Eleventh anniversary of the Mexico-European Union FTA - Awex

Eleventh anniversary of the Mexico-European Union FTA - Awex

Eleventh anniversary of the Mexico-European Union FTA - Awex

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

TABLE OF CONTENTS<br />

<strong>Eleventh</strong> <strong>anniversary</strong> <strong>of</strong> <strong>the</strong><br />

<strong>Mexico</strong>-<strong>European</strong> <strong>Union</strong> <strong>FTA</strong><br />

MEXICO<br />

Trade Balance<br />

Financial and Economic Indicators<br />

BUSINESS<br />

<strong>Mexico</strong>’s Official Gazette Notices<br />

EU Official Journal<br />

<strong>Eleventh</strong> <strong>anniversary</strong> <strong>of</strong> <strong>the</strong><br />

<strong>Mexico</strong>-<strong>European</strong> <strong>Union</strong> <strong>FTA</strong><br />

Eleven years ago, on July 1 st , 2000, <strong>Mexico</strong> and <strong>the</strong> <strong>European</strong> <strong>Union</strong><br />

(EU) put into force a Free Trade Agreement (MEU<strong>FTA</strong>) which is part<br />

<strong>of</strong> <strong>the</strong>ir Economic Partnership, Political Co-ordination and Cooperation<br />

Agreement, that also promotes political dialogue and intensifies<br />

co-operation between both partners. .<br />

MEU<strong>FTA</strong> -<strong>the</strong> first free trade agreement between Europe and <strong>the</strong> American<br />

continent- has boosted bilateral trade and investment. Additionally, <strong>Mexico</strong> has<br />

signed Bilateral Investment Treaties (BIT) with 16 EU Member States*. All <strong>the</strong><br />

above has allowed to create exceptional conditions for business development<br />

between <strong>Mexico</strong> and <strong>the</strong> EU.<br />

Since 2007, as foreseen in <strong>the</strong> MEU<strong>FTA</strong>, all bilateral trade for industrial products<br />

is free <strong>of</strong> duties. Moreover, since 2003 <strong>the</strong> EU liberalized all <strong>the</strong> industrial<br />

products originating from <strong>Mexico</strong>.<br />

Meanwhile, agricultural trade has been subject to a gradual and longer liberalization<br />

process. Nowadays, 79% <strong>of</strong> EU’s agricultural imports from <strong>Mexico</strong> are<br />

free <strong>of</strong> duties, while <strong>Mexico</strong> has already liberalized 73% <strong>of</strong> its agricultural imports<br />

from <strong>the</strong> EU in that sector.<br />

Bilateral Trade<br />

After a historic decline in international trade in 2009, a global recovery is now<br />

underway; and trade between <strong>Mexico</strong> and <strong>the</strong> EU is not <strong>the</strong> exception. In fact,<br />

in 2010 bilateral trade reached more than 50 billion dollars (bd), representing<br />

an increase <strong>of</strong> 21% compared to 2009.<br />

Fur<strong>the</strong>rmore, trade between <strong>Mexico</strong> and <strong>the</strong> EU has grown 170% compared<br />

with 1999 (year before <strong>the</strong> entry into force <strong>of</strong> MEU<strong>FTA</strong>). In contrast, EU trade<br />

with o<strong>the</strong>r partners has increased 148% in <strong>the</strong> same period. Meanwhile, <strong>Mexico</strong>’s<br />

trade with <strong>the</strong> rest <strong>of</strong> <strong>the</strong> world grew 113%, which demonstrates that, for<br />

both parties, bilateral trade is more dynamic than with <strong>the</strong> rest <strong>of</strong> <strong>the</strong>ir respective<br />

trade partners.<br />

(Continues on page 2)<br />

June 2011<br />

Year 11, no. 6<br />

* Austria, Belgium, Czech Republic, Denmark, Finland, France, Germany, Greece, Italy,<br />

Luxembourg, <strong>the</strong> Ne<strong>the</strong>rlands, Portugal, Slovak Republic, Spain, Sweden and United Kingdom.

