Broome Port Authority - Parliament of Western Australia

Broome Port Authority - Parliament of Western Australia

Broome Port Authority - Parliament of Western Australia

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

22. Financial instruments<br />

(i) Financial risk management objectives and policies<br />

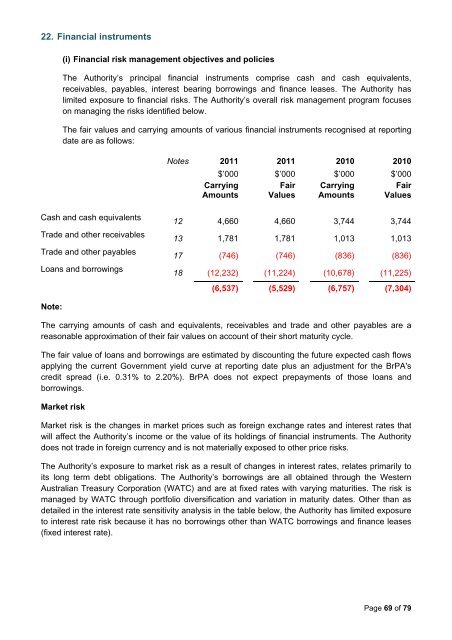

The <strong>Authority</strong>’s principal financial instruments comprise cash and cash equivalents,<br />

receivables, payables, interest bearing borrowings and finance leases. The <strong>Authority</strong> has<br />

limited exposure to financial risks. The <strong>Authority</strong>’s overall risk management program focuses<br />

on managing the risks identified below.<br />

The fair values and carrying amounts <strong>of</strong> various financial instruments recognised at reporting<br />

date are as follows:<br />

Notes 2011 2011 2010 2010<br />

$’000 $’000 $’000 $’000<br />

Carrying<br />

Amounts<br />

Fair<br />

Values<br />

Carrying<br />

Amounts<br />

Fair<br />

Values<br />

Cash and cash equivalents<br />

Trade and other receivables<br />

Trade and other payables<br />

Loans and borrowings<br />

12 4,660 4,660 3,744 3,744<br />

13 1,781 1,781 1,013 1,013<br />

17 (746) (746) (836) (836)<br />

18 (12,232) (11,224) (10,678) (11,225)<br />

(6,537) (5,529) (6,757) (7,304)<br />

Note:<br />

The carrying amounts <strong>of</strong> cash and equivalents, receivables and trade and other payables are a<br />

reasonable approximation <strong>of</strong> their fair values on account <strong>of</strong> their short maturity cycle.<br />

The fair value <strong>of</strong> loans and borrowings are estimated by discounting<br />

the future expected cash flows<br />

applying the current Government yield curve at reporting date plus an adjustment for the BrPA's<br />

credit spread (i.e. 0.31% to 2.20%). BrPA does not expect prepayments <strong>of</strong> those loans and<br />

borrowings.<br />

Market risk<br />

Market risk is the changes in market prices such as foreign exchange rates and interest rates that<br />

will affect the <strong>Authority</strong>’s income or the value <strong>of</strong> its holdings <strong>of</strong> financial instruments. The <strong>Authority</strong><br />

does not trade in foreign currency and is not materially exposed to other price risks.<br />

The <strong>Authority</strong>’s exposure to market risk as a result <strong>of</strong> changes in interest rates, relates primarily to<br />

its long term debt obligations. The <strong>Authority</strong>’s borrowings are all obtained through the <strong>Western</strong><br />

<strong>Australia</strong>n Treasury Corporation (WATC) and are at fixed rates with varying maturities. The risk is<br />

managed by WATC through portfolio diversification and variation in maturity dates. Other than as<br />

detailed in the interest rate sensitivity analysis in the table below, the <strong>Authority</strong> has limited exposure<br />

to interest rate risk because it has no borrowings other than WATC borrowings and finance leases<br />

(fixed interest rate).<br />

Page 69 <strong>of</strong> 79