Warszawa, stycznia 2010 r

Warszawa, stycznia 2010 r

Warszawa, stycznia 2010 r

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Translation from Polish<br />

Ministry of Treasury of the Republic of Poland<br />

Warsaw, 9 February <strong>2010</strong><br />

With reference to our cooperation heretofore I would like to present the privatisation plans of the<br />

Ministry of Treasury of the Republic of Poland for the year <strong>2010</strong>. The following projects are<br />

conducted as part of “The Privatisation Programme for the years 2008-2011”, under which over<br />

600 state-owned companies are currently scheduled for privatisation.<br />

This ambitious plan is likely to succeed due to a fairly stable economic situation in Poland, which<br />

undergoes a “velvet crisis” and as one of few EU countries recorded GDP growth throughout the<br />

whole 2009. Poland is the regional leader because of its stable economy, high domestic demand<br />

and continuous flow of substantial funds from the EU. Poland is also considered<br />

to be an attractive country for investment due to competitive labour costs and a favourable tax<br />

system.<br />

The key sectors are power industry, financial institutions and the chemical sector. According<br />

to the privatisation plans of the Ministry, as a result of an agreement with Eureko BV the IPO<br />

of an insurance group PZU S.A. is planned in <strong>2010</strong>. The IPO of an energy company Tauron<br />

Polska Energia S.A. is also scheduled for <strong>2010</strong>, as well as privatisation of the Warsaw Stock<br />

Exchange.<br />

Within the power industry Enea S.A., Energa S.A. and Zespół Elektrowni Pątnów-Adamów-<br />

Konin S.A. are scheduled for privatisation in <strong>2010</strong>. Shares of the energy group PGE Polska<br />

Grupa Energetyczna S.A. and a telecommunications company Telekomunikacja Polska S.A. will<br />

be sold on the stock exchange. In the chemical sector <strong>2010</strong> will bring the finalisation of the sale<br />

of the First Chemical Group, Zakłady Azotowe Puławy S.A. and Zakłady Chemiczne Police S.A.<br />

Other key projects include a coal mine Lubelski Węgiel Bogdanka S.A., two lignite mines:<br />

Kopalnia Węgla Brunatnego Konin S.A. and Kopalnia Węgla Brunatnego Adamów S.A., Bank

Gospodarki Żywnościowej S.A., Międzynarodowe Targi Poznańskie Sp. z o.o. international fairs,<br />

The Mint of Poland (Mennica Polska S.A.) and a press distributor Ruch S.A.<br />

To assist in the implementation of the programme the Ministry has taken a number of initiatives<br />

aimed at meeting investors’ expectations. The Ministry’s website www.msp.gov.pl includes<br />

a regularly updated “For Investors” area and all information can be obtained by contacting the<br />

Investor Relations Centre, which has been established to better respond to information needs.<br />

I also kindly encourage you to subscribe our newsletter containing updated information about<br />

privatisation projects.<br />

Considering your interest in the Polish privatisation plans please find enclosed a list of major<br />

projects scheduled for <strong>2010</strong>. I would like to thank you for cooperation and sincerely invite you<br />

to get a closer look at the unique investment opportunities offered by the Polish privatisation<br />