<strong>Eleventh</strong> <strong>anniversary</strong> <strong>of</strong> <strong>the</strong> <strong>Mexico</strong>-<strong>European</strong> <strong>Union</strong> <strong>FTA</strong><br />

(Continues from page 1)<br />

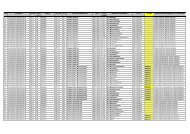

18.5 22.2 23.8<br />

23.4<br />

13.2 15.4 16.9 17.2 18.7 21.8<br />

5.3 6.8 6.9 6.2 7.4 8.6<br />

Mexican exports to <strong>the</strong> EU<br />

Bilateral Trade <strong>Mexico</strong>-EU<br />

(Billion USD)<br />

26.1<br />

30.4<br />

99 00 01 02 03 04 05 06 07 08 09 10<br />

EU's Imports<br />

In 2010, Mexican exports to <strong>the</strong> EU reached 17.4 bd,<br />

24% more than in 2009; consolidatating <strong>the</strong> EU’s position<br />

as <strong>Mexico</strong>’s second export market.<br />

It is worth highlighting that since <strong>the</strong> entry into force <strong>of</strong><br />

MEU<strong>FTA</strong>, Mexican exports to <strong>the</strong> EU have increased<br />

230%, equivalent to almost <strong>the</strong> double growth rate <strong>of</strong><br />

Mexican sales to <strong>the</strong> rest <strong>of</strong> <strong>the</strong> world in <strong>the</strong> same period<br />

(1999 -2010).<br />

Thanks to this dynamics, <strong>the</strong> EU’s participation as a destination<br />

for Mexican exports climb to almost 5% in 2010,<br />

positioning <strong>Mexico</strong> as EU’s 24th supplier. In contrast<br />

such participation reached only 4% in 1999.<br />

In <strong>the</strong> period 1999-2010, sectors accounting for <strong>the</strong> largest<br />

shares <strong>of</strong> <strong>the</strong> increase in value terms <strong>of</strong> Mexican exports<br />

to <strong>the</strong> EU included: machinery and transportation<br />

equipment (45.3% <strong>of</strong> <strong>the</strong> increase), oil and gas (20.6%)<br />

and chemical products (7.6%).<br />

37.6<br />

42.4<br />

50.5<br />

26.1 29.2 33.9<br />

39.3<br />

11.5 13.3 16.6 20.2 14.0 17.4<br />

<strong>Mexico</strong>'s Imports<br />

Source: Mynistry <strong>of</strong> <strong>the</strong> Economy <strong>of</strong> <strong>Mexico</strong> with data from Banxico and Eurostat<br />

59.5<br />

41.3<br />

27.3<br />

50.0<br />

32.6<br />

Mexican imports from <strong>the</strong> EU<br />

In 2010 Mexican imports from <strong>the</strong> EU reached 32.6 bd,<br />

achieving an increase <strong>of</strong> 19% compared to 2009, wherewith<br />

<strong>the</strong> EU consolidates its position as <strong>Mexico</strong>’s third<br />

supplier, only behind <strong>the</strong> United States and China.<br />

The EU’s share in Mexican purchases from abroad was<br />

10.8% in 2010, which compares favorably with <strong>the</strong> 9.3%<br />

in 1999.<br />

Since MEU<strong>FTA</strong> came into effect, Mexican imports from<br />

<strong>the</strong> EU surged 146.7%, in contrast with <strong>the</strong> growth rate <strong>of</strong><br />

109% <strong>of</strong> <strong>the</strong> rest <strong>of</strong> <strong>the</strong> world.<br />

Between 1999 and 2010, <strong>the</strong> Mexican import sectors that<br />

have contributed with <strong>the</strong> greatest share <strong>of</strong> <strong>the</strong> increase<br />

in Mexican imports from <strong>the</strong> EU, in terms <strong>of</strong> value, included<br />

machinery and transportation equipment (35.8% <strong>of</strong><br />

<strong>the</strong> increase), chemical products (21.0%) and oil and gas<br />

(15.7%).<br />

It is important to highlight that more than three quarters <strong>of</strong><br />

<strong>the</strong>se imports are capital goods (18%) and inputs (60%)<br />

used on manufacturing process, whereupon MEU<strong>FTA</strong><br />

allows to reduce production costs and improves <strong>the</strong> competitiveness<br />

