Endeavour Energy Annual Performance Report - Parliament of New ...

Endeavour Energy Annual Performance Report - Parliament of New ...

Endeavour Energy Annual Performance Report - Parliament of New ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

09<br />

Financial<br />

statements<br />

Notes to the Financial Statements<br />

For the year ended 30 June 2011<br />

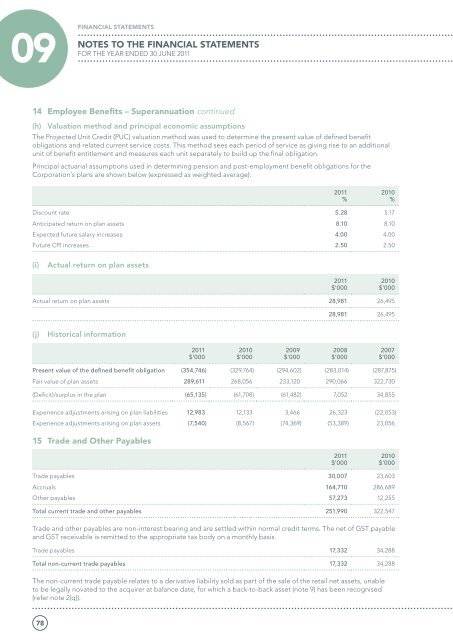

14 Employee Benefits – Superannuation continued<br />

(h) Valuation method and principal economic assumptions<br />

The Projected Unit Credit (PUC) valuation method was used to determine the present value <strong>of</strong> defined benefit<br />

obligations and related current service costs. This method sees each period <strong>of</strong> service as giving rise to an additional<br />

unit <strong>of</strong> benefit entitlement and measures each unit separately to build up the final obligation.<br />

Principal actuarial assumptions used in determining pension and post-employment benefit obligations for the<br />

Corporation’s plans are shown below (expressed as weighted average):<br />

2011<br />

%<br />

2010<br />

%<br />

Discount rate 5.28 5.17<br />

Anticipated return on plan assets 8.10 8.10<br />

Expected future salary increases 4.00 4.00<br />

Future CPI increases 2.50 2.50<br />

(i)<br />

Actual return on plan assets<br />

2011<br />

$’000<br />

2010<br />

$’000<br />

Actual return on plan assets 28,981 26,495<br />

28,981 26,495<br />

(j)<br />

Historical information<br />

2011<br />

$’000<br />

2010<br />

$’000<br />

2009<br />

$’000<br />

2008<br />

$’000<br />

2007<br />

$’000<br />

Present value <strong>of</strong> the defined benefit obligation (354,746) (329,764) (294,602) (283,014) (287,875)<br />

Fair value <strong>of</strong> plan assets 289,611 268,056 233,120 290,066 322,730<br />

(Deficit)/surplus in the plan (65,135) (61,708) (61,482) 7,052 34,855<br />

Experience adjustments arising on plan liabilities 12,983 12,133 3,466 26,323 (22,053)<br />

Experience adjustments arising on plan assets (7,540) (8,567) (74,369) (53,389) 23,056<br />

15 Trade and Other Payables<br />

2011<br />

$’000<br />

2010<br />

$’000<br />

Trade payables 30,007 23,603<br />

Accruals 164,710 286,689<br />

Other payables 57,273 12,255<br />

Total current trade and other payables 251,990 322,547<br />

Trade and other payables are non-interest bearing and are settled within normal credit terms. The net <strong>of</strong> GST payable<br />

and GST receivable is remitted to the appropriate tax body on a monthly basis.<br />

Trade payables 17,332 34,288<br />

Total non-current trade payables 17,332 34,288<br />

The non-current trade payable relates to a derivative liability sold as part <strong>of</strong> the sale <strong>of</strong> the retail net assets, unable<br />

to be legally novated to the acquirer at balance date, for which a back-to-back asset (note 9) has been recognised<br />

(refer note 2(q)).<br />

78