The Pfandbrief 2011 | 2012

The Pfandbrief 2011 | 2012

The Pfandbrief 2011 | 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Landesbank Hessen-Thüringen (Helaba) is an important German real estate bank active in both the domestic<br />

and international markets. Its core business lies in the field of commercial financings, especially office<br />

space, retail property, commercial areas and logistics hubs. <strong>The</strong> Bank takes a distinctly customer-focused<br />

approach to business with a team of highly specialised staff serving customers in the domestic market and<br />

internationally in all of the main European and US markets. From classic loans to structured financings,<br />

the bank offers the entire product and service range for property transactions.<br />

Helaba has a longstanding tradition as a public sector partner. In public-sector lending it offers its customers<br />

the entire range from tailor-made financing solutions and services to active debt management.<br />

Helaba’s main focus here is on German counterparties with an excellent ranking. <strong>The</strong> bank also holds an<br />

excellent market position with regard to public private partnerships (PPP). In both business segments, its<br />

Mortgage and Public <strong>Pfandbrief</strong>e play a key role for funding purposes.<br />

<strong>The</strong> AAA ratings testify to the high quality of the cover assets. <strong>The</strong> bank’s issuing policy seeks to achieve a<br />

wide diversification of the investor basis. In addition to its domestic issuing activity, Helaba therefore also<br />

banks on international, large-volume benchmark bonds as well as a comprehensive selection of structured<br />

issues.<br />

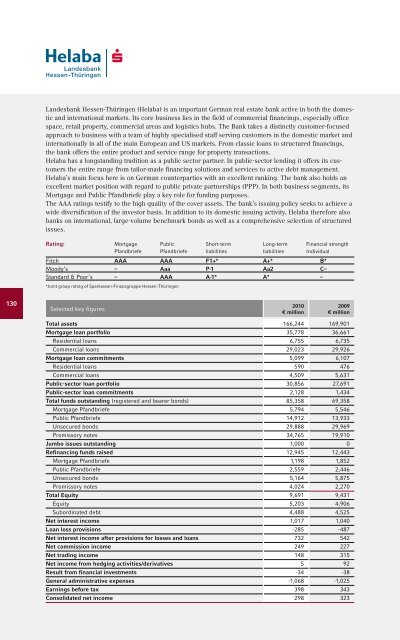

Rating: Mortgage Public Short-term Long-term Financial strength<br />

<strong>Pfandbrief</strong>e <strong>Pfandbrief</strong>e liabilities liabilities Individual<br />

Fitch AAA AAA F1+* A+* B*<br />

Moody‘s – Aaa P-1 Aa2 C–<br />

Standard & Poor‘s – AAA A-1* A* –<br />

* Joint group rating of Sparkassen-Finanzgruppe Hessen-Thüringen<br />

130<br />

Selected key figures<br />

2010<br />

€ million<br />

2009<br />

€ million<br />

Total assets<br />

166,244<br />

169,901<br />

Mortgage loan portfolio<br />

35,778<br />

36,661<br />

Residential loans<br />

6,755<br />

6,735<br />

Commercial loans<br />

29,023<br />

29,926<br />

Mortgage loan commitments<br />

5,099<br />

6,107<br />

Residential loans<br />

590<br />

476<br />

Commercial loans<br />

4,509<br />

5,631<br />

Public-sector loan portfolio<br />

30,856<br />

27,691<br />

Public-sector loan commitments<br />

2,128<br />

1,434<br />

Total funds outstanding (registered and bearer bonds)<br />

85,358<br />

69,358<br />

Mortgage <strong>Pfandbrief</strong>e<br />

5,794<br />

5,546<br />

Public <strong>Pfandbrief</strong>e<br />

14,912<br />

13,933<br />

Unsecured bonds<br />

29,888<br />

29,969<br />

Promissory notes<br />

34,765<br />

19,910<br />

Jumbo issues outstanding<br />

1,000<br />

0<br />

Refinancing funds raised<br />

12,945<br />

12,443<br />

Mortgage <strong>Pfandbrief</strong>e<br />

1,198<br />

1,852<br />

Public <strong>Pfandbrief</strong>e<br />

2,559<br />

2,446<br />

Unsecured bonds<br />

5,164<br />

5,875<br />

Promissory notes<br />

4,024<br />

2,270<br />

Total Equity<br />

9,691<br />

9,431<br />

Equity<br />

5,203<br />

4,906<br />

Subordinated debt<br />

4,488<br />

4,525<br />

Net interest income<br />

1,017<br />

1,040<br />

Loan loss provisions<br />

-285<br />

-487<br />

Net interest income after provisions for losses and loans<br />

732<br />

542<br />

Net commission income<br />

249<br />

227<br />

Net trading income<br />

148<br />

315<br />

Net income from hedging activities/derivatives<br />

5<br />

92<br />

Result from financial investments<br />

-34<br />

-38<br />

General administrative expenses<br />

-1,068<br />

-1,025<br />

Earnings before tax<br />

398<br />

343<br />

Consolidated net income<br />

298<br />

323