<strong>of</strong> firms established in <strong>Mexico</strong>. Additionally,<br />

producing high quality consumer goods in <strong>Mexico</strong> at lower<br />

prices, brings benefits for Mexican families.<br />

Thanks to <strong>the</strong> MEU<strong>FTA</strong>, EU’s companies that consolidate<br />

production in <strong>Mexico</strong> increase <strong>the</strong>ir capacity to compete<br />

internationally at lower costs, taking advantage <strong>of</strong><br />

<strong>FTA</strong>’s network great potential, that grant preferential access<br />

from <strong>Mexico</strong> to 43 countries in North America, Europe,<br />

Latin America and Japan.<br />

(Continued on page 3)<br />

<strong>Mexico</strong>’s Total Trade in April<br />

(billion US$)<br />

2010 2011 %<br />

Total 49.6 55.2 11.2<br />

Exports 24.8 28.0 12.6<br />

Exports (excluding oil) 21.4 23.4 9.0<br />

Imports 24.8 27.2 9.8<br />

Source: Banco de México<br />

2<br />

<strong>Mexico</strong>’s Trade with EU and E<strong>FTA</strong><br />

(million US$)<br />

January - April 2010 2011 %<br />

Exports to <strong>the</strong> EU 4,276.8 5,863.5 37.1<br />

Imports from <strong>the</strong> EU 9,663.0 11,020.7 14.1<br />

Exports to <strong>the</strong> E<strong>FTA</strong> 356.1 512.9 44.0<br />

Imports from <strong>the</strong> E<strong>FTA</strong> 473.3 545.9 15.3<br />

Source: Banco de México

<strong>Eleventh</strong> <strong>anniversary</strong> <strong>of</strong> <strong>the</strong> <strong>Mexico</strong>-<strong>European</strong> <strong>Union</strong> <strong>FTA</strong><br />

(Continues from page 2)<br />

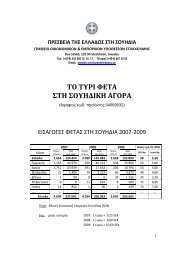

Enhanced bilateral investment flows<br />

MEU<strong>FTA</strong> and <strong>the</strong> BITs have also generated higher level<br />

<strong>of</strong> investments between <strong>Mexico</strong> and <strong>the</strong> EU given that in<br />

addition to guaranteeing <strong>the</strong> free flow <strong>of</strong> investment, <strong>the</strong>se<br />

instruments ensure protection for investors and provide<br />

a mechanism to solve any eventual dispute.<br />

<strong>Mexico</strong> has received almost 108 bd <strong>of</strong> Foreign Direct Investment<br />

(FDI) from <strong>the</strong> EU in <strong>the</strong> period 1994-2010,<br />

highlighting that most <strong>of</strong> this stock, 93.8 bd, was received<br />

since MEU<strong>FTA</strong>’s entry into force (2000-2010), which represent<br />

a growth <strong>of</strong> more than five times than in <strong>the</strong> period<br />

94-99.<br />

303%<br />

61.3<br />

247.0<br />

14.1<br />

FDI in <strong>Mexico</strong><br />

(Billion USD)<br />

Growth (%)<br />

568%<br />

93.8<br />

Total EU U.S. Rest <strong>of</strong> <strong>the</strong><br />

World<br />

Source: Ministry <strong>of</strong> <strong>the</strong> Economy<br />

247%<br />

125.3<br />

36.1<br />

94-99<br />

152%<br />

27.9<br />

11.1<br />

Moreover, it is worth mentioning that in 2010 only, FDI<br />

flows from <strong>the</strong> EU almost duplicated those in 2009 and<br />

that EU contribution to total FDI in <strong>Mexico</strong> reached a historical<br />

participation <strong>of</strong> 62%.<br />

Among <strong>the</strong> investment accumulated in <strong>Mexico</strong> between<br />

2000 and 2010, <strong>the</strong> EU accounted for 39% <strong>of</strong> <strong>the</strong> total<br />

received, with more than 10 thousand companies with<br />

<strong>European</strong> capital operating in <strong>the</strong> country. The top three<br />

most active countries are: Spain, which accounted for<br />

40.7%, <strong>the</strong> Ne<strong>the</strong>rlands, 38.7%, and <strong>the</strong> United Kingdom<br />

8.5%. These countries were, respectively <strong>the</strong> second,<br />

third and fifth investors in <strong>Mexico</strong>.<br />

In terms <strong>of</strong> sectors, <strong>the</strong> bulk <strong>of</strong> FDI from <strong>the</strong> EU has been<br />

allocated to manufacturing activities (38.4%), mainly in<br />

processed food, chemical and automotive industries. O<strong>the</strong>r<br />

important part <strong>of</strong> <strong>the</strong> FDI has also been oriented on financial<br />

services (25.9%).<br />

MEU<strong>FTA</strong> has also promoted <strong>Mexico</strong>’s investment in <strong>the</strong><br />

EU. Between 1995 and 2009, Mexican companies invested<br />

14.4 billion euros in <strong>the</strong> EU, <strong>of</strong> which 12.8 were carried<br />

out since <strong>the</strong> entry into force <strong>of</strong> <strong>the</strong> MEU<strong>FTA</strong> (2000).<br />

