Eleventh anniversary of the Mexico-European Union FTA - Awex

Eleventh anniversary of the Mexico-European Union FTA - Awex

Eleventh anniversary of the Mexico-European Union FTA - Awex

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Eleventh</strong> <strong>anniversary</strong> <strong>of</strong> <strong>the</strong> <strong>Mexico</strong>-<strong>European</strong> <strong>Union</strong> <strong>FTA</strong><br />

(Continues from page 2)<br />

Enhanced bilateral investment flows<br />

MEU<strong>FTA</strong> and <strong>the</strong> BITs have also generated higher level<br />

<strong>of</strong> investments between <strong>Mexico</strong> and <strong>the</strong> EU given that in<br />

addition to guaranteeing <strong>the</strong> free flow <strong>of</strong> investment, <strong>the</strong>se<br />

instruments ensure protection for investors and provide<br />

a mechanism to solve any eventual dispute.<br />

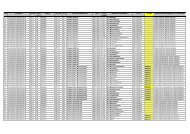

<strong>Mexico</strong> has received almost 108 bd <strong>of</strong> Foreign Direct Investment<br />

(FDI) from <strong>the</strong> EU in <strong>the</strong> period 1994-2010,<br />

highlighting that most <strong>of</strong> this stock, 93.8 bd, was received<br />

since MEU<strong>FTA</strong>’s entry into force (2000-2010), which represent<br />

a growth <strong>of</strong> more than five times than in <strong>the</strong> period<br />

94-99.<br />

303%<br />

61.3<br />

247.0<br />

14.1<br />

FDI in <strong>Mexico</strong><br />

(Billion USD)<br />

Growth (%)<br />

568%<br />

93.8<br />

Total EU U.S. Rest <strong>of</strong> <strong>the</strong><br />

World<br />

Source: Ministry <strong>of</strong> <strong>the</strong> Economy<br />

247%<br />

125.3<br />

36.1<br />

94-99<br />

152%<br />

27.9<br />

11.1<br />

Moreover, it is worth mentioning that in 2010 only, FDI<br />

flows from <strong>the</strong> EU almost duplicated those in 2009 and<br />

that EU contribution to total FDI in <strong>Mexico</strong> reached a historical<br />

participation <strong>of</strong> 62%.<br />

Among <strong>the</strong> investment accumulated in <strong>Mexico</strong> between<br />

2000 and 2010, <strong>the</strong> EU accounted for 39% <strong>of</strong> <strong>the</strong> total<br />

received, with more than 10 thousand companies with<br />

<strong>European</strong> capital operating in <strong>the</strong> country. The top three<br />

most active countries are: Spain, which accounted for<br />

40.7%, <strong>the</strong> Ne<strong>the</strong>rlands, 38.7%, and <strong>the</strong> United Kingdom<br />

8.5%. These countries were, respectively <strong>the</strong> second,<br />

third and fifth investors in <strong>Mexico</strong>.<br />

In terms <strong>of</strong> sectors, <strong>the</strong> bulk <strong>of</strong> FDI from <strong>the</strong> EU has been<br />

allocated to manufacturing activities (38.4%), mainly in<br />

processed food, chemical and automotive industries. O<strong>the</strong>r<br />

important part <strong>of</strong> <strong>the</strong> FDI has also been oriented on financial<br />

services (25.9%).<br />

MEU<strong>FTA</strong> has also promoted <strong>Mexico</strong>’s investment in <strong>the</strong><br />

EU. Between 1995 and 2009, Mexican companies invested<br />

14.4 billion euros in <strong>the</strong> EU, <strong>of</strong> which 12.8 were carried<br />

out since <strong>the</strong> entry into force <strong>of</strong> <strong>the</strong> MEU<strong>FTA</strong> (2000).<br />

MEU<strong>FTA</strong> boosts <strong>the</strong> recovery <strong>of</strong> bilateral trade and<br />

investment<br />

2010 was an exceptional year for <strong>the</strong> bilateral economic<br />

relationships, experiencing a quick recovery after <strong>the</strong> deep<br />

global recession in 2009, <strong>the</strong> deepest since <strong>the</strong> Second<br />

World War.<br />

In this context, MEU<strong>FTA</strong> demonstrated its great potential<br />

to reactivate trade and investment flows between <strong>Mexico</strong><br />

and <strong>the</strong> EU, wherewith now our companies are better positioned<br />

to take advantage <strong>of</strong> <strong>the</strong> business opportunities<br />

that are showing up in this recovery environment and reconfiguration<br />

<strong>of</strong> world markets.<br />

Indeed, <strong>European</strong> and Mexicans companies are uniting<br />

forces to consolidate <strong>the</strong>ir positions in <strong>the</strong> most attractive<br />

markets and sectors with better perspectives <strong>of</strong> growth.<br />

<strong>Mexico</strong> has been recognized by many international organizations<br />

as one <strong>of</strong> <strong>the</strong> best places in <strong>the</strong> world to do business<br />

–it is even considered as <strong>the</strong> best in Latin America<br />

(see “TradeLinks” <strong>of</strong> December 2010); <strong>the</strong>refore <strong>European</strong><br />

companies are taking advantage <strong>of</strong> <strong>the</strong> strategic position<br />

and competitive advantages that <strong>Mexico</strong> <strong>of</strong>fers to improve<br />

and enlarge <strong>the</strong>ir position in <strong>the</strong> global markets.<br />

MEU<strong>FTA</strong> supports our return to <strong>the</strong> path <strong>of</strong> economic<br />

growth, <strong>the</strong> companies development, and not less important,<br />

jobs creation for Mexicans and <strong>European</strong>s.<br />

In any case, our challenge remains to take even more advantage<br />

<strong>of</strong> <strong>the</strong> MEU<strong>FTA</strong> considering all <strong>the</strong> great potential<br />

that still exists to widen and deepen <strong>the</strong> economic relationship<br />

between <strong>Mexico</strong> and <strong>the</strong> EU.<br />

<strong>Mexico</strong>’s Economic Indicators<br />

Inflation rate: -0.74% (May, 2011);<br />

3.2% (2011, annual)<br />

Industrial Production: 1.4% (April 2011 / April 2010)<br />

Manufacturing: 2.1%; Construction: 1.9%, Mining: -3.1%<br />

Global Index <strong>of</strong> Economic Activity: 3.58% (March 2011/March 2010)<br />

Consumer Confidence Index: 89.3 pts. (May 2011)<br />

4.7 percentage points (May 2011 / May 2010)<br />

Open unemployment rate: 5.2 % (May 2011) Source: INEGI<br />

<strong>Mexico</strong>’s Financial Indicators<br />

Foreign exchange rate: 11.89 peso/dollar (June 27, 2011)<br />

International reserves: $129,569 million dollars (June 17, 2011)<br />

Mexican stock market index (IPC): 35,602 (June 27, 2011)<br />

Interest rate treasury bonds CETES 28 days:<br />

4.35 % (June 23, 2011)<br />

Source: Banco de <strong>Mexico</strong><br />

3