The Pfandbrief 2011 | 2012

The Pfandbrief 2011 | 2012

The Pfandbrief 2011 | 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Westdeutsche ImmobilienBank AG<br />

Grosse Bleiche 46<br />

55116 Mainz<br />

Telephone: +49 6131 9280-7300<br />

Telefax: +49 6131 9280-7200<br />

Internet: www.westimmo.com<br />

Shareholder:<br />

WestLB AG (100%)<br />

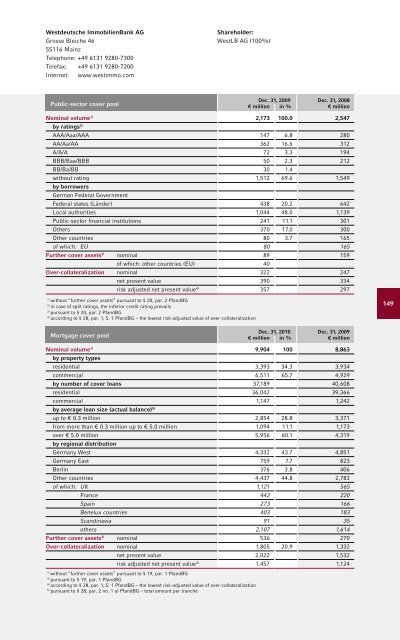

Public-sector cover pool<br />

Dec. 31, 2009<br />

€ million in %<br />

Dec. 31, 2008<br />

€ million<br />

Nominal volume 1)<br />

by ratings 2)<br />

AAA/Aaa/AAA<br />

AA/Aa/AA<br />

A/A/A<br />

BBB/Baa/BBB<br />

BB/Ba/BB<br />

without rating<br />

by borrowers<br />

German Federal Government<br />

Federal states (Länder)<br />

Local authorities<br />

Public-sector financial institutions<br />

Others<br />

Other countries<br />

of which: EU<br />

Further cover assets 3) nominal<br />

of which: other countries (EU)<br />

Over-collateralization nominal<br />

net present value<br />

risk adjusted net present value 4)<br />

2,173<br />

147<br />

362<br />

72<br />

50<br />

30<br />

1,512<br />

438<br />

1,044<br />

241<br />

370<br />

80<br />

80<br />

89<br />

40<br />

322<br />

390<br />

357<br />

100.0<br />

6.8<br />

16.6<br />

3.3<br />

2.3<br />

1.4<br />

69.6<br />

20.2<br />

48.0<br />

11.1<br />

17.0<br />

3.7<br />

2,547<br />

280<br />

312<br />

194<br />

212<br />

1,549<br />

642<br />

1,139<br />

301<br />

300<br />

165<br />

165<br />

159<br />

247<br />

334<br />

297<br />

1)<br />

without “further cover assets” pursuant to § 20, par. 2 PfandBG<br />

2)<br />

in case of split ratings, the inferior credit rating prevails<br />

3)<br />

pursuant to § 20, par. 2 PfandBG<br />

4)<br />

according to § 28, par. 1, S. 1 PfandBG – the lowest risk-adjusted value of over-collateralization<br />

149<br />

Mortgage cover pool<br />

Dec. 31, 2010<br />

€ million in %<br />

Dec. 31, 2009<br />

€ million<br />

Nominal volume 1)<br />

9,904<br />

by property types<br />

residential<br />

commercial<br />

by number of cover loans<br />

residential<br />

commercial<br />

3,393<br />

6,511<br />

37,189<br />

36,042<br />

1,147<br />

by average loan size (actual balance) 5)<br />

up to € 0.3 million<br />

from more than € 0.3 million up to € 5.0 million<br />

over € 5.0 million<br />

2,854<br />

1,094<br />

5,956<br />

by regional distribution<br />

Germany West<br />

Germany East<br />

Berlin<br />

Other countries<br />

of which: UK<br />

France<br />

Spain<br />

Benelux countries<br />

Scandinavia<br />

others<br />

4,332<br />

759<br />

376<br />

4,437<br />

1,121<br />

442<br />

273<br />

403<br />

91<br />

2,107<br />

Further cover assets 3)<br />

Over-collateralization<br />

nominal<br />

nominal<br />

net present value<br />

risk adjusted net present value 4)<br />

536<br />

1,805<br />

2,022<br />

1,457<br />

1)<br />

without “further cover assets” pursuant to § 19, par. 1 PfandBG<br />

3)<br />

pursuant to § 19, par. 1 PfandBG<br />

4)<br />

according to § 28, par. 1, S. 1 PfandBG – the lowest risk-adjusted value of over-collateralization<br />

5)<br />

pursuant to § 28, par. 2 no. 1 a) PfandBG – total amount per tranche<br />

100<br />

34.3<br />

65.7<br />

28.8<br />

11.1<br />

60.1<br />

43.7<br />

7.7<br />

3.8<br />

44.8<br />

20.9<br />

8,863<br />

3,934<br />

4,929<br />

40,608<br />

39,366<br />

1,242<br />

3,371<br />

1,173<br />

4,319<br />

4,851<br />

823<br />

406<br />

2,783<br />

565<br />

220<br />

166<br />

183<br />

35<br />

1,614<br />

270<br />

1,332<br />

1,532<br />

1,124