programme in <strong>2010</strong>.<br />

/ - /<br />

Aleksander Grad<br />

Minister of Treasury

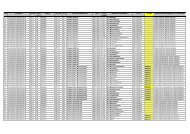

KEY PRIVATISATION PROJECTS FOR THE YEAR <strong>2010</strong><br />

No. Company Branch<br />

Treasury’s stake<br />

/stake for sale<br />

1. Enea S.A. Energy 76.48%/67.05%<br />

Procedure<br />

Sale on the<br />

WSE/negotiations<br />

2. Tauron Polska Energia S.A. Energy 88.65%/10-35% Sale on the WSE<br />

3. PGE Polska Grupa Energetyczna S.A. Energy 85%/10-35% Sale on the WSE<br />

4. Energa S.A. Energy 91.28%/82.63% Negotiations<br />

5.<br />

ZE PAK S.A. (Zespół Elektrowni<br />

Pątnów-Adamów-Konin S.A.)<br />

Energy 50%/50% Negotiations<br />

6.<br />

EC Zabrze S.A. (Elektrociepłownia<br />

Zabrze S.A.)<br />

Energy 100%/85% Negotiations<br />

7. LW Bogdanka S.A. Hard coal mine 60.53%/51% Public offer<br />

8.<br />

KWB Adamów S.A. (Kopalnia Węgla<br />

Brunatnego Adamów S.A.)<br />

Lignite mine 100%/85% Negotiations<br />

9.<br />

KWB Konin S.A. (Kopalnia Węgla<br />

Brunatnego Konin S.A.)<br />

Lignite mine 100%/85% Negotiations<br />

10.<br />

WZK Victoria S.A. (Wałbrzyskie<br />

Zakłady Koksownicze Victoria S.A.)<br />

Coke works 100%/85% Negotiations<br />

11.<br />

The Warsaw Stock Exchange (GPW<br />

98.82%/51%-<br />

Stock exchange<br />

w Warszawie S.A.)<br />

73.82%*<br />

To be decided<br />

12.<br />

The Mint of Poland (Mennica Polska<br />

S.A.)<br />

Securities 31.64%/31.64% Public procedure<br />

13.<br />

First Chemical Group: Ciech S.A.,<br />

ZAK S.A. and ZAT S.A. (Zakłady<br />

Azotowe w Tarnowie S.A.)<br />

Chemical<br />

36.68%/36.68%,<br />

86.28%/85%,<br />

52.56%/52.15%<br />

Negotiations<br />

14.<br />

ZA Puławy S.A. (Zakłady Azotowe Chemical/nitrogen<br />

Puławy S.A.)<br />

works<br />

50.68%/50.12% Public procedure<br />

15. Zakłady Chemiczne Police S.A. Chemical works 59.41%/59.23% Public procedure<br />

16. Grupa Lotos S.A. Petroleum 53,19%/** Lock-up**<br />

17.<br />

KiZCS Siarkopol S.A. (Kopalnie i<br />

Sulphur mine<br />

Zakłady Chemiczne Siarki Siarkopol<br />

and works<br />

w Grzybowie S.A.)<br />

100%/85% Public procedure<br />

18.<br />

ZGH Bolesław S.A. (Zakłady<br />

Górniczo-Hutnicze Bolesław S.A.)<br />

19. Centrozłom Wrocław S.A.<br />

Metallurgy<br />

/mining<br />

Metallurgy/metal<br />

processing<br />

100%/85%<br />

Sale on the WSE<br />

/negotiations<br />

100%/85% Negotiations<br />

Council of<br />

BGŻ S.A. (Bank Gospodarki<br />

20.<br />

Banking 37.2%/37.2% Ministers consent<br />

Żywnościowej S.A.)<br />

/negotiations<br />

21. TP S.A. (Telekomunikacja Polska S.A.) Telecommunications 4.15%/4.15% Sale on the WSE<br />

22.<br />

Poznań International Fair<br />

(Międzynarodowe Targi Poznańskie<br />

Sp. z o.o.)<br />

International fair 60%/up to 60% To be decided<br />

23. Ruch S.A.<br />

Press & FMCG 56.86%/up to Sale on the WSE<br />

distributor<br />

56.63% /negotiations<br />

24. Dipservice w Warszawie S.A.<br />

Property<br />

management<br />

100%/up to 85% To be decided<br />

25.<br />

TON Agro S.A. (Towarzystwo Obrotu Property 100%/up to<br />

Nieruchomościami Agro S.A.)<br />

management<br />

100%<br />

To be decided<br />

26. H. Cegielski Poznań S.A. Machine 100%/85% Negotiations<br />

27. Nitroerg S.A. Defence 100%/85% Auction<br />

28. Intraco S. A.<br />

Services/property<br />

management<br />

100%/up to 85% To be decided<br />

GAT S.A. (Gliwicka Agencja<br />

29.<br />

Turystyczna S.A.)<br />

* new privatisation strategy to be developedas<br />

** a 180-day lock-up as part of a transaction finalised in January <strong>2010</strong><br />

Services/tourism 100%/100% Auction