The Pfandbrief 2011 | 2012

The Pfandbrief 2011 | 2012

The Pfandbrief 2011 | 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

UniCredit Bank AG (former Bayerische<br />

Hypo- und Vereinsbank AG)<br />

Kardinal-Faulhaber-Strasse 1<br />

80333 Munich<br />

Telephone: +49 89 378-0<br />

e-mail: info@unicreditgroup.de<br />

Internet: www.hypovereinsbank.de<br />

Shareholder:<br />

UniCredit S.p.A., Rom (100 %)<br />

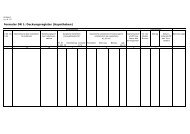

Public-sector cover pool<br />

Dec. 31, 2010<br />

€ million in %<br />

Dec. 31, 2009<br />

€ million<br />

Nominal volume 1)<br />

by borrowers<br />

German Federal Government<br />

Federal states (Länder)<br />

Local authorities<br />

Public-sector financial institutions<br />

Others<br />

Other countries<br />

of which: EU<br />

non-EU<br />

Further cover assets 2) nominal<br />

Over-collateralization nominal<br />

net present value<br />

risk adjusted net present value 3)<br />

1)<br />

without “further cover assets” pursuant to § 20, par. 2 PfandBG<br />

2)<br />

pursuant to § 20, par. 2 PfandBG<br />

3)<br />

according to § 28, par. 1, S. 1 PfandBG – the lowest risk-adjusted value of over-collateralization<br />

9,361<br />

7<br />

2,202<br />

2,204<br />

294<br />

3,351<br />

1,303<br />

389<br />

914<br />

0<br />

3,412<br />

3,490<br />

3,429<br />

100<br />

0.08<br />

23.52<br />

23.54<br />

3.14<br />

35.8<br />

13.92<br />

4.16<br />

9.76<br />

0<br />

36.45<br />

37.28<br />

36.63<br />

9,762<br />

8<br />

2,437<br />

2,238<br />

168<br />

3,489<br />

1,422<br />

430<br />

992<br />

0<br />

2,706<br />

2,793<br />

2,775<br />

Mortgage cover pool<br />

Dec. 31, 2010<br />

€ million in %<br />

Dec. 31, 2009<br />

€ million<br />

Nominal volume 1)<br />

by property types<br />

residential<br />

commercial<br />

by number of cover loans<br />

residential<br />

commercial<br />

by average loan size (actual balance) 4)<br />

up to € 0.3 million<br />

from more than € 0.3 million up to € 5.0 million<br />

over € 5.0 million<br />

by regional distribution<br />

Germany West<br />

Germany East<br />

Berlin<br />

Other countries<br />

of which: UK<br />

France<br />

Spain<br />

Benelux countries<br />

Scandinavia<br />

others<br />

Further cover assets 2) nominal<br />

Over-collateralization nominal<br />

net present value<br />

risk adjusted net present value 3)<br />

29,306<br />

21,019<br />

8,287<br />

267,077<br />

15,848<br />

16,531<br />

8,312<br />

4,463<br />

22,642<br />

4,658<br />

1,995<br />

11<br />

2<br />

3<br />

6<br />

2,743<br />

5,216<br />

5,469<br />

5,378<br />

100<br />

71.72<br />

28.28<br />

94.4<br />

5.6<br />

56.41<br />

28.36<br />

15.23<br />

77.26<br />

15.89<br />

6.81<br />

0.04<br />

0.01<br />

0.01<br />

0.02<br />

9.36<br />

17.8<br />

18.66<br />

18.35<br />

32,055<br />

23,350<br />

8,705<br />

297,696<br />

17,476<br />

18,723<br />

8,966<br />

4,366<br />

24,747<br />

5,202<br />

2,094<br />

12<br />

0<br />

2<br />

1<br />

3<br />

0<br />

6<br />

2,313<br />

4,494<br />

4,692<br />

4,550<br />

145<br />

1)<br />

without “further cover assets” pursuant to § 19, par. 1 PfandBG<br />

2)<br />

pursuant to § 20, par. 2 PfandBG<br />

3)<br />

according to § 28, par. 1, S. 1 PfandBG – the lowest risk-adjusted value of over-collateralization<br />

4)<br />

pursuant to § 28, par. 2 no. 1 a) PfandBG – total amount per tranche