Eleventh anniversary of the Mexico-European Union FTA - Awex

Eleventh anniversary of the Mexico-European Union FTA - Awex

Eleventh anniversary of the Mexico-European Union FTA - Awex

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Eleventh</strong> <strong>anniversary</strong> <strong>of</strong> <strong>the</strong> <strong>Mexico</strong>-<strong>European</strong> <strong>Union</strong> <strong>FTA</strong><br />

(Continues from page 1)<br />

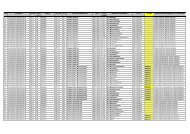

18.5 22.2 23.8<br />

23.4<br />

13.2 15.4 16.9 17.2 18.7 21.8<br />

5.3 6.8 6.9 6.2 7.4 8.6<br />

Mexican exports to <strong>the</strong> EU<br />

Bilateral Trade <strong>Mexico</strong>-EU<br />

(Billion USD)<br />

26.1<br />

30.4<br />

99 00 01 02 03 04 05 06 07 08 09 10<br />

EU's Imports<br />

In 2010, Mexican exports to <strong>the</strong> EU reached 17.4 bd,<br />

24% more than in 2009; consolidatating <strong>the</strong> EU’s position<br />

as <strong>Mexico</strong>’s second export market.<br />

It is worth highlighting that since <strong>the</strong> entry into force <strong>of</strong><br />

MEU<strong>FTA</strong>, Mexican exports to <strong>the</strong> EU have increased<br />

230%, equivalent to almost <strong>the</strong> double growth rate <strong>of</strong><br />

Mexican sales to <strong>the</strong> rest <strong>of</strong> <strong>the</strong> world in <strong>the</strong> same period<br />

(1999 -2010).<br />

Thanks to this dynamics, <strong>the</strong> EU’s participation as a destination<br />

for Mexican exports climb to almost 5% in 2010,<br />

positioning <strong>Mexico</strong> as EU’s 24th supplier. In contrast<br />

such participation reached only 4% in 1999.<br />

In <strong>the</strong> period 1999-2010, sectors accounting for <strong>the</strong> largest<br />

shares <strong>of</strong> <strong>the</strong> increase in value terms <strong>of</strong> Mexican exports<br />

to <strong>the</strong> EU included: machinery and transportation<br />

equipment (45.3% <strong>of</strong> <strong>the</strong> increase), oil and gas (20.6%)<br />

and chemical products (7.6%).<br />

37.6<br />

42.4<br />

50.5<br />

26.1 29.2 33.9<br />

39.3<br />

11.5 13.3 16.6 20.2 14.0 17.4<br />

<strong>Mexico</strong>'s Imports<br />

Source: Mynistry <strong>of</strong> <strong>the</strong> Economy <strong>of</strong> <strong>Mexico</strong> with data from Banxico and Eurostat<br />

59.5<br />

41.3<br />

27.3<br />

50.0<br />

32.6<br />

Mexican imports from <strong>the</strong> EU<br />

In 2010 Mexican imports from <strong>the</strong> EU reached 32.6 bd,<br />

achieving an increase <strong>of</strong> 19% compared to 2009, wherewith<br />

<strong>the</strong> EU consolidates its position as <strong>Mexico</strong>’s third<br />

supplier, only behind <strong>the</strong> United States and China.<br />

The EU’s share in Mexican purchases from abroad was<br />

10.8% in 2010, which compares favorably with <strong>the</strong> 9.3%<br />

in 1999.<br />

Since MEU<strong>FTA</strong> came into effect, Mexican imports from<br />

<strong>the</strong> EU surged 146.7%, in contrast with <strong>the</strong> growth rate <strong>of</strong><br />

109% <strong>of</strong> <strong>the</strong> rest <strong>of</strong> <strong>the</strong> world.<br />

Between 1999 and 2010, <strong>the</strong> Mexican import sectors that<br />

have contributed with <strong>the</strong> greatest share <strong>of</strong> <strong>the</strong> increase<br />

in Mexican imports from <strong>the</strong> EU, in terms <strong>of</strong> value, included<br />

machinery and transportation equipment (35.8% <strong>of</strong><br />

<strong>the</strong> increase), chemical products (21.0%) and oil and gas<br />

(15.7%).<br />

It is important to highlight that more than three quarters <strong>of</strong><br />

<strong>the</strong>se imports are capital goods (18%) and inputs (60%)<br />

used on manufacturing process, whereupon MEU<strong>FTA</strong><br />

allows to reduce production costs and improves <strong>the</strong> competitiveness<br />

<strong>of</strong> firms established in <strong>Mexico</strong>. Additionally,<br />

producing high quality consumer goods in <strong>Mexico</strong> at lower<br />

prices, brings benefits for Mexican families.<br />

Thanks to <strong>the</strong> MEU<strong>FTA</strong>, EU’s companies that consolidate<br />

production in <strong>Mexico</strong> increase <strong>the</strong>ir capacity to compete<br />

internationally at lower costs, taking advantage <strong>of</strong><br />

<strong>FTA</strong>’s network great potential, that grant preferential access<br />

from <strong>Mexico</strong> to 43 countries in North America, Europe,<br />

Latin America and Japan.<br />

(Continued on page 3)<br />

<strong>Mexico</strong>’s Total Trade in April<br />

(billion US$)<br />

2010 2011 %<br />

Total 49.6 55.2 11.2<br />

Exports 24.8 28.0 12.6<br />

Exports (excluding oil) 21.4 23.4 9.0<br />

Imports 24.8 27.2 9.8<br />

Source: Banco de México<br />

2<br />

<strong>Mexico</strong>’s Trade with EU and E<strong>FTA</strong><br />

(million US$)<br />

January - April 2010 2011 %<br />

Exports to <strong>the</strong> EU 4,276.8 5,863.5 37.1<br />

Imports from <strong>the</strong> EU 9,663.0 11,020.7 14.1<br />

Exports to <strong>the</strong> E<strong>FTA</strong> 356.1 512.9 44.0<br />

Imports from <strong>the</strong> E<strong>FTA</strong> 473.3 545.9 15.3<br />

Source: Banco de México