MEU<strong>FTA</strong> boosts <strong>the</strong> recovery <strong>of</strong> bilateral trade and<br />

investment<br />

2010 was an exceptional year for <strong>the</strong> bilateral economic<br />

relationships, experiencing a quick recovery after <strong>the</strong> deep<br />

global recession in 2009, <strong>the</strong> deepest since <strong>the</strong> Second<br />

World War.<br />

In this context, MEU<strong>FTA</strong> demonstrated its great potential<br />

to reactivate trade and investment flows between <strong>Mexico</strong><br />

and <strong>the</strong> EU, wherewith now our companies are better positioned<br />

to take advantage <strong>of</strong> <strong>the</strong> business opportunities<br />

that are showing up in this recovery environment and reconfiguration<br />

<strong>of</strong> world markets.<br />

Indeed, <strong>European</strong> and Mexicans companies are uniting<br />

forces to consolidate <strong>the</strong>ir positions in <strong>the</strong> most attractive<br />

markets and sectors with better perspectives <strong>of</strong> growth.<br />

<strong>Mexico</strong> has been recognized by many international organizations<br />

as one <strong>of</strong> <strong>the</strong> best places in <strong>the</strong> world to do business<br />

–it is even considered as <strong>the</strong> best in Latin America<br />

(see “TradeLinks” <strong>of</strong> December 2010); <strong>the</strong>refore <strong>European</strong><br />

companies are taking advantage <strong>of</strong> <strong>the</strong> strategic position<br />

and competitive advantages that <strong>Mexico</strong> <strong>of</strong>fers to improve<br />

and enlarge <strong>the</strong>ir position in <strong>the</strong> global markets.<br />

MEU<strong>FTA</strong> supports our return to <strong>the</strong> path <strong>of</strong> economic<br />

growth, <strong>the</strong> companies development, and not less important,<br />

jobs creation for Mexicans and <strong>European</strong>s.<br />

In any case, our challenge remains to take even more advantage<br />

<strong>of</strong> <strong>the</strong> MEU<strong>FTA</strong> considering all <strong>the</strong> great potential<br />

that still exists to widen and deepen <strong>the</strong> economic relationship<br />

between <strong>Mexico</strong> and <strong>the</strong> EU.<br />

<strong>Mexico</strong>’s Economic Indicators<br />

Inflation rate: -0.74% (May, 2011);<br />

3.2% (2011, annual)<br />

Industrial Production: 1.4% (April 2011 / April 2010)<br />

Manufacturing: 2.1%; Construction: 1.9%, Mining: -3.1%<br />

Global Index <strong>of</strong> Economic Activity: 3.58% (March 2011/March 2010)<br />

Consumer Confidence Index: 89.3 pts. (May 2011)<br />

4.7 percentage points (May 2011 / May 2010)<br />

Open unemployment rate: 5.2 % (May 2011) Source: INEGI<br />

<strong>Mexico</strong>’s Financial Indicators<br />

Foreign exchange rate: 11.89 peso/dollar (June 27, 2011)<br />

International reserves: $129,569 million dollars (June 17, 2011)<br />

Mexican stock market index (IPC): 35,602 (June 27, 2011)<br />

Interest rate treasury bonds CETES 28 days:<br />

4.35 % (June 23, 2011)<br />

Source: Banco de <strong>Mexico</strong><br />

3

<strong>Mexico</strong>’s Official Gazette Notices<br />

04/05/2011 Decree announcing <strong>the</strong> Additional Protocol to <strong>the</strong> Agreement between <strong>Mexico</strong> and <strong>the</strong> International<br />

Atomic Energy Agency so as to Application <strong>of</strong> Safeguard in relation to <strong>the</strong> Treaty for <strong>the</strong> Prohibition <strong>of</strong><br />

Nuclear Weapons in Latin America and <strong>the</strong> Caribbean and <strong>the</strong> Nuclear non-Proliferation Treaty, done in<br />

Vienne on March 29, 2004.<br />

06/05/2011 Agreement that publicizes <strong>the</strong> Second Additional Protocol to <strong>the</strong> Economic Complementation<br />

Agreement No. 55 celebrated between Mercosur and <strong>Mexico</strong>.<br />

10/05/2011 Decree amending, adding and abolishing certain provisions to <strong>the</strong> Federal Law <strong>of</strong> Economic<br />

