eurozone<br />

Covered Bond<br />

Sources: Morningstar, UniCredit Research<br />

eb.rexx<br />

<strong>The</strong> eb.rexx family of indices depicts the market for fixed-income bonds denominated in Euro<br />

and traded on the Eurex Bonds platform. <strong>The</strong> index is calculated by the Deutsche Börse. <strong>The</strong><br />

eb.rexx indices cover the most liquid bonds from the sovereign bonds (“Government”) segment,<br />

the asset-covered issues (“Collateralized”) segment, as well as the sovereign-guaranteed<br />

bonds (“Sub-Sovereigns”) segment, traded on the Eurex Bonds platform. <strong>The</strong>se fixed-income<br />

securities are aggregated in the eb.rexx Overall index. <strong>The</strong> indices are further subdivided into<br />

the respective segments Government and Non-Government. <strong>The</strong> Non-Government segment<br />

basically comprises Jumbo <strong>Pfandbrief</strong>e issues, sovereign bonds, as well as bonds from other<br />

issuers. It is further subdivided into the segments Collateralized and Sub-Sovereigns. Overall<br />

indices as well as the following maturity buckets are calculated and distributed for any index<br />

involved: 1 month - 1 year, 1.5 – 2.5 years, 2.5 – 5.5 years, 5.5 – 7.5 years, 7.5 – 10.5 years,<br />

5.5 – 10.5 years, and more than 10.5 years. <strong>The</strong> eb.rexx Jumbo <strong>Pfandbrief</strong>e index comprises<br />

the 25 most liquid Jumbo <strong>Pfandbrief</strong>e issues (at most five bonds per issuer) with a remaining<br />

time to maturity 1.5 to 10.5 years. <strong>The</strong> weight of any issuer in the eb.rexx Jumbo <strong>Pfandbrief</strong>e<br />

indices is limited to 20% by market capitalisation. <strong>The</strong> eb.rexx Jumbo <strong>Pfandbrief</strong> index enjoys<br />

a certain amount of prominence, in that it underlies the largest ETF based on <strong>Pfandbrief</strong>e.