Competition, <strong>the</strong> Federal Criminal Code and <strong>the</strong> Federal Fiscal Code.<br />

13/05/2011 Decree announcing <strong>the</strong> Arrangement between <strong>Mexico</strong> and Australia on Air Services, done in<br />

<strong>Mexico</strong> City on April 9, 2010.<br />

EU Official Journal<br />

11/05/2011 L122 Council Implementing Regulation (EU) No 443/2011 <strong>of</strong> 5 May 2011 extending <strong>the</strong> definitive<br />

countervailing duty imposed by Regulation (EC) No 598/2009 on imports <strong>of</strong> biodiesel originating in <strong>the</strong> United<br />

States <strong>of</strong> America to imports <strong>of</strong> biodiesel consigned from Canada, whe<strong>the</strong>r declared as originating in<br />

Canada or not, and extending <strong>the</strong> definitive countervailing duty imposed by Regulation (EC) No 598/2009 to<br />

imports <strong>of</strong> biodiesel in a blend containing by weight 20 % or less <strong>of</strong> biodiesel originating in <strong>the</strong> United States<br />

<strong>of</strong> America, and terminating <strong>the</strong> investigation in respect <strong>of</strong> imports consigned from Singapore<br />

11/05/2011 L122 Council Implementing Regulation (EU) No 444/2011 <strong>of</strong> 5 May 2011 extending <strong>the</strong> definitive<br />

anti-dumping duty imposed by Regulation (EC) No 599/2009 on imports <strong>of</strong> biodiesel originating in <strong>the</strong> United<br />

States <strong>of</strong> America to imports <strong>of</strong> biodiesel consigned from Canada, whe<strong>the</strong>r declared as originating in Canada<br />

or not, and extending <strong>the</strong> definitive anti-dumping duty imposed by Regulation (EC) No 599/2009 to imports<br />

<strong>of</strong> biodiesel in a blend containing by weight 20 % or less <strong>of</strong> biodiesel originating in <strong>the</strong> United States <strong>of</strong><br />

America, and terminating <strong>the</strong> investigation in respect <strong>of</strong> imports consigned from Singapore<br />

14/05/2011 L127 Council Decision <strong>of</strong> 16 September 2010 on <strong>the</strong> signing, on behalf <strong>of</strong> <strong>the</strong> <strong>European</strong> <strong>Union</strong>,<br />

and provisional application <strong>of</strong> <strong>the</strong> Free Trade Agreement between <strong>the</strong> <strong>European</strong> <strong>Union</strong> and its Member<br />

States, <strong>of</strong> <strong>the</strong> one part, and <strong>the</strong> Republic <strong>of</strong> Korea, <strong>of</strong> <strong>the</strong> o<strong>the</strong>r part<br />

14/05/2011 L128 Council Implementing Regulation (EU) No 451/2011 <strong>of</strong> 6 May 2011 imposing a definitive<br />

anti-dumping duty and collecting definitively <strong>the</strong> provisional duty imposed on imports <strong>of</strong> coated fine paper<br />

originating in <strong>the</strong> People's Republic <strong>of</strong> China<br />

14/05/2011 L128 Council Implementing Regulation (EU) No 452/2011 <strong>of</strong> 6 May 2011 imposing a definitive<br />

anti-subsidy duty on imports <strong>of</strong> coated fine paper originating in <strong>the</strong> People's Republic <strong>of</strong> China<br />

31/05/2011 L145 Regulation (EU) No 511/2011 <strong>of</strong> <strong>the</strong> <strong>European</strong> Parliament and <strong>of</strong> <strong>the</strong> Council <strong>of</strong> 11 May<br />

2011 implementing <strong>the</strong> bilateral safeguard clause <strong>of</strong> <strong>the</strong> Free Trade Agreement between <strong>the</strong> <strong>European</strong> <strong>Union</strong><br />

and its Member States and <strong>the</strong> Republic <strong>of</strong> Korea<br />

<strong>Mexico</strong>-EU Trade Links is a monthly informational newsletter published by <strong>the</strong> Mexican Mission to <strong>the</strong> EU,<br />

Representative <strong>of</strong>fice <strong>of</strong> <strong>the</strong> Ministry <strong>of</strong> <strong>the</strong> Economy. Av. Franklin Roosevelt 94, 1050, Brussels, Belgium.<br />

For more detailed information or questions regarding this issue please contact us: e-mail info@economia-bruselas.be,<br />

fax: 32 (02) 644 04 45, or visit our website at: http://www.economia-bruselas.gob.mx<